Australia has some important and resilient industries which have taken up some of the slack in the wind down of the construction-led commodities boom. Record tourist numbers from China, education for international students, strong food exports and a resurgent wine export industry have been sectors which have not only been performing well but have been creating new records. Australia’s economy grew 3.1% year on year to the first quarter of 2016 on the back of a better than expected services sector.

Increasing arrivals to Australia, especially from Asia

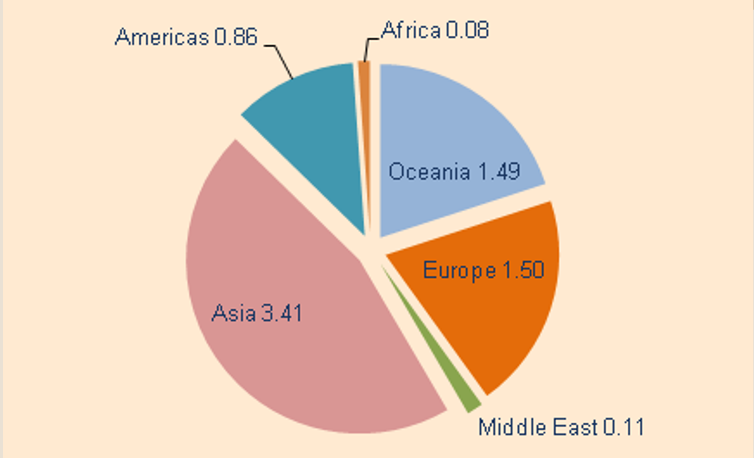

Short-term arrivals from Asia into Australia make up the largest share of any source region. In 2015, as shown in Chart 1, 3.4 million visitors from Asia came to these shores. For the first five months of this year, 3.3 million people have arrived on short-term stays, almost one million more than for the same period five years ago.

Chart 1: Short-term arrivals into Australia in millions, 2015

Source: ABS, Owners Advisory, July 2016

Australia is one of the biggest beneficiaries of the rising consumer in Asia where the region is expected to account for more than two-thirds of the global middle class by 2031. The tourism numbers have boomed from China with 1.4 million short-term arrivals from the mainland and Hong Kong in the past 12 months. This number has now surpassed New Zealand as the country where most short-term arrivals originate.

In addition to tourism, Chinese and Indian students are taking education opportunities in Australia. Education sits behind iron ore and coal as the country’s third largest export. In 2014–15 export income from education was estimated at $18.1 billion. Education is also a pathway to settlement for students who opt to remain in the country as skilled participants.

Food glorious food

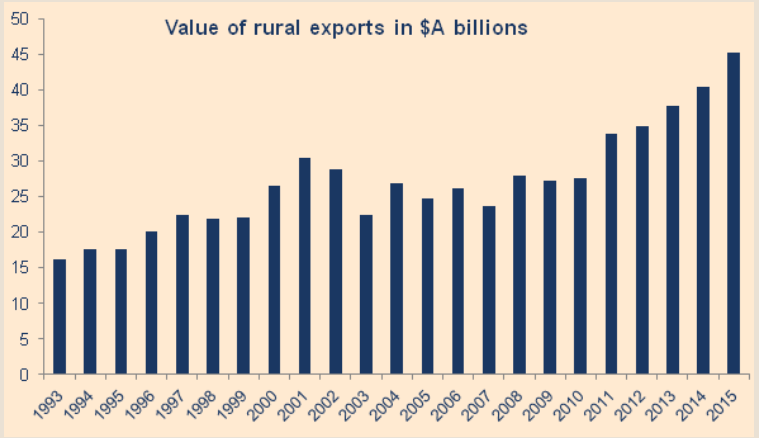

Demand for a bit of ‘Australia’ in the form of food and wine has seen both export classes touch record highs in the past three years. Grain and meat sales have garnered a lot of the attention as Asian consumers change to a more protein-based diet. Agricultural and fisheries exports for the last financial year reached about $46 billion, as shown in Chart 2, or about 25% of Australia’s overall commodity exports of $205 billion.

Chart 2: Australia exported over $45 billion of rural products in 2015

Source: ABS, Owners Advisory, July 2016

Australian wine rises on strong Chinese demand

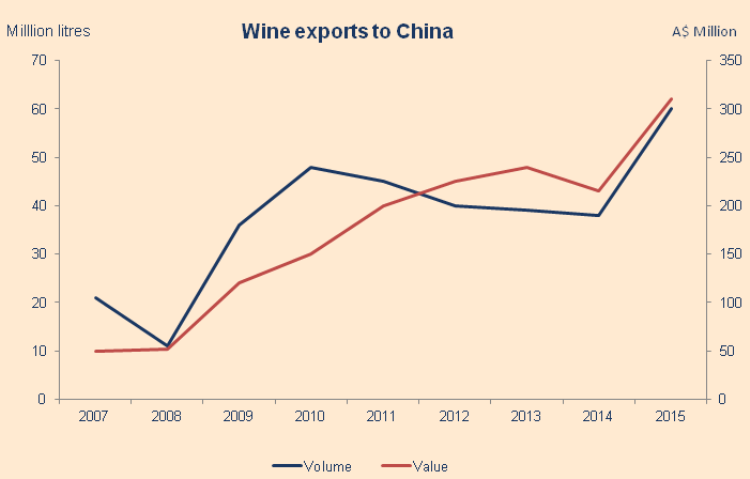

The Australian Bureau of Agricultural Sciences reports that annual wine exports grew over 10% in 2015, and is forecast to generate sales of $2.2 billion in the coming year.

Chart 3: Australian wine to China

Source: Department of Foreign Affairs and Trade, Owners Advisory, July 2016

Austrade points to the Chinese middle class as the primary driver of interest in Australian wine, which is regarded as a stable, consistent and high-quality product. China is now the second largest export destination for Australian sparkling, red and white wines, taking over from the United Kingdom earlier this year.

Achieving exposure to these export sectors

There are many ways for investors to gain exposure to these sectors. Without going into much detail here, Sydney Airport is one of the main gateways into Australia, and while shares are not cheap, the medium- to long-term returns should persist into the future.

Navitas is a global education provider offering a range of educational services including university programmes, resettlement assistance and language training. Navitas scores well on a number of key metrics of profitability, quality of earning and a management team delivering on its mandate.

Treasury Wines is one of the world’s largest wine companies with brands including Penfolds, Wolfblass and Rosemount, and the outlook for growth of underlying sales and earnings looks strong.

John O’Connell is Chief Investment Officer of Macquarie's Wealth Management group, and Founder of the bank’s roboadvice division, OwnersAdvisory. This article is general information and does not consider the investment needs of any individual.