If you want attention in the global investment scene, write a lengthy – and preferably extreme - piece about Tesla and place it on socials. You’ll discover friends you never thought you had.

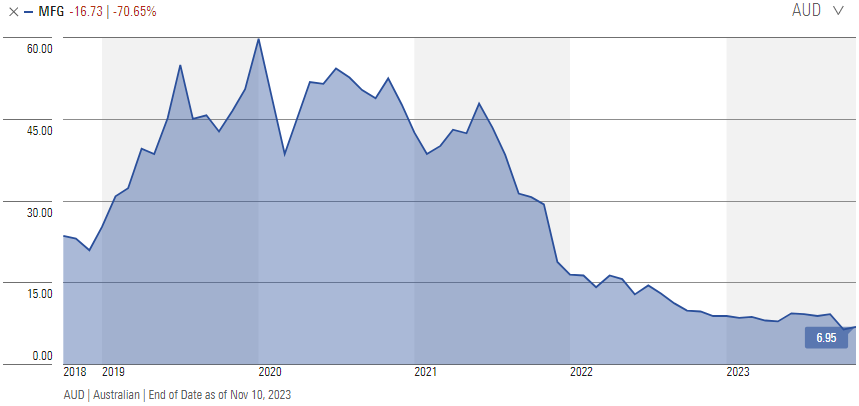

In Australia, it’s astonishing that a mere $1.3 billion company attracts proportionally similar interest amongst commentators. That is instructive as to how wide a network that Magellan created for itself in its boom years from 2009-2021, how people embraced Australia’s second home-grown global equity manager, and now how disappointed they are in its difficulties.

Turning around an underperforming funds management business is not easy. I have been involved in a couple of reasonably successful efforts, and there is simply no substitute for meeting the clients face to face, let them vent if need be, and understand these are the folks whose livelihoods you are looking after. It’s even harder in the institutional world since once a gatekeeper has removed you from the list, there’s very little upside for them to speculate on putting you back on as a potential or actual turnaround.

The attraction to investors in holding successful funds management stocks is the four-way asset light investment leverage. A fixed cost business that gives you profit growth simply from upward trending markets, which then attracts natural inflow. Add in performance fees – which are not always relative to benchmark – and then if the manager is especially successful, the shares re-rate, sometimes dramatically. Remember Magellan Financial Group (ASX: MFG) traded at >38x forward P/E and 12.7% of funds under management (FuM) at one stage. The operating leverage doesn’t always work symmetrically on the downside; retail clients take a long time to leave, and the manager can still earn significant cash flows even from a dwindling pool of managed assets.

That, of course, is where we are in new territory for Australia’s first two global asset managers, Platinum and Magellan. Just to prove you should never put an asset manager on a board, neither company currently has a proper CEO/Managing Director and seem to be just existing in the ether, in a fashion they would criticise remorselessly should it be an investee company of their funds.

In the evening after Magellan’s AGM on 8 November, I posted up an ‘X’ thread discussing the company. Given that 12,000 folks have checked it out – when I barely participate in Australian markets these days – there’s clearly a desire to see Magellan win again, or do something to bring about a share price recovery.

MFG is more than funds management

The issue for MFG shares, as opposed to the funds management business, is that the two are not 100% aligned. On my estimates, the funds business, having had its global equity institutional funds reduced to virtually nil (and Airlie’s nearly halved since John Sevior retired) represents only around 35% of the value of the listed company. This situation has grown appreciably worse over the course of 2023 as other people have picked up on it – most publicly Sandon Capital and UBS Investment analyst Shreyas Patel.

The reconstituted board of Magellan have the real capacity to continue messing up by adopting a conventional ‘clear the desks’ strategy, with some vested interest financial market players hoping they do so. The board must think outside the square, understand what they have, and be less opaque with shareholders about the value of the other assets in the company. The financial media’s obsession with ‘the manager’ as opposed to the value within the listed Magellan Financial Group entity is disconcerting.

In my opinion, MFG shares can be reasonably valued at over $8.50/share, against a prevailing price of ~$7 assuming a stabilisation in the funds management business – which should be more likely given, assuming the infrastructure equities component doesn’t haemorrhage. The listed company has ~$300 million cash ($1.67/share) after the dividend payouts and assuming there isn’t a need to fund the closed end fund option exercise discount. In addition, at end June 2023, the company held $420 million in seed assets of its own funds and initiatives ($2.33/share). So that’s $4.00 a share in ‘liquidity’ leaving you paying, at prevailing prices, around $3/share for the ailing funds manager and the stakes in Finclear (small) and Barrenjoey – replete with options.

