The US Federal Reserve is tightening monetary policy and US bond yields are rising. In the current environment, we believe there are significant differences between the US and Australia that suggest local monetary policy may continue somewhat independently.

Australia is different

While Australian bond yields often move in tandem with the US, particularly during periods of weakness, it is not unprecedented for the domestic market to outperform US moves or even ‘do its own thing’. Market correlation is a strong force, but sometimes domestic fundamentals are stronger.

1. The extent of the easing cycle

The first major difference is the extent to which the US and Australian central banks eased monetary policy following the financial crisis in 2008. US rates went to zero, Australian rates did not. The US used extensive quantitative easing (QE) to stimulate the economy, Australia did not. This is significant as it suggests the early stage of the US tightening cycle – the part we are in right now – is actually policy rate normalisation, not really policy tightening. It’s about the Federal Funds rate going back to a ‘normal’ level relative to history, now that the US economy has recovered.

In Australia, the mining boom initially supported the economy and when that ended in 2012, growth broadened to other sectors, preventing a recession. Monetary policy was eased but the cash rate settled at 1.5% and no QE was necessary. There is less need to normalise interest rates and the Reserve Bank of Australia (RBA) has now kept interest rates on hold for 18 consecutive months.

2. The structure of the housing market

The process of setting mortgage rates is different in each country. Australian mortgage rates are priced off the official cash rate, so a tightening of monetary policy, of say 0.25%, usually leads to a corresponding 0.25% lift in mortgage rates. This can slow the housing sector significantly and impact consumption.

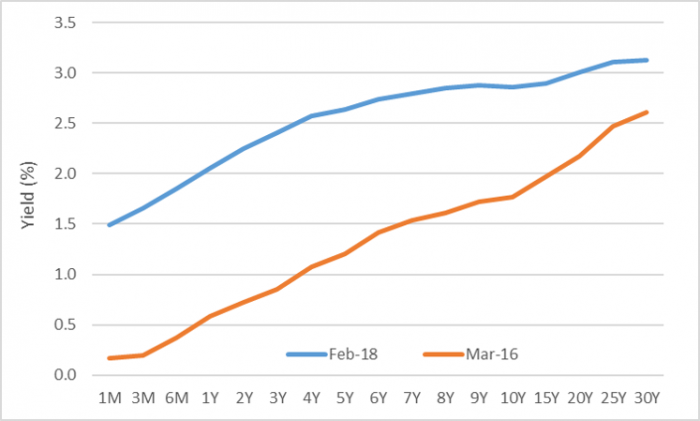

By contrast, US mortgage rates are priced off the 30-year bond yield which doesn’t move in line with the US Federal Funds rate. So US monetary policy tightening doesn’t feed straight into higher US mortgage rates. To date, the 30-year bond has been relatively stable as shown in Chart 1 that compares the US yield curve in March 2016 and February 2018. The yield curve suggests growth is expected to be brought forward by tax cuts and fiscal stimulus, but this isn’t anticipated to increase inflation materially, hence long-term bond yields have risen by less than the shorter end.

Chart 1: US yield curve

Source: Bloomberg, March 2018

Australian households currently have a lot of mortgage debt, with a household debt to GDP ratio of about 120%. High debt levels make the housing market more vulnerable to any monetary policy tightening and increase the risk of sharp slowdown in consumer demand. The RBA has stated many times that it is concerned about financial stability and this is keeping policy on hold despite US tightening. We expect this to remain the case through 2018.

The key to higher rates in Australia is real growth in wages which remains at record lows. Until consumers experience higher wages, it is unlikely that growth and inflation will accelerate sufficiently for the RBA to tighten without risking a consumption slump.

3. US fiscal stimulus

Another driver of higher US interest rates is President Trump’s fiscal stimulus, including large corporate tax cuts. It is also increasing US sovereign debt, causing investors to shift their view on where US bond yields should trade.

Consequently, the spread between US and Australian 10-year bonds has narrowed and Australian rates are just below US rates, as shown in Chart 2. This is unusual but not unprecedented, but the US is embarking on debt-funded fiscal stimulus whilst Australia is not.

Chart 2: Australian - US 10-year bond spread

Source: Bloomberg, March 2018

4. Australian dollar is holding its level

When Australian interest rates fall below US rates, there is always a risk that the $A may react negatively. This has happened in the past, but it assumes investors are only happy to invest in Australia as long as they are compensated via an interest rate premium. This is not always the case.

We believe the interest rate differential is less important as a driver of the $A, partly because commodity prices are quite strong. As a capital importer, Australia still needs willing investors to provide funding, but with the global economy strong and possibly getting stronger, investors should be more comfortable with Australian yields below US yields since national income is underpinned by commodity demand.

It is also worth noting that European interest rates have been below US rates for quite some time and this has not led to weakness in the Euro.

5. Credit spreads and positive fundamentals should prevail

Australian credit spreads between government and non-government bonds remained firm in 2017 despite concerns about US tightening. Corporate profitability is improving, as shown in the February 2018 reporting season, economic growth is steady-to-improving, and domestic leverage has moved downwards in the past 12 months.

Technical factors also suggest ongoing support for the sector, with several recent deals being well oversubscribed. For example, AusNet issued a 10.5-year BBB security during the market volatility in February and it was oversubscribed. Australian investors are still seeking yield for both cyclical (historically-low term deposit rates) and structural (baby boomers retiring) reasons. We do not expect this to change in the near term.

The bottom line

Short-term Australian interest rate rises are unlikely until early 2019, and even then, we expect the pace of tightening to be slow, with the RBA mindful of debt levels and not wanting to inhibit growth. We expect credit spreads to do well and we remain overweight in the sector, albeit with a focus on the shorter maturities, in our bond portfolios.

Anthony Kirkham is the Head of Investments at Western Asset Australia and Portfolio Manager of the Legg Mason Western Asset Australian Bond Fund. This article is in the nature of general information only and does not consider the circumstances of individual investors.