With recent volatility in the value of the Australian dollar (AUD), investor attention is again drawn to the topic of currency hedging. This article looks at the impact of currency on international equity investments for an Australian investor and explores some of the factors that influence the decision to hedge currency exposure.

The impact of currency risk

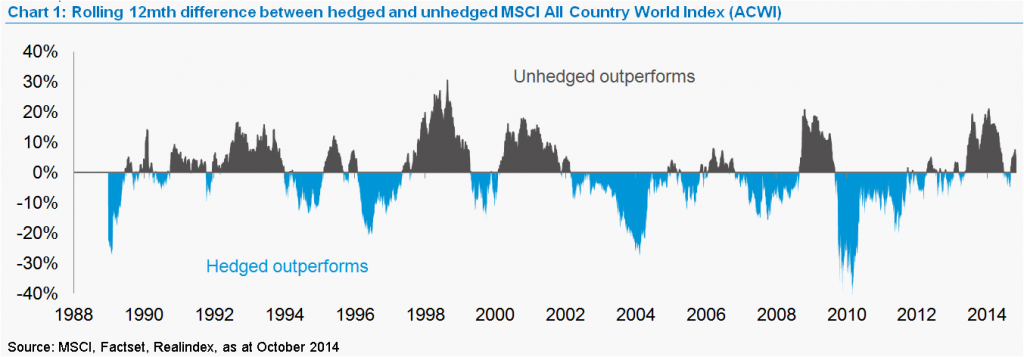

Currency risk is typically a significant proportion of the total risk of an unhedged international equity portfolio which can have a large impact on returns. For example, over the 12 months to February 2009, unhedged investors were about 20% better off than their hedged counterparts, while over the 12 months to March 2010 they were about 40% worse off (Chart 1).

Over the long term, the difference between hedged and unhedged returns is less dramatic because currencies have a tendency to fluctuate around a long-term average. However, hedged investors have been better off by an average of 1.2% per annum (ignoring hedging and carry costs) over the 26 years since 1988. The hedged portfolio has had the added benefit of lower volatility (on average) than the unhedged (14.0% vs 14.8%).

The relationship between currency and equity returns

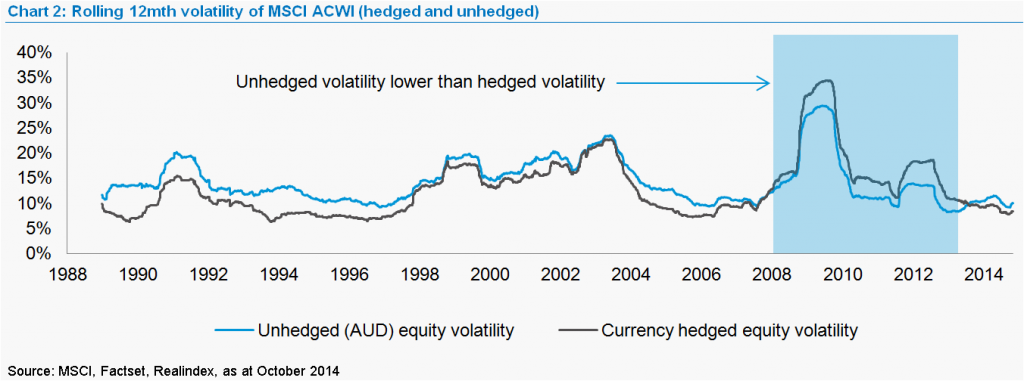

In the aftermath of the GFC, the volatility of a currency-hedged All Country World Index (ACWI) portfolio rose above that of an AUD unhedged ACWI portfolio; an unusual situation that persisted until mid-2013 (Chart 2).

