Everyone is fixated on when the US Federal Reserve will cut rates. The discussion isn’t if, but when, and by how much. This is welcome news for a bond market that, so far in 2024, is treading water when one considers the year-to-date negative returns for the major benchmarks – the Bloomberg Ausbond Composite Index and Bloomberg Global Aggregate.

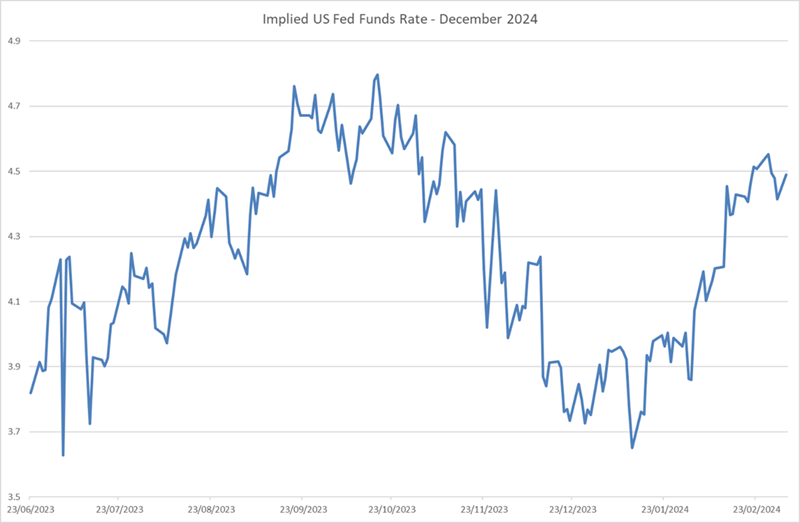

A big part of bond market skittishness has been the reluctance of US data to endorse a chunky easing cycle in 2024, which has seen Fed easing expectations slashed from >175bps to around 75bps for the year, as we write this. The chart below shows the roller coaster ride of markets trying to anticipate what the Fed Funds rate will be in December 2024 versus its current 5.25%. Call it ~100bps of rate cuts removed in a matter of weeks.

Market Implied US Federal Reserve Funds Rate December 2024

Source: Franklin Templeton; Bloomberg Data

Few think the RBA will cut before the Fed. That could get challenged. The Fed has the complication of a US election, which heightens sensitivity around the timing of the first cut. Commencing an easing cycle in May or June is still far enough away from the Presidential election in November to be ‘arm’s length’. It’s unlikely to us they start in September, which is the last meeting prior to the election, if they can avoid it. The clock is ticking for the data to give the Fed permission to start the cycle comfortably ahead of a key political contest. The RBA is unlikely to face a federal election until 2025.

What could drive the RBA to move before the Fed?

Three things stand out to us:

1. Inflation

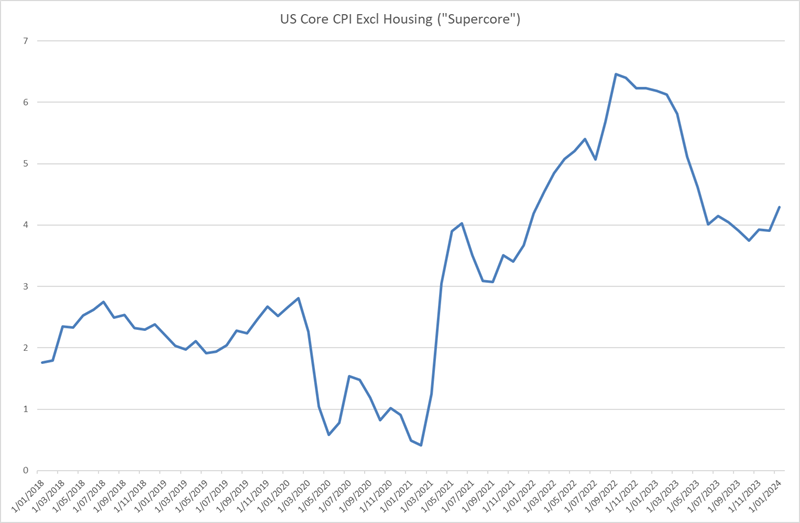

The stop start volatility in US markets reflects disappointing inflation data, which has failed to endorse the 'rate cuts are coming soon' narrative. Fed chairman Powell’s favourite measure the ‘super core’ CPI has ticked up recently, which is likely a setback rather than the start of a reacceleration, but it’s enough to keep nerves frayed. The super core is services ex-shelter inflation and a favoured measure because it is most sensitive to wages. Year-over-year it has ticked above 4%, so the next few months are key to see a decline resume.

