There’s been a spike in interest in rating agencies recently, due to the recent downgrade in the UK’s rating and the possibility that Australia could follow suit. Yet few people understand what goes into a credit rating and what it’s really worth, if anything. So should investors pay any attention to these agencies, particularly after their poor performance during the financial crisis?

Credit ratings are a mix of qualitative and quantitative factors. The primary driver of a rating is a combination of financial ratios such as debt/EBITDA for corporates or debt/GDP for governments. Analysts overlay a qualitative adjustment to the ratios that can result in a slightly higher or lower outcome than the ratios alone would indicate. The entire process is subjective; what ratios are used, and in what proportion they are weighted. Additionally, the qualitative adjustments are all components that issuers argue about.

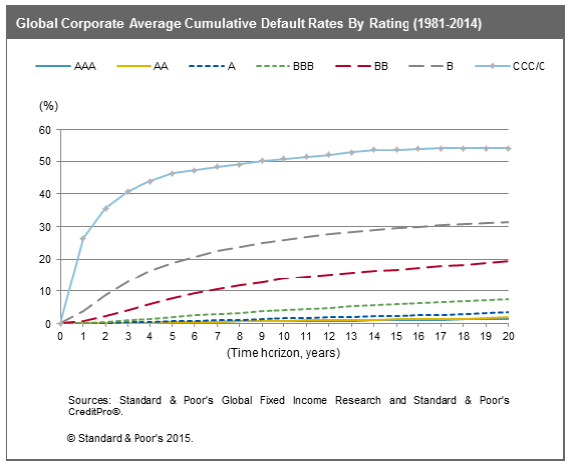

Investors still value agency’s opinions. A lower rating indicates a higher risk of principal and interest not being paid in full. The chart below shows how companies with lower ratings have an exponentially higher probability of defaulting on their debts. As a result, debt issuers with lower ratings must pay a higher interest rate to attract buyers for their debt.

Criticisms of credit agencies

1. Conflicts of interest

Governments, regulators and investors have criticised the big three rating agencies (Standard & Poor’s, Moody’s and Fitch) for charging both issuers and investors for their services. Issuers pay the agencies to prepare a report and provide an opinion on their risk profile. This creates tension as the issuer can threaten not to pay if they don’t like the opinion. Investors pay rating agencies to access detailed reports, though the agencies make the ratings publicly available for free. As a result of this conflict of interest, independent credit research firms such as CreditSights and Egan-Jones have emerged where only investors pay for their analysis.

2. Ratings are not equivalent

One of the biggest misgivings with agency credit ratings is that they apply the same risk rating for different types of debt (e.g. corporate, sovereign, financial institution), meaning they believe that they have equal likelihood of defaulting. As history has shown many times, different types of debt have very different risk profiles. It is reasonable to compare ratings within the same debt type, but erroneous to compare ratings between debt types.

3. Ratings changes are delayed

Investors have long complained that agencies fail to downgrade ratings in a timely fashion. Many prefer credit default swaps as a better measure of the real time probability of default, although these have a tendency to overshoot when negative information comes to light. Rating agencies often give the benefit of the doubt to debt issuers as downgrading a rating is typically a controversial step that the issuer may publicly disagree with.

4. Performance in the financial crisis

Very poor performances during the financial crisis means the big three aren’t trusted anywhere near as much as they used to be. Lehman Brothers had 'A' ratings when it defaulted and many other failing banks were similarly rated. Thousands of ratings and trillions of dollars of debt were downgraded across mortgage-backed securities and collateralised debt obligations from 2007 onwards. In the worst examples, securities went from AAA to defaulting within a year. Investors who failed to do their own due diligence suffered substantial losses and many took legal action as a result.

Merits of ratings for different debt types

1. Corporate debt

Ratings on corporate debt are the bread and butter of rating agencies and it is where they do their best work. Thousands of companies have been publicly rated with Moody’s data set stretching back to 1920. Annual reports from the agencies confirm that lower-rated corporates are far more likely to default than higher-rated ones. On the whole, there are few examples of highly rated corporates defaulting, with Enron and Parmalat arguably the worst in recent decades. Both of these involved financial deception by management. The main criticism of corporate debt ratings is the slowness of downgrades as companies deteriorate. Investors can generally expect corporate credit ratings to be an approximately fair reflection of default risk.

