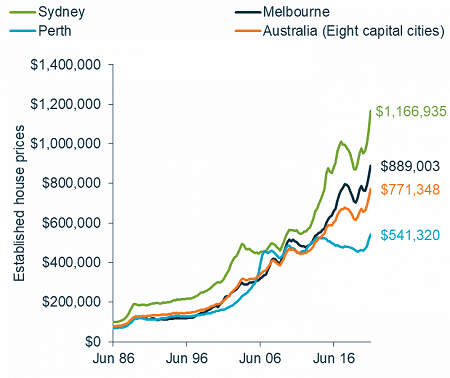

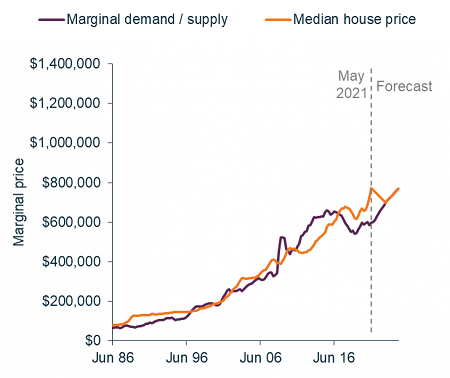

Recent data released by the ABS and CoreLogic shows that median house prices in Australia rose 14.9% in the year to 31 May 20211. This has taken house prices to record levels, with a near unprecedented acceleration triggered by, among other factors, the COVID-19 pandemic crisis response to cut interest rates to near zero levels.

House Price Index

Source: Martin Currie Australia, ABS, CoreLogic; as of 31 May 2021. $ value represents average CoreLogic value April / May

