More than half of Australian retirees are spending less than the age pension each year, raising significant questions about current retirement policy and super fund strategies. The unexpected finding, which is also affected by age and location, was revealed in Milliman’s latest Retirement Expectations and Spending Profiles (ESP) analysis of 300,000-plus retirees’ real-world annual expenditure.

It suggests mandatory and voluntary measures to boost super may not be enough to produce improved retirement lifestyles without a deeper understanding of the motivations driving retiree behaviour. The findings come as a particular surprise given the commonly used ‘50% of median income’ poverty line typically captures many retirees.

For example, the latest Australian Council of Social Service Poverty in Australia report estimated that 13.9% of age pension recipients were living below the poverty line. The OECD’s Pensions at a Glance 2015 report found a more pronounced issue. It ranked Australia second lowest on social equity among 33 countries, with more than one-third of pensioners living below the poverty line.

Common measures and targets for adequate retirement incomes (including the median income poverty line) provide a starting point for discussion, but the data suggests they can also mislead. Such measures fail to explain the motivations and experiences (given most surveys are statistically insignificant) of the majority of retirees who spend less than the age pension each year.

Are retirees attempting to self-insure against longevity risk?

Running out of retirement savings is a key concern for many people given that a 60-year-old man is now expected to live for a further 26.4 years and a 60-year-old woman for 29.1 years, according to the government’s 2015 Intergenerational Report.

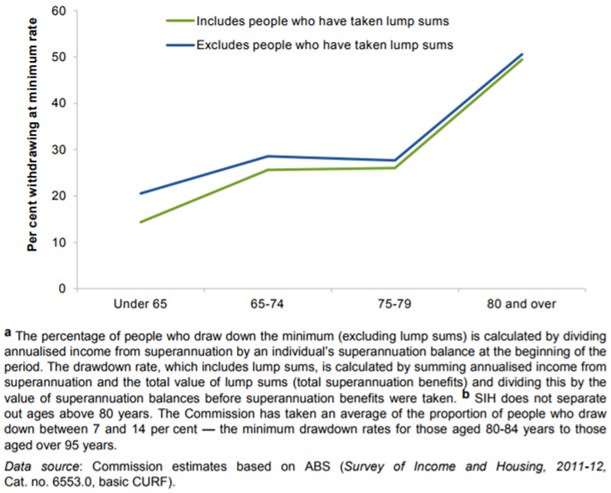

This concern may be a driver for the substantial proportion of retirees with account-based pensions who draw down the minimum legislated annual amount.

Figure 1: Percentage of retirees drawing down their superannuation at the age-specific minimum rate, 2011-12a, b

However, the age pension, which can be viewed as a sovereign-backed perpetual lifetime annuity indexed to inflation, is traditionally viewed as a safety net rather than a discretionary income source for savings.

Are older retirees more prone to frugality given their experience of multiple recessions compared to younger generations? While the Australian economy has suffered several slowdowns in recent decades, its last technical recession occurred in the early 1990s. Before that, the economy went through regular booms and busts. Many retirees today entered the workforce during the 1970s, a period when the Australian economy suffered four recessions in a decade. Have these experiences made some retirees more cautious now that they are no longer in the workforce?

Untapped equity in the family home

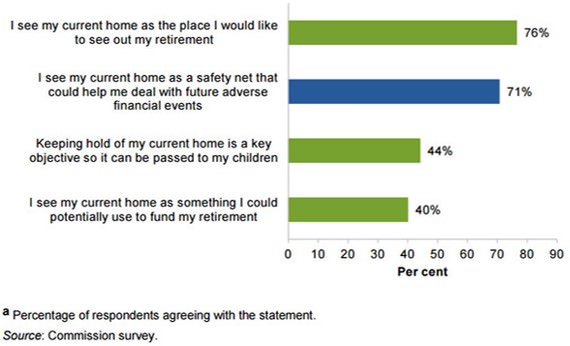

Is the desire to leave a bequest to adult children stronger than assumed? Does this include the family home, leaving significant housing equity untapped that could help fund retirement?

The family home has become a significant source of wealth for many older Australians as east coast residential property prices have soared in recent years. However, few retirees use this wealth to fund their retirement with reverse mortgages remaining deeply unpopular.

The majority of retirees want to ‘age in place’, viewing their home as another safety net if required to potentially pay for an aged-care bond or some other unexpected event, but plan to leave the home to their adult children.

Figure 2: Perceptions of the role of the family home in retirementa

Government policies, such as excluding the family home from the age pension assets test and state-imposed stamp duties on property transactions, have also encouraged retirees to hold on to their home. However, the 2017-2018 budget proposed allowing people over 65 to sell their primary residence and roll up to $300,000 per person into super.

Are retirees diverting savings to help their adult children enter the property market at the cost of their own retirement lifestyle?

Home ownership rates have plummeted in recent years as record low interest rates have spurred an investor-led housing boom. According to the Household, Income and Labour Dynamics in Australia (HILDA) survey, couples (aged between 20 and 29) with kids aged younger than 14, have seen a 13% fall in house ownership, and single people in this age bracket, also with kids younger than 14, have seen a 40% drop. Married couples, aged between 60 and 69, with no dependent kids, have seen a 1% increase, while single 50- to 59-year-olds, with kids, have seen a 7% increase.

Yet, there is some evidence that a rising proportion of parents are helping their adult children get a foot on the property ladder by guaranteeing home loans or providing a partial deposit.

What is the subjective experience of Australians in retirement?

Has the financial services industry overestimated the cost of living in retirement or will spending pick up as the super system matures and people have higher balances? This is a confronting issue for many people that tests our assumptions about work, lifestyle, and the nature of retirement.

The HILDA survey has previously suggested that increases in age strongly correlate with reduced odds of financial stress, beyond what can be accounted for by differences in education, marital status, labour market experiences, wealth, or household income.

Financial stress classifies any individual who struggles to pay their utility bills, mortgage, or rent on time, and has foregone necessities, pawned or sold something, or has sought financial assistance from friends, family, or a welfare organisation. Financial stress is more common among young people (20- to 29-year-olds), with 56% experiencing financial stress in 2015, down from 61% from 2006. For individuals aged between 40 and 49, half experienced financial stress, compared to only 39% in 2006. Finally, for those aged over 70, only 13% experienced financial stress, compared to 10% in 2006.

A separate analysis of HILDA data, examining individuals’ self-reported changes in standard of living, financial security, and overall happiness over the transition to retirement, found subjective well-being either improved or remained constant for the majority of people.

However, the research also found that people who were forced to retire early after losing their job or due to poor health, and then suffered lower-than-expected retirement incomes, reported significant declines in their well-being.

It is difficult to draw a direct line between this research and the knowledge that half of all retirees are spending less than the age pension.

More information is needed, which superannuation funds can obtain directly from their members. In this way, super funds’ general advice can be better aligned with the actual experience and needs of members. It is also part of an important, and broader, conversation about the adequacy of older Australians’ living standards after a lifetime in the workforce.

Jeff Gebler is a senior consultant at actuarial firm, Milliman. Read more about the Milliman Retirement ESP here.