Is political democracy good for economic growth and ultimately, stock markets in Asia? Sound political systems are crucial for economic development and progress. It would be hoped that democracy allows for competition for public office and theoretically, the best people end up occupying the seats of power. Democracy, and the freedom it engenders, should be positive for the country and by extension the stock market. But is it?

This paper does not attempt to answer the question of whether democracy is the best form of political system for every nation, but it does argue that positive fundamental changes in Asia are afoot. Asia’s moment is now for the taking and the next 12-24 months will be critical for shaping investors’ image from one of a perpetually-emerging Asia into one that has finally emerged.

The first question is how much control is necessary for any given government before policies can be translated into meaningful economic gains. Stable control of government can be highly effective particularly if it stretches for long periods.

Singapore

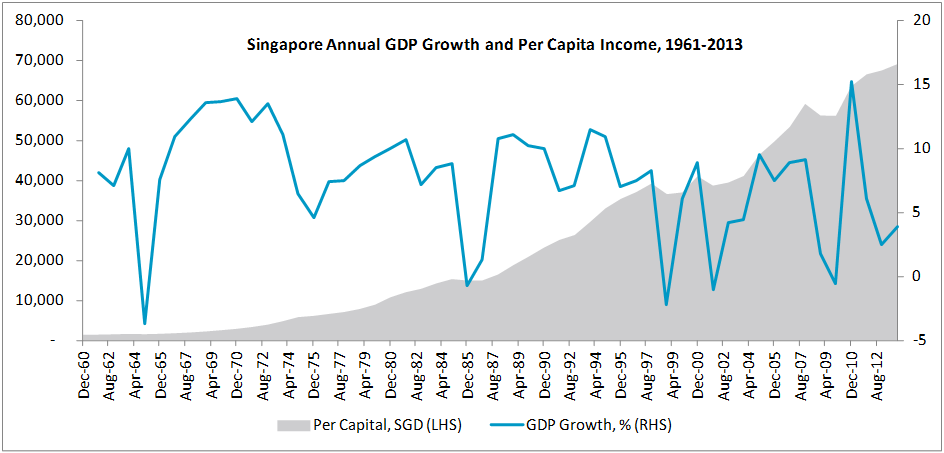

Look at what a single political party over a prolonged period can achieve. In only five short periods was Singapore’s economic growth negative over the last 53 years. Per capita income has grown more than 5,000% in the same period.

Source: Bloomberg, 7 October 2014

Philippines

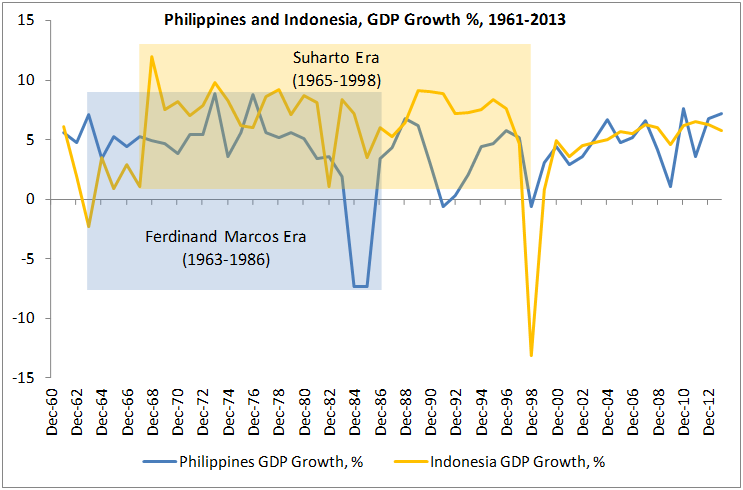

Singapore’s neighbours like the Philippines and Indonesia managed to carve out an enviable sustained economic growth path over long periods where political power was absolute (the assassination of opposition leader Benigno Aquino in 1983 and the start of the Asian financial crisis in 1997 effectively marked the end of the Marcos and Suharto regimes, respectively).

