When you look at charts comparing commodity prices and the share prices of mining companies, you begin to realise that it really doesn’t matter what the broker analysts say, what the earnings forecasts are, what the return on equity of the Brazilian subsidiary of BHP (ASX:BHP) is or what anyone thinks.

When you are trying to decide whether to be in the resources sector or not, it is all about guessing what the underlying commodity prices are going to do next.

The chart below shows the very close correlation between the iron ore price and the ASX 200 resources sector (ASX:AXJR).

(All charts are created in May 2021 and sourced from Refinitiv).

Commodity prices are all that matters

BHP, Rio Tinto (ASX:RIO) and Fortescue Metals (ASX:FMG) can look cheap or expensive, but it really doesn’t matter. Their share prices are inextricably tied to commodity prices and in particular, the iron ore price.

That makes them great long duration trading stocks, great proxy trades for the less volatile commodity prices which sometimes offer significant and accelerated gains in short periods of time compared to the industrial stocks.

But don’t for a moment bother looking at an earnings forecast, or a PE, or a DCF valuation or a broker target price, because they are only as good as the commodity price assumptions they are based on.

And that’s a guess, and that guess changes every day that the company wakes up and finds the commodity price has changed. It means those accelerated gains are not based on fundamental analysis. They are based on whether you can time the sector and that means one thing – timing commodity prices.

The game at the moment, with the iron ore price up from US$80 to around US$200, is to decide whether the iron ore price rise is sustainable or overbought. It is the multi-million-dollar question. Capital Economics guesses the iron ore price will drop to US$100 per tonne by the end of 2021. Morgan Stanley research guesses the iron ore price, under a bull case scenario, could hit US$215 by the end of this year. It has already reached that. And a UK broker recently put out some now misdirected research saying “We expect continued weakness in the iron ore price with the market increasingly oversupplied as the year progresses."

Everybody’s guessing. They always are. When it comes to resources, even the people who know more than anyone else about the stocks and about commodities, can’t agree.

Watch the chart trends not the fundamentals

Your best bet is not in depth fundamental analysis, but charts, charts of the stocks, charts of the commodity prices, and an assumption that they trend. Applying technical analysis is something everyone can attempt, it is a 'commodity art' available to all.

So what do we do with BHP and Rio and the other Australian resources stocks geared to commodity prices?

For now, with BHP on a PE of 11.4x and a yield of 9.9% (including franking), with Rio on a PE of 7.0x with a yield of 14.1%, and with FMG on 5.6x with a yield of 15.4%, there is no fundamental reason to sell and as yet no technical reason to sell either.

But here’s the rub. Those fundamental numbers should give you no comfort. As soon as the iron ore price falls over, so will the share prices, no matter the yield, no matter the PE. When the iron pore price falls, the earnings numbers and the dividend forecasts will be downgraded on a daily basis.

To make a few points clear:

- Forget fundamentals when analysing resources stocks.

- Commodity prices drive share prices.

- Respect the trend in commodity prices, it is the 'wind beneath the wings'.

- Australian resources stocks are great long duration trading stocks.

- Australian resources stocks offer great leveraged exposures to commodity prices.

- Get the commodity prices right and you’ll get the share prices right.

- Never stand like King Canute saying stocks are cheap when commodity prices drop.

Checking some more charts, commodity and share prices

Here are a few more charts (also created in May 2021 and sourced from Refinitiv) which make it clear that this commodity price correlation phenomenon is not confined to BHP, Rio and iron ore.

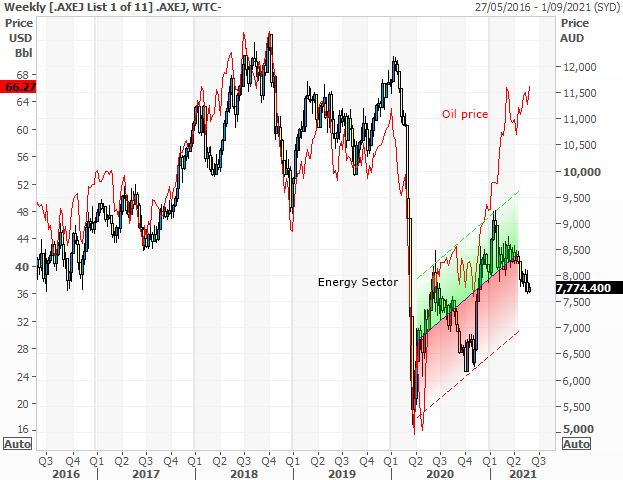

This is the Energy sector and the oil price:

This is the gold sector and the gold price:

This is Oz Minerals (ASX:OZL) and the copper price:

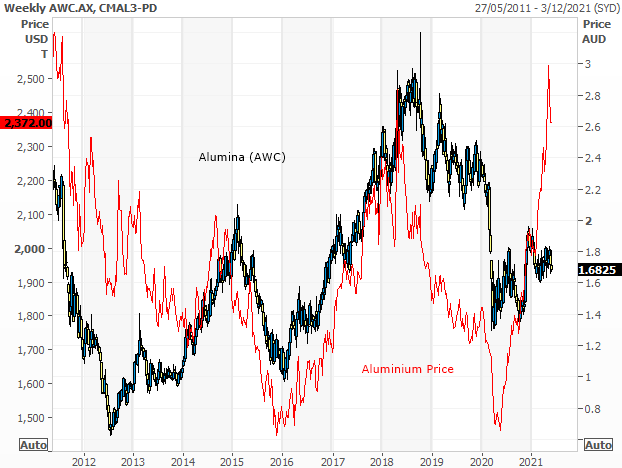

This is Alumina (ASX:AWC) and the aluminium price:

I could go on. It’s a wonder why any analyst bothers visiting the big resources companies. All their analysis, all their insight, all their experience, counts for nothing is their commodity price assumptions are wrong.

Do you have a special insight into commodity prices?

Unless you have an insight into the future of the relevant commodity price, you have nothing to offer because your fundamental analysis of the individual resources stocks is futile.

The good news is that commodity prices trend. They have big trends, some that last for years, and these provide solid 'tides' for the stocks involved. If you can catch or spot or predict the big pivot points in the major commodity prices, investment becomes easy in Australia.

And if you don’t have such an insight, you still have a chance if you resort to technical analysis. Where there is a trend and the occasional trend changes, you have a chance of exploiting the resources sector for the accelerated gains on offer in the stocks rather than the commodity.

Bottom line, as an individual investor, you could do a lot worse than focus on one or two commodity prices, find out everything about them, what drives them, the seasonal moves, the daily chatter, and take a view.

Marcus Padley is the author of the daily stock market newsletter Marcus Today and the Co-Manager of the Marcus Today Separately Managed Accounts. This article is general information and does not consider the circumstances of any investor.