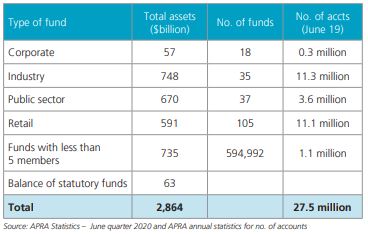

When the superannuation system was designed for compulsory contributions starting in 1992, nobody expected SMSFs to become so popular. Over 1.1 million Australians hold $735 billion in their own funds, as shown below in an ASFA table, running equal with the other success story, the industry funds, both well ahead of the laggards, the retail funds. An entire industry has sprung up to service the needs of trustees and members.

Former Prime Minister, Paul Keating, wrote in Firstlinks (then Cuffelinks) in 2013:

“I never expected Self Managed Super Funds (SMSFs) to become the largest segment of super. They were almost an afterthought added to the legislation as a replacement for defined benefit schemes.”

As superannuation balances increased over the years, and especially as members headed into retirement, it became common to switch from a large institutional fund into an SMSF, much to the chagrin of the industry and retail funds as they lost clients at the point where they were the most valuable.

The SMSF move was encouraged by thousands of financial advisers and accountants who could see a steady stream of work from advising on structure and maintaining financial accounts. Over the years, specialist administrators improved the user experience and reduced the cost of running an SMSF.

It was initially argued by service providers that an SMSF allowed the major benefit of control over investments, but there has always been a debate about cost because it was never clear what components were included.

In October 2019, when ASIC issued Information Sheet 206 to guide professionals providing advice on SMSFs, it shocked the industry by stating that it takes 100 hours and $13,900 a year to run an SMSF. It was based on Productivity Commission work (in a 722-page Report) that included Finding 2.6 which said:

“The SMSF segment has delivered broadly comparable investment performance to the APRA-regulated segment, but many smaller SMSFs (those with balances under $500 000) have delivered materially lower returns on average than larger SMSFs.”

This set the bar at $500,000 which was much higher than most service providers had suggested to their clients. Furthermore, ASIC gave this threatening instruction:

“Compliance tip: We are likely to look more closely at advice to establish an SMSF, to consider whether the advice complies with the best interests duty and related obligations, if the starting balance of the SMSF is below $500,000”.

That introduced risk for an industry previously satisfied with recommending SMSFs down to around $200,000. SMSF service providers pored over the numbers and found that less than 10% of the stated costs were attributed to administration, with the rest coming from investment management and items such as insurance. But still the debate raged.

What is included in these new numbers?

The starting point in reading any research is to know who is performing it. These latest numbers are co-presented by Rice Warner and the SMSF Association, supported by SuperConcepts, with the aim “… to educate, inform and assist existing and potential SMSF investors decide if an SMSF is a suitable and effective retirement savings vehicle for them”.

In any comparison of SMSFs with retail or industry funds, it is essential know what is included. SMSF trustees can choose to outsource some or all of the administration and investing, and this makes a major difference in how SMSF costs are judged. Put simply, an SMSF with $1 million paying a fund manager a fee of 1% looks like a $10,000 cost, but that is paying for the investing skills, not the cost of running an SMSF.

As Rice Warner advises:

“Direct investment fees have been excluded from this analysis as they are dependent on the specific asset types chosen by specific SMSFs and cannot be estimated for a generic fund for comparison purposes.”

A breakdown of the results

While the data can be cut a million ways, the new research reaches some broad findings that will please the SMSF industry, while admitting it is not possible to say one product is cheaper or better than another for a specific balance.

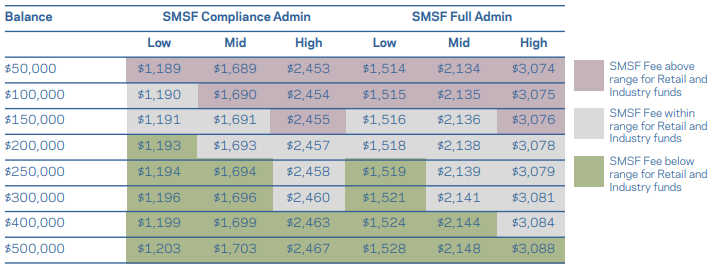

For example, the table below shows a range of costs for SMSFs of various balances and the colour coding indicates whether the cost is:

- Pink - Above the range of fees for equivalent balances held in industry or retail funds

- Grey - Within the range of fees for equivalent balances held in industry or retail funds (ie between the high and low fee for that account balance.

- Green - below the range of fees for equivalent balances held in industry or retail funds.

Under the two headings, SMSF Compliance Admin represents SMSFs that outsource only their compliance administration to a service provider and SMSF Full Admin outsources all their administration. The table below refers to accumulation accounts.

Like other tables in the report, the broad conclusion is that SMSFs of around $200,000 to $250,000 are cost-competitive with institutional funds, and at higher balances have lower fees.

Range of annual costs ($) accumulation account

Why such a difference versus the $500,000 ASIC and the Productivity Commission findings? Looking under the hood shows the Rice Warner numbers exclude financial advice, investment management and insurance, whereas ASIC captured these.

Rice Warner summarises as follows:

“SMSFs with balances of $200,000 or more provide equivalent value to industry and retail funds at all levels of administration. SMSFs with balances of $500,000 or more are generally the cheapest alternative. The majority of SMSFs with low balances either grow to competitive size or are closed.”

If an SMSF has a simple range of investments, especially where trustees make their own decisions, it can be justified at around $200,000. Administration costs can rise for complexity, especially owning property in an SMSF, but fees are highly competitive from a wide range of service providers.

Importance of investment costs

When an industry or retail fund charges 0.75% on a balanced superannuation fund, a common price point, it covers managing the fund with investing and reporting included. There is usually an additional administrative fee of about $2 a week or $100 a year. When an SMSF costs $3,000 to administer a $1 million fund, it is not comparable to say that is cheaper because that is only 0.3%.

The SMSF could invest in cash or term deposits for nil 'cost', or in Exchange-Traded Funds for less than 0.1%, or buy a residential property with higher costs. These are investment decisions made by the trustee independent of the 'SMSF cost' argument. The SMSF is the vehicle that facilitates it.

In commenting on the study, sponsor SuperConcepts said:

"On closer examination, SMSFs may be even more affordable than other institutional options because they can avoid significant investment management charges if necessary ... few SMSFs use structured products like managed funds, we know it is only about 20% of the money that is in the SMSF space is in those sort of products.”

The ultimate answer to the question of whether the cost of an SMSF can be justified versus a retail or industry fund depends on the investment intentions of the SMSF's trustees and the amount involved. SMSFs are more suitable for large balances and active investor engagement while institutional funds provide solutions for smaller balances and less member involvement.

Graham Hand is Managing Editor of Firstlinks. For a copy of the full Rice Warner report, go here. This article is general information and does not consider the circumstances of any person.