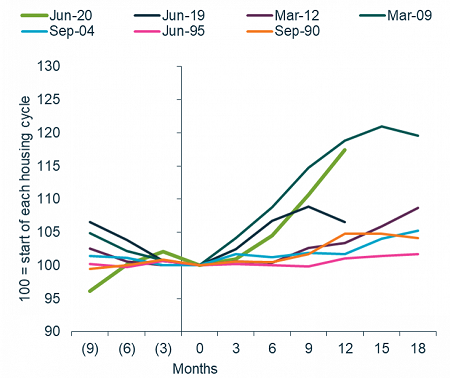

National Housing Price Cycles

Source: Martin Currie Australia, ABS, CoreLogic; as of 31 May 2021

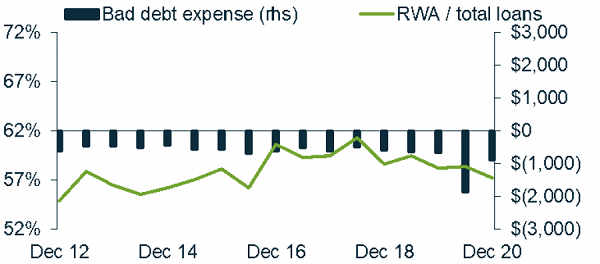

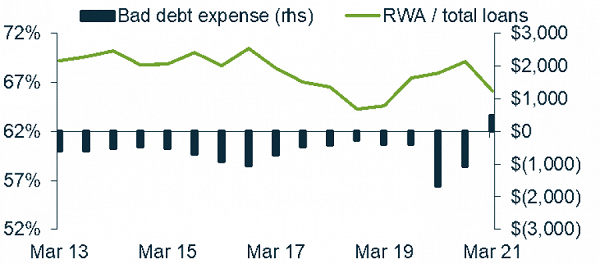

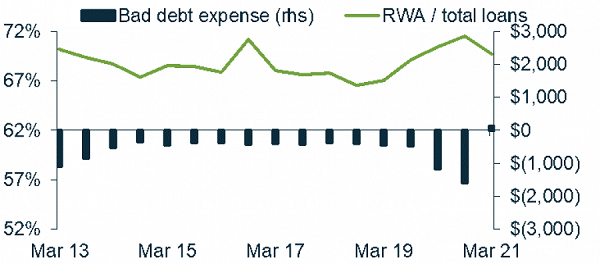

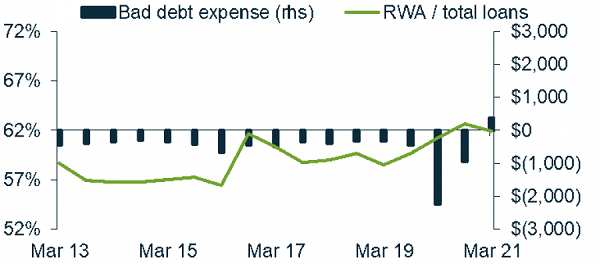

House prices have supported improving risk metrics for the banks

This boost in house prices has aided banks by contributing to credit growth, but more importantly, rising house prices have been a feature of the improving economic backdrop that has supported bad debt releases and lower risk weights.

This trend can be seen in recent reporting for banks, such as in the improvement in the level of bad debt expenses and risk-weighted assets (RWA) ratios2.

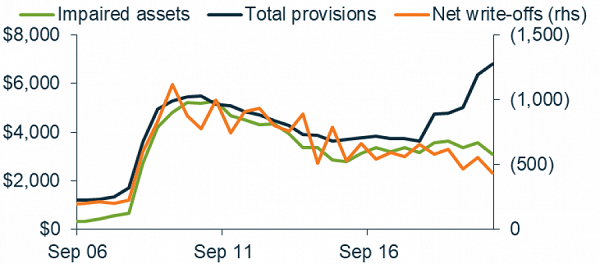

Commonwealth Bank

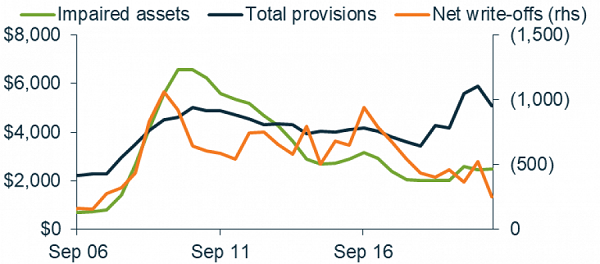

ANZ Bank

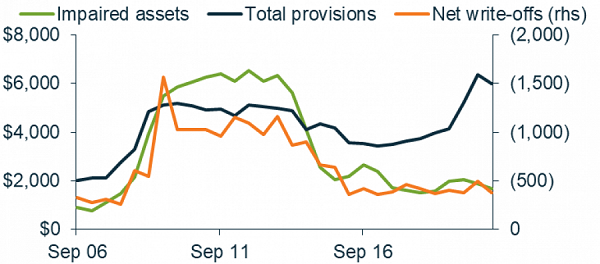

NAB

Westpac

Additionally, the consequent consumer confidence lift should support spending, as we cycle off stimulus payments, and this should in turn afford banks more comfort with the outlook for bad debts.

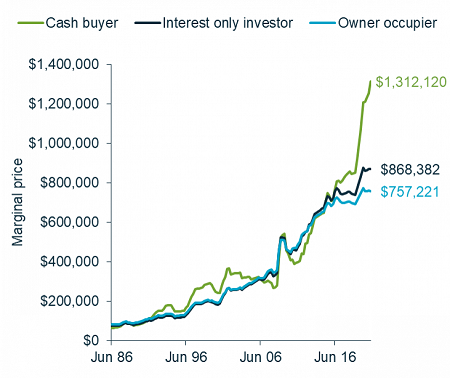

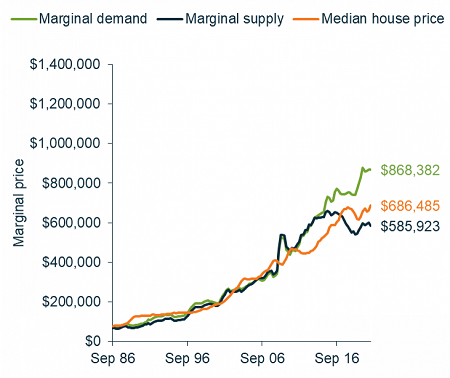

House prices seem stretched, but loan growth should improve

In October 2019 we published an article that described the credit-centric outlook model we use for forecasting house prices. This model looks at both credit supply from banks and demand from borrowers, and is grounded in the theory that house prices and debt levels largely reflect the capacity of borrowers to service and access debt.

