Most companies report their financial years ending in June, and as we head into profit reporting season in Australia, it is worth checking the outlook for earnings and dividends.

Company earnings tend to rise after economic booms and then decline after economic slowdowns. There is a lag between when activity affects a company and the time it reports it to the market, often many months later. Share prices lead earnings. Ironically, share price crashes generally occur while earnings are strong (because reporting lags activity) and share rebounds generally happen when earnings are weakest. Dividends lag even further behind. Dividends cuts are the last resort for boards.

Earnings and share market cycles

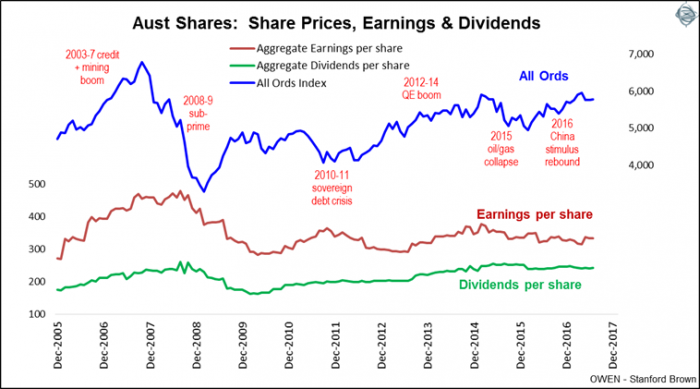

The chart shows the All Ordinaries Index (blue), the aggregate company earnings per share (orange) and aggregate dividends per share (green) since 2005.

2008 was a great year for profits (although much of it was accounting fiddles, revaluations of already over-valued assets, and straight out fraud, as it is in all booms) but share prices crashed. Then in mid-late 2009 to 2010 earnings were falling and dividends were being cut savagely but share prices rebounded strongly.

The problem at the moment is on the right side of the chart. Aggregate earnings per share fell in 2015 and 2016, mainly due to losses in the big miners, oil and gas, and other write-offs on bad acquisitions such as by NAB and Woolworths. Dividends are also weak, again mainly due to mining but also ANZ last year and probably Telstra soon.

Company earnings and dividends struggling

Despite Australia’s so-called ‘miracle economy’ that has not had a ’recession’ in 25 years, company earnings are still some 30% below where they were 10 years ago, and dividends are still 7% lower - and that’s before inflation. The actual dollar amount of dividends has risen, but the per-share figures are lower because of all the dilutive capital raisings imposed on investors in the GFC. Investors have had to put their hands in their pockets due to the mistakes of managements and boards and to pay more for the same dollar amount of dividends.

In the up-coming August reporting season, we are expecting modest growth in earnings and dividends. The big cartel-like banks are reaping windfall profits from their coordinated rate hikes on housing loans while they keep loss provisions at wafer-thin levels, and the miners are restoring profits and dividends as they put prior losses behind them thanks to the commodities price rebound in 2016.

What lies ahead?

This calendar year thus far has been kind to investors who hold sensibly diversified portfolios. Share prices are rising in most markets around the world, interest rates remain low everywhere, oil prices are benign, and market volatility is at record lows. There are even early signs of much hoped-for price inflation in Europe and Japan. Only faint, but enough to prompt central bankers to start talking about scaling back asset buying programs and maybe even raising interest rates. Probably too soon, but the prospect has kept bond yields low after their spike late last year.

Europe seems to have settled down a little following Emmanuel Macron’s stunning election win in France, but a much larger test will be at the Italian elections later this year. Italy has probably the largest general anti-Europe vote and it may be a repeat of Brexit. Chinese growth numbers are being propped up leading up to November’s convention when Xi Jinping will seek (and receive) glowing endorsement of his glorious reign. In Australia, the government seems to glide along not doing much, getting diverted into endless dead ends and distractions. The local economy bounces along lurching from one source of good fortune to the next. This time it is the purely fortuitous rise in commodities prices and the resulted unexpected gains in mining tax revenues taking the pressure off doing anything about the budget deficit and mounting debt pile.

In the US President Trump remains completely incomprehensible and unpredictable. Months ago, I gave up trying to remember the names of all the various characters he hires and fires each week. So far Trump has run into difficulty getting his legislation through Congress and his executive orders through the Courts. Where he has freer rein is in foreign policy, but in the past week another major check to his power was added when Congress effectively blocked his ability to lift sanctions on Russia. Trump is certainly inventing new ways to be unconventional, but the rest of the system (and increasingly his own Republican Party) is also inventing new ways to make sure he doesn’t do too much damage. The bigger picture is that Trump is probably removing America from its dominant place in the world, exemplified by the recent G-20 meeting in Hamburg which effectively became the G19 without Trump.

When an incumbent power is removed or vacates its central role, the resulting vacuum rarely resolves itself neatly. There will be big challenges ahead where real leadership is required, such as dealing with China’s North Korea.

Ashley Owen is Chief Investment Officer at privately-owned advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is general information that does not consider the circumstances of any individual.