Do you prefer regular or smart investing? Smart, of course, which is why fund marketers invent catchy names for investment products. ‘Smart beta’ is one such product category.

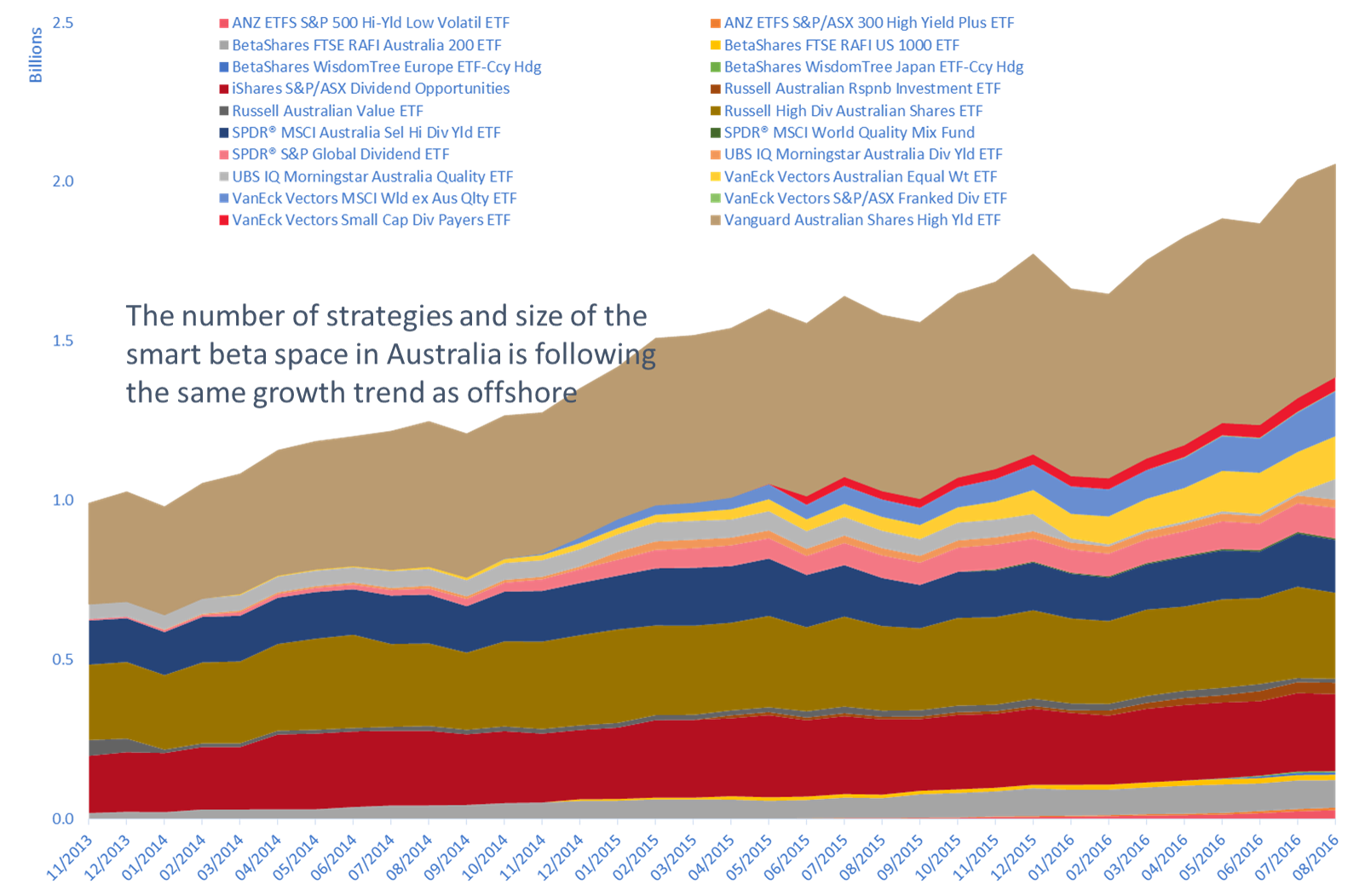

Smart beta ETFs are not new. Globally, there were 1,123 smart beta ETFs as at 30 June 2016. In Australia, there are 154 ETFs and 21 are known as smart beta, accounting for about $1.4 billion or 8.4% of the market, up 20% from a year earlier.

