On Thursday 1 May 2014, Joe Hockey released the National Commission of Audit, accompanied by this statement. It’s an important review, the first into the scope and efficiency of the federal government in 20 years. Mr Hockey said it will provide important input to the forthcoming budget, as well as guiding future policy.

For those who would like to read the report, the home page of the Commission is linked here. In the following extracts, we have links to the recommendations on aged pensions and superannuation preservation age, as well as the Commission’s statements on age pensions and aged care.

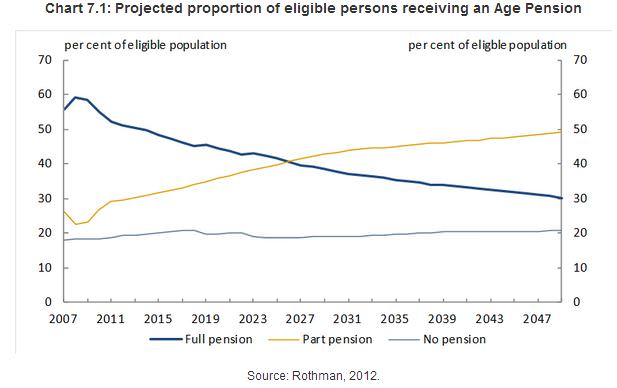

Perhaps the most important graph in the entire report, as shown below, estimates the proportion of the eligible population receiving an age pension. While the proportion on full pension is expected to fall from the current level of 50% to about 30% by 2050, part-pensioners rise by the same amount, from 30% to 50%. So the current ratio of 80% of the eligible population receiving a pension remains unchanged out to 2050. A part-pension gives eligibility to a wide range of benefits relating to health, transport and utilities. This will change if the recommendation is adopted to include the family home in the means test for the age pension, and income from super for eligibility for the Commonwealth Seniors Health Card.

The full list of recommendations is linked here.

Recommendation 13: Age Pension – tighter targeting of eligibility

The Age Pension is an essential part of Australia's social safety net. The Commission recommends that changes be made in future to ensure it is more sustainable, affordable and better targeted by:

- formally linking the eligibility age of the Age Pension to 77 per cent of life expectancy at age 65 from 2033. This will result in the eligibility age for the Age Pension increasing to around 70 by 2053. The proposed change would not affect anyone born before 1965;

- replacing the current income and assets tests with a single comprehensive means test. Under this approach the existing assets test would be abolished with the income test extended by deeming income from a greater range of assets. The new comprehensive means test would apply prospectively to new recipients of the Age Pension from 2027-28 onwards;

- including in the new means test the value of the principal residence above a relatively high threshold. The threshold in 2027-28 would be equivalent to the indexed value of a residence valued today at $750,000 for coupled pensioners and the indexed value of a residence valued today at $500,000 for a single pensioner. This change would apply prospectively to new recipients of the Age Pension from 2027-28 onwards; and

- increasing the income test withdrawal (taper) rate from 50 per cent to 75 per cent. This change would apply prospectively to new recipients of the Age Pension from 2027-28 onwards.

Recommendation 14: Superannuation preservation age

The Age Pension and superannuation are interrelated elements of the retirement income system. The Commission recommends some changes be made to the superannuation system to complement changes being recommended for the Age Pension by:

- increasing the superannuation preservation age to five years below the Age Pension age;

- extending the current phased increase in the preservation age by an extra four years so the preservation age reaches 62 by 2027; and

- increasing the preservation age in conjunction with the Commission's proposed increases in the Age Pension age thereafter.

The section on Age Pension is linked here.

In 2013-14, an estimated $39.5 billion will be spent on the Age Pension, benefitting 2.4 million recipients. Expenditure on the Age Pension is currently growing at 7 per cent per year. Age Pension expenditure is expected to continue to increase largely as a result of an ageing population, increased life expectancies and benchmarking to the Male Total Average Weekly Earnings benchmark.

The features of the Age Pension means test, such as a 50 per cent taper rate and high income free area, can mean pensioners with relatively high levels of income (up to $47,000 in annual income) are able to access a part-rate pension.

As shown in Chart 7.1 on current projections there is unlikely to be an increase in the proportion of individuals who are completely self-sufficient and not reliant on the Age Pension despite the significant investment in superannuation over time. Even allowing for a decline in the proportion of people receiving the full pension, a rise in the number of people receiving the part-rate pension will see the proportion of older Australians eligible for the Age Pension remaining constant at 80 per cent over the next forty years or so.

The section on aged care is linked here.

Currently around 1 million older Australians receive some form of aged care support. The majority of these are people who receive services in their own home and the community. Around 200,000 people are in permanent residential care.

With the ageing of the population, the number of Australians aged 65 and over will rise rapidly, from 3 million today to over 8 million by 2050. Moreover, by 2050 it is expected that more than 3.5 million people will access aged care services, with around 80 per cent of these delivered in the community.

There is a strong rationale for government involvement in aged care on equity grounds and also to overcome information gaps and protect vulnerable Australians. However, over recent years there has been increased acceptance and use of private co-contributions toward the cost of care.

Formal aged care services are predominantly financed by government, with supplementary user contributions also required in many areas. Public funding is primarily delivered through payments to the providers of the various care services.

Aged care expenditure is expected to be around $13 billion in 2013-14, with strong growth expected over coming years. Expenditure on aged care is currently growing at around 4 to 5 per cent per year in real terms. Residential age care is the single largest area of expenditure. Expenditure is being driven primarily by demographic and health factors.