At the Morningstar Investment Conference 2015 in Sydney on 21 May 2015, delegates were asked a series of questions prior to each session, and the results were presented. They provide a valuable insight into how financial advisers and other market professionals currently view opportunities in the market.

Here is a summary of each session, along with the results of each feedback question:

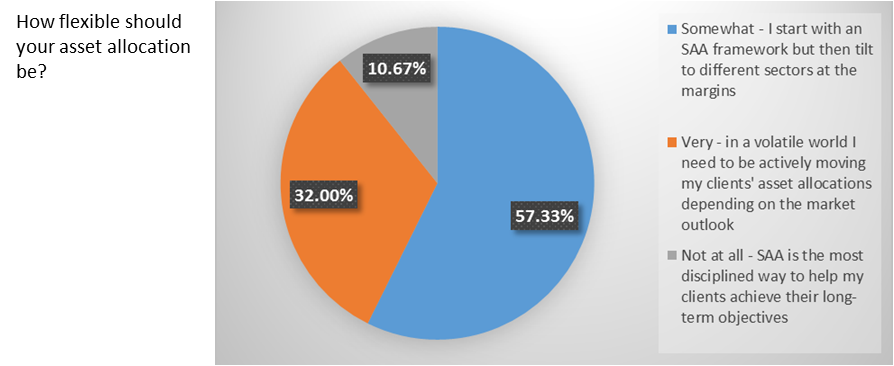

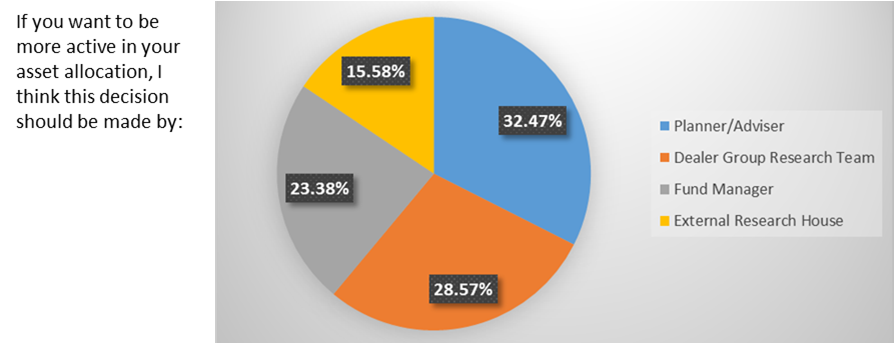

Asset allocation – Good value is even harder to find

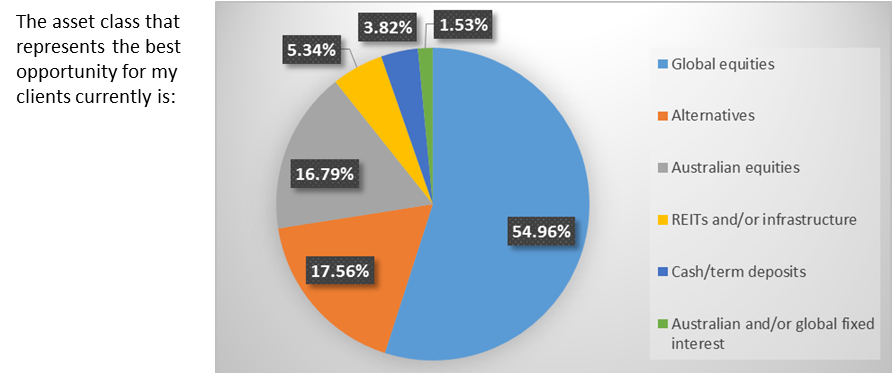

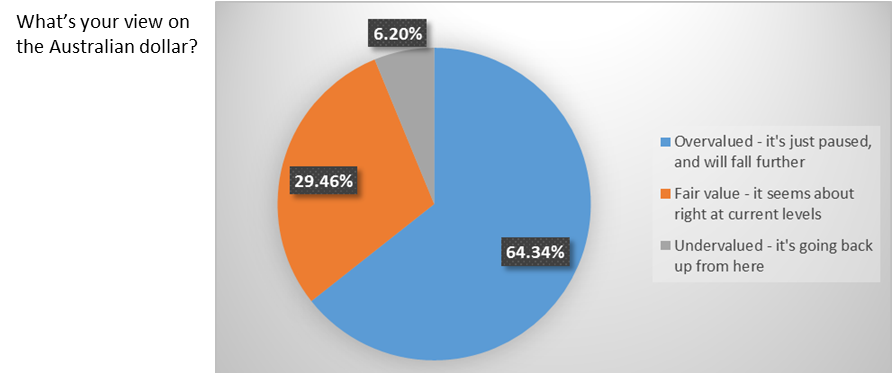

Session introduction: While the global economy in aggregate is ticking along, economic growth has been varied – the United States has been leading the charge, and China slowing down, against a backdrop of benign inflation and very accommodative policy settings. Valuations across many asset classes