US Bloomberg BLS CPI Core Services Less Shelter Inflation

Source: Franklin Templeton; Bloomberg Data

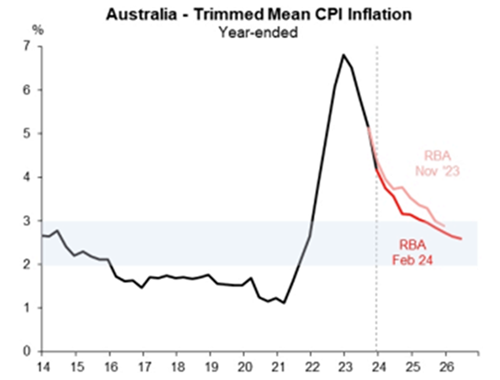

Meanwhile, inflation in Australia has been falling more quickly than the RBA forecast. The chart below shows the evolution of RBA forecasts for underlying trimmed mean CPI.

Source: Franklin Templeton; ABS; RBA; Macquarie Group

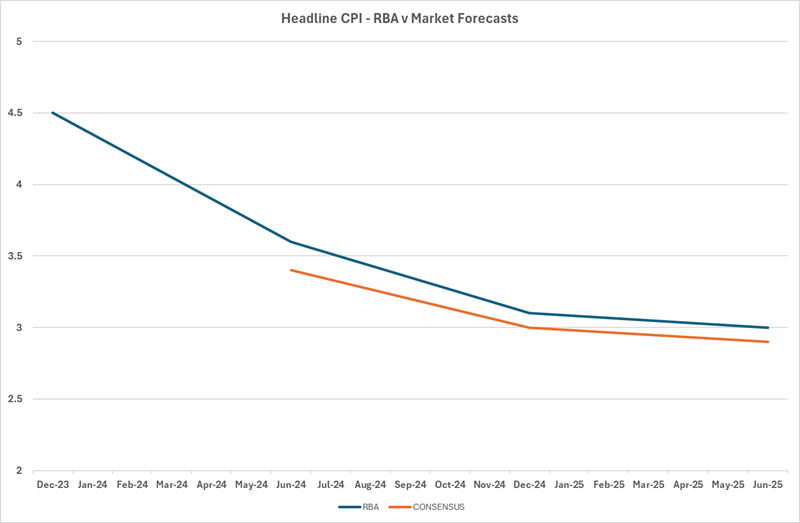

In addition, market consensus for CPI continues to undershoot the RBA out to mid-2025. It looks like at the next update the RBA will downgrade their forecasts. One major US investment bank now sees both headline and core back in the 2-3% band by the end of 2024, well ahead of current RBA thinking.

Source: Franklin Templeton; Bloomberg

2. The employment market

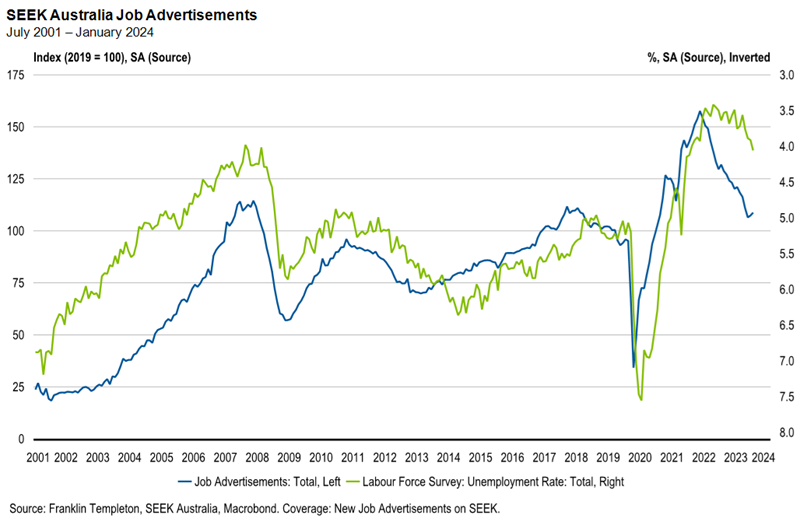

In contrast with the US, the Australian labour market looks to be softening more quickly. The RBA forecasts unemployment at 4.3% by Dec 24. We are at 4.1% now. If this moves higher in the next few months and challenges their forecasts, it’s quite likely they could find an excuse to cut by mid-year.

