The recent release of the Mercer CFA Institute Global Pension Index, the 13th edition of this annual survey of the world’s key pension systems, could not have been better timed. Not just because of widespread debate on differing retirement income systems, but it’s an opportunity to revisit one of my earliest contributions for Firstlinks eight years down the track.

In 2013, I wrote a piece entitled “In super the Danes are great, Australia a close third” , based on the fifth edition of the Index. The underlying methodology for ascribing an index value to each country has remained consistent since. The final value is a weighting of three sub components; Adequacy has a 40% weight, Sustainability a 35% weight and Integrity the balancing 25%.

The latest edition covers 43 nations and around 65% of the world’s population. Some 50 questions are posed of each country, the answers helping to rate each from a scale of A (a system with an index score above 80) to E (a system with an index score below 35).

In the case of Australia, only the APRA-regulated part of Australia’s $3.3 trillion super system is subject to the rating process; so in effect 156 or so corporate, industry, public sector and retail funds. The SMSF sector, incorporating some 600,000 funds that collectively hold approximately $820 billion (as at 30 June 2021) is not considered.

Australia slipping in relative and absolute terms

The latest report sees Australia receive an index score of 75.0, putting it in sixth place among the 43 nations. This compares to a score of 77.8 and third place in the 2013 report.

How did Australia slip off the podium of the world’s elite pension systems, and why has it been going backwards, both on a relative (position amongst peers) and absolute (falling index value) basis?

Australia’s fall is partly due to the continuous addition of new countries from the original 11 of 2009. This year four new nations were added. One of them, Iceland, went straight to the gold medal position, scoring an impressive 84.2 on debut. Neither previous winner Denmark or the Netherlands cracked 84 in any prior report. That’s quite an entrance.

Iceland had both the highest Adequacy and Sustainability index scores, with its retirement income system comprised of a state pension with two components (both of which are income tested according to different rules), mandatory occupational pension schemes with contributions from both employers and employees, rounded out by voluntary contributions into government-approved pension products.

Australia was also nudged out of fifth spot by a much-improved Norway, its index value climbing from 71.2 in 2020 to 75.2 this year. Israel took out the fourth spot (77.1), with Denmark third (82.0) and the Netherlands second (83.5).

The strain from Hayne

The decline in Australia’s index value since 2013 is perhaps the more worrying development. After scoring 77.8 in that 2013 report, Australia peaked at 79.9 the following year, a whisker shy of attaining an ‘A’ rating, and with it recognition as ‘a first class and robust retirement income system that delivers good benefits, is sustainable and has a high level of integrity’.

Australia then trended downward, before a significant fall in 2018 to 72.6, losing its coveted B+ grade for the first time. 2018 was, of course, the year during which the Hayne Royal Commission sat, and much of the evidence surfaced therein was damaging to the super sector, some of it brutally excoriating.

A system in need of a reboot

In addition, the Productivity Commission’s inquiry into the sector, delivered a few short months before Commissioner Hayne’s final report, painted an unflattering picture of superannuation as an “unlucky lottery”, prone to frictions created by unintended multiple accounts, and serial underperformance experienced by far too many superannuation members.

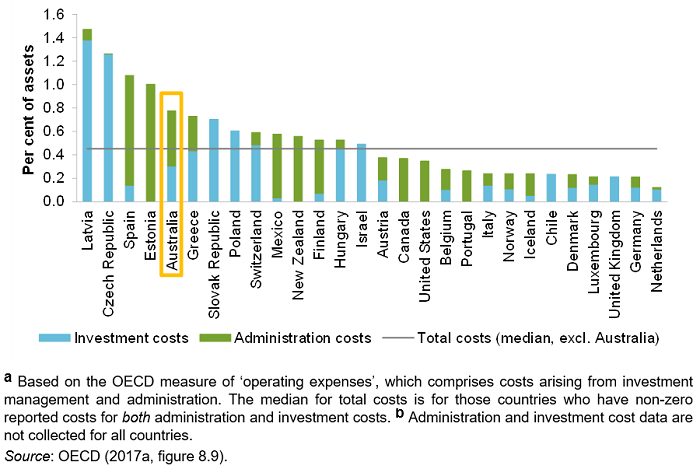

Data collected by the Productivity Commission showed that superannuation fees and costs were at the upper end of global comparators, and significantly higher than pension top dogs, Denmark and the Netherlands, as the following chart from the final report illustrates.

Fees and Costs as a Percentage of Assets, 2016

Part of the reason for this imbalance does, to be fair, lie in Australia’s heavy tilt toward Defined Contribution plans, where the administration burden at the individual member level (contributions, switches, partial commutations, pension payments) tends to be resistant to scale benefits that more readily accrue to other aspects of superannuation management (such as investments).

New headwinds of scale

The super landscape looks very different today than it did when Commissioner Hayne presided over those 2018 hearings. Many financial conglomerates, and most of the big four banks, have exited retail superannuation altogether, if not substantially.

Chief amongst these changes is the recently-enacted ‘Your Future, Your Super’ package which has just seen the commencement of account stapling, so that one super account follows an individual through any number of employment changes, and a new annual investment performance test, the first of which saw 13 MySuper products fail to come within -0.5% p.a. of their respective risk-adjusted benchmarks.