look expensive when set against the expected outlook. The discussion centred on how much to allocate to Australian equities, the appropriate balance between cash and fixed interest, and where value can be found in what have been strongly-performing markets.

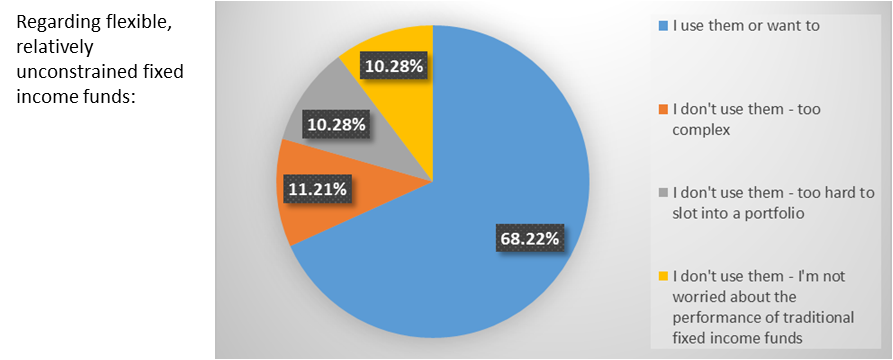

Fund investing stream – Fixed interest: haven’t we been here before?

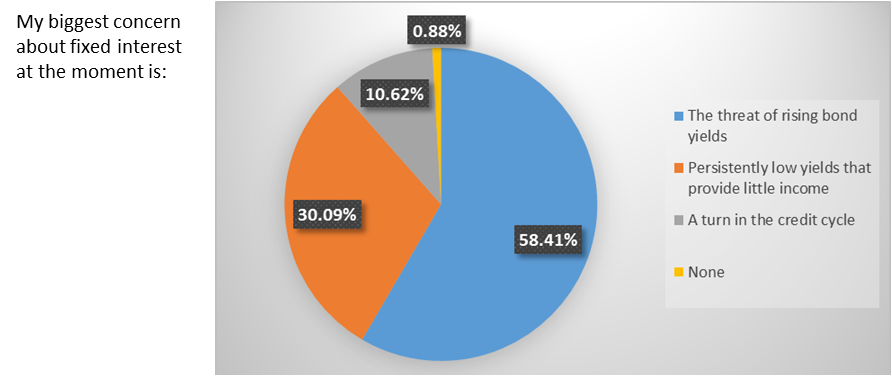

Many investors were caught off-guard as global bond yields reversed course and fell after the taper-induced jitters of 2013. Developed market government bond yields plumbed new depths, policy rates remain ultra-accommodative, and unconventional monetary stimulus is back in the headlines. Fixed income investors are again left wondering where to find value and how best to manage risk under these conditions. This session discussed fixed income markets and the implications for investors’ portfolios.

