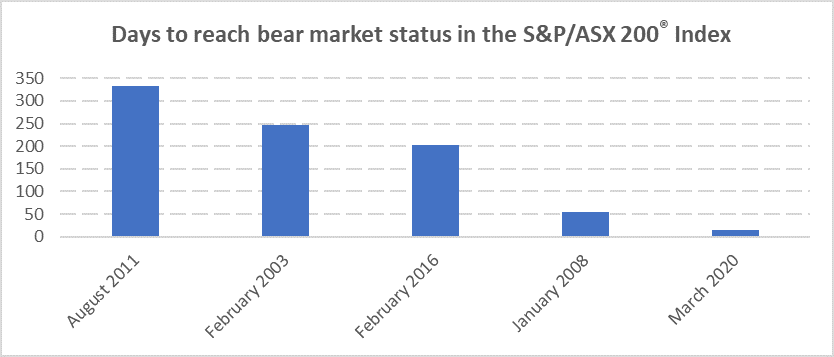

Notching up record after record, financial markets are continuing to deliver unpleasant reminders of just how unprecedented the global pandemic crisis is. One recent record is the speed of the S&P/ASX 200 Index’s sudden slide to bear market status (defined as a 20% decline in pre-tax value from peak to trough). This slide took a mere 14 days in March, the quickest in the index’s history, easily eclipsing the next worst market slide of 55 days which signalled the onset of the GFC.

Source: Bloomberg, Parametric 31 March 2020. For illustrative purposes only. It is not possible to invest directly in an index.

Portfolio management in a crisis

A sophisticated approach to managing equities through this crisis period, as any large super fund will tell you, focuses on two things: first, avoid being a forced seller, and second, be well-positioned to take advantage of buying opportunities (which have been hard to find in recent years).

Despite fearmongering about the liquidity of large super funds in these extraordinary times, my conversations with super fund clients have been focused on the latter—tactical buying opportunities—not the risk of a debilitating run on funds and becoming a forced seller of equities. This suggests that, at least for these funds, liquidity is being well managed and will not be an issue.

Beyond the bargain-hunting opportunities for super funds (and other investors), there is a bigger opportunity available when bear markets hit—to give the whole equity portfolio itself a structural ‘makeover’.

As funds become larger and more sophisticated, they look to migrate their equity holdings from pooled investment funds housed in a legal trust structure (for example, ETFs and unlisted managed funds) across to separately managed accounts (discrete mandates) which give super funds direct ownership of the equities in their portfolios.

Pooled investment funds have their place as they are easy to use, ‘off-the-shelf’ ways to invest in equities. They shield the investor from much of the complexity and compliance burden of equity investing, which are instead borne by the product provider or pooled fund manager. But trends in the APRA-regulated super fund sector suggest funds are favouring more transparency, tax efficiency and customisation in equity investing.

The package of benefits that can be delivered in a separate account equity investment structure (with the right managers) but not through pooled funds includes:

- specific ethical screens and values-driven investing

- centralised portfolio management (CPM)

- innovative fee structuring

- tactical portfolio ‘tilting’

- efficient transition management

- after-tax investing

- better assessment and management of portfolio risks, and

- custom stakeholder reporting.

The window to restructuring a portfolio

Ironically, the strong returns on equities over the past decade (Australian, developed and emerging markets) have created a problem for super funds wanting to restructure their equity holdings—the capital gains tax liability they would incur in redeeming their investments from a pooled equity fund to seed a new separate account.

This kind of restructure can be done tax-free under US law, but not under Australian law, so beware literature from the US, which misleads Australian investors on this issue.

Consider a super fund wanting to transfer its $500 million equity portfolio from equity unit trust holdings into a separate account. The units have appreciated 25% since their acquisition, and 90% of the units are long-term holdings, with the remainder acquired in the past year. In isolation (and without tax-managing the transition), the fund faces a $10.5 million tax bill to restructure, or over 2% of portfolio value. While the restructure would deliver many benefits, the up-front tax bill is hard to swallow and a reason to delay the move and persist with what the fund believes is a sub-optimal structure.

Which brings us to the bear market conditions suddenly upon us. For super funds and others encumbered with ‘legacy’ investment structures and their embedded tax, now is an important window of opportunity for much more than just bargain-hunting—to re-cut the numbers to see just how much lower the tax cost of a move to their desired ‘future state’ for equity investing would be.

It is far more likely right now that the tax cost of a ‘portfolio makeover’ to move equities to a separate account structure would be immaterial or easily outweighed by the benefits. In our example above, the fund might even find that the current market value of its units in the equity trust has dipped below the original $400 million acquisition cost, which would actually deliver a windfall tax benefit if the fund seized the opportunity to restructure now.

While this ‘portfolio makeover’ opportunity represents a rare piece of good news for those navigating current market conditions, the cautionary lesson for super funds given the ASX bear market’s sudden, dramatic arrival is this: that predicting the market turnaround and speed and shape of the recovery (V-shape; U-shape; Nike ‘swoosh’?) will be fraught with difficulty.

The opportunity to not just find equity bargains, but migrate to a best-of-breed equity investment structure, is one to seize now, in case it vanishes just as fast.

Raewyn Williams is Managing Director of Research at Parametric Australia, a US-based investment adviser. This material is for general information only and does not consider the circumstances of any investor. Additional information is available at parametricportfolio.com.au.