This is an edited transcript of a webinar hosted by Schroders. Part II features Natalie Morcos, Head of Product, Solutions, and Client Service with Justin Halliwell, Head of Research in Australian Equities, and Dr Sally Warneford, Equity Analyst. Part I, featuring Natalie Morcos with Martin Conlon, Head of Australian Equities, can be viewed here.

Natalie Morcos: We hold [RIO and BHP]. Both very similar in iron ore and copper. Can you share with us your current views on these stocks?

Justin Halliwell: The first thing to say is the companies have never been more similar. If you reflect back, say, 10 years ago, BHP still had the South32 assets, and they had petroleum. And in the last 10 years, they've done the South32 demerger, and they've also demerged the petroleum assets. So, now, about two-thirds of each company is iron ore. Those assets go through cycles. Sometimes the costs are a bit lower. Sometimes the profits are a bit higher. But by and large, they are identical. BHP produces a little bit more at a lower profitability, but the net dollars of profit are almost identical.

Then they both own a share in Escondida, which is the largest copper mine in the world. And so, by that stage, you're almost at three quarters of the valuation for both businesses are identical. And so, we're really arguing around the tail. They both have more copper. BHP has a bigger extra copper business than Rio. But really, the difference is coking coal for BHP versus aluminum for Rio Tinto.

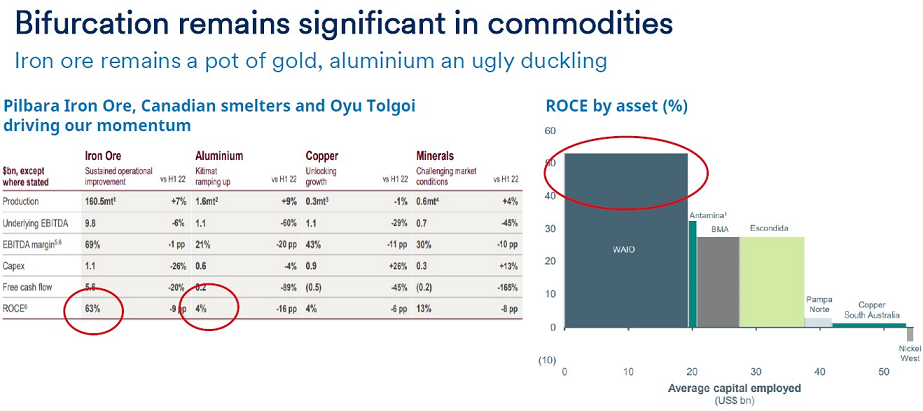

And we own both, but we're underweight BHP and we're overweight Rio. One reason is our outlook for those two commodities. You can see on the chart [below], and where the prices are today, Rio's aluminum business is unquestionably one of the best in the world. It's powered by green energy. And we think over time, not only with aluminum price rising, as I mentioned earlier, but also the green energy, you're going to get either carbon getting priced into commodity prices, so the price goes even higher, or you get green credits, one or the other green premiums, one way or another, Rio's aluminum business will make a lot more money. And you can see at the moment, it's providing a 4% return on capital. Now, look at the iron ore businesses there, they're generating 60% to 70% return on capital.

Source: BHP RIO, Schroders

These iron ore businesses are making supernormal profits. And we think that has to correct. It will impact both of them. But also coking coal prices are elevated at the moment. But obviously, with the focus on decarbonisation, coking coal is the source of carbon. So, over time, that's going to have to come out of the production of steel. And therefore, as you look forwards, the demand for coking coal is not as strong as for aluminum. So, we think, well it's pretty clear that we want to be in green aluminum versus coking coal, and hence the difference in positions. And also, having said, they're so similar, Rio is a $100 billion company, BHP is $150 billion company.

Morcos: Turning to banks, Justin, with rising bad debts expected, has our view on banking stocks changed? And how do our local banks compare to the global banks in particular?