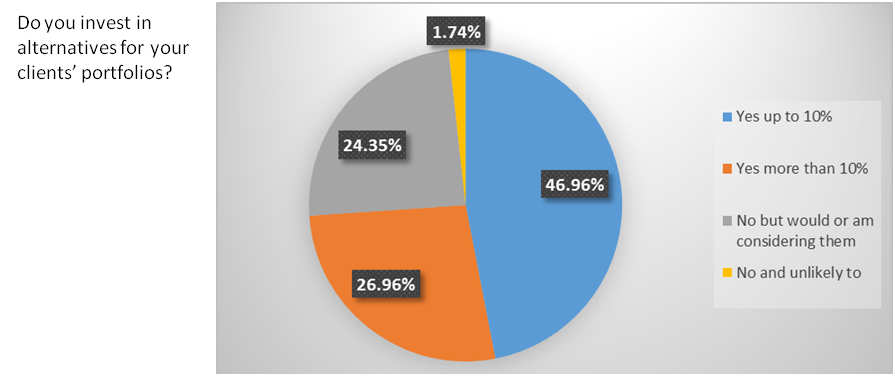

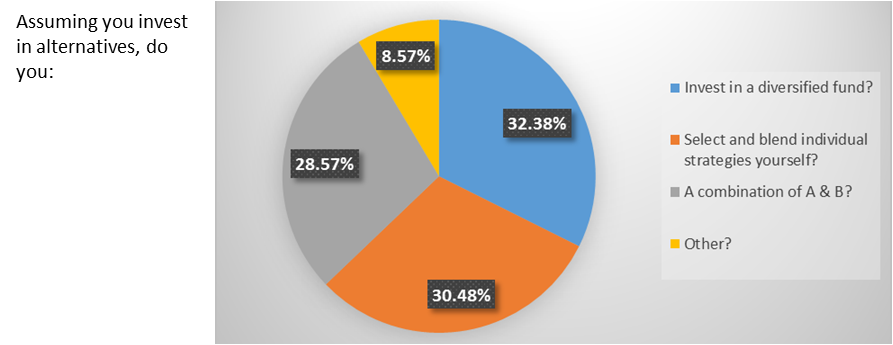

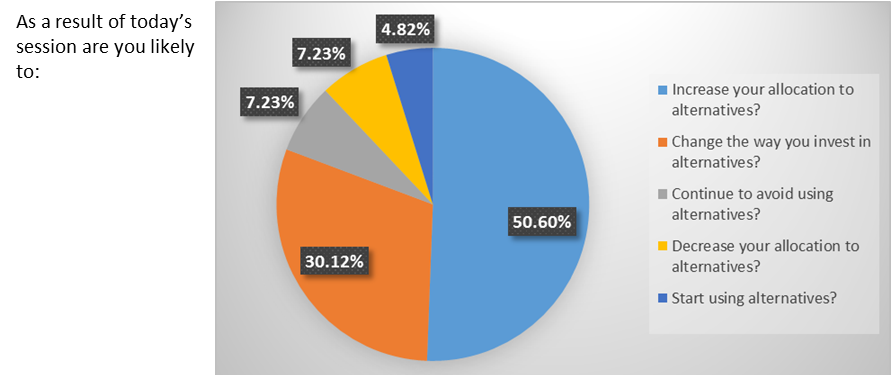

Fund investing stream - Exploring the case for alternatives

Alternatives are frequently touted as an effective portfolio diversification strategy, but how does this stack up? The session explored the case for using alternatives in client portfolios, what to look for and to avoid, how to build an alternatives portfolio allocation, and analyse current market trends.

