The ability to find the ‘next big thing’ - that is, the next big long-term structural growth trend, before anybody else does - is a key component of investing, especially in global markets.

Identifying and understanding these big technological and structural changes in society are an integral part of our investing process. We call these trends 'Areas of Interest'.

It should come as no surprise, particularly in the wake of COP26, that climate is a major Area of Interest. While many governments continue to drag their feet on de-carbonising their economies, private enterprises see the potential and are acting quickly to develop the technology that consumers are increasingly demanding.

Money is backing into the climate theme

In 2020, global investment in the transition to low-carbon energy exceeded $US500 billion for the first time ever. Given the ambitious carbon goals now being announced around the world, we forecast the transition to decarbonisation will require an investment of over $US30 trillion between now and 2050.

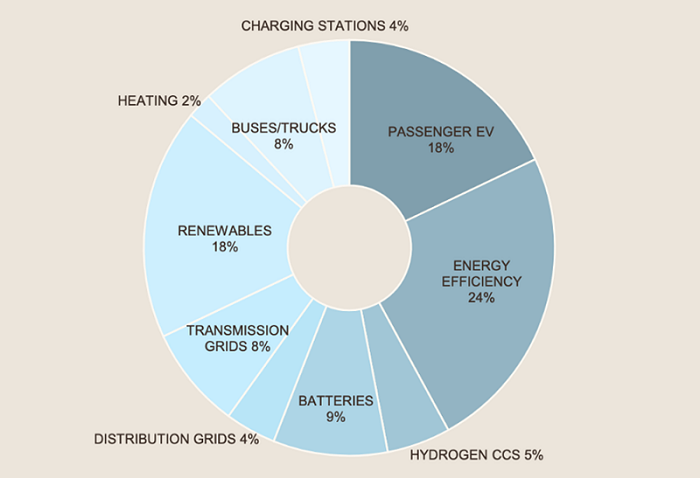

The below chart shows where we believe the investment opportunities will lie in this transition.

Finding tomorrow’s winners: Climate

Source: Goldman Sachs, Munro Partners Estimates (31st December 2020)

In climate, there are four structural categories that will be outliers in the decarbonisation of the planet.

1. Clean energy

Companies at the forefront of renewable energy generation know clean energy is not just good for the planet, but it is now cheap enough to compete with fossil fuels and is less reliant on government subsidies to succeed.

A focus for us in renewable energy is wind generation. Onshore wind production may receive a lot of media attention, but offshore wind is the faster growing segment in this industry. To highlight the potential in this space, the amount of offshore wind capacity auctioned in 2020 equalled the amount that has been built in the entirety of its existence.

Denmark-listed Orsted commissioned the first offshore windfarm back in 1991. This extensive experience and head start is part of what makes Orsted attractive and what will see it continue to develop as an ‘offshore major’ as the industry matures and despite oil companies entering.

2. Clean transport

Electric vehicles will be an integral part of any future transport strategy, something governments are slowly realising. Currently, less than 1% of Australian cars on the road are electric vehicles but this will grow rapidly as infrastructure, affordability and range are improved.

The problem for investors is identifying which companies are looking outside the box in the move towards clean transport. Battery technology is a critical, but often overlooked, component of this transition.

Korean-listed Samsung SDI is a leader in large energy storage batteries and electric vehicle battery manufacture. Although barely profitable today, with more governments around the world making announcements similar to Australia’s designed to boost electric vehicle uptake, we expect companies producing energy storage batteries to grow and prosper.

3. Energy efficiency

A more efficient energy future includes the best use that energy, for example, through more efficient insulation or metering.

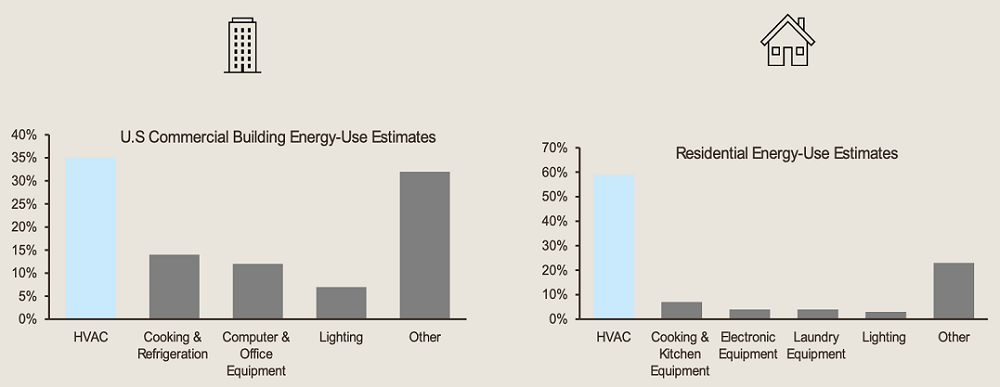

We forecast this category of energy efficiency to account for a quarter of all global decarbonisation spending. Companies in heating, ventilation, and air-conditioning (HVAC), insulation products, electrical switches, lighting and metering technology will offer the best prospects in this category as offices, commercial buildings and households increase focus on their energy ratings. HVAC retrofitting represents a potential $US350 billion investment market.

Another potential tailwind is the role of air quality in reducing the risk of COVID-19 transmission. More companies and buildings are retrofitting existing systems, or installing new ones, that are able to monitor air quality instantaneously.

HVAC Emissions

Source: Bloomberg Finance L.P as at 15 April 2021

Governments are also expected to introduce stricter air quality rules that will mandate the use of these newer technologies in new builds.

US-listed Trane Technologies is a HVAC business that targets sustainability benefits through the increased energy efficiency of their systems. They have spent a decade repositioning their brand to be more sustainable and have pledged to reduce their customer carbon footprint by one gigaton by 2030.

4. Circular economy

Consumers are increasingly aware of the waste their consumption can produce, with supermarkets, for example, reducing their plastic packaging over recent years in response to consumer demand. Councils are labelling general rubbish bins as ‘landfill’ to make their constituents more aware of where their waste ends up, and primary schools are encouraging an awareness of recycling and the global effects of too much waste production from a very young age.

Unfortunately, just 14% of plastic is currently recycled, compared to 60% of paper and up to 90% of steel. We expect this to increase as consumers continue to become more aware of the true cost of the ‘convenience’ of plastics. The ‘true’ cost of the oil and gas required to produce plastics is also expected to rise, and become more understood, which will further increase the demand for plastics recycling.

Norwegian listed Tomra Systems started off manufacturing reverse vending machines for used beverage containers in 1972 and today provides advanced collection and sorting technology that enables the circular economy and helps minimise waste. They estimate this underpenetrated addressable market to be between $US50 and $US80 billion.

The bottom line

Climate-related companies in the four categories outlined above will experience exponential growth over the years and decades to come. This will be driven by increased consumer demand for more climate conscious solutions and by governments, corporations and investors setting ambitious climate reduction targets.

By identifying and investing in these companies at the beginning of a very long S-curves, we can profit from their prescience and deliver those benefits to investors. We have established the Munro Climate Change Leaders Fund to capture this opportunity.

James Tsinidis is a Portfolio Manager and Co-Lead of the Munro Climate Change Leaders Fund. Munro Partners is a specialist investment manager partner of GSFM Funds Management, a sponsor of Firstlinks. Munro Partners may have holdings in the companies mentioned in this article. This information is general in nature and has been prepared without taking account of the objectives, financial situation or needs of individuals.

For more articles and papers from GSFM and partners, click here.