Halliwell: We've been on the more cautious side for a while. And the reason for that is really around when you look back over the last two decades, credit has ballooned. There's been huge, huge credit growth and we think that's over. So, that's really, if you think about what we'd call revenue for an industrial, for a bank, credit is the volume and then the NIM is the price. NIMs are under pressure due to competitive forces. Even if nothing else changes, we think they're pretty dull and boring and there are better places to be, especially with the looming threat of bad debts.

Now, to be fair, to date, they've surprised us and everyone on the fact that they've stayed very low. But clearly, the potential pressure on the consumer, the mortgage cliff and the like, there's still the risk around bad debts. And then, also looming in the background, is he threat of increased taxes on banks, as seen in Europe. It makes us pretty cautious about the outlook for profits.

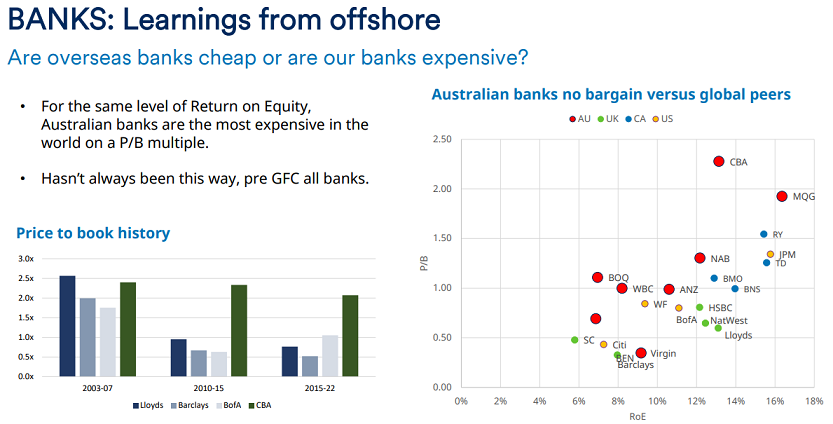

And then, there's this chart to the point about how they trade against the international peers.

Source: Refinitiv, Company data

You can see here, especially on the right-hand charts, the best one to look at is, for a given ROE, which is the X-axis, the Australian banks, in particular CBA and Macquarie, look very expensive, not only relative to the domestic peers but the international peers. So, there are key underweights in the sector.

Morcos: [Sally], I'm keen to get your current views on CSL.

Sally Warneford: Yes, I wrote my very first report on CSL back in 1994 for the IPO and the share price was $2.30 and the market cap was about $130 million. Since then, it split its shares three times. So, that share price was actually $0.77. Now, it's something like $270 and its market cap is something like $130 billion, which makes it about the 18th largest pharmaceutical company in the world. That's been an extraordinary journey and it's been an incredible performance by the company and the management team over time.

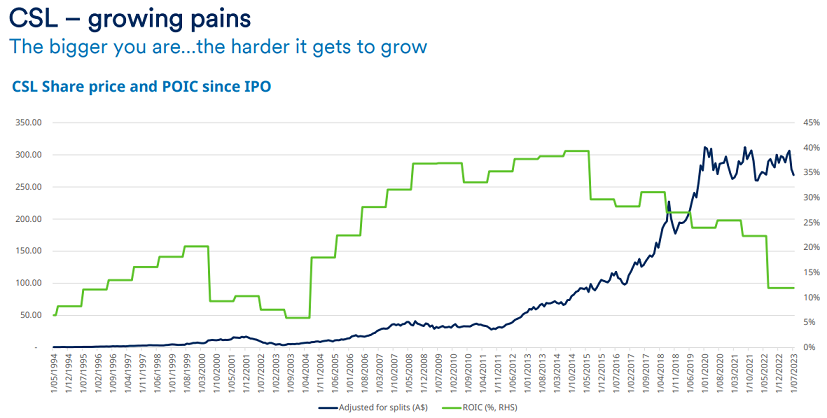

But if we have a look at the chart where the dark blue shows the share price performance, and it's been marking time for a number of years now. And then, the green line shows us the return, so the earnings before interest and tax that you get for the invested capital, which is the net assets plus the net debt.

