It is well recognised that avoiding large losses is a key element in building wealth. The focus on capital preservation is warranted as heavy losses require very high rates of return to restore the original capital. For example, a 100% gain is required to recoup a 50% loss.

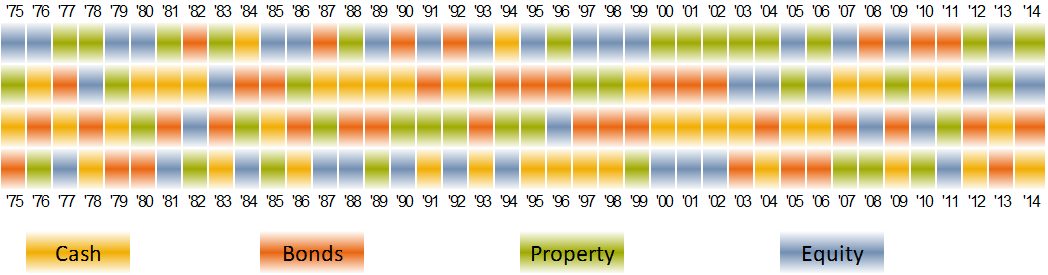

Exhibit 1 shows the annual returns of each of the four major asset classes over a 40-year period. The asset classes are arranged in descending order of return so that the best performing asset class is at the top and the poorest performing asset class is at the bottom. It is clear from the ‘gameboard’ that no single asset class either outperforms or underperforms consistently. The largest recorded annual fall in the 40-year period was property with 55.3%.

So how do we avoid the extreme losses to capital?

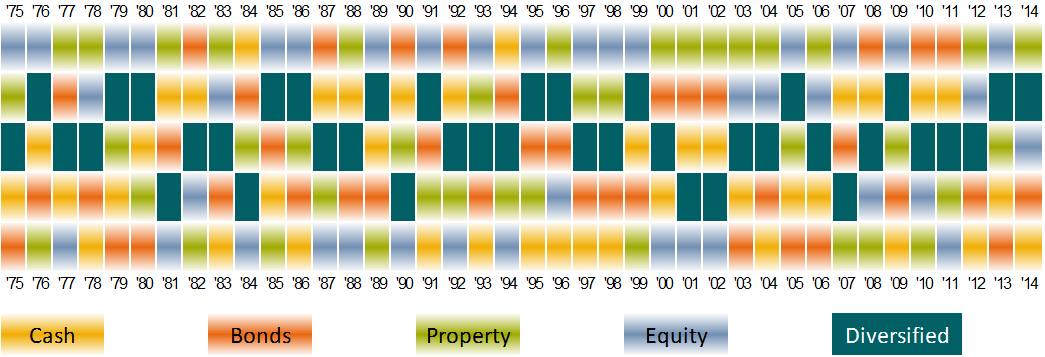

Diversifying or spreading investments across multiple asset classes reduces an investment portfolio's overall risk. This is because losses made in one asset class can be offset by gains in others. The benefits of diversification can be seen in Exhibit 2. It illustrates how a diversified multi-asset portfolio (60% growth assets) has performed compared to individual asset classes in the same 40-year period. In 34 years, the diversified portfolio has achieved a return in the top 3 asset classes and in only six periods, the portfolio has produced a return in the second-last ranking asset class. The diversified portfolio is neither the best- nor, more importantly, the worst-performing investment in any given year. The risk of a large loss to capital has been significantly reduced and the overall return is less volatile.

Peter Gee is Research Products Manager with Morningstar Australasia. Information provided is for general information only, and individuals should seek personal advice before making investment decisions. The objectives of any individual have not been considered in this article.