Source: Morningstar, Owners Advisory, September 2016

What are smart beta ETFs?

Smart beta is a name given to investment strategies that aim to either enhance returns or reduce risks of the existing traditional market-capitalisation-weighted indices – the most referenced one in Australia is the S&P/ASX 200. One of the simplest examples of a smart beta version of the ASX 200 is the equal-weighted version. As the name suggests, this strategy invests 1/200th in each stock on the index. Smart beta strategies differ from active strategies in that:

- they are rules based

- they are transparent (we know what the rules are)

- they are typically low cost when compared with actively managed funds.

Most of these strategies aim to exploit a weakness in a market-cap index and fundamental to their investment philosophy is ‘just because a company is big doesn’t mean you should own a lot of it’. It is common to see so-called ‘factor’ ETFs – smart beta ETFs that increase the weight of smaller companies relative to larger companies or value, momentum, quality or any of the other common factors that are known to perform over time.

Main types of smart beta ETFs

There are five main types of smart beta ETFs currently available in the Australian market, with more types expected to follow:

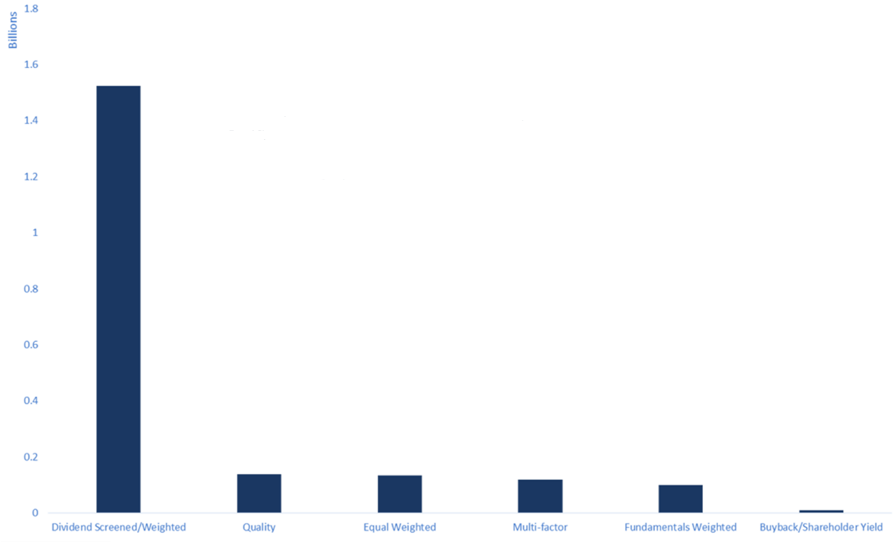

- Dividend screened – as the name suggests, this one seeks higher-income stocks and is currently the most popular of the smart beta ETFs available. This trend is occurring globally as yields on fixed income products fail to meet investors’ income demands.

- Fundamental – this one typically weights or positions each stock based on company fundamentals derived from balance sheets/cashflow statements and profit/loss statements.

- Quality – weights are determined according to the quality of each stock’s earnings.

- Equal weighted – the name says it all.

- Minimum variance or volatility – these are designed to exhibit lower price variability than the market capitalisation index.