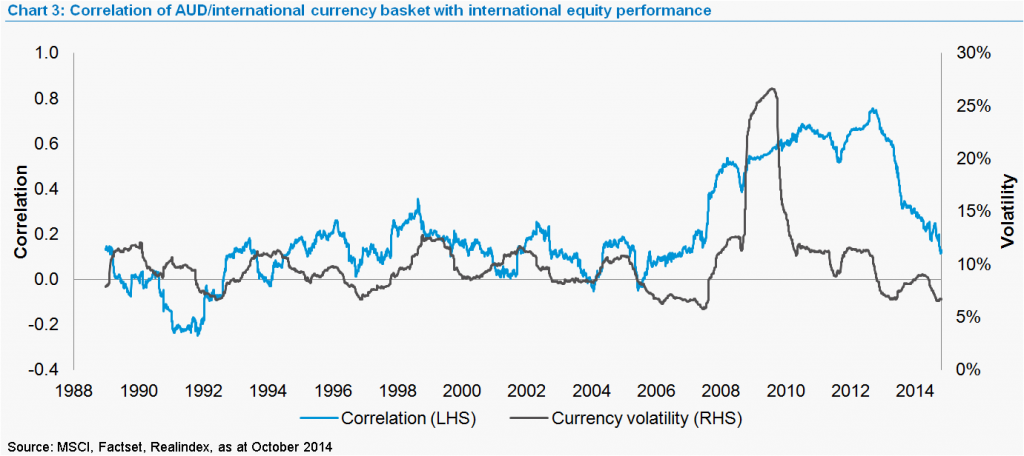

In other words, it became more ‘risky’ for an investor to hedge their AUD currency exposure than to not hedge during this period. This somewhat counter-intuitive phenomenon was the result of a significant increase in correlation between the AUD currency basket and international equity returns (as shown in Chart 3). During this period the currency exposure of an AUD ACWI equity portfolio became a diversifying position. From a ‘total risk’ perspective it was hard to justify hedging currency risk during this period because it increased overall risk. However correlations have now returned to more normal levels and hedged volatility has again dropped below unhedged on a trailing 12 month measure.

This event clearly illustrates that relationships between financial assets are not guaranteed to remain stable and any assumptions that are made as part of the investment process need to be monitored.

Optimal currency hedge ratios

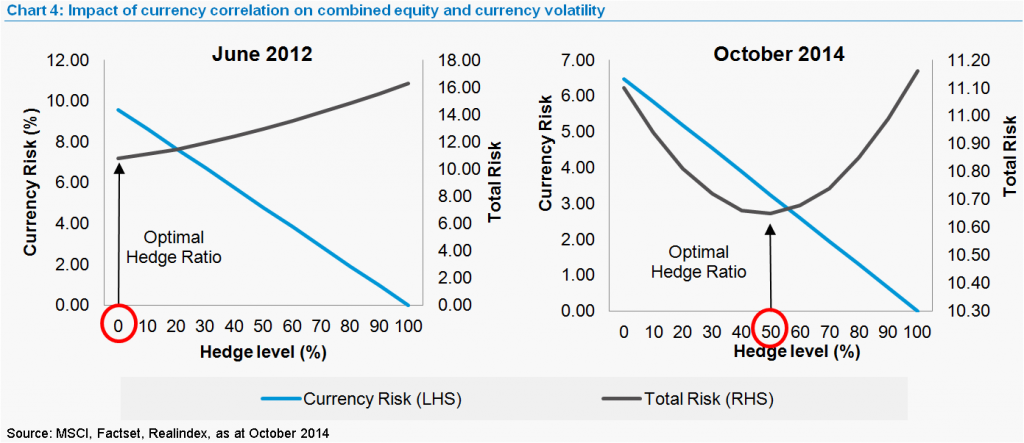

To illustrate the impact of this correlation change we calculate the optimal currency hedge ratio for an investor trying to minimise the total volatility of their global equity portfolio by adjusting the currency hedge (Chart 4). The grey lines show the total risk of equity and currency combined, while the light blue line shows the currency risk in isolation. The optimal total-risk hedge level will be the lowest point on the grey line. We see that in June 2012 the optimal total-risk position was to leave AUD exposure completely unhedged, while the current optimal position is to be roughly 50% hedged. A hedge level of 50% implies that half of the total currency exposure is hedged. Of course if your objective is to eliminate as much currency risk as possible then the optimal choice is always to be fully hedged, regardless of total portfolio volatility.

