Midway through 2020, the prevailing view was that 2021 would be a challenging year for Australia banks, which were expected to face an unemployment rate above 10%, a 20% fall in house prices and significant declines in lending as the economy was expected to be beset by large company collapses.

This scenario would have seen the banks eat through their carefully-hoarded capital reserves and probably encouraged by a nervous regulator to issue more equity at deeply discounted prices.

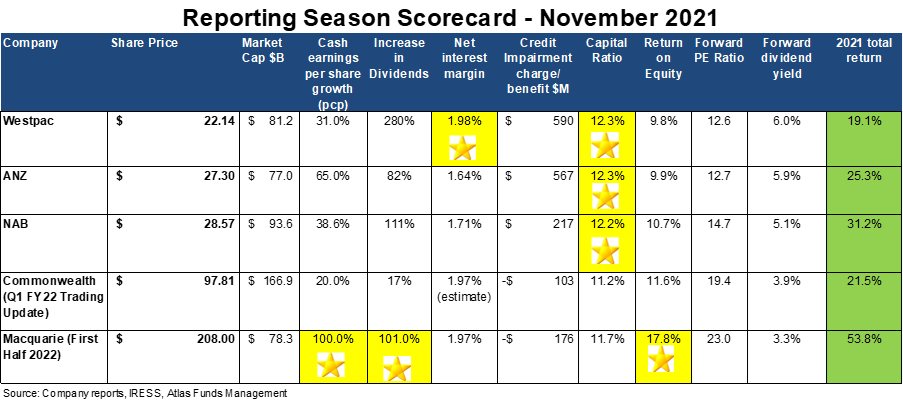

The November 2021 reporting season proved these forecasts incorrect, with bank dividends increasing sharply, loan loss provisions taken in 2020 written back, all banks conducting share buybacks and demand for business and home loans robust.

In this piece, we will look at the themes in the approximately 800 pages of financial results released over the past two weeks, including CBA's 1st Quarter 2022 Update, awarding gold stars based on performance over the past six months.

Recovering from the pandemic

The key feature of the November results for the banking sector was the continued recovery in the financial health of corporate and household Australia.

Instead of a steep increase in unemployment and falling house prices, thus increasing bad debts for the banks, the unemployment rate has declined from a peak of 7.5% in June 2020 to 5.2% in October 2021. The CoreLogic Home Property Value Index increased by 20.6% over the 12 months ending in October, led by Sydney houses and apartments that gained 25.2%.

This vast improvement in the outlook saw Westpac, ANZ and NAB continue to write back provisions taken against expected COVID, with CBA and Macquarie only recording minimal loan losses. The discrepancy between loan losses is due to the different times that the various banks report their results. Bank management teams were facing a bleak and uncertain outlook during COVID and made provisions of approximately $2 billion each for expected losses. Additionally, NAB raised $3.5 billion from its shareholders. As CBA has a June year-end, its management team had the advantage of observing a recovering economy and the impact of $311 billion in Australian government stimulus measures.

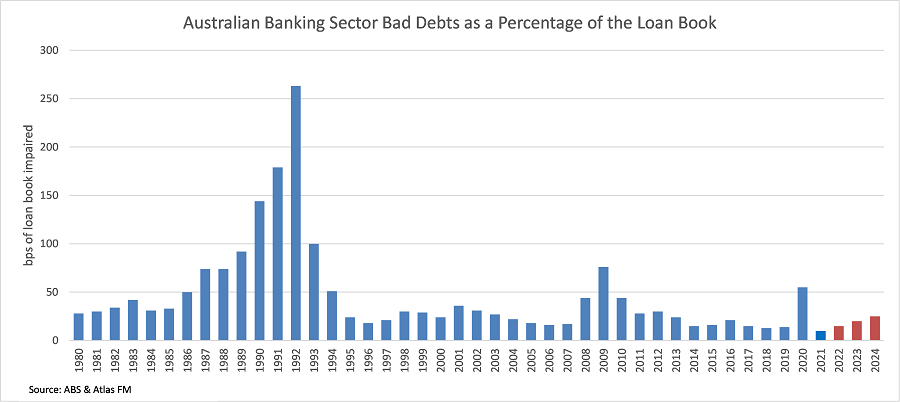

The chart below shows banking sector bad debts over the past 40 years. The recovery from COVID has been faster than the GFC, and nothing like the decade it took the banks to recover from the 1991/92 recession.

Give me my money back

Excess capital and share buybacks have been a feature of the recent results season, a theme that would have been unfathomable 18 months ago.

All banks have a core Tier 1 capital ratio well above the Australian Prudential Regulation Authority's (APRA) 'unquestionably strong' benchmark of 10.5%, aided by asset sales in wealth management, COVID provisions, as well as low to no dividend payments and lack of the expected loan losses.

The second half of 2021 has seen the four major banks buy back $13.5 billion worth of their own shares, with CBA ($6 billion) and Westpac ($3.5 billion) buying back off-market due to a higher level of franking credits which can be paid directly to investors. NAB ($2.5 billion) and ANZ ($1.5 billion) have been gradually buying back shares on the ASX, due to their lower level of excess franking credits stemming from these two banks offshore adventures, which limited the amount of tax paid in Australia.

