The surprise Federal election result has been positive for hybrids, and good value appears to remain in this sector. The market’s overreaction to franking credit fears, moreover, highlights the benefits of active management in this complex area.

Fading overreaction to the Labor Party policy

When Labor initially announced their proposal to eliminate cash refunds on franking credits in mid-March 2018, we estimated that the policy would affect only a small minority of hybrid holders. Indeed, months later this was confirmed by Morningstar research, which estimated that only 10% to 20% of investors would be impacted by the policy.

Our assessment was that as most hybrids would likely end up in the hands of investors who could still continue to fully utilise franking credits, they should suffer no real valuation or price effects over the medium term.

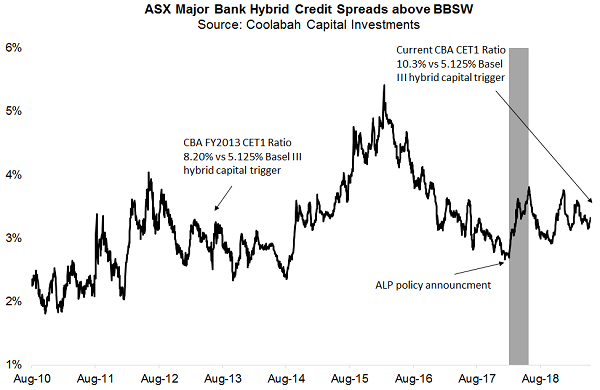

Despite this assessment, the hybrids market did undergo waves of selling between March and May 2018. As seen in the chart below, this pushed the interest rate spread on 5-year major bank hybrids over short-term market interest rates (technically, the bank bill swap rate or 'BBSW') from around 3% to 4%.

Click to enlarge

At Coolabah, as manager of the BetaShares Active Australian Hybrids Fund (ASX: HBRD), we 'faded' this move, increasing HBRD’s portfolio exposure to hybrids. As it turned out, major bank hybrid spreads eventually normalised back down from 4.0% to 3.25% above BBSW by September 2018, helped by an absence of new issuance due to these more expensive hybrid funding levels. We used this opportunity to sell back the extra hybrid exposure we had accumulated during the market sell-off.

We have since made several adjustments to our hybrids exposure when we have considered shifts in market pricing to have been advantageous.

Coming into the May 2019 election, for example, 5-year major bank hybrid credit spreads had once again widened from around 3% above BBSW in January 2019 to 3.55% leading up to the election, reflecting fears that the Labor Party would win and restrict the availability of franking credits.

Coolabah’s analysis suggested otherwise. It determined there were two more likely scenarios.

First, we considered there remained a good chance the Coalition would win, based on the view that sheer self-interest would drive voters away from Labor. We also felt that in this new digital age where privacy has become a paramount issue, polling results had proven increasingly unreliable, as shown by the Brexit and Trump campaigns. Respondents are less comfortable sharing their private views with complete strangers.

Second, even if Labor did win, key independent Senators holding the balance of power in the Senate appeared to be opposing its franking policy.

Either way, it seemed to us investor fears with regard to franking credits appeared overblown.

In the month or so before the election, we bought an extra $100 million of ASX hybrids across all its portfolios and lifted HBRD’s portfolio weight to the sector to close to 90%. With the Coalition election win, the 5-year major bank ASX hybrid spread has quickly narrowed back to 3.37%, and our view is that this should compress further towards the January levels around 3.0%, providing further upside potential.

Hybrid outlook

More generally, as evident in the chart above, while the major banks have been boosting their equity substantially, with CBA’s common equity tier 1 (CET1) ratio rising from 8.2% in June 2013 to 10.3% in June 2018, the credit spreads on hybrids have drifted wider, not tighter, in recent years.

Reflecting the apparent improvement in relative value, this may explain why institutional investors are increasingly gravitating to the hybrids sector, such as the $60 billion Unisuper reported to have invested $300 million in the latest NAB hybrid in February 2019, and having committed about $1 billion to major bank hybrids in 2016.

As banks continue to de-risk their business models by selling non-core operations and focusing on their core savings and loans activities, we see no reason why major bank hybrid spreads should not compress to levels observed in 2014 and earlier, which implies credit spreads of less than 3.0% above BBSW. This would drive substantial total return performance.

What’s more, what the Coalition victory assures is that no political party is likely to ever mess with franking credits again. This means retirees should be able to comfortably claim their cash refunds on franking credits in perpetuity. Over time, this should see advisers and brokers who encouraged clients to sell hybrids over the last 14 months to re-embrace the sector.

Since inception in November 2017 to 30 April 2019, HBRD has returned around 5.1% per annum net of fees on a franked basis. It is diversified across 40 different bonds and hybrids with an estimated gross portfolio running yield of 5.12% as at 20 May 2019*.

All investors should note that hybrids are relatively complex securities that combine elements of debt and equity securities. Further details on the features and risks associated with the HBRD Fund are available here.

Christopher Joye is a Portfolio Manager with Coolabah Capital Investments and the investment manager of BetaShares HBRD fund. BetaShares is a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any investor. *Past performance is not indicative of future results. Yield figure is indicative only and will vary over time. Not all investors will be able to obtain the full value of franking credits.