From 1 January 2015 the way account-based income streams (including account-based pensions) will be assessed under the income test for Centrelink purposes is changing.

The age pension rules

Any account-based pension commenced on or after 1 January 2015 will be treated as a financial asset and deemed under the income test.

Account-based pensions commenced prior to 1 January 2015 where the pensioner is in receipt of Centrelink benefits at 1 January 2015 will be grandfathered under the existing rules.

Where the grandfathering conditions are not met or where a person ceases to receive Centrelink entitlements, their pension will be treated under the deeming rules when the person next applies for the age pension. As such any existing pension held by persons who are not receiving Centrelink entitlements at 1 January 2015 will be assessed as a financial asset under the income test.

Also, consider a household on the ‘border’ currently receiving a small age pension entitlement. If good investment returns are experienced, the value of their assets may increase and this may cause them to lose their age pension entitlement. Following this, the pension is then assessed as a deemed income stream for future age pension entitlements.

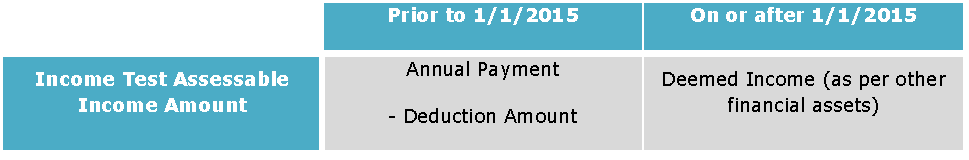

The table below outlines the changes. Please note the treatment for the assets test is not changing.

Deciding what to do before 1 January 2015

There has been a lot of discussion around what decisions could be made to maximise the income test and ultimately the long term age pension outcome for clients with existing pensions who are in receipt of Centrelink benefits prior to 1 January 2015 including:

1. Would ‘rebooting’ (ie. commuting and recommencing) any existing pensions prior to 1 January provide a better deduction amount?

As the social security changes relate to pensions commencing on or after 1 January 2015, rebooting a pension before that date will lock in the relevant deduction amount for any future age pension assessment.

If the pension is rebooted after 1 January 2015, the deduction amount will be irrelevant as the pension will be assessed as a deemed income stream for future age pension entitlements.

2. Would a change to death benefit nominations affect the grandfathered rules for the pensioner’s spouse?

Where a pensioner with a grandfathered account-based pension passes away, the pension will only continue to be treated as grandfathered under the income test where the pension automatically continues to be paid to a reversionary beneficiary, and where the beneficiary is also in receipt of Centrelink benefits.

Unless the terms of the pension specify an automatic reversion, the death benefit pension may fall under the new deeming rules. Note that changing the death benefit nominations of a pension to be automatically reversionary may involve rebooting the account-based pension.

Age pension implications

The age pension entitlement under the income test for a deemed account-based pension in the short term may lead to lower pension entitlements, but there may come a point during retirement where the entitlement using the deeming rules is greater than the entitlement under the grandfathered rules. At this point, depending on the person’s particular circumstances, the member may consider whether or not to reboot their pension (to be assessed under the deeming rules) to help maximise their age pension entitlement as highlighted in the following case study.

Case study: income test decision point

Consider Fred and Jane:

- a 65-year-old couple

- assets of $500,000 all held in Fred’s SMSF

- spend $58,000 per annum increasing in line with inflation.

Fred retired during 2014 and commenced an account-based pension with all of his SMSF assets.

Fred and Jane are currently eligible for a part age pension from Centrelink and the income test rules applying to Fred’s account-based pension will be grandfathered from 1 January 2015. Their $58,000 of spending will be partly sourced from the age pension and partly from the SMSF assets.

If the SMSF earns 4% p.a. real returns (over and above inflation) then in this example we would expect their SMSF balance to reduce over time. By modelling the drawdown of the SMSF assets we can compare all three Centrelink means tests in future years:

(a) income test under the grandfathered rules

(b) income test under the new deeming rules

(c) assets test

(a) Age pension entitlements – grandfathered rules

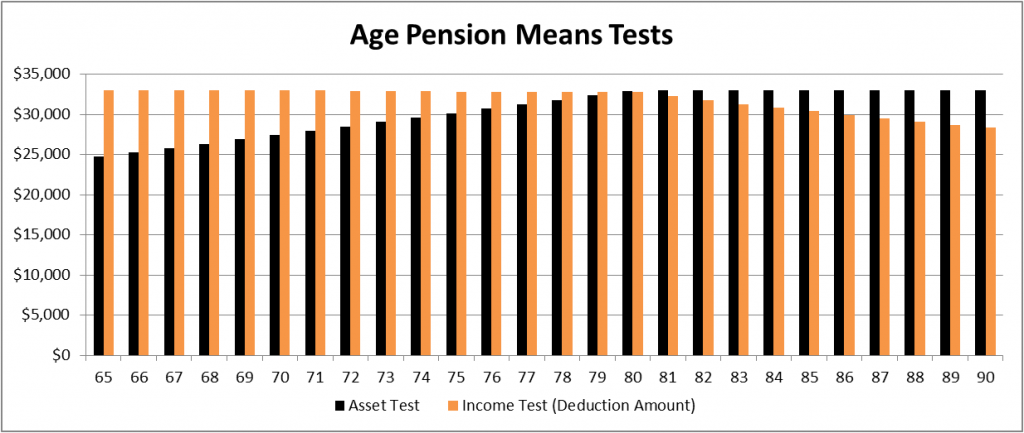

The graph below shows the projected age pension entitlement under both the assets test and the grandfathered income test rules.

The black lines represent the asset test entitlement in each year, and the orange line the income test entitlement based on the existing deduction amount rules.