Source: Schroders

You can see where they've made large capital raisings and acquisitions. For example, in 2000, they bought the Swiss Red Cross, and they raised equity then. And then, again in 2003-2004, they bought Aventis Behring, and they raised equity then. And then, going forward, it took another many years before they made another acquisition which was the flu vaccine business of Novartis in about 2015. So, you can see some step changes in returns when you have some new equity coming in or a loss-making new business. But that doesn't get away from that steady downwards trend in returns despite the great success of the flu vaccine business.

And this is where you're seeing the problem of being such a large company. New investments have come with large amounts of goodwill and also intangible assets in the form of intellectual property. So, it's getting a lot harder for CSL to grow. And people invest in CSL for its growth, and that growth is coming at a cost, and that cost is more acquisitions, more goodwill in the balance sheet and more intangible assets in the balance sheet. And CSL has to try and generate a meaningful return on those investments for shareholders in order to justify being the number 18 market cap pharmaceutical company in the world.

Morcos: What about Ramsay Health Care? This reporting season, we saw them halve their dividend. Can you share with us your current views on Ramsay?

Warneford: When we were talking about COVID earlier, Ramsay was a classic example of a COVID loser. They were forced by governments to close their hospitals and that meant that they couldn't earn any money. They were relying on grants for governments to cover their fixed costs, and they were forced to treat COVID patients, which is good. We needed that at the time, but not good for Ramsay's ongoing business.

We're seeing a big hangover from COVID and that is labour shortages, elevated labour costs, labour inefficiencies because there's been increased absenteeism and people wanting reduced hours. And then, we've got this very modest recovery, slower than I would have thought, of volumes of elective surgeries which is their bread and butter around the world. The share price has been derated substantially.

And then, unfortunately, Ramsay is one of those companies with significant gearing in the balance sheet and that has meant that interest costs with the rising interest rates have been very substantial and depressed the bottom-line profit for the company. That is why we've seen that fall in the dividend.

But with this gradual return in activity, we expect that the profitability will gradually return as will the cash flows to pay down the debt. So, Ramsay should continue to improve from here.

Morcos: ResMed, another beneficiary, but this time of the growing trend in sleep apnea. Now, obviously, with the correlation between sleep apnea and obesity the question here is around whether weight loss solutions such as Ozempic have actually going to become a threat to a company like ResMed.

Warneford: Yes, it's a fascinating situation. ResMed has recently been the beneficiary of its major competitor Philips being absent from the market due to a recall, but there was a COVID-related shortages of components. But over the last two years something that's been weighing on investors' minds has been the impact of the new class of GLP-1 agonist drugs for diabetes and now for weight loss or obesity. And the ones that spring to mind are the brand names Ozempic, Wegovy, both from Novo Nordisk in Denmark and then Mounjaro from Eli Lilly, which is currently in clinical trials. These drugs are amazing. They are able to generate weight losses of 10% to 30% and they're a simple injection. One of the problems that has been there have been shortages of the drugs. Eli Lilly and Novo Nordisk just haven't been able to keep up with the demand.

Now, why is this important for ResMed? It's important because obesity is probably the single biggest risk factor for obstructive sleep apnea, which is what ResMed's machines treat. If you can cure obesity, we then in turn cure obstructive sleep apnea. And that's the question that investors are wrestling with. Now, I don't believe that that will be the case because something like 15% to 40% of obstructive sleep apnea cases are not solely due to obesity, and in addition to that, the obesity drugs are drugs for life. The weight piles back on if you stop them. So, that will be an issue.

This is an edited transcript of a webinar hosted by Schroders, a sponsor of Firstlinks. Part II features Natalie Morcos, Head of Product, Solutions, and Client Service with Justin Halliwell, Head of Research in Australian Equities, and Dr Sally Warneford, Equity Analyst. Part I can be viewed here.

For more articles and papers from Schroders, click here.