Source: Bloomberg, 7 October 2014

India

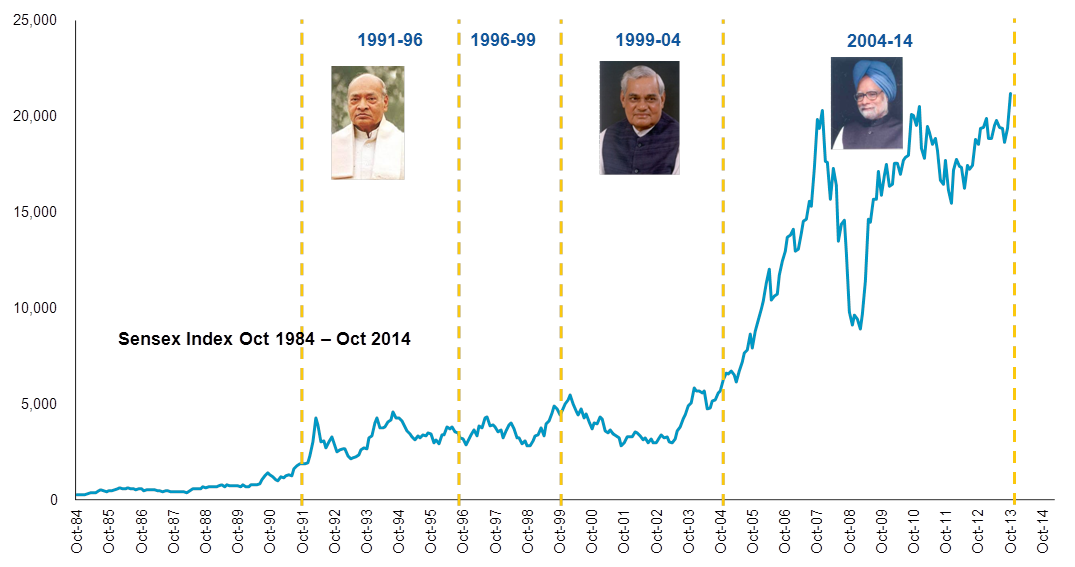

India now has the chance to shake off the (now maligned) BRIC moniker and stand on its own. The general election on 16 May 2014 was won by the Bharatiya Janata Party (BJP), the first time in 30 years that a single party has secured an electoral majority. Culture, tradition, religion and politics have conspired through the years and kept India from achieving its full economic potential. Despite the reformist attitudes of leaders such as Narasimha Rao (1991-1996), Atal Vajpayee (1999-2014) and Manmohan Singh (2009-2014), the last 20 years were underwhelming and characterised by political in-fighting and shaky coalitions that consequently eroded the will of the incumbent prime minister.

Source: Axis Capital, 7 October 2014

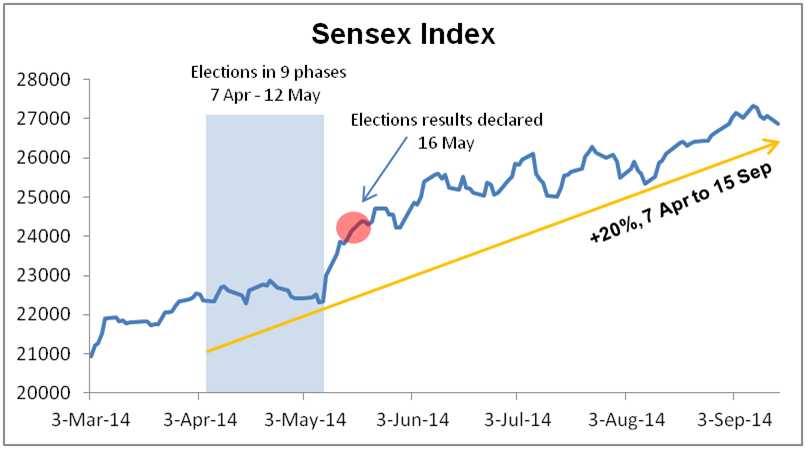

Can the BJP under Narendra Modi deliver policies that will lift the living standards of the poorest and deliver sanitation to the slums? Market expectations are high. India’s Sensex has risen strongly pre and post election.

Source: Bloomberg, 7 October 2014

The Modi government has been busy, but catering to 814 million voters will take enormous will and patience. Underscoring the task ahead, the much-needed rail fare hike had to be partially rolled back after the first protests under the new government. Otherwise, the pace of reforms has not faltered. Execution must follow promises in areas such as agriculture, industry, infrastructure and centre-state relations.