Our favourite indicator in Australia, the monthly SEEK Job ads index, continues to point to weakness in the official unemployment rate.

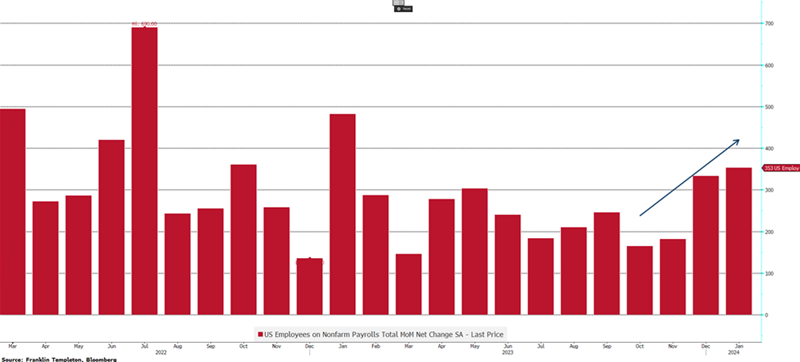

In the US, the monthly non-farm payrolls release has been reaccelerating in recent months. The official unemployment rate in the US has had a 3-handle since early 2022, and still sits at 3.7%.

US Employees on Nonfarm Payrolls Total MoM Change

Source: Franklin Templeton; Bloomberg

3. Households remain under intense pressure

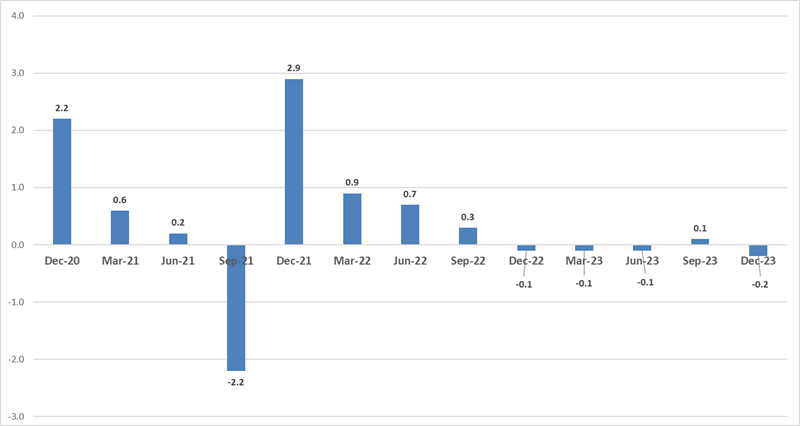

The Q4 Australia GDP data requires a microscope to find economic growth, coming in at a puny 0.2% on the quarter. In annual terms, the economy grew 1.5% for 2023, a year where population growth was ~2.4%. The ABS points out that per capita growth for the year was -1%, and that government spending and business investment were the drivers with the household barely retaining a spending pulse.

Indeed, household discretionary spending growth continues to be non-existent. Aside from a tiny +0.1% in the September quarter, every single quarter of 2023 saw discretionary consumption shrink.

Quarterly Change in discretionary household spending (%)

Source: Franklin Templeton; ABS

By contrast, US GDP grew at more than double the pace of Australia’s in the year to December 2023, at ~3.2%, with personal consumption up 3%. Right now, at least, the US consumer hasn’t been slugged as hard with rate hikes as the Australian consumer has.

What does it all mean? Duration looks modestly attractive in Australia but it’s not a pile-in opportunity. The market has already priced approximately two 25bp cuts locally by around December but implies these will occur in the latter months of the year. On balance, we think these could be brought forward a little, and the amount of easing could be a little more than that. We like being long but absent an accident, it’s hard to see the RBA, or the Fed, slashing rates in a way that would send bond yields plunging.

Andrew Canobi, CFA is a Director within the Franklin Templeton Fixed Income team and a Portfolio Manager for the Franklin Australian Absolute Return Bond Fund (ASRN 601 662 631). Franklin Templeton is a sponsor of Firstlinks. This article is for information purposes only and does not constitute investment or financial product advice. It does not consider the individual circumstances, objectives, financial situation, or needs of any individual.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.