The rationale for buying back shares is couched around neutralising the impact of lost earnings from divested insurance and wealth management businesses. However, reducing the share count will make it easier for bank management teams to hit the return on equity targets (ROE) as the equity divisor is reduced. NAB, ANZ and Westpac all have similar levels of Tier 1 capital post their capital management initiatives, with CBA's current lower level of capital reflecting both a large buyback in 2021 and not taking large loan loss provisions in 2020.

As APRA appears content allowing CBA to have a lower level of excess capital, investors in the other three banks can probably expect further share buybacks in 2022 if economic conditions remain benign.

Falling Net Interest Margins

Net Interest Margins (NIM) were a major topic during the November banks reporting season, with the share prices of CBA and Westpac both falling after reporting declining margins. Banks earn a NIM [(Interest Received - Interest Paid) divided by Average Invested Assets] by lending out funds at a higher rate than borrowing these funds either from depositors or on the wholesale money markets.

When the prevailing cash rate was 6%, it is much easier for a bank to maintain a profit margin of 2% than when the cash rate is 0.1%. Falling interest rates reduce the benefits banks get from the billions of dollars held in zero or near-zero interest transaction accounts that can be lent out profitably. However, this cheap source of funding continues to benefit the banks. In their result, Westpac revealed that as of September 2021, the bank held $282 billion on accounts earning less than 0.25% and a further $126 billion paying interest between 0.26% and 0.49%.

The November 2021 reporting season saw NIM compress for Westpac and CBA as they competed to take market share off the two Melbourne-based banks. In a competitive market for loans, Westpac and CBA were able to grow their loan book by offering cheaper rates, though this comes at a cost. ANZ's margin was broadly stable though this came at the expense of lost market share as the bank struggled to process the elevated level of home loans over the past six months. The banks more heavily exposed to mortgages (CBA and Westpac) traditionally have higher margins than the business banks (NAB and ANZ) which face competition from international banks when lending to large corporates.

Westpac posted the highest net interest margin in November with 1.98%. However, this declined over the past six months due to growing market share and borrowers concerned about rising rates shifting to lower margin fixed-rate loans and the bank continuing to reduce its exposure to interest-only loans and loans to investors. While this looks concerning, Westpac's lower margins will be offset by the growth in its loan book.

Expenses

Containing growth in expenses has proved challenging for the banks, with low unemployment contributing to wage growth combined with the need to hire more compliance staff after the 2018 Banking Royal Commission. Additionally, compliance teams have grown in response to CBA and Westpac getting hit with hefty penalties from AUSTRAC for not complying with Anti-Money Laundering and Counter-Terrorism Financing Act 2006. Westpac surprised the market after growing expenses by 8%, mainly due to the bank hiring 3,000 new staff to set up new financial crime and complaints handling procedures and meet other regulatory obligations.

While there was minimal discussion around cutting expenses by closing branches, Atlas sees that rationalising the branch network will be the easiest way for banks to grow earnings. On average, the significant banks each have over 1,000 branches around Australia. They have experienced a decline in usage of these branches over the past decade, as most bank transactions are now conducted either online or via smartphones.

In November, NAB reported processing 1,300 digital transactions for every in-person transaction conducted at a bank. Westpac said that it had closed 98 branches over the past year, which should show benefits in coming years. The gold star goes to ANZ, who kept expenses unchanged at $7.4 billion despite higher revenue.

Dividends

All banks sharply increased their dividends in the most-recently completed reporting season. However, there was an element of catching up for reduced payments to shareholders in 2020 after APRA placed a cap limiting dividends to 50% of earnings. ANZ increased its semi-annual dividend by 66% to 72 cents, though this is still 10% below their pre-COVID levels. Macquarie wins the gold star, increasing their dividend by 100%, but what is more important for investors is that the $2.72 paid to investors is ahead of the $2.50 per share paid to investors in November 2019. As a global investment bank, Macquarie Bank has enjoyed a good pandemic, growing earnings in 2020 and 2021, profiting from market volatility.

Our take

Investing in Australian banks is one of the major questions facing institutional and retail investors alike, with the banks comprising 25% of the ASX 200.

We expect the banks to deliver around 5-10% earnings growth over the coming year as earnings continue to recover from the hit from the pandemic. However, growth will be muted by lower credit growth, normalising bad debts and reduced earnings support from provision write-backs. In the wider Australian market, the banks look relatively cheap and are well capitalised. Unlike other income stocks such as Telstra, they should have little difficulty maintaining their high, fully franked dividends.

Additionally, their share prices are likely to see support over the next 12 months from share buybacks. Looking further ahead, Australia's banks have historically performed well in an environment of rising interest rates. They have seen expanding profit margins by being swift to increase interest rates on loans but slower to increase the rate paid on term deposits and transaction accounts.

Hugh Dive is Chief Investment Officer of Atlas Funds Management. This article is for general information only and does not consider the circumstances of any investor.