The last three years of a pandemic have taught us to expect the unexpected. It is also an apt lesson for anyone planning for retirement.

Fidelity International's latest retirement study - New life, old life - which surveyed over 1,200 Australians found that while the average age at which Australians would like to retire fully is 64.8 years, the average age we actually retire at is 63.4 years.

Furthermore, the average age at which Australian’s plan to reduce their work commitments and transition into retirement is even younger, at 62.5 years, but the average age at which Australians start reducing their work commitments is 61.4 years.

So many of us are likely to transition into retirement somewhat earlier than expected and we will be fully retiring probably at least 12 months earlier than we had planned.

Some of the reasons for this earlier retirement are out of our control. The top three reasons cited for retiring earlier than planned were:

- personal health issues (one in four)

- redundancy (one in four) and

- needing to care for someone suffering from health issues (one in eight).

An unexpected early retirement can leave some people reeling in shock from which it may be difficult to recover. But if these people had planned ahead for the unexpected, if they had a Plan B already in place, that shock would likely be much less. They would be more resilient to the unexpected.

In fact, the Plan B is perhaps more important than the Plan A, given the potential impact it can have. So it's more important than ever to start thinking about retirement plans as early as possible.

Running out of money

Pre-retirees biggest fears is running out of money whilst in retirement and, closely related to this, the fear of not having enough income to live on.

How long your money will last in retirement essentially depends on three variables:

- how much you start with

- how much and when you draw income down from capital (spending)

- the characteristics of your investments.

When forced into early retirement, people don’t have full control over their starting capital and it’s probably less than they planned. But retirees do have control and agency over the other two variables.

Deferring or reducing expenditure could help sustain the savings pool for longer. This lever is often used by many retirees as they adapt to their lived experience of spending needs and wants, and their experience with investment outcomes. An important element of course is their lived experience of their investment portfolio. Retirees who have a plan in place and an investment framework for dealing with income needs, market volatility and maintaining suitable risk exposures, will likely feel more in control and more resilient to the inevitable gyrations of the investment markets.

Getting help with how to invest

For many people who are not familiar with financial markets, professional advice can be useful. The preferred source of professional advice on retirement, according to the Fidelity survey, is a professional financial adviser at 55%, followed by accountants at 23%.

But there are some barriers to accessing financial advice, with a large chunk of advisers leaving the industry during the last four years - up to 40% - and with each adviser seeing fewer clients now because of increased regulatory requirements, the cost of advice has also increased.

When it comes to reasons for not seeking financial advice, after a preference for doing it themselves or feeling confident they can manage their own financial affairs, not being able to afford financial advice is the reason most pre-retirees (28%) and retirees (30%) cite.

Other evidence suggests that existing clients of advisers may not be as price sensitive because they understand the good that financial advice does when it comes to addressing their retirement worries and concerns.

Addressing financial advice barriers

The Federal Treasury's Quality of Advice Review, released to the public in February 2023, has made some radical suggestions for improving access to financial advice. These recommendations are designed to reduce some of the administration and compliance burdens that currently rest with advisers and will hopefully reduce the barriers and the cost to getting advice.

The Government has not given any indication yet of what it will do with those recommendations. It is now consulting before bringing in any new regulation. There is widespread support for many of the recommendations although there is also some resistance from consumer groups who are concerned that consumer rights will not be protected appropriately.

According to research, the five most common questions pre-retirees have about retirement are:

- How much do I really need?

- Am I on track?

- What are my options?

- How much should I be saving today?

- What can I afford to spend in retirement?

Sitting down with an adviser and asking these questions could be beneficial to both the client and advisers looking to demonstrate the value of financial advice.

Changing goals

The good news is that once you have retired, anxiety levels usually drop as expectations change over time. How we judge a successful retirement changes as we age.

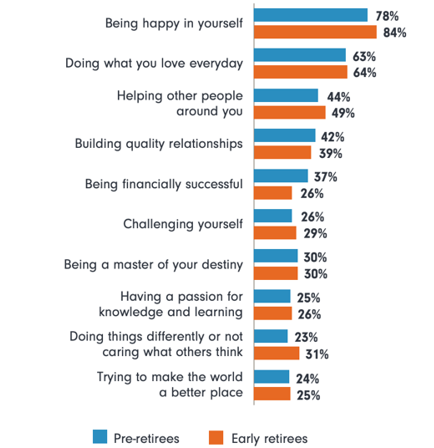

When asked what success in life means, only 37% of pre-retirees chose being financially successful as their key measure. And this drops to just 26% for early retirees. For those already in retirement, the best measures of having a successful and fulfilling retirement were Being happy in yourself at 84%, followed by Doing what you love every day at 64%. Early retirees were also more likely to see Helping other people around you as an indicator of success at 49%, compared to 44% of pre-retirees.

Also, many retirees are not big spenders. They often spend their time engaging in low-cost activities, including relaxing, time with family and friends, reading and engaging in hobbies and exercise.

Calming down

From the research study, it seems that once people enter retirement, settle into a new rhythm and come to a level of acceptance about their circumstances, their anxiety levels around their financial situation drops and they are better able to enjoy their retirement within their means.

Financial advice can play a very important role in improving life satisfaction in retirement, so let’s hope that financial advice becomes more accessible for all.

Richard Dinham is Head of Client Solutions and Retirement at Fidelity International, a sponsor of Firstlinks.

Current as at 30 September 2022. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2021 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited. FD18634.