As investors focused on long-term sustainability, we have long focused on emissions, energy efficiency as well as long-term opportunities and threats in business models as it relates to their sustainability and competitiveness over the long run. This includes evaluating these considerations from an operations perspective, but also from a products and services perspective. Greening of transportation, greening of real estate infrastructure, greening of industrial tools and equipment—these are some examples of product life cycle innovation, on the road to drastically reduced emissions in the long term. In this piece, we focus on the potential opportunities relating to electric vehicles.

On-road vehicles are responsible for the majority of transportation-related greenhouse gas emissions. In particular, emissions from light-duty vehicles, which include passenger cars and light-duty trucks, accounted for 61% of total sector combustion emissions in 2016. Emissions from medium- and heavy-duty vehicles accounted for 23% of total sector combustion emissions while combustion emissions from all other transport modes together made up the remaining 16% of total transportation sector combustion emissions.

Electric Vehicles (EVs) are two to four times more efficient than conventional internal combustion engine models, which can reduce reliance on fossil fuels and can enable significant reductions in greenhouse gas emissions (GHGs) as well as air pollutants [IEA Global EV Outlook 2021].

By emitting no tailpipe emissions, EVs have the potential to significantly decarbonize the U.S. transportation sector. The question remains, however, how long will this take? While EVs of all types are already displacing over 1 million barrels of oil demand per day, the U.S. transportation sector currently remains far from zero emissions, as the composition of the current on-road vehicle fleet is mostly gasoline vehicles and the impact on overall GHG emissions is limited in the near term. EVs represent a growing yet small share of all vehicles on the road today while internal combustion engines will remain on the road for at least another decade or longer before being completely phased out. According to Bloomberg New Energy Finance (BNEF), as soon as 2030, nearly 60% of new car sales must be zero emissions, to stay on track for BNEF’s Net Zero Scenario.

EV commitments from governments and the private sector are necessary for the world’s net-zero goals to be met in the transportation sector. So far, gradual tightening of fuel economy and tailpipe CO2 standards, in the EU in particular, has augmented the role of EVs to meet the standards. Today, over 85% of car sales worldwide are subject to such standards. To date, more than 20 countries have announced the full phase-out of internal combustion engine (ICE) car sales over the next 10 to 30 years, including the U.K., China and several European countries. [IPCC, 2018] In response, the world’s major automakers have stepped forward with their own commitments to phase out internal combustion engine vehicles over the next decade.

Automaker Commitments

- GM will invest $35 billion globally in EV and AVs through 2025. GM also plans to be carbon-neutral? by 2040 in its global products and operations.

- Ford is investing $22 billion through 2025 to deliver battery EVs, and plans to be carbon-neutral by 2050.

- Honda will sell only EVs and hybrids in Europe after 2022. By 2030, Honda says 40% of its North American vehicle sales will be either battery electric or hydrogen, and by 2040 all gas cars will be phased out.

- Toyota will have 70 electrified models by 2025, 15 of them battery EVs and seven of them with the Beyond Zero bZ brand. Pickups will also get electrified, and Toyota has the goal of being carbon-neutral by 2050.

- Volkswagen says that battery EVs will be 70% of its sales in Europe in 2030, up from a projected 35%. For the U.S. and China, the VW brand goal is more than 50% full-electric vehicle sales by 2030. The VW Group has 70 new electrified models in the pipeline, and several already on the market.

EVs Are on the Cusp of Rapid Expansion

Over the past decade, we have seen sales of EVs go from a trickle to a steady stream of rapid adoption. While EV penetration necessary to reach net zero by 2050 is a long way off, there seem to be signs that 2020 was a pivotal year for EVs, which are now on the cusp of rapid expansion and have momentum to move the transport sector towards a path to decarbonization. We believe the transportation sector will play a critical role in achieving the goal of the Paris Climate Change Agreement to keep global temperature rise to well below 2 degrees Celsius above pre-industrial levels.

Over 1 billion passenger cars travel the streets and roads of the world today, and by 2040, that number is set to double to at least 2 billion. There were 10 million electric cars on the world’s roads at the end of 2020, following a decade of rapid growth. Vehicle manufacturers have since announced increasingly ambitious electrification plans. Out of the world’s top 20 vehicle manufacturers, which represented around 90% of new car registrations in 2020, 18 have stated plans to widen their portfolio of models and to rapidly scale up the production of light-duty electric vehicles. The model availability of electric heavy-duty vehicles is also broadening, with four major truck manufacturers indicating an electric future.

