Over the past few years, the Reserve Bank of Australia (RBA) has been subjected to a blizzard of criticism from all corners for being too slow to react, not lifting rates enough, being too slow to cut rates and being economic troglodytes in general, clinging to discredited, outdated theories of how the economy really works.

The 2023 Government Review into the RBA found that:

- Between 2016 and 2019 interest rates at 1.5% p.a. were too HIGH

- While the actions during the pandemic were decisive, the board had too many generalists and not enough specialists who truly understood how the economy worked

- They responded too slowly to rising inflation in 2022 due to limitations in their modelling and data sources

Governor Philip Lowe was duly made to walk the plank. His replacement, Michelle Bullock, seems to have much of the same DNA as Lowe and, from the outside at least, RBA decision-making has continued much as before.

Private sector economists were, if anything, even more damning about the RBA than was the Government Review:

- Between 2016 and 2019 interest rates were kept artificially LOW and sowed the seeds for the dysfunctional resource allocation in the Australian economy that is behind our appalling productivity data

- It was obvious that the growth in the money supply from JobKeeper and other support programs were going to cause a surge in inflation – where was this in their models?

- Not only were rate rises too slow, but they didn’t go nearly far enough

- All classical economic modelling is useless in any event

Many from the private sector highlighted the Reserve Bank of New Zealand (RBNZ) as the very model of a modern, fast-moving, pro-active central bank. Under the muscular leadership of Adrian Orr, the RBNZ moved earlier than the RBA, lifted rates further and openly indicated that they expected a recession to result.

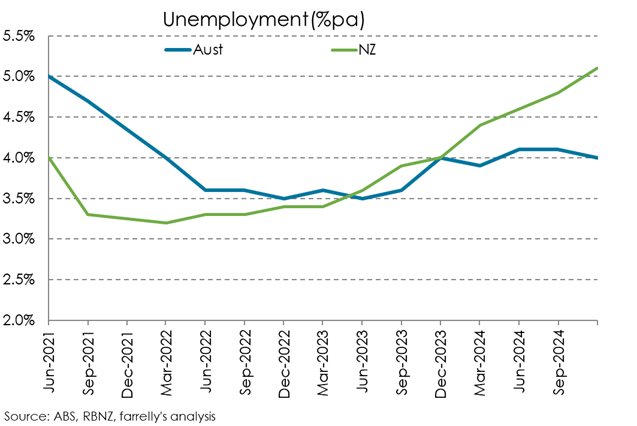

They were correct. The NZ economy has been in recession since 2023, the unemployment rate has increased from 3.2% to 5.1% at present and residential property prices have fallen by around 20%.

To put the unemployment data in context, the chart below shows the unemployment rate in New Zealand and Australia. If the RBA had followed the muscular example of the RBNZ, as so many had urged, perhaps Australia too could have unemployment at 5.1% and rising. The human cost of that would not be insignificant; an extra 166,000 Australians without work, probably an extra 150,000 Australian families desperately struggling to make ends meet.

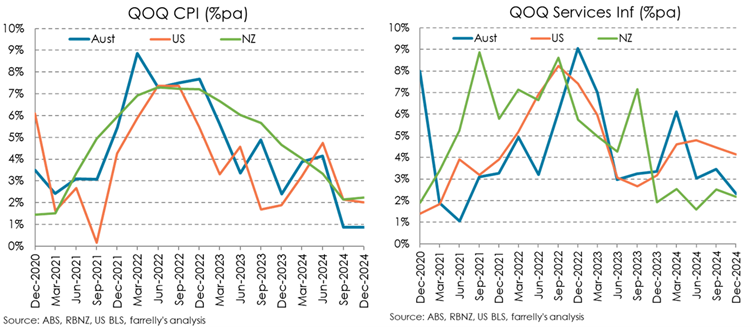

And to what end? The second chart shows the annualised quarter-on-quarter inflation rate in New Zealand against those of Australia and the US. The third chart shows rate of services inflation, perhaps a better indicator of underlying inflation. For all the pain, New Zealand does not appear to have achieved better inflation outcomes than Australia.

In early March, Adrian Orr unexpectedly resigned his role as Governor of the RBNZ without warning or explanation. Perhaps none was needed.

And what of the US Federal Reserve? Like the RBA, they appear have avoided a hard landing while bringing inflation down. Nonetheless, the jury is still well and truly out as to whether they have actually tamed inflation. In the chart above, we see US services inflation is still running at above 4% (compared to 2.3% in Australia) and that is without any impact to date of Trump’s tariff and immigration policies. The Fed still has an enormous amount of work to do.

It may well be too early to declare the RBA’s battle with inflation won. Nonetheless, at this point, despite their flawed forecasting approaches, potentially destabilising changes in leadership and seemingly ponderous decision-making, perhaps the RBA has engineered that rarest of beasts, the fabled soft landing.

It’s time to give the RBA some credit for a job well done.

Tim Farrelly is the founder of farrelly’s Investment Strategy, an independent, specialist asset allocation research service for investment advisory firms in Australia and New Zealand. Tim is also a member of Portfolio Construction Forum’s core faculty of leading investment professionals, contributing to the Conference, Markets Summit, and Academy programs.