Indonesia

In Indonesia, the pace of change has lagged leaving the country ‘mired’ in the 5-6% GDP growth range. Where did the can-do attitude go? To the critics, outgoing President Susilo Bambang Yudhoyono may have been the first popularly-elected President, but his Vice President and the opposition parties arguably had more power. With 560 members in the DPR (People’s Representative Council) and his own party controlling only 10.9% of the seats, imagine the horse trading and one can understand why things move slowly in Indonesia.

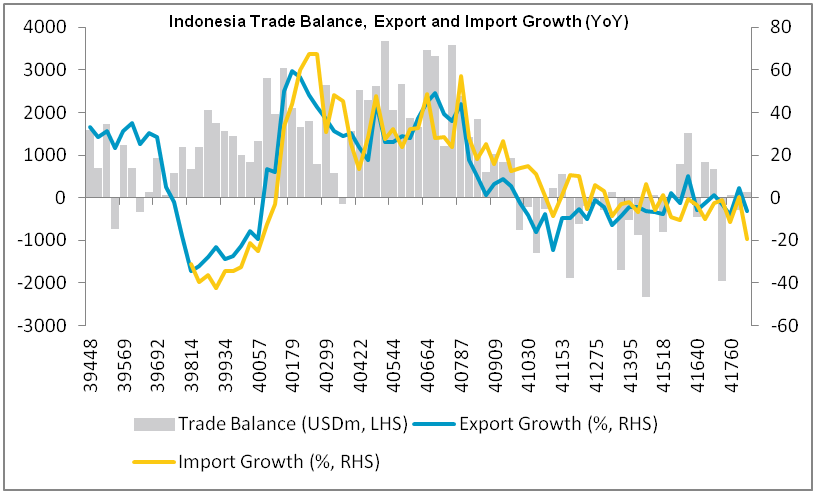

When Joko Widodo won the Presidency in July this year after a hastily arranged ‘marriage’, he inherited an Indonesia underperforming its potential. Its trade balance is hurt by a self-inflicted export ban on certain resources, and fuel subsidies have risen from about 0.7% of GDP in 2007 to an estimated 2.8% this year, costing US$20 billion a year.

Source: Bloomberg, 7 October 2014

Growth risks for Indonesia are rising even if fuel subsidies are rolled back gradually. Exports of both hard and soft commodities are falling while the central bank wages wars on dual fronts: controlling inflation and a currency deemed too weak. Anyone who has been to Jakarta in the last 20 years will have experienced inconveniences due to an inadequate infrastructure that is particularly acute during the rainy season.

China

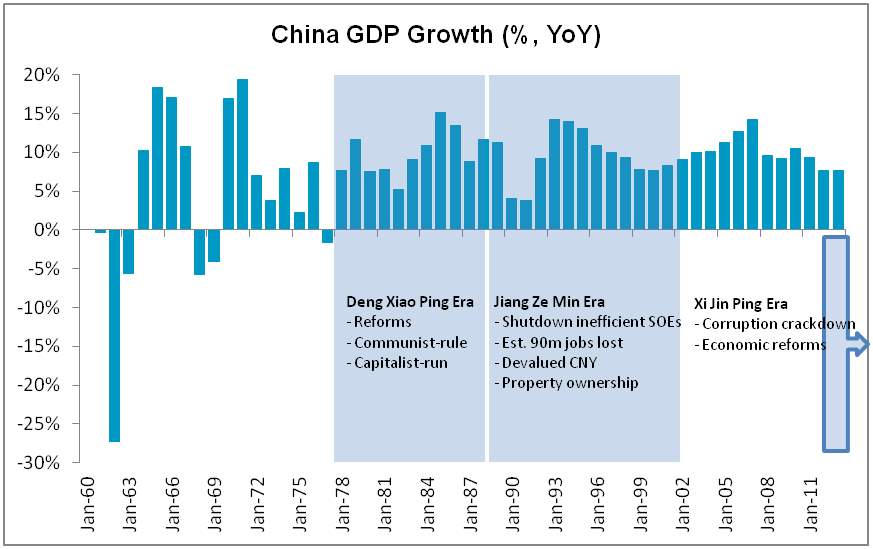

In contrast to true democracy, Asia’s largest and most powerful nation practises a form of closed-door democracy to choose its leaders. By no means less effective, China’s leaders have transformed a largely communist country to the world’s second-largest economy in the short space of 36 years. In the beginning, there was Deng Xiao Ping, the pioneer of the Communist-Rule/Capitalist-Run economy. The successful trial run with Shenzhen as a Special Economic Zone, a then fishing town in the 1980s, could well have been the seed of manufacturing in China.

