Despite the Trump Administration’s retreat from global climate leadership, we nevertheless stand at the beginning of a larger structural shift – the transition to a net-zero economy. For investors, few themes have ever matched the scale and urgency of climate change. Climate change is a multi-decade investment opportunity, and one that will outlast the current four-year term of the Trump presidency.

Decarbonisation is not a distant goal but a process that is already well underway, driven by governments, corporations, and investors alike. Identifying the companies driving this transition requires an approach that goes beyond simply screening out high emitters. The real winners will be those delivering practical solutions to decarbonisation – whether by producing clean energy, reducing industrial emissions, or improving efficiency across sectors.

Opportunities in clean energy

There are investment opportunities in renewable energy producers, though investors should be more cautious with those producing solar and wind energy. China has oversupplied solar, and wind has industry-specific supply chain problems. Nuclear energy, on the other hand, is seeing greater support as a reliable, carbon-free power source.

Constellation Energy (NASDAQ:CEG), for example, is a leader in the field. The company owns the largest fleet of nuclear power stations in the US. Nuclear energy is a carbon-free source of electricity, and nearly 90 per cent of Constellation’s annual output is carbon-free. The company is likely to see rising demand for its clean energy.

Corporate investment, too, is turning nuclear climate ambition into reality. Some of the world’s largest companies – including Microsoft, Amazon, and Google – are making direct investments in nuclear power and signing long-term power purchase agreements (PPAs) to ensure a stable supply of carbon-free energy. These investments are not just about sustainability, but about meeting demand. Demand is rapidly increasing, driven by artificial intelligence (AI) and data centres, as well as US reshoring and electrification of transport and industry.

At the same time, commercial real estate owners and industrial manufacturers are investing in HVAC (heating, ventilation and air conditioning) systems, insulation, and efficiency upgrades, which help cut costs while reducing emissions.

This shift marks a fundamental change in how businesses view climate solutions. Instead of simply offsetting emissions, companies are embedding decarbonisation into their operations, supply chains, and infrastructure. The result is a growing demand for technologies that enable net-zero goals, from energy storage to next-generation grid systems.

A focus on energy efficiency

Beyond clean energy generation, energy efficiency is key to reducing emissions in the US. This remains one of the most overlooked areas of climate investment. Unlike energy production, efficiency solutions reduce demand altogether, cutting costs and emissions in the process.

Buildings alone account for nearly 40 per cent of global energy use, making HVAC systems, insulation, and energy management software critical areas of investment. With short payback periods – often under two years – energy efficiency solutions represent one of the fastest-growing and most financially attractive areas of climate investment.

At the same time, industrial energy efficiency is becoming a major investment theme. Technologies such as industrial process optimisation, heat pumps, and waste heat recovery are improving operational efficiency in manufacturing, logistics, and data centres.

AI impacts

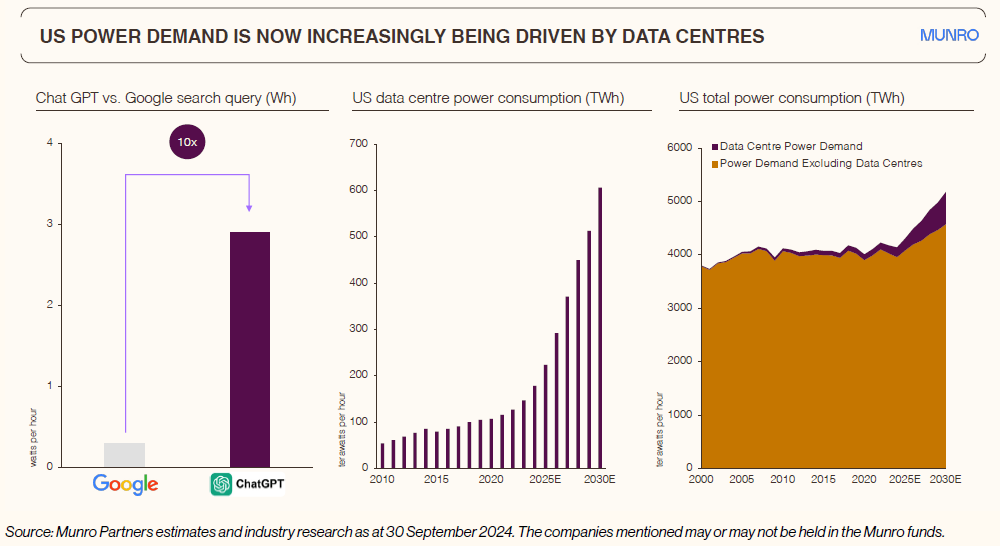

The rapid adoption of AI is reshaping global energy consumption. AI workloads are significantly more power-intensive than traditional computing, and as businesses deploy AI at scale, data centre electricity demand is set to surge. Data centres already contribute over 2.5 per cent of global emissions, a figure set to rise as AI expands. AI could increase the urgency of the energy transition, forcing companies to scale clean energy investment and grid infrastructure faster than previously expected.

Energy efficiency will become more important. Nvidia (NASDAQ:NVDA), for example, leads in this area. As the world’s demand for AI grows rapidly, Nvidia is enabling more energy efficient data centres through its Graphics Processing Units (GPUs), which are as much as 20 times more energy efficient for certain AI and high-performance computing workloads versus Central Processing Units (CPUs). Newer computer chip products are continuing to achieve large energy efficiency gains per unit of computing.

Additionally, AI is playing a role in grid optimisation. Machine learning models are being used to improve electricity demand forecasting, enhance battery storage performance, and increase the efficiency of industrial and building energy systems. While AI is accelerating the need for clean power, it is also emerging as a key enabler of smarter energy use.

Circular economy – reducing waste, increasing sustainability

The transition to a sustainable economy is also about redefining how we use materials. The circular economy focuses on reducing waste, increasing recycling, and creating more sustainable production systems.

Plastics, industrial waste, and water scarcity present some of the biggest environmental challenges today. Companies involved in waste management, advanced recycling, and water treatment solutions are seeing rising demand, particularly as corporate and government policies push for higher sustainability standards in packaging and industrial processes.

Beyond traditional waste management, innovation in alternative materials, such as bio-based plastics, low-carbon cement, and synthetic fuels, are opening up new investment opportunities. These industries are still in the early stages, but they are set to grow as global supply chains adapt to increasing regulatory and consumer pressure.

We believe companies operating in clean energy, clean transport, energy efficiency, and the circular economy will be the winners of this structural shift. Climate change is a multi-decade investment opportunity, and as the world accelerates toward a low-carbon future, long-term investors who have positioned early in the climate thematic will be well placed for the next phase of growth.

James Tsinidis is a portfolio manager at Munro Partners. Munro Partners is a fund manager partner of GSFM, a sponsor of Firstlinks. This article is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons.

For more articles