On face value, the major Australian banks' recent earnings results were weak and below expectation. ANZ Bank (ANZ), National Bank (NAB) and Westpac (WBC) have all now posted second half FY17 results and Commonwealth Bank (CBA) a first quarter FY18 update.

Over the period, all the banks suffered a drag from the government’s bank levy and from fines and regulatory compliance costs emanating from their various indiscretions. But the biggest drag on earnings was market income.

Market income refers to profits made by the banks’ proprietary financial market trading and broking activities. For these divisions to be profitable, market volatility is required to provide for both trading range opportunities and client interest. What did we see over the period in question? A stock market stuck in the same range for months, with the VIX volatility measure at an historical low, and the RBA’s cash rate unchanged, leading to little volatility in interest rates.

Solid underlying result

Ignoring market income, analysts saw a pretty good underlying result from the majors over the period. Revenue growth was solid, reflecting mortgage repricing. Asset quality continued to improve, implying yet another earnings boost from lower bad & doubtful debts (BDD).

Underlying net interest margins improved, despite the drag from the levy and regulatory costs. Aside from the banks all increasing rates on investor mortgages and interest-only mortgages, on the other side of the equation, wholesale funding costs fell. Competition among the banks on deposit rates eased.

As Deutsche Bank puts it, “There was little to suggest [in this result season] a material deterioration in credit quality is imminent, with no new problem areas”.

We have also now eased off on fears over bank capital positions, which so dominated the past couple of years as APRA waited interminably for new Basel IV international guidelines that never came, before spending another lifetime finally deciding what the earlier throwaway line of ‘unquestionably strong’ actually meant in real numbers. It meant 10.5%.

Analysts agreed that achieving a tier one capital ratio of 10.5% by the 2020 deadline would be a stroll in the park for the majors. As at this result season, ANZ and Westpac are already over the line, with ANZ in particular benefitting from asset divestments. NAB is dragging the chain at 10.1% but should catch up ahead of time. CBA was looking comfortably on track in the middle, but we’re yet to find the extent of fines.

The bottom line is that bank investors no longer have to fear possible capital raisings or dividend slashes in order for the banks to meet stricter capital requirements.

All looks rosy in bank land ... or does it?

What can investors look forward to?

Things are looking a little rosier on the bank market income side as we move into FY18 (further into FY18 for CBA). The local stock market has at least broken out of its trading range. But FY18 will see bank earnings handicapped by a full year of the government’s bank levy and as noted, there remains an unresolved issue of fines.

On the positive side, mortgage repricing benefits will continue to flow through. But APRA’s crackdown on interest-only loans, and subsequent hikes to banks’ variable interest-only rates, has prompted a flood of property investors switching to standard principal & interest loans at lower rates.

The banks should continue to enjoy an earnings boost for another six months or so. However, the flipside is additional APRA restrictions regarding the ratio of risk-weighted assets held in bank portfolios, which in short means the banks have to cut the number of riskier loans on their books (investor, interest-only) as a ratio of all loans. Repricing those mortgages goes some way to achieving such a reduction, as existing investors switch to P&I and potential new investors are put off, but this also ultimately implies lower loan book growth.

Analysts agree that the impact of tighter APRA restrictions is an ongoing story rather than a one-off event. The benefits of repricing will continue to provide a tailwind. Eventually, the number of investors still looking to get into the property market will ease, offsetting those repricing benefits. There will be a point at which any further repricing will lead to a fall-off in demand to the extent that bank earnings reduce, not rise. And that’s in isolation, before we begin to even talk about signs the Australian housing boom is now cooling.

Morgan Stanley, for one, suggests bank margins are currently in a sweet spot that won’t last as far as the second half of FY18. Morgan Stanley is not alone. Of the various brokers’ result season report headlines, “Has retail banking seen its best days?” asks Citi. “Environment challenging,” suggests Deutsche Bank. “Tapped out on revenue growth,” says Credit Suisse.

It has nevertheless been a while now that bank analysts have warned of subdued earnings growth ahead. The question is as to whether or not such a view is reflected in bank share prices.

Banks trading at discount to other industrials

One of the enduring bull arguments for the banks, notes Goldman Sachs, is that bank PEs are trading at a -30% discount to non-bank industrial PEs compared to a 17-year average of -15%. But as Goldman notes, the banks are expected to deliver less earnings growth and return on equity compared to non-bank industrials than has been the case on average since 2000.

Thus, suggest the analysts, unless one believes the risk inherent in the Australian banking system is materially less today than has been the case since 2000, the banks appear to be trading at relative fair value.

Which brings us to relative valuations between the banks themselves.

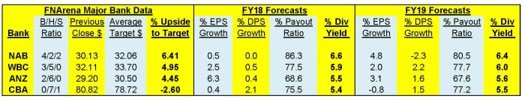

NAB’s result was the least well-received by the market, not because it was any worse on an underlying basis than peers but because the bank announced a costly increase in investment. A month ago, the market had priced NAB to within 1% of the FNArena database consensus target price for the bank, but as the above table shows, the gap has now blown out to over 6%.

CBA’s earnings update received the most positive market response, despite the bank having to shift money aside to cover (hopefully) whatever the regulator may apply in fines. This remains a point of uncertainty for CBA.

ANZ’s earnings growth is expected to lag peers in FY18 but the bank’s program of simplification and subsequent divestments will put the bank in a strong capital position. Westpac will, continue to do what Westpac does.

The government recently slapped the levy on the banks to head off increasing calls for a bank Royal Commission. The Opposition has made it clear that were it to win government, a Royal Commission would sit atop the to-do list. A Royal Commission is all the banks need right now.

Greg Peel is Senior Writer at FNArena. Investors can trial their service two weeks for free at www.fnarena.com. This article is general information and does not consider the circumstances of any investor.