Source: Morningstar

Earlier in 2022, I valued the funds management business at $979 million, when it had over $45 billion of FuM. That's far too high given FuM is now ~$34 billion (but will rebound in November given markets), the brand continues to suffer with adverse publicity and whilst expenses have been lowered, this is still a fixed cost business. Based on both earnings estimates at a lower level of FuM than currently managed, cross checked against more asset-based parameters, I believe the funds management business to be worth around $550 million ($3.05/share) – below 10x equivalent P/E or 1.6% of current FuM.

What beautiful symmetry! My valuation of cash, seeds and funds management, equates to the current share price around $7. Which leaves the two equity accounted investments, made in the days of Hamish Douglass, to decide how much your MFG shares are worth.

MFG carry these two investments on an equity accounted basis. Equity accounted values are taken at MFG’s entry cost less their subsequent proportional share of losses and bear no resemblance whatsoever to reality. MFG’s board and audit committee should stand up to the auditors and ditch this – they have no effective ‘control’ up to the level of economic interest. Then they can value the stakes appropriately – with justification - in the books.

Finclear is small in the scheme of things with MFG paying $20 million for a 17% stake in November 2020; the investment is carried in the books at just above $25 million (14c/share).

Barrenjoey, however, is where MFG’s management and board are going to earn their money. I recommend the piece by Aaron Weinman in the AFR of 30 October 2023 ('Inside the Country’s most talked about investment bank'). Apart from the fact Aaron falls for the equity accounting ‘scam’, it details just how successful Barrenjoey has been albeit with the benefit of significant financial banking from Barclays facilitating the operating losses from build out. Barclays has an 18% economic interest at a cost of $120 million; so why is MFG’s 36% interest valued at $124 million, which in turn is over $30 million below the September 2020 entry price of $156 million (albeit only $90 million was in cash)?

MFG is now of limited use to Barrenjoey. It could even be argued they are a hindrance, providing limited to no support. But this is a very substantial asset for MFG shareholders, which could easily be worth far above the entry cost as Barrenjoey has now established itself. The problem is that investment banking is in a slump with limited IPO’s or other ECM activity; Barrenjoey is getting more than its share, that’s for sure.

Do MFG’s management become impatient and sell ‘at the bottom’ in the wake of approaches from some of the smartest investment banking executives in Australia who have an intensely competitive streak? Shareholders in MFG must be alert to this and ensure management find a way to retain the stake for shareholder benefit until the investment bank further matures. A spin-off would be excellent, but I assume pre-emption/confidentiality conditions preclude this. Bluntly, MFG will be leaving significant money - $100 million+ in my opinion over a few years – on the table should they sell now.

Add in a more realistic valuation of Barrenjoey plus the small Finclear stake is where I get my extra $1.50 a share from to bring the valuation up to $8.50.

Other options to extract value

There are alternatives – could MFG merge with Barrenjoey, rather than just pursue buying up funds management businesses at significant goodwill to retiring executives? Or, of course, put MFG up for sale. Anyone acquiring MFG will recoup around half their outlays from liquidating seeds and the cash in the business. To make the ‘sum of the parts’ valuations more transparent, Sandon Capital’s push to have significant funds returned to shareholders makes a great deal of sense.

There’s simply no expectation that MFG’s board will spend the money wisely. Should they sell the Barrenjoey stake at just above book value and reinvest proceeds in a funds management acquisition at above 1.7% of FuM, shareholders would be justified in making next year’s AGM a far more volatile affair.

With corporate activity being the equity management theme and story of the past twelve months, and with Magellan Asset Management yet to really start its recovery, it remains at a genuine crossroads, But nothing like the complex junction in front of its parent company board, a feature that local financial media continually underplay.

Andrew Brown is the Principal of East 72 Management Pty Limited, and manager of East 72 Dynasty Trust. East 72 Dynasty Trust holds shares in Magellan Financial Group. This article contains general information only; it does not purport to provide recommendations or advice or opinions in relation to specific investments or securities. It has been prepared without taking account of any person’s objectives, financial situation or needs and because of that, any person should take relevant advice before acting on the commentary.