The model creates a property demand curve that looks at the ‘average’ property and the average available funds to purchase that property from three cohorts of buyers – ‘theoretical’ cash buyers, geared investors and geared owner occupiers. It follows that at any given time, the marginal demand price setter will be the second highest of these three categories.

Generally, for house prices to rise, the supply of credit to purchase property must match or exceed the demand from borrowers. Our assessment is that despite the reduction in variable mortgage rates supporting higher prices, floor rates and maintenance of reasonable lending criteria by the banks mean the marginal supply curve will not support a continuation in the current demand driven spike in house prices.

Property buyer demand3

Credit supply and housing demand3

Prior to COVID-19, in mid-2019, our model had foreshadowed a healthy period of house price growth, but today, this approach suggests the national price move has outrun the fundamentals and should again fall to meet more constrained credit supply from banks.

Saying this, post the one-off paydowns driven by superannuation withdrawals and stimulus payments, and a restart in paused spending during COVID-19, we do expect to see a reduction in paydown activity and a higher average size of loan.

This means that despite a potential fall in future house prices, credit growth should rise, and this will support bank earnings.

House price forecast3

Lending growth and approvals3

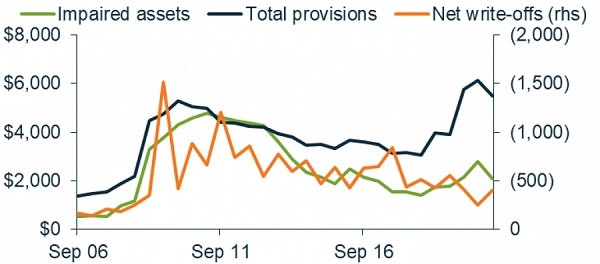

More provision unwinding to come…

As such, we believe that the benefits to bank capital and asset quality have further to run.

A combination of accounting and risk models dealing with an unprecedented pandemic resulted in collective bad debt provisions being raised well ahead of problem loans, and capital buffers created to deal with risk weighted asset inflation.

While bank management is still digesting the recent movements in house prices and better than expected economic growth data, this process should inevitably drive a more sanguine view of overall asset quality, and flow into lower capital intensity and capital releases4.

Commonwealth Bank

ANZ Bank

NAB

Westpac

… leading to a strong earnings outlook for the banks5

We believe that the over-zealous provisions have further to be released as the broader economic buoyancy flows through to an improved outlook for bad debts and further earnings momentum.

The outlook for consensus bad debts assumes much of this provision build is still utilised into 2022. We think the evidence is to the contrary, and as a result we should continue to see positive earnings momentum as the market improves their forward-looking bad debt forecasts for the banking sector.

Overall, in our Value Equity strategy, we are favouring on overweight position to banks, with higher active weights in ANZ Bank and NAB, a neutral position in Westpac, and an underweight in Commonwealth Bank (albeit we materially reduced this earlier in the year), due to the potential for valuations to better reflect bad debt unwinding, capital returns and improved credit growth.

From our Equity Income strategy, which focusses on Sustainable Dividends, we like the dividend opportunities from all banks, but we see Westpac’s dividend having a slower dividend recovery than its peers.

1Source: Martin Currie Australia, ABS, CoreLogic; as of 31 May 2021. For established houses across the eight capital cities.

2Source: Martin Currie Australia, FactSet, company reports; as of 31 March 2021

3Source: Martin Currie Australia, ABS, Bloomberg, CoreLogic, FactSet; as of 31 March 2021

4Source: Martin Currie Australia, FactSet, company reports; as of 31 March 2021

5Source: Martin Currie Australia; as of 31 May 2021. Based on a representative MCA Value Equity (Index: S&P/ASX 200 Accumulation) and MCA Equity Income account.

Matthew Davison is a Senior Research Analyst at Martin Currie Australia, a Franklin Templeton specialist investment manager. Franklin Templeton is a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any individual. Past performance is not a guide to future returns.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.