The benefits of investing through an SMSF include control, cost efficiency, tax management and flexibility but issues such as underperformance and viability due to size should also to be considered.

The massive inflows into the sector have meant that SMSFs are nearly 30% or $654 billion of total superannuation assets of $2.2 trillion. Is the increasing interest in doing-it-yourself (DIY) justifiable?

Size of SMSFs matter

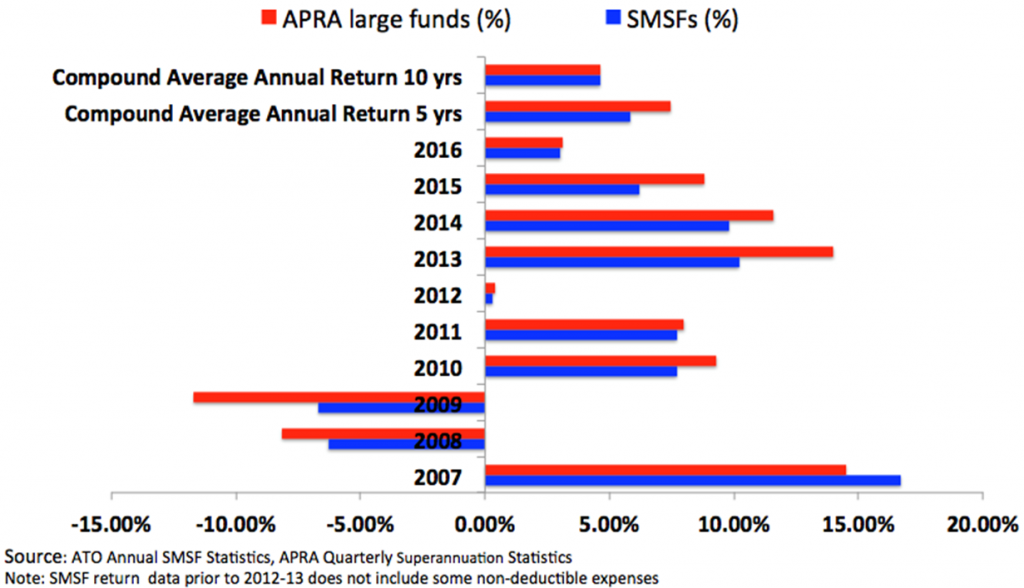

According to ATO data, the APRA-regulated large institutional funds (including retail and industry funds) have outperformed SMSFs in seven out of 10 years to 2016. APRA funds’ compound average annual net return (after fees) over 10 years is in line with SMSFs, but higher over five years, as shown below. The outperformance of SMSF’s during the financial crisis years (2008 and 2009) helped support returns over 10 years, but once that outperformance disappeared, the APRA funds have done better. But, a statement in APRA’s Annual Superannuation Bulletin that in their calculations “expenses are generally understated”, suggests that APRA fund returns’ may be inflated.

According to data from a report by SMSF Centre of Excellence, SMSFs holding over $1 million in assets were the best performers over seven years. Smaller SMSFs (under $1 million), retail funds and industry funds did not do as well as larger SMSFs.

Net returns of SMSFs and large funds over 10 years

Assets are categorised differently

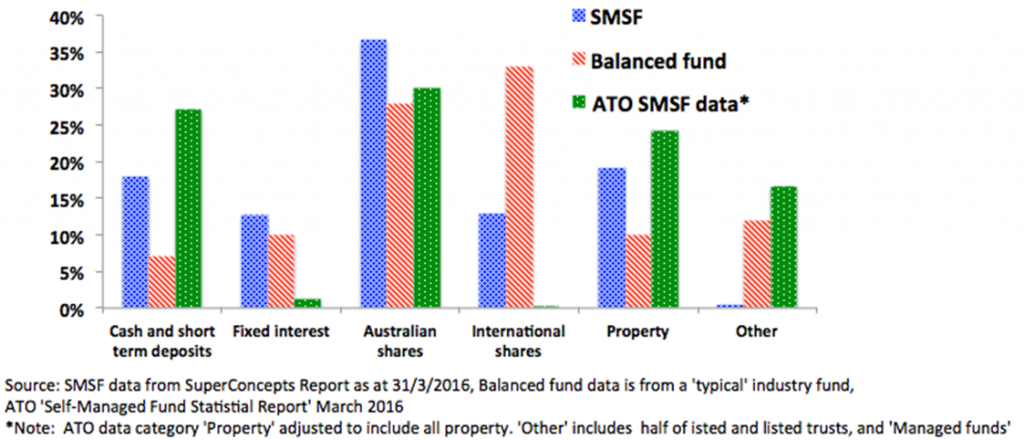

There are different sources of SMSF statistics. The ATO compiles the SMSF statistical data from SMSF tax returns, but some sectors are not accurately represented including property and international shares.