As EVs continue to drive advances in battery technology, batteries keep getting better and more cost competitive. Average battery energy density is rising at 7% per year and new chemistries are hitting the market faster than ever. Maximum EV charging speeds are also rising. Lithium-ion battery pack prices fell 89% from 2010 to 2020, with the volume-weighted average hitting $137/kWh. Many expect underlying material prices will play a larger role in the future, but the introduction of new chemistries, new manufacturing techniques and simplified pack designs will keep prices falling.

Technology Solutions Enabling the Path to Electrification

Despite all the progress to date, much remains to happen in order to hit the 2050 Paris Climate Agreement goals, according to a report by the World Resources Institute.

According to the report, an aggressive multifaceted approach is needed to accelerate the progress. We can’t look to just one piece of the industry to solve the problem; for example, we need the grid/charging infrastructure for the renewable energy supply to power the EVs; we need more semiconductors; we need solutions for greening commercial trucks and transport. And while these technologies can improve the CO2 profile of vehicles on the road, there is potential for technologies like autonomous ridesharing to pull tens of millions of vehicles off the road altogether. The report indicates that all of these things in tandem will have a multiplier effect on achieving meaningful goals to expand electrification. We discuss the progress with a few of these solutions below:

Semiconductors

EVs require both more semiconductor content and more advanced chips than gasoline-powered vehicles. Semiconductors enable EVs to be efficient, safe and interactive, and are necessary for a car’s battery, powertrain and firmware. We believe the demand for semiconductors will only continue to grow and enable the expansion of EVs. Current supply chain shortages can largely be traced back to production cutbacks due to the COVID-19 pandemic.

Auto Parts/Auto Makers

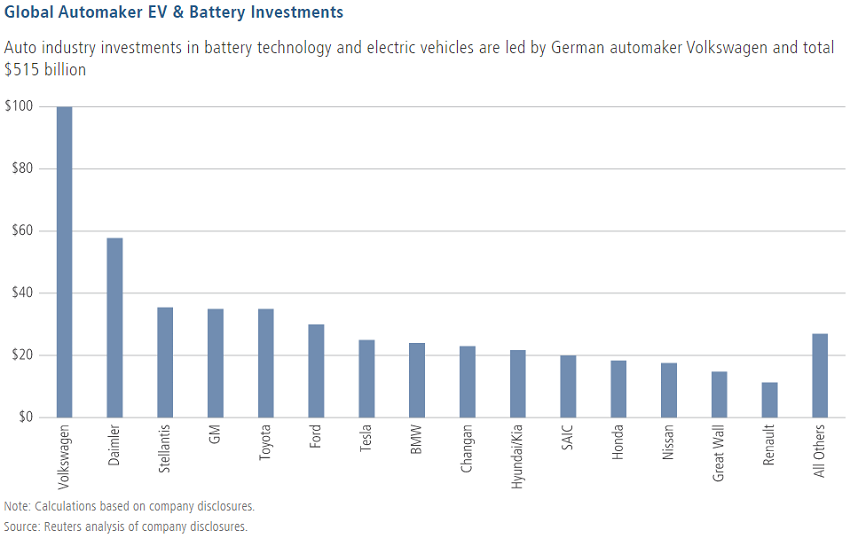

Automakers are now enabling EVs to go mainstream. Every international automaker is introducing battery cars, and plug-in hybrid options are increasingly part of model lines. Global automakers are planning to spend more than half a trillion dollars on electric vehicles and batteries through 2030, according to a Reuters analysis, increasing investments aimed at meeting increasingly tough decarbonization targets. The most recent analysis shows carmakers planning to spend an estimated $515 billion over the next five to 10 years to develop and build new battery-powered vehicles and shift away from combustion engines.

Grid and Charging Station/Infrastructure

As the country adds more EVs to the road, charging infrastructure will be needed to support them. According to Department of Energy data, as of 2021 the U.S. has fewer than 46,000 EV public charging sites compared to more than 150,000 gasoline fueling stations.

President Joe Biden's $1 trillion infrastructure package, which was recently passed by Congress, includes $7.5 billion toward a nationwide network of 500,000 EV charging stations by 2030. We believe this is likely to fall short of what is needed but is seen as a much-needed boost for meeting the most immediate infrastructure needs.

Daniel Hanson is the Senior Portfolio Manager and Head of the U.S. Sustainable Equity team at Neuberger Berman, a sponsor of Firstlinks. This material is provided for informational purposes only. Nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security.

For more articles and papers from Neuberger Berman, click here.