Economic progress was strong under Deng and continued with his successor Jiang Ze Min. Unfortunately, by the late 1980s and early 1990s, China was beset with bloated state-owned enterprises (SOE). The Tiananmen Square episode in 1989 was compounded by the systematic elimination of inefficient SOEs and an estimated 90 million jobs leading to a softer period of growth.

Source: Bloomberg, 7 October 2014

This proved temporary as the lure of cheap labour and favourable tax concessions were too attractive, resulting in a continuation of foreign direct investments.

Source: Bloomberg, World Bank, 7 October 2014. * Sum of equity capital, reinvestment of earnings, other short and long term capital as shown in the Balance of Payments.

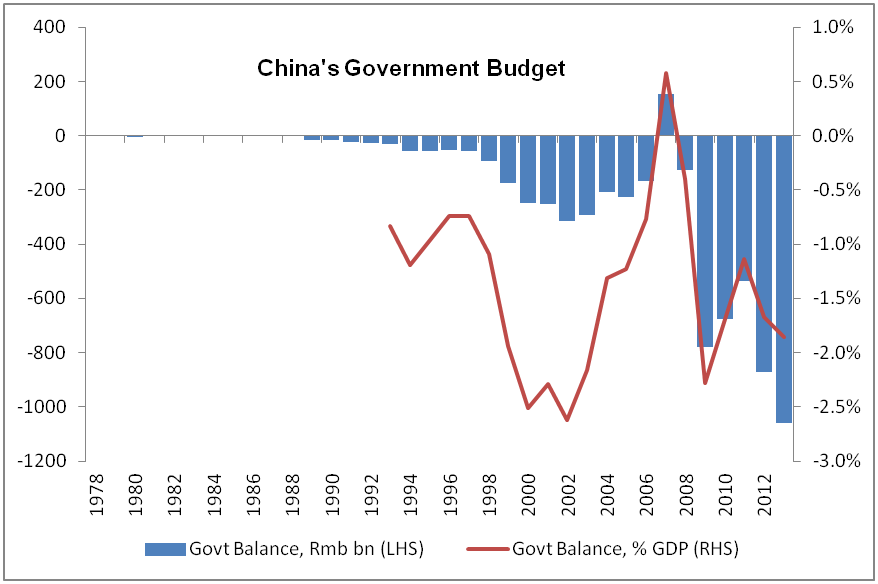

This golden era of high economic growth admittedly led to an over-zealous policy response in the midst of the GFC. In an attempt to preserve growth, employment and to shield its economy, the central authorities moved forcefully with both fiscal and monetary policy initiatives. The fiscal stimulus plan amounted to a staggering 14% of GDP in 2009.

Source: Bloomberg, 7 October 2014

That overhang is no doubt a source of China’s current problems in property and trust loans.

The changing of the guards in 2013 ushered in a leader that traces his parentage to the Communist Party. His ascension is complete and absolute. Xi Jin Ping is the only person to concurrently hold the highest office of the party, state and military, within his first term of office. He moved quickly to eliminate corruption leaving virtually no office untouched. As the Chinese proverb goes “cut the weeds and dig up the roots – to stamp out the source of trouble” (zhan cao chu gen).

The focus is on the long-term structural problems of China. Examples include financial and capital market liberation, an aging population and gender imbalance, labour mobility, bloated state-owned sector and pollution.

While armchair commentators from afar and talking heads will argue incessantly about China’s property sector and shadow banking, we suggest that market mechanisms are already at work with some property-related companies and trust products in trouble.

Despite outstanding issues, there are many investment opportunities in China. SOE reforms (think Sinopec selling its retail business) and the government’s gradual abdication of healthcare to the private sector (Ikang Healthcare Group) are examples. If the era of Xi is borne of both a recognition and desire for change, the short-term pain in cleaning the slate will give way to more sustainable growth.

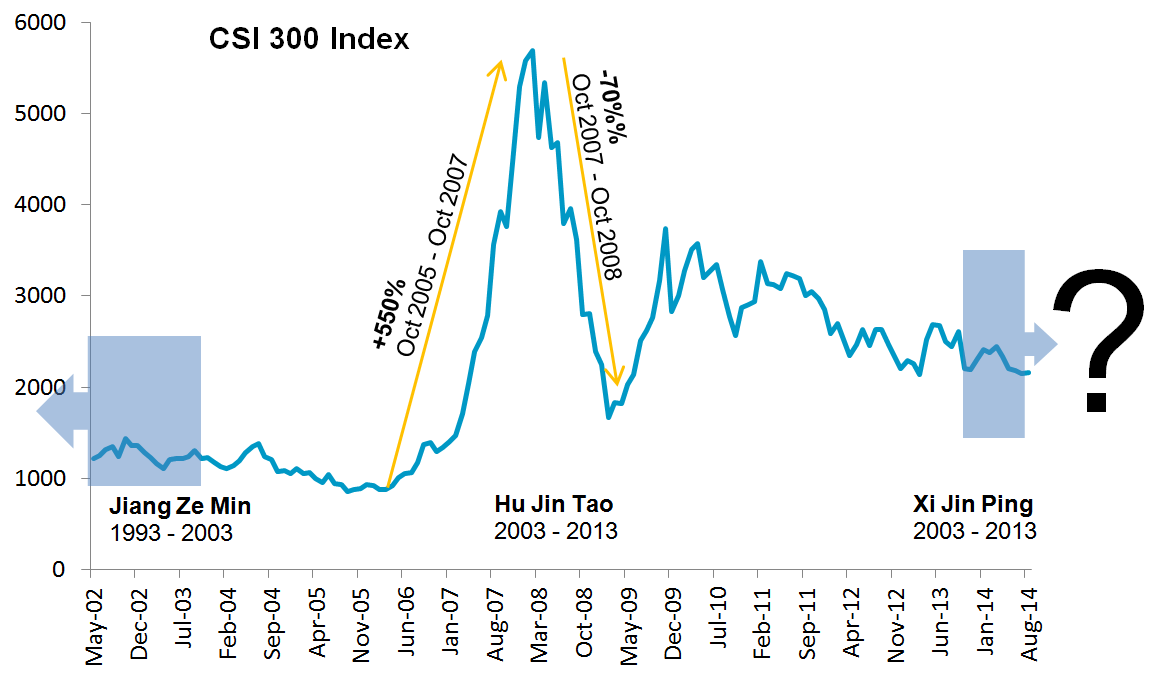

China’s recent and present leaders have made and will make an impact on advancing the country, including opening up of its economy and guiding and nurturing it during turbulent times. But we can’t overlook the period when China’s stock market enjoyed its best performance … and worst decline.

Source: Bloomberg, 7 October 2014

Hu ruled over a period of upheavals from natural disasters (earthquakes and floods) to the man-made financial crisis. Under his watch, the local stock market rose a staggering 550% in the space of two years and subsequently gave back 70% of that gain over 12 months.

Xi is undoubtedly using his new broom to sweep clean some litter. The determination to write a new chapter for China is matched by an unparalleled command of power. China bears should be afraid especially as the market has been marking a bottom for the last two years; still a substantial 60% from the high point reached in 2007.

The mechanisms facilitating government change may not be as important in Asia as the western press makes it out to be. A case in point is the current military junta in Thailand. Self-appointed in a bloodless coup, the Junta has made progress where previous governments have failed miserably. For many years, Thais have had a dysfunctional government. Was it the democratic process that stymied economic progress in Thailand? And economic progress or not, many people consider democracy as a fundamental freedom. We are seeing demonstrations in Hong Kong from thousands of pro-democracy protesters rallying against government plans to limit electoral changes promised for 2017.

Conclusion

We come to the conclusion that firstly, we should be careful drawing casual relationships based on Western values. And secondly, the value of a stable government cannot be overestimated. Absolute power? Perhaps it is instructive to quote former US president, Gerald R Ford:

“A government big enough to give you everything you want is a government big enough to take from you everything you have.”

Was China’s ascension to a global power one born of a democratic process? Why is India, the oldest and largest democracy in Asia, still stuck at a per capita income of US$1,500 which is lower than the likes of Zambia, PNG, Sudan, Mongolia? Alas, we do not have an answer for this. All we know as investors is to pay close attention to any changes at the top regardless of how that change is affected.

Peter Sartori is Head of Asian Equity at Nikko Asset Management Asia.

This article is for information only with no consideration given to the specific investment objectives, financial situation and particular needs of any specific person. You should seek advice from a financial adviser before making any investment.