Last year I wrote about the fact that almost a quarter of SMSF portfolios are in property (see ‘Property takes one in four SMSF dollars’ (paywall) in The Australian newspaper). As the ATO makes the assumption that ‘assets in trusts are treated as though half is invested in equities and half in property’, then up to half of the 14% allocation to unlisted and listed trusts may be invested in property trusts (listed and unlisted). Additionally, there is the increasing allocation to “limited recourse borrowings” supported by the buying of investment properties. However, these numbers include business real property where professionals such as doctors and dentists sell their premises to their SMSFs and rent them to the business, rather than residential real estate.

In the case of international shares, Graham Hand from Cuffelinks found out from the ATO that there is likely to be international shares allocations held by ‘Listed trusts’ and ‘Unlisted trusts’, as well as ‘Other managed investments’ categories. These would substantially increase the low weighting to international shares that is reported.

SuperConcept’s ‘SMSF Investment Patterns Survey’, which covers approximately 2,750 funds representing over $3 billion in super, provides SMSF asset allocation data, which may be closer to what SMSFs are really doing, as shown below. SuperConcept’s inclusion of hybrid securities as fixed interest is debatable. Hybrids may pay a fixed interest-like return, but the securities also deliver downside risk rather than upside reward. During a market correction, the behaviour is more like shares, albeit with lower volatility than the underlying shares (see my article in Cuffelinks). So, more realistically SMSFs are most likely holding lower levels of fixed interest and higher levels of Australian equities than SuperConcepts’ data. Their clientele also tends to be ‘advised’, with greater use of managed funds than the overall SMSF population.

According to ‘Class SMSF Benchmark Report’ dated March 2016, more than 40% of Exchange Trade Funds (ETFs) or $11 billion of the $27 billion ETF market, is held by SMSFs. Some of the reported Australian equity allocation held by SMSFs is really in international equity ETFs or managed investment trusts to gain international equity exposure. If SMSFs are investing in ETFs for international exposure, the allocation to Australian shares is not as top heavy as has been believed. The same could apply to other asset classes such as fixed interest.

Asset allocation of SMSF and a balanced (Industry) fund as at June 2016

SMSF or APRA fund?

Are members of SMSFs better off where they are or should they return to an APRA fund? Whether or not the SMSF is meeting the members’ expectations may depend on why the fund was initially set up.

During the GFC, many APRA funds fell heavily, which may have encouraged the setting up of SMSFs, especially post-crisis. But SMSFs have their own idiosyncrasies including a home country bias to Australian equities, due to their familiarity, higher expectations of return, currency and costs.

Also, the allocation to cash and term deposits, despite record low interest rates, continues to be high compared with APRA funds. Around the time of the GFC in 2008, ATO data shows cash levels of SMSFs were around 29% and Australian equities 31%. Although the levels of cash were conservative, the high weighting to equities led to negative returns not to the extent of APRA funds.

Fees matter

The fees paid by SMSFs influence their returns over time. SMSFs with larger balances (over $1 million) are likely to be paying a relatively lower fee due to the fixed cost payable by all SMSFs. The average expense ratio according to 2015 ATO data for funds between $1 million and $2 million is under 1%, while smaller funds with less than $500,000 may be paying closer to 2.5%. Larger funds also have the advantage of economies of scale, enabling access to wholesale investment products with lower fees. A complete administrative package for an SMSF with many investments should cost less than $5,000 a year, which is only 0.5% on $1 million and 0.25% on $2 million.

If not for the years of 2008 and 2009, SMSF long-term performance might have been less attractive. A standout feature of SMSFs’ asset allocation is essentially the split between three asset classes: cash, equity and property. Nearly 40% of SMSF members are over the age of 60 and transitioning to retirement or in retirement, which may support the need for liquidity in the form of cash for capital stability and franked dividends on Australian equities for income generation.

Rosemary Steinfort is a Research Manager with DirectMoney. This article is general information and does not address the circumstances of any individual.