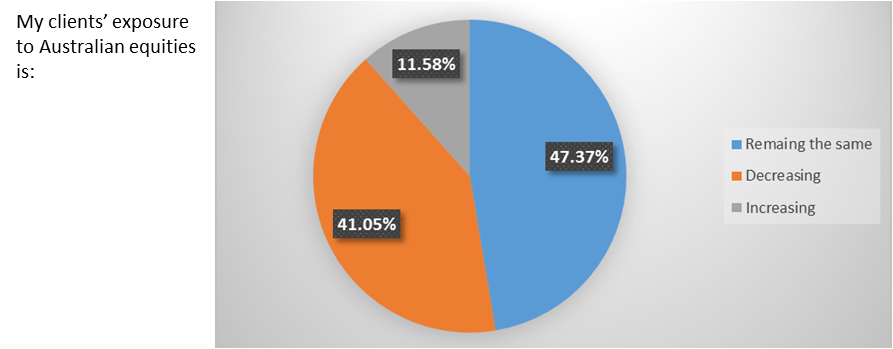

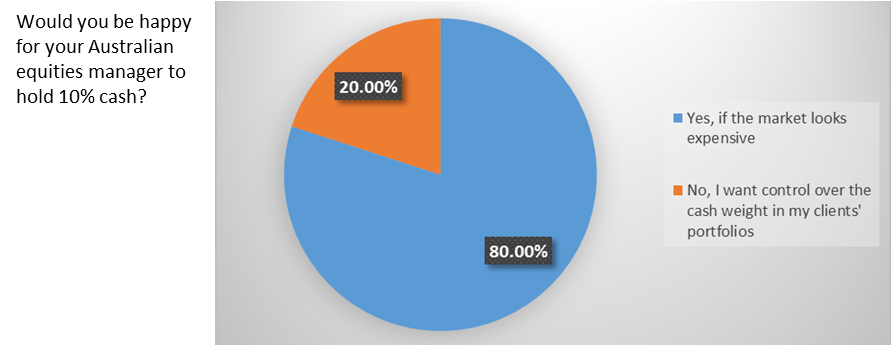

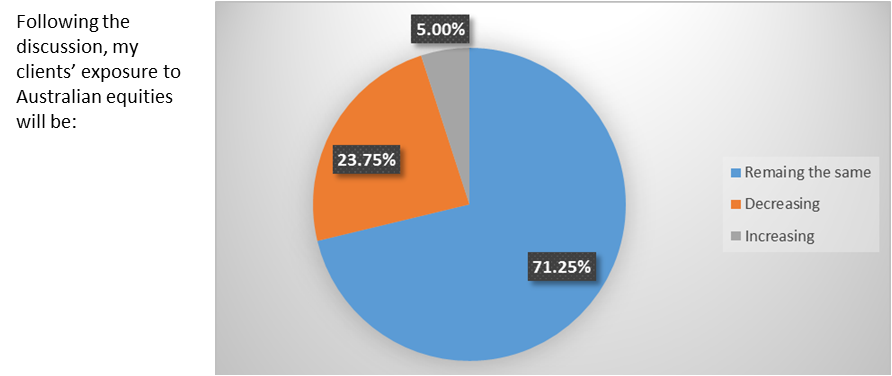

Australian equities – What’s next for Australian equities?

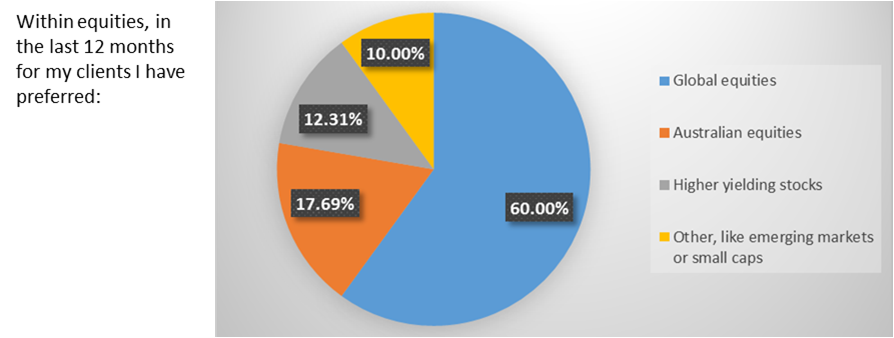

The Australian sharemarket got the year off to a flying start in the first quarter of 2015. More strong returns from high-yielding stocks help compound the great returns of the last three years – but can this continue? Is it time to increase your clients’ exposure for the next leg-up, or are we due a pullback?

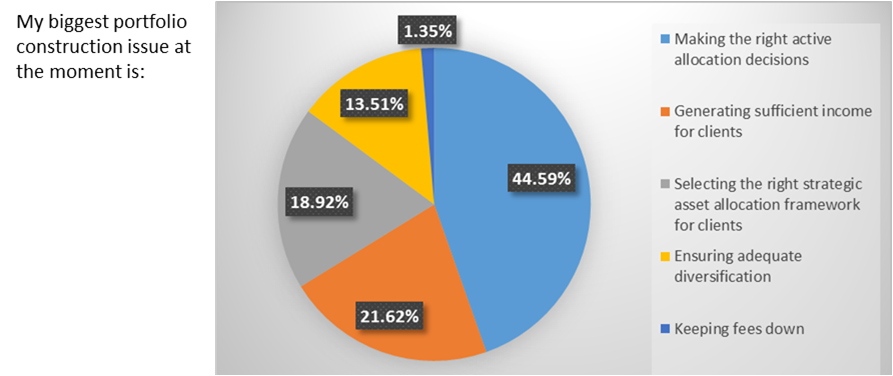

Portfolio construction – Putting it all to work

A recap and analysis of the major investment themes discussed during the day, from the top-down macro and asset allocation discussions to the bottom-up individual investment selection insights and the role of alternatives.

