As part of the latest superannuation reforms, from 1 July 2018 individuals with a total superannuation balance of less than $500,000 before the beginning of the financial year will be able to make ‘catch-up’ concessional superannuation contributions.

These individuals will be able to access their unused prior years’ concessional contributions cap (that is, the amount by which those contributions are less than $25,000) on a rolling basis for five years and claim a tax deduction for those contributions in the year in which they are made. Any unused concessional contributions cap for the year will expire after five years.

The aim of the measure is to make it easier for people with interrupted work patterns, and with varying capacity to save over periods of time, to accumulate wealth in superannuation and gain access to the same tax concessions as those people who have regular and steady work patterns and income.

Reform offers planning opportunity

It also provides a planning opportunity. By deferring concessional contributions to a year in which an individual’s taxable income is higher, and making them as ‘catch-up’ contributions in the year when they are in the higher tax bracket, they will be able to create a larger tax arbitrage between tax at the super fund level and tax at the personal level. An example illustrates the point.

Dennis is a consultant operating as a sole practitioner. It is June 2019 and his taxable income for the 2019 year will be $80,000. He has not made any superannuation contributions for the year and has a superannuation balance of $300,000. Dennis expects that his taxable income in 2020 will be $165,000 higher because of a net capital gain that he is likely to crystallise due to the disposal of an investment property that he has just put on the market. That is, his taxable income in 2020 will be $245,000.

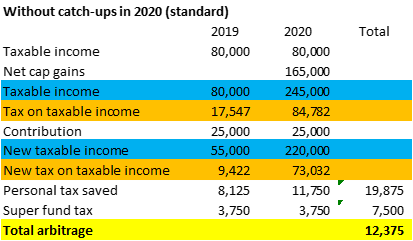

If Dennis makes a concessional contribution of $25,000 to his super fund in June 2019 and then another $25,000 in 2020 he will create a total tax arbitrage of $12,375. This could be considered a ‘standard’ contribution pattern.

In 2019, his personal taxable income will go from $80,000 to $55,000 and his tax will reduce from $17,547 (not including Medicare levy or small business tax discounts to which he might be entitled) to $9,422. A saving of $8,125 in personal income tax.

His super fund will pay tax of $3,750.

In 2020, his personal taxable income will go from $245,000 to $220,000 and his tax will reduce from $84,782 (not including Medicare levy or small business tax discounts to which he might be entitled) to $73,032. A saving of $11,750 in personal income tax.

His super fund will again pay tax of $3,750.

$8,125 + $11,750 - $3,750 - $3,750 = a $12,375 tax arbitrage.

How catch-ups will work

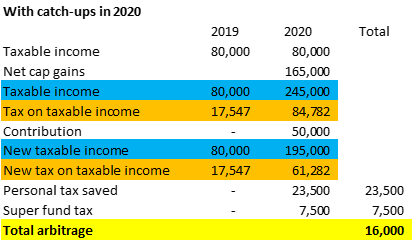

If Dennis defers the 2019 concessional contribution and makes a catch-up contribution in 2020 (along with the $25,000 allowed for that year) then Dennis will create a tax arbitrage of $16,000.

There is no personal tax saving in 2019. And no tax at the super fund level.

However, in 2020, his taxable income will go from $245,000 to $195,000 and his tax will reduce from $84,782 (not including Medicare levy or small business tax discounts to which he might be entitled) to $61,282. A saving of $23,500 in personal income tax.

His super fund will pay tax of $7,500.

$23,500 – $7,500 = a $16,000 tax arbitrage. $3,625 more than the standard approach of making the maximum $25,000 in each year.

By deferring the superannuation contribution from 2019 until 2020, the tax rate arbitrage goes from 17.5% (32.5% – 15%) to 32% (47% – 15%). The extra 14.5% arbitrage on the $25,000 catch-up concessional contribution amounts to $3,625.

Same amount in super with less tax

Under a 'standard' contribution pattern, over the three years, Dennis will get $75,000 into super with $16,750 in total tax arbitrage.

Under a 'catch-up and reserve' strategy, over two years Dennis will get $75,000 into super with $23,000 in total tax arbitrage.

Denis has created a 30% return, in two years, on his $75,000 contribution.

The strategy will work best where there is a large jump in taxable income from one year to the next resulting in changing tax brackets. Taxpayers would need to know that their taxable income in subsequent years is going to be (much?) higher than the current year.

And, of course, there is the risk that waiting to make catch-up contributions could back-fire if the taxable income drops or the catch-up contributions bring the taxpayer into a lower tax bracket in the catch-up year than they were in in the previous year. Or, indeed, if future government generosity leads to the lowering of the marginal tax rates or expanding of the lower tax brackets or the rules change.

But circumstances could arise where taxpayers will know with a degree of certainty that their taxable income will jump up in a particular year (and then maybe fall again). For example, as in the above scenario where a property is being prepared for sale which will finalise in a later year. Or where a person is party to an option contract which, upon exercise, will result in the disposal of a CGT asset at a price which the person knows will result in a taxable capital gain. Or large dividends might be paid from private companies.

In such circumstances, a person might wish to consider deferring concessional contributions and make them as catch-up contributions in the year when the taxable income increases to maximise the total tax arbitrage. Don’t forget, though, the savings are tied up in super.

Stephen Lawrence is a Lecturer, Taxation and Business Law School, UNSW, Chartered Accountant and Member of the International Tax Planning Association. These views are considered an accurate interpretation of regulations at the time of writing but are not made in the context of any investor’s personal circumstances.