Although they have commanded little attention recently, consumer staples companies such as food and beverage groups are a core part of global equity portfolios. These companies have underperformed perceived growth sectors such as information technology and health care, but they are generally considered quality companies whose share prices have lower volatility than more cyclical companies. For many of these companies, the characteristics that cause them to be considered quality companies are the same ones that enable them to score well on standard ethical investing criteria.

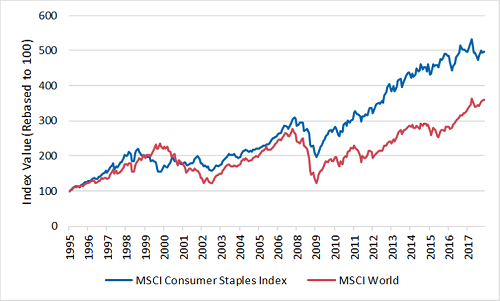

After a period of investor attention in the five years following the 2008-2009 financial crisis, consumer staples companies have fallen off the radar of many investors. Their performance, particularly in the past 12 months, has been sluggish, as shown in the chart below. Most global equity investors – particularly those focused on future earnings growth – have turned to companies in the information technology, healthcare, and consumer discretionary sectors, which collectively appear to be signalling the likely sources of economic focus in decades to come.

MSCI Consumer Staples versus MSCI World, 1995-2018

Source: Bloomberg, Whitehelm Advisers

But consumer staples companies have not gone away. From an economic perspective, most are as large as ever, and the products they provide are for the most part still considered essential.

Consumer staples defined

There are two definitions of consumer staples. The first is essential products, such as food, beverages, and household items. That is a relatively broad definition. The second, however, is goods or services that people are unable or unwilling to cut out of their budgets regardless of their financial situation. This textbook definition of inelastic demand is the one that investors pay most attention to. Consumer staples sell in all economic conditions.

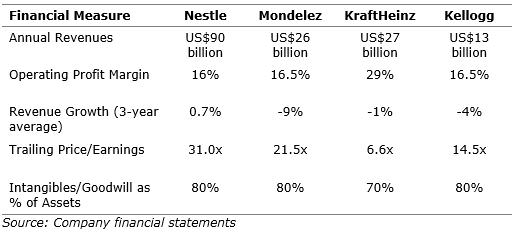

Virtually all global consumer staples companies have consistent year-over-year net profits and dividends, and as shown below, they also have other characteristics associated with quality companies: relatively high operating margins, low debt and a low cost of capital.

Financial summary for selected consumer staples food groups

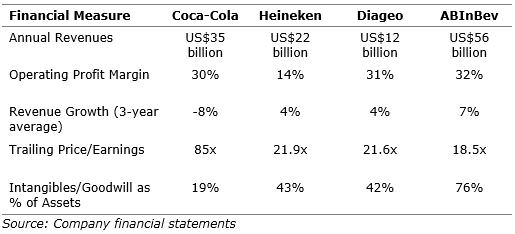

The beverage group of consumer staples companies – alcoholic and non-alcoholic – shares many of the same characteristics of consumer staples food groups: stable earnings, generous profit margins (even after government taxes), low debt, and high intangible assets.

Financial summary for selected consumer staples beverage groups

Australian consumer staples companies are different, however. The long, inexorable march toward convenience-oriented food over the past 70 years did not develop as fully as in other developed countries, particularly North America and northern Europe. This is reflected clearly in the consumer staples segment of Australian stocks within the ASX200. The main constituents of the index are large integrated grocery chains and specific health and nutrition companies, including vitamin and infant health companies.

On the surface, it might be considered unfortunate that whole other sectors of the Australian food-producing economy are essentially uninvestable to listed equity investors, but perhaps it is a blessing in disguise, since many of these businesses are highly cyclical in nature, whereas consumer staples companies are generally very stable.

Threats to food and beverage consumer staples companies

A company like a consumer staples food or beverage producer may be attractive to investors because of its stable revenues and relatively high operating profit margins. Such a company may also be attractive from an ethical investing perspective because of its focus on providing essential products without harmful effects. Just as consumer preferences and collective beliefs change over time, however, so does the financial landscape in which these companies operate. A company that has comfortable profit margins, stable earnings, low debt, and a low cost of capital, with diverse brands and a focus on adhering to ethical standards may grow too comfortable. For an activist investor, a consumer staples company could have higher operating profit, higher debt, and more dynamic management. The very things that have made it a quality company are on the way to making it a mediocre company, and one vulnerable to outside shareholder action. This action may come either through activist investing - agitating for change from the outside, typically through board representation - or alternatively from a takeover of the company’s management, and an accompanying efficiency drive. That is essentially what 3G, a consumer food and beverages group originally based in Brazil, has done sequentially with the world’s largest beer company, Anhauser Busch InBev, and with KraftHeinz, the US food products company.

A second financial threat to the consumer staples group is consumer preferences themselves. This has manifested itself in static or falling revenues. While the low growth and low inflation environment of many developed world countries since the 2008-2009 financial crisis does not make this particularly surprising, a number of consumer food groups are experiencing declining revenues, or revenues that would be declining if not for growth in developing country sales. In most cases, however, consumer staples company sales are declining not only due to low economic growth, but also due to consumer preferences that do not match what the companies are producing.

In response, only a minority of large consumer staples companies have taken the 3G approach of attempting to make operations significantly more efficient, however. The first response of consumer staples companies to falling sales has instead been to acquire smaller companies. For the most part, however, these absorptions have only stopped revenues from falling further, rather than increasing them. A minority of companies have continued to focus on increasing sales organically, rather than through continued acquisitions. A common theme has been a focus not on reducing costs, but on increasing sales through reinvestment in brands, employees and research. Whether doing so can be considered more advisable, however, is an open question.

Australian institutional investors collectively own a large amount of consumer staples companies both inside and outside Australia and will likely own more in the future. Even today, a single Australian investor is one of the largest shareholders in several global consumer staples food groups. As their collective influence grows, Australian investors might consider teaching the rest of the world the lessons that they have learned about how companies can balance the competing concerns of investor, consumer and shareholder objectives.

John O'Brien is a Principal Adviser at Whitehelm Capital, an affiliate of Fidante Partners. This article is for general information purposes only and does not consider the circumstances of any investor.

Fidante is a sponsor of Cuffelinks. For more articles and papers from Fidante, please click here.