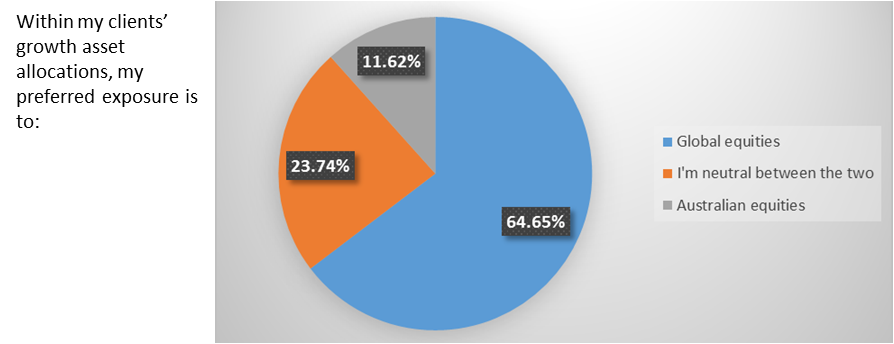

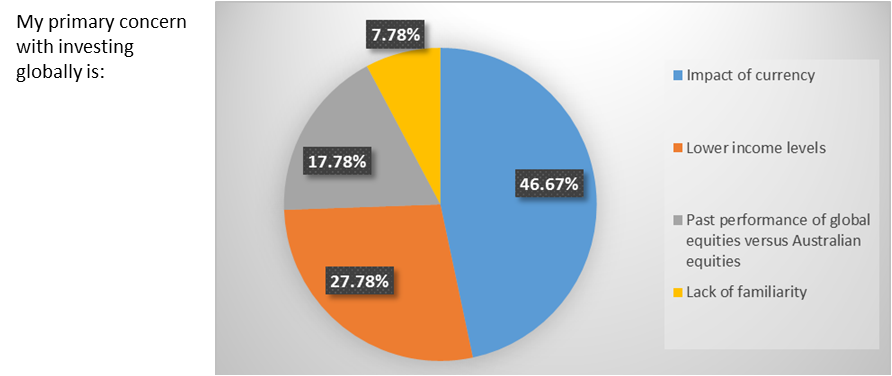

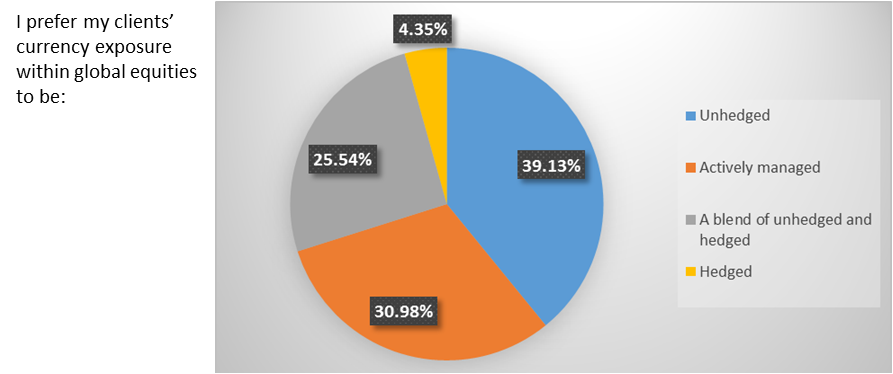

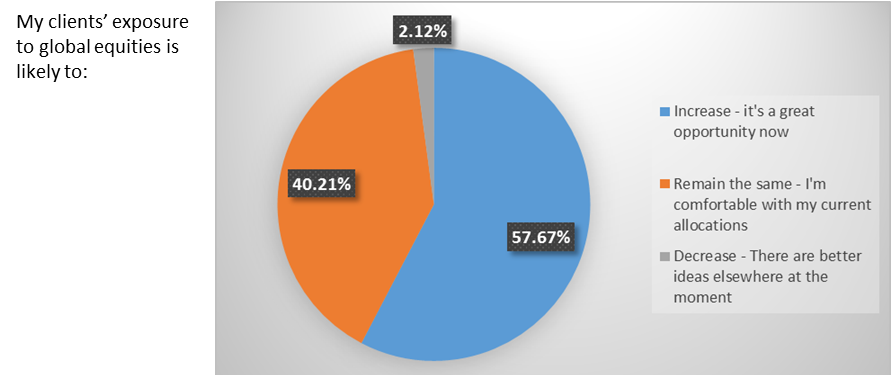

Global equities – Time for risk management, or faith in recovery?

After multiple years of strong gains, advisers would be right to doubt whether global equities is a good place for their clients’ next dollar. But relative underperformance in some regions over the past few years combined with a sustained decline in oil prices and persistently low bond yields make that analysis far from straightforward. A discussion on whether to batten down the hatches or look for good opportunities.

These results were reproduced with the permission of Morningstar. The information contained in this article is for general education purposes and does not consider any investor’s personal circumstances.