According to the renowned Elroy Dimson, Emeritus Professor of Finance at the London Business School, the share prices of small companies have consistently outperformed large companies over the longer term. The ‘small-cap premium’, as Dimson describes it, equates to an average of 0.54% per month across global equities over the long term. In the United States the premium is 0.72% per month and in Australia, it accounts for 0.52% of outperformance per month, one of the highest premiums of the markets compared. However, over the last two years small caps have underperformed their large cap rivals in Australia. So why have our small company share prices bucked the historical trend?

Measuring up

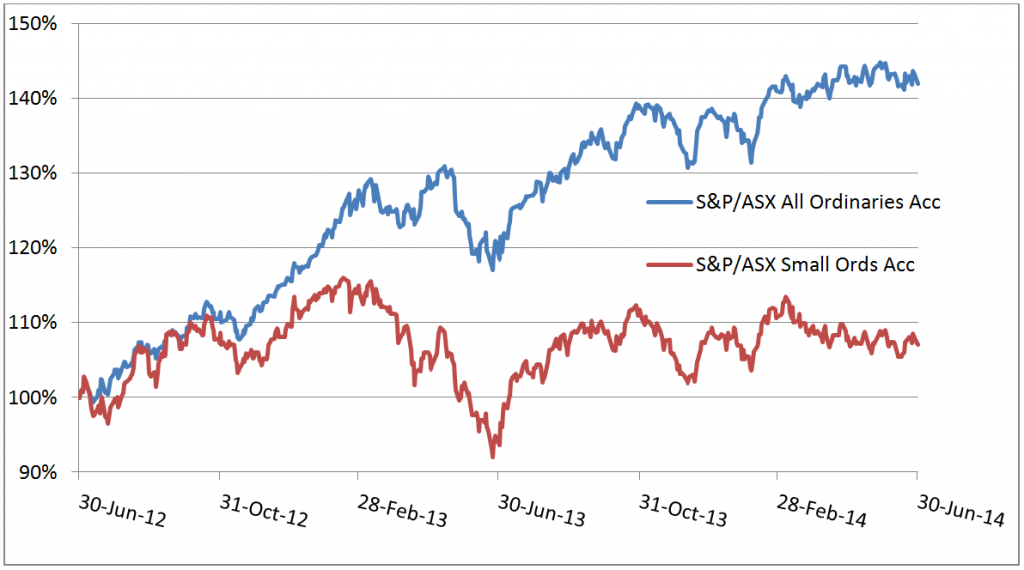

Since mid-2012, the S&P/ASX All Ordinaries Accumulation Index, which represents the 500 largest companies listed on the Australian Securities Exchange (ASX), has risen a remarkable 47.0% as the current bull market has charged ahead. Over the same period, the S&P/ASX Small Ordinaries Accumulation Index, which tracks the performance of the ASX’s small-cap companies (outside the top 100), has increased just 11.7%. The contrast between the two indexes is stark and particularly incongruous when you compare the two indexes over the preceding three years. Between March 2009 and June 2012 the Small Ordinaries Index outperformed the All Ordinaries by 9.6%.

Is the 35.0% outperformance by large companies over small companies in the last couple of years reflective of a structural change or is it a mere short term variance? In our view, the last two years in the Australian equities market represents a short term anomaly to the longer term trend. We believe this is the case for two main reasons. Firstly, small mining and mining services companies which dominate the Small Ordinaries Index have significantly underperformed in recent years. Secondly, the All Ordinaries Index is dominated by the big four banks and Telstra and has relatively outperformed as investors have piled into these stocks in search of yield.

End of the mining boom

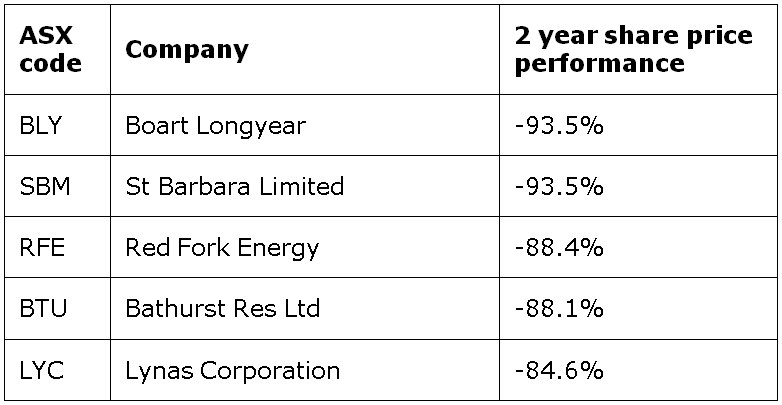

The well-documented end of Australia’s recent resources investment boom has hit the mining and mining services sector hard. As China adapts to lower economic growth, the demand for resources has softened and spot commodity prices have fallen, in some cases, significantly. While Australia’s miners were the major beneficiaries of numerous major mining projects announced, through the 2000s, many of these projects are now coming to an end. With Hancock Prospecting’s Roy Hill mine the only major new domestic project currently slated to come on line, the contract pipeline for many of Australia’s mining and mining services companies is now very weak. As a result the valuations and share prices of many of these companies have plummeted with some trading below their prices during the depths of the GFC. Tellingly, the five worst performers over the last two years are mining and mining services companies as shown in the following table.