Dividend seeking investment strategies are extremely popular globally

Source: Morningstar, Owners Advisory, September 2016

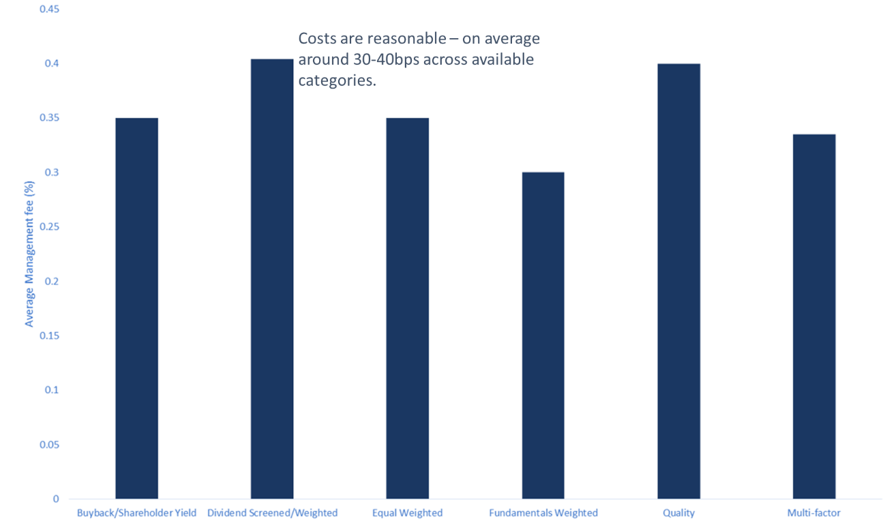

Fees for the smart beta products are usually cheaper than active management but dearer than the traditional market-capitalisation indexes, as shown below.

Source: Morningstar, Owners Advisory, September 2016

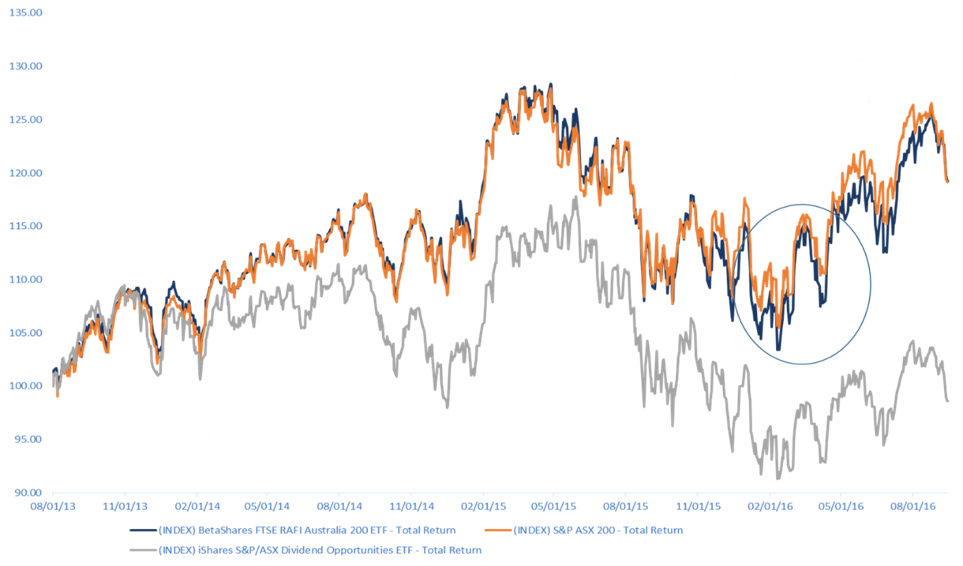

The relative performance of smart beta-style ETFs that are rules-based investment strategies are often tied to the investment cycle. For example, those based on value or fundamental factors can underperform the market-capitalisation-weighted index for a period of time – such is the nature of value investing. Likewise, those screening for dividends also will have periods where they will underperform the market. The chart below shows periods where smart beta strategies can overshoot to the downside as well as the upside.

Source: Factset, Owners Advisory, September 2016

Rules-based funds, such as smart beta funds offered on the ASX, straddle the spectrum between active and passive investment management. Like active funds there is the possibility of outperformance, but also underperformance when the ‘rules’ are not favoured by prevailing market conditions. However, compared to their passively managed peers, net of fees beating the market is still possible. Smart beta strategies offer access to a form of active management without the need to filter through the vast array of mixed-performing stock pickers.

Leah Kelly is a Portfolio Manager at Owners Advisory. This article is general information and does not consider the circumstances of any individual.