And then there is the new Best Financial Interests Duty (BFID), which places a statutory obligation on super fund trustees to do all things necessary to ensure that spending is best directed to the advancement of member outcomes. The days of profligacy in certain parts of the super sector now appear numbered.

The message being sent to the superannuation industry is as clear as it is stark: cost matters in providing appropriate member outcomes. If you can’t meet that challenge through scale, you should consider your position.

The reason is simple enough, as the Mercer CFA Institute Global Pension Index report states:

“it is likely that as funds increase in size, their costs as a proportion of assets will reduce and some (or all) of these benefits will be passed onto members.”

Australia: big system, small funds

It is remarkable that, as a nation of some 20 million adults, Australia has the fourth largest pension pool, after the US, the UK and Canada. OECD data put our super system at 3.8% of total OECD pension assets (as at the end of 2019). But by global standards, with a few exceptions, our pension funds lack the scale needed to push costs down significantly.

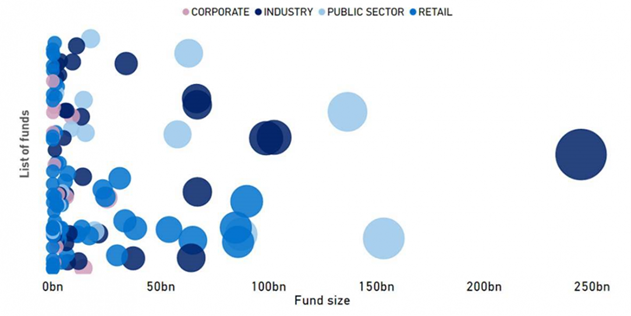

Margaret Cole, APRA’s new board member in charge of superannuation (British by birth and a veteran of pension regulation within that system) left little doubt of APRA’s thinking at a recent speech. She pointed out that, as at 30 June this year, of the current 156 APRA-regulated funds, only four manage assets in excess of $100 billion. Another 13 managed assets between $50 and $100 billion. In short, 11% of funds currently manage 70% of all APRA-regulated super assets.

To make her point crystal clear she produced the below chart showing the dispersion of funds by size:

Breakdown of APRA-regulated superannuation funds by size and type

Source: APRA

The Australian system is characterised by a handful of funds that have meaningful scale, and a large tail of funds that don’t, and who must now be considering Ms Cole’s warning:

“[f]or all funds, but especially for the vast majority managing assets of less than $10 billion, that [the members’ best interests] needs to include urgent, focused consideration of finding a compatible merger partner, or consolidating products, to gain economies of scale, cut costs and lift returns”.

Consider the latest Pensions & Investments list of the world’s largest pension funds, provided in US dollars as at the end of 2020.

The largest Australian pension fund, AustralianSuper, ranks 22nd, with some USD $156 billion. The next largest is Aware Super at 39th (USD $107 billion). No other Australian pension fund makes the Top 50.

Compare that to the largest pension fund in the world, Japan’s Government Pension Investment Fund (GPIF). It had USD $1.7 trillion in assets under management at year end, 11 times the size of Australia’s largest fund. With that size and buying power, GPIF now has an investment fee of under 0.05% per annum.

That is a stark reminder of the scale discrepancy currently in existence in Australia, and the dilemma in which many smaller super funds now find themselves.

Decumulation - super’s final frontier

Another curious artefact of Australia’s modern super system, barely 20 years old, is that the emphasis so far has been on ‘accumulation’ (growing member balances during their working lives) rather than ‘decumulation’ (converting those balances to a sustainable income in retirement).

In the closing section of my 2013 piece I noted that “[p]ension systems exist to provide benefits in retirement, and the best systems deliver that goal to the greatest number by the most robust means possible”.

Only now, some seven years and numerous consultations, white papers, green papers, roundtables and conferences later, has a legislative framework been implemented to bring the David Murray-led Financial System Inquiry ‘Comprehensive Income Products for Retirement’ (CIPR) vision to life, at least partially.

As from 1 July 2022, super fund trustees will be required to have a Retirement Income Covenant in place for members; essentially a document that details how they propose to create retirement income products to cater for their retiring members. Retirement income strategies can either be developed to treat all retiring members equally, or to separate members into cohorts based on characteristics the trustee deems most relevant.

In some ways, APRA-regulated super funds are playing catch-up with the SMSF sector which has long had a focus on the decumulation phase. Lessons learned in SMSF pensions may well, somewhat ironically, find their way to the APRA-regulated space.

Shooting for an ‘A’ grade?

Despite the unexpected fall in Australia’s standing as a Top 3 super system, with the new legislative impetus, our system can turn the corner and regain its former glory.

With industry consolidation and scale, Australia might not just recapture its previous Bronze medal podium place, but has every chance of pushing for an index score north of 80, and thus an ‘A’ rating.

The APRA-regulated super sector might look significantly different from today when it does, but that will be to the good of all Australians who rely on the super system to help make our retirement years our golden years.

Harry Chemay has more than two decades of experience across both wealth management and institutional asset consulting. An active participant within the wealth and superannuation space, Harry is a regular contributor to investment websites in Australia and overseas, writing on investing and financial planning.

He has also been appointed an Australian ambassador to the Transparency Task Force, a UK-led global initiative to bring greater transparency and accountability to financial services.