We see initially the asset test is dominant, and then at age 80 the income test takes over to determine the age pension received. The age pension entitlement reduces after age 80 because the income test deduction amount is reducing in today’s purchasing power.

The total payments from the age pension between now and age 90, in today’s purchasing power, is approximately $763,000. The example assumes that the Centrelink thresholds and rates keep pace with inflation over time.

(b) Age pension entitlements – deeming rules

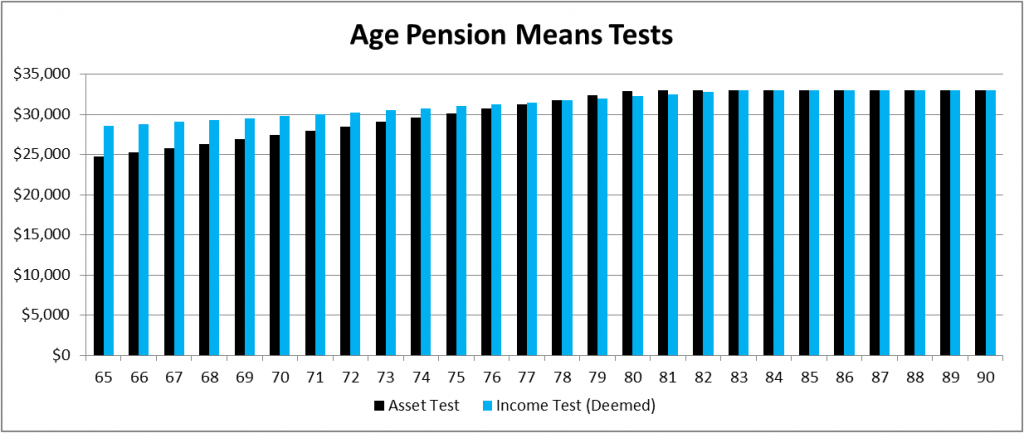

If Fred decided to commute and recommence his pension at 1 January 2015 then the pension would be deemed under the income test. The means test results using the deeming rules is shown below in blue.

The income test takes over at age 78, two years earlier than under the grandfathered rules. The total payments from the age pension between now and age 90, in today’s purchasing power, is approximately $789,000.

What Fred and Jane really need to do is look at what this means overall …

Centrelink entitlements – grandfathering, then switching

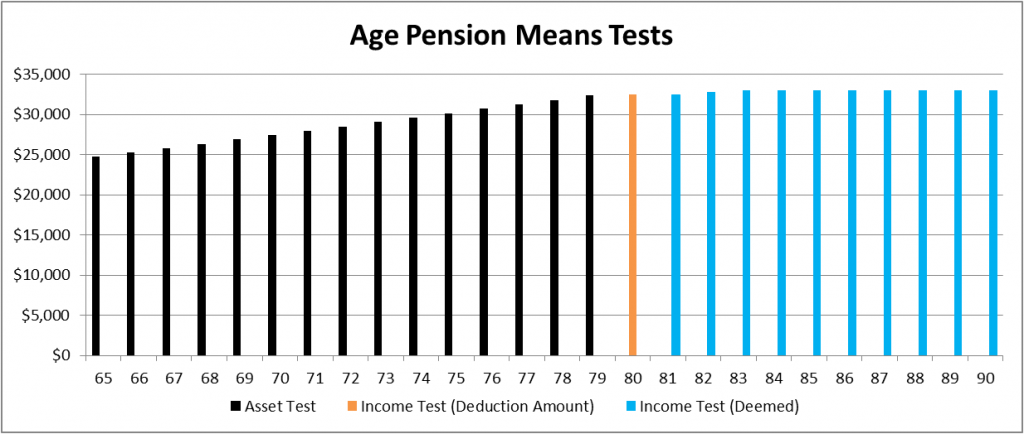

Examining both graphs in this case study; we can see that Fred and Jane will receive less age pension from age 78 to age 80 under the deeming rules, then from age 81 onwards the deeming rules provide a higher income test entitlement.

The graph below illustrates all three means test outcomes:

Switching over to the deeming rules by rebooting the grandfathered pension at age 81 may help maximise the age pension during the period that the income test determines the pension received.

From the date of commutation onwards Fred is then locked in to the deeming rules and can’t re-elect to have the grandfathered rules apply. But we can see that under these assumptions the highest Centrelink entitlements come from opting for the deeming rules as assets deplete. In this example, the age pension entitlement increases to the full age pension in later years rather than continuing to decline. The total payments from the age pension between now and age 90, in today’s purchasing power, is approximately $790,000.

Fred and Jane’s actual decision would need to be monitored over time to take into account fund values, ongoing spending plans and Centrelink rates and bands at the time.

Grandfathering considerations

There may be some advantages of commencing or rebooting account-based pensions before 31 December 2014, thereby locking in existing rules for clients who are in receipt of Centrelink entitlements. These include:

- The income test entitlement may be lower in the short term under the new deeming rules, so if the income test is determining the client’s age pension entitlement, the existing rules may be more advantageous.

- Grandfathered pensions won’t be exposed to the risk of increased deeming rates in the future.

- A pension may be rebooted at any later date to enable the pension to be assessed under the new deeming rules.

Based on the above, it appears that grandfathered pensions will provide the most flexibility in potential social security outcomes for clients. However, rules continue to change and retirees need to stay on top of entitlement amendments.

Melanie Dunn is SMSF Technical Services Manager at Accurium (formerly Bendzulla Actuarial). This information illustrates social security treatment of income streams only and is not intended to be financial product advice, legal advice or tax advice, and should not be relied upon as such. Individuals should seek appropriate professional advice before making any financial decisions.