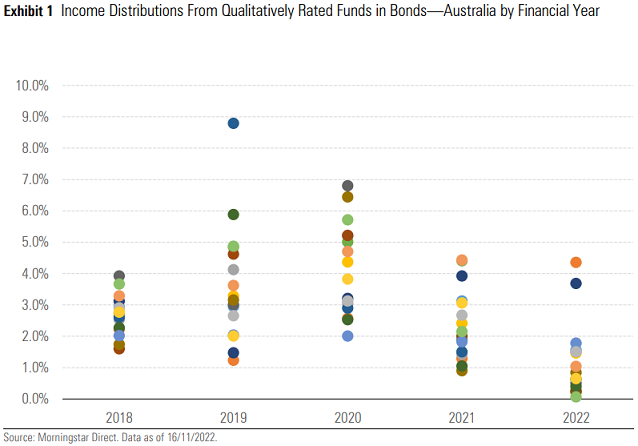

The momentous rise in government bond yields since the second half of 2021 has had one unexpected effect: shrinking income distributions. This may be surprising given bond managers have been able to reinvest at progressively higher yields, and presumably they are able to distribute more income. The income distributions we qualitatively cover among the Australian bond fund managers are shown in Exhibit 1.

This experience is principally due to fund distributions comprising both coupon income and realised capital gains or losses. Coupon income may rise as funds reinvest but can be offset by sizable capital losses. The mid-2021 starting point accentuated this situation—near-zero policy rates globally combined with yield curve control in diminishing the running yield of many bond portfolios.

As a side note, some fund managers opted to make a fair value election under the Taxation of Financial Arrangements Act, or TOFA, which also requires funds to pay out unrealised gains and losses, effectively making total returns the basis for distributions. The widespread mark to market capital declines raised the hurdle for distributing income over this period. (To be clear, this TOFA election enables funds to largely mitigate the effect of gains or losses on currency hedges on distributions, a major reason for its use.) Strategies that have not made the TOFA fair value election and have been unable to pay distributions underscores the influence of trading activity (some of which is necessary as bonds mature) in conjunction with the delicate initial conditions.

Strategies that couldn't pay a distribution at all through the first three quarters of the 2022 calendar year included CC JCB Active Bond 41406, Janus Henderson Australian Fixed Interest 17690, and Yarra Australian Bond 10858. Over the 2022 financial year, several others distributed little more than that. The two outliers in Exhibit 1—Janus Henderson Tactical Income 17406 and Altius Sustainable Bond 40709—each avoided a slump in distributions, their shorter duration dampening sensitivity to sharply rising government-bond yields.

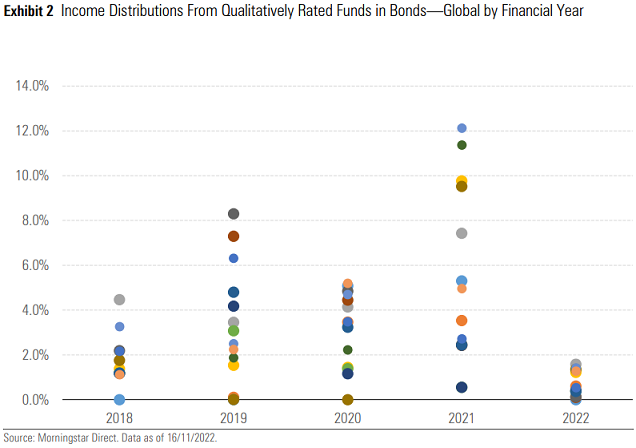

We've written extensively about how and why unitholder distributions can bear little resemblance to underlying coupon or dividend yields in pooled funds (see Onshore and Offshore Fixed Interest Investing March 2012, Is Global Listed Infrastructure a Defensive Asset? September 2012, and Infrastructure and Income April 2013). However, having such a significant portion of a cohort affected does mark this occasion out. Several global fixed-income managers have also been similarly affected as Exhibit 2 shows; focusing on Australian bond strategies just helps to sidestep the potential complications of currency hedge losses.

Likely temporary, but stay attentive

It's understandable to see this and question the role of traditional bond funds to generate income. It is an unfortunate development, but one that's ultimately temporary. These funds will accrue coupon income, which will eventually outweigh realised capital losses and allow distributions to resume.

Estimating when this may occur is complicated. For starters, each fund will have its own level of capital losses to recoup. Moves in interest rates and fund flows can also influence proceedings. Further delays could ensue if interest rates rise considerably further or if funds experienced sizable outflows (leaving it with a smaller assets base from which to claw back the accumulated dollar value of realised capital losses). On the other hand, the higher starting point for yields (especially compared with mid-2021) allows more leeway to withstand such moves.

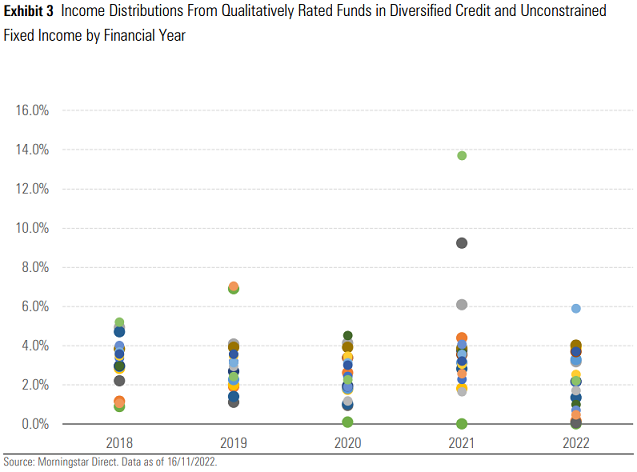

Meanwhile, many credit and unconstrained fixed-income strategies encountered much less disruption to distributions during 2021-22. This shouldn't be too surprising. Many had a higher starting yield than traditional Australian and global bond index-relative portfolios leading into the second half of 2021 (mainly by taking more credit risk). Drawdowns were also often shallower by virtue of having less interest-rate risk. Figure 3 shows the income returns for funds we cover in these categories.

Distributing income under these circumstances doesn't make these strategies better than the group of index-relative funds. Rather, it underlines the difference in risk characteristics. In this case, sharply higher government-bond yields caused problems for duration-sensitive funds; a severe risk-off event may prove problematic for more credit-oriented portfolios.

For instance, AB Dynamic Global Fixed Income 40260 and Payden Global Income Opportunities 19589 didn't distribute any income during the first quarter of 2020 when the coronavirus pandemic struck. Meanwhile, ongoing struggles in emerging markets has caused Franklin Templeton Multisector Bond 17390 to hemorrhage losses and distribute little income from 2020-22.

For those who prioritise income, being attentive to the different factors that can affect distributions, both within and outside of a fund manager's control, can help set appropriate expectations when unforeseen circumstances materialise.

Tim Wong, CFA is a Director, Fixed Income Strategies at Morningstar Australasia. Firstlinks is owned by Morningstar. This article is general information and does not consider the circumstances of any investor. This article was originally published by Morningstar Manager Research.

Access data and research on over 40,000 securities through Morningstar Investor, as well as a portfolio manager integrated with Australia’s leading portfolio tracking service, Sharesight. Sign up to a free, four week trial below:

Try Morningstar Investor for free