2. Sovereign debt

Rating agencies are almost always too optimistic in regards to their ratings for developed nations. The standout example is Japan, with the big three all seeing it in the “A” category. Most independent analysis of Japan has it unable to repay its debt without printing money. If the average interest rate on its debt was to rise by 3% all government revenues would be consumed by interest payments with nothing left for healthcare, education or defence spending. Many governments in Europe and the US continue to receive high ratings even though they are running substantial budget deficits year after year and have sizeable unfunded pension obligations. Ratings for developing nations tend to be a fairer reflection of their risk of defaulting. Investors should treat sovereign debt ratings with great caution.

3. Financial institutions debt

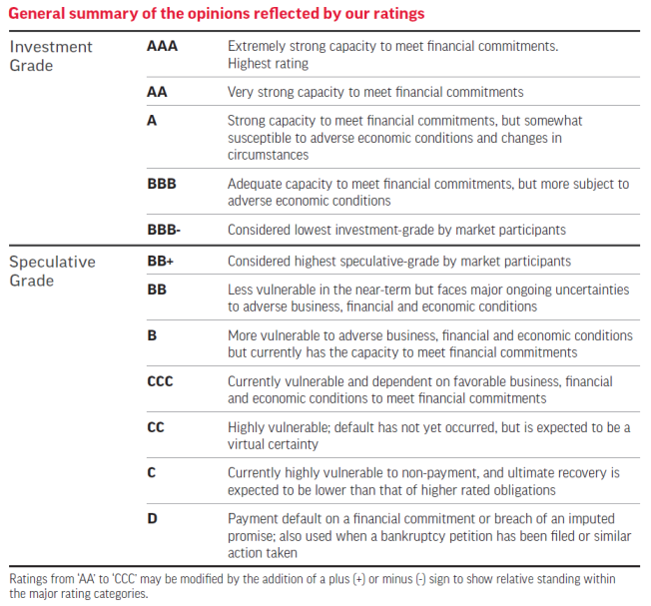

Rating agencies tend to be way too optimistic in rating large banks and somewhat less optimistic in their opinions of smaller banks. For large banks, credit ratings have a substantial impact on their ability to attract institutional funding and to trade with their counterparts. A downgrade below investment grade (below BBB-) is effectively a death knell. AIG and Lehman Brothers were examples of hugely optimistic ratings during 2008. Comparisons are now being made between Lehman Brothers and Deutsche Bank, which could see its funding and trading opportunities rapidly disappear if it suffers further downgrades. Several Italian banks are being talked about as needing government bailouts yet still have credit ratings in the “B” and “BB” categories. Investors should also treat credit ratings of financial institutions with great caution.

4. Securitised debt

Rating agencies were rightly excoriated for their ratings of securitised debt such as mortgage-backed securities and collateralised debt obligations in the lead-up to the financial crisis. As highlighted in the movie The Big Short, rating agencies gave inflated ratings to securitised debt to protect their market share and maximise revenues. However, since the financial crisis, rating agencies have dramatically increased their analysis of securitised debt to the point where the ratings are generally pessimistic. In a reverse of the situation for other types of debt, agencies are now being criticised for failing to upgrade ratings in a timely fashion when securitised transactions perform in line or better than expected. Investors can generally expect securitised debt credit ratings to be an approximately fair reflection of default risk, but need to bear in mind the diversity within securitised debt and the range of complex assumptions required to produce a rating.

Conclusion

Credit ratings play an important part in the functioning of capital markets, but should always be treated as an opinion not a definitive judgement. Investors should conduct their own financial analysis and form their own judgement before investing.

Source: Standard & Poor's

Jonathan Rochford is Portfolio Manager at Narrow Road Capital and this article expresses the personal views of the author at a point in time. It is for educational purposes and is not a substitute for professional financial advice. Narrow Road Capital advises on and invests in a wide range of securities.