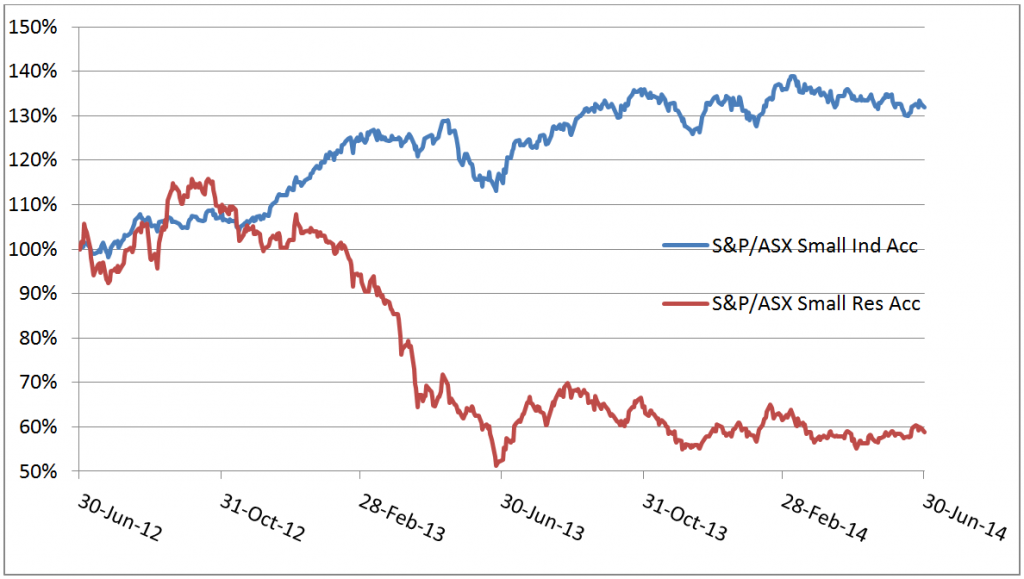

In 2012, a total of 36% of companies that made up the Small Ordinaries Index were mining or mining services companies. As at 30 June 2014, this figure had dropped to 26%. Over the last two years, the Small Resources Index which measures the performance of small mining companies alone, shows they collectively fell 42%. Stripping out the mining companies from the Small Ordinaries Index, the Small Industrials Index reveals the remainder of the small caps performed strongly, rising 32% over the last two years. While mining companies have floundered, we have experienced a recovery in many cyclical industrial stocks such as those in the housing and finance sector.

The hunt for yield

A key market theme over the last couple of years has been investors’ chase for yield as the Baby Boomer generation moves into retirement. While in the past a reasonable income stream could have been derived from term deposits, the current historically low interest rates have driven investors into higher-yielding blue chip stocks. Whereas term deposit yields are averaging around 3.3% per annum, Telstra, for example, is currently paying a grossed-up yield of 7%. With some maturing term deposits previously paying around 6%, the choice between rolling over at around half the yield or investing in Telstra is compelling. And as banks have benefitted from low interest rates and better economic conditions, they have performed strongly.

Australia’s equity market is very narrow with the four major banks and Telstra currently accounting for 32% of the All Ordinaries Index. Their valuations have increased with a disproportionate impact on the equity market resulting in them being responsible for approximately two-thirds of the equity market’s performance over the last two years.

Small cap performance to return to long term trend

The key to small caps turning around will be the improvement in mining stocks. If commodity prices rise and investor sentiment towards mining stocks improves, this will necessarily improve their valuations. Already there has been an improvement in sentiment which has led to a rise in the sector’s share prices of approximately 15% off their recent lows.

We expect that current low interest rates could drive economic growth which would in turn lead to an uptick in small cap earnings. In our view, the small cap sector will again outperform the large caps reflecting Dimson’s findings over the longer term, and the recent underperformance by the small cap sector is a cyclical, rather than a structural change.

Chris Stott is Chief Investment Officer at Wilson Asset Management. His views are general in nature and readers should seek their own professional advice before making any financial decisions.