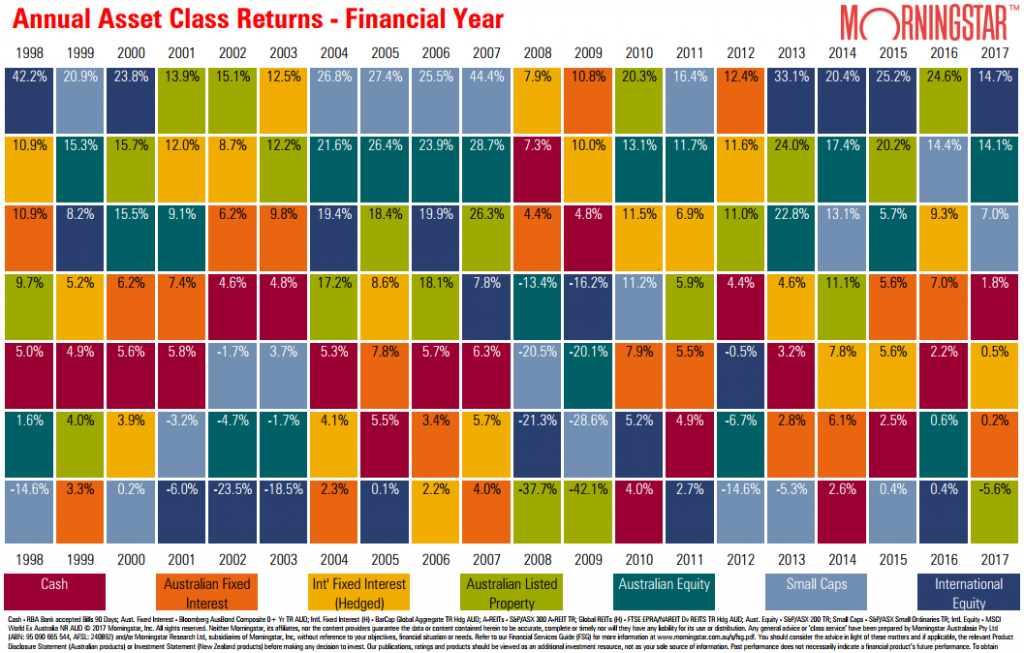

It’s always fascinating to look back on a financial year and see the winners and losers, and confirm how tough it is to pick the best asset class in advance. The Morningstar Asset Class Gameboard for 2016/2017 shows the order from best to worst was:

- International Equity (unhedged): 14.7%

- Australian Equity (ASX/S&P200 Total Return): 14.1%

- Australian Small Caps: 7.0%

- Cash: 1.8%

- International Fixed Interest (hedged): 0.5%

- Australian Fixed Interest: 0.2%

- Australian Listed Property: -5.6%.

Asset allocation is more important for long-term returns than stock selection, although within each asset class, there are significant successes and failures. For example, last year there was a dramatic difference in performance among Australian A-REITs and it was the big stocks than pushed the overall index down.

These equity returns are far higher than most analysts expected a year ago, and the ‘lower for longer’ has yet to play out. International Equities has hit the jackpot in four of the last five years. Will it do it again?

What do you expect for 2017/2018?

More important than looking back is what the future brings. We attach three quick questions on which asset class you expect to come first and last in this new year, and how you expect the S&P/ASX200 Total Return Index (including dividends) to perform. The survey is linked here or can be completed below, and will take less than a minute to complete.