Hedging returns

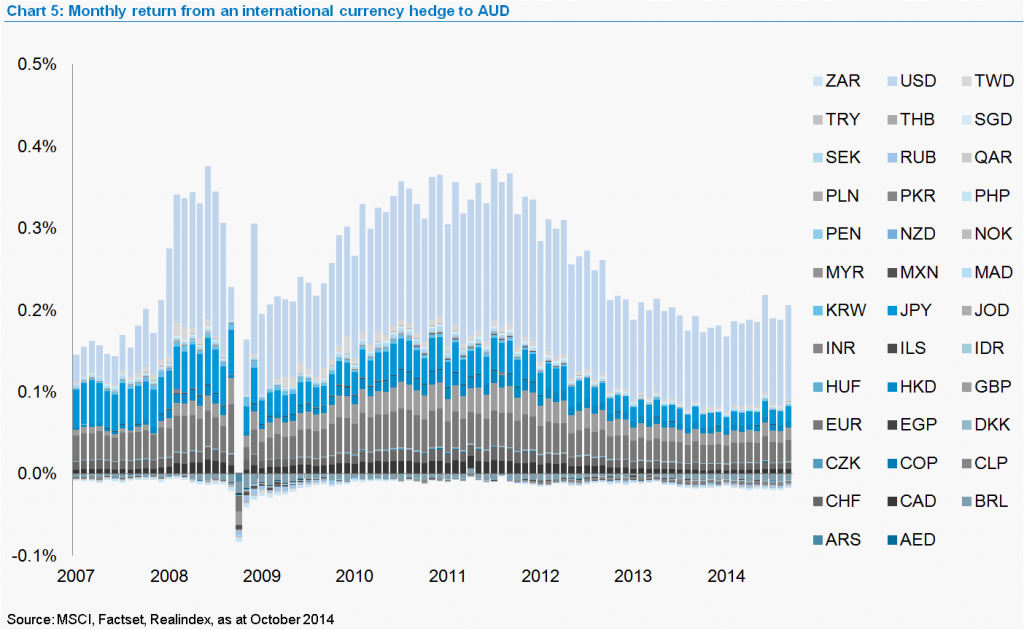

Some investors may not be aware that there is a return associated with a currency hedge that is independent of currency and market movements. This return is the ‘cost of carry’ (or a ‘return of carry’) which reflects interest rate differential between the base currency and foreign currency exposures which are being hedged; it is priced into the currency ‘forward points’. A currency hedge effectively earns the domestic interest rate and pays the foreign rate; for AUD investors this has historically provided a benefit, as illustrated in Chart 5. This benefit would reduce if, for example, US interest rates were to rise while AUD rates remain on hold. You will notice there is variability in the hedging return, which means that it is not ‘risk free’, however the variation in forward returns is typically much lower than the variation in the currency returns which are being hedged.

Why hedge currency exposure

So does it make sense to hedge currency exposure? There are several reasons investors might want to consider currency hedging, including:

- Prior to 2008, hedging currency exposure reduced the total volatility of an AUD based international equity portfolio. Now that correlations have returned to more historically normal levels this may be the case again going forward (though of course this is not guaranteed).

- If a view is held on the AUD, this can be reflected in the level of currency hedge. If there is no view on the currency then arguably it is unwise to take exposure to a source of risk from which you have no expectation of return and therefore we would argue that currency hedging should be considered in this scenario too.

- Historically there has been a carry benefit to hedging the AUD due to the prevailing interest rates. As long as interest rates in Australia are higher than the weighted average rates of international markets, then this may remain the case.

Summary

At Realindex we always encourage investors to take a long-term view on their investment. If an investor holds a long term view on the AUD then it is sensible to implement a hedging strategy that reflects that view (be it hedged or unhedged), and stick to it. If no view is held on the currency, then there are still very valid reasons to consider hedging currency exposure. In either case, it is important to ensure that any performance benchmark is aligned with the strategic hedging decision, and that the risk and cost implications of this decision are fully considered.

Scott Hamilton is a Senior Quantitative Analyst with Realindex Investments. This article is for general educational purposes and readers should seek their own professional advice.