For many, the word ‘retirement’ is associated with extended holidays to far-flung locations or spending quality time with grandchildren. And while the new-found status of ‘retiree’ sits well with some, for others it’s a different story. It depends on how smoothly the transition into retirement progresses. There are, in fact, a range of financial, emotional and psychological fears that are often linked to retirement – for good reason.

Australians spend most of their working lives saving for their retirement so that when the time comes to retire, they can lead a comfortable life. However, many people are uncertain about what to expect in retirement, and the issues they may face are not always just financial. For many investors, financial planners play a pivotal role in providing technical advice, guidance and peace of mind before, during and after the retirement process. But there are also the emotional and psychological impacts of transitioning to retirement to be considered.

Despite the best laid plans and the most strongly-held expectations, research from CoreData found that around 50% of Australians retire early due to unexpected circumstances and within timeframes they did not choose. The reasons range from health issues to unemployment to providing care to loved ones. This can result in retirees feeling out of control and impacted not only financially, but emotionally as well.

Retirement planning is not a ‘one size fits all’ approach.

Common fears and expectations associated with retirement

While it is not surprising that pre-retirees with no superannuation savings are worried about funding their retirement, they are not the only cohort concerned. Despite healthy superannuation balances, CoreData’s research shows that close to two-thirds of pre-retirees are worried about being able to fund their retirement, with only a small percentage feeling very optimistic that they will have adequate financial resources to do everything they want in retirement.

In fact, more than half of those with retirement balances of between $750,000-$1 million say they worry about funding their retirement. These concerns only recede once an individual has accumulated more than $1 million in savings.

Encouragingly though, 44% of pre-retirees expect to live a reasonable retirement life, understanding that not all of their desires will be fulfilled. Only four in 10 retirees say that their actual retirement lifestyle is aligned with what they expected, and three in 10 say their retirement lifestyle exceeds their expectations.

Successful retirement factors

A successful retirement involves more than just money. Other important factors in a successful retirement include, mental and physical health, having realistic expectations and owning a home.

Retirement satisfaction occurs when a retirement lifestyle matches the retiree’s expectations. Not every retiree has expectations of a luxurious retirement lifestyle but all of them expect basic needs to be addressed.

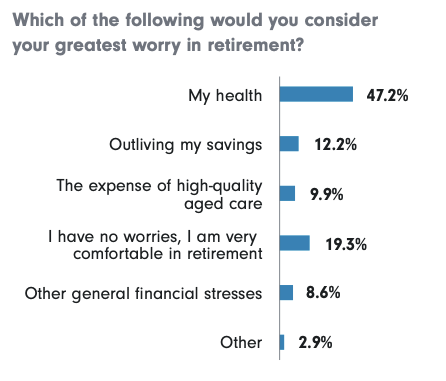

Once a person is retired, the concern turns to whether they will run out of savings later in life. Around one in eight say their greatest worry is they will outlive their savings, and close to 10% are worried about affording the costs of high-quality aged care facilities. While the welfare system allows for a basic level of income, budgeting for discretionary expenditure can cause stress.

Having adequate savings in place allows for a degree of flexibility when it comes to discretionary spending and provides a stronger sense of control.

When planning for retirement there are two core factors that determine the amount of savings a retiree needs - life expectancy and projected expenses. Other factors including marital status, health and home ownership when determining how much in savings a retiree needs in order to enjoy their desired lifestyle.

Staying healthy

Early retirement is often seen in a favourable light and is eagerly planned for, however 28% of Australians retire early and unexpectedly due to health-related issues. Almost half of all retirees consider their health as their greatest worry in retirement.

Research from the Australian Centre of Financial Studies found those who retire early due to health issues are likely to have lower incomes and are more likely to have lower superannuation balances. By default, they are also most likely to incur additional health-related expenses in retirement.

Maintaining a healthy lifestyle and addressing potential health issues early are therefore important factors to consider when planning for retirement.

Owning a home

Unsurprisingly, owning a mortgage-free home provides a greater sense of security and retirement satisfaction. Research from the Australian Housing and Urban Research Institute found older people with secure long-term accommodation tend to have better physical and mental health too.

Home ownership is also intrinsically linked to retirement readiness and satisfaction. Those who own more than one property with no mortgage typically experience retirement success. Single property owners also enjoy a high level of retirement satisfaction. In contrast, individuals who own no property score the lowest in terms of retirement satisfaction.

Retirement is one of the larger changes in an individual’s life and it comes with a host of financial, emotional and psychological fears. A sound financial plan can help manage associated fears and expectations and most importantly, ensure the transition into retirement is as seamless as possible.

Richard Dinham is Head of Client Solutions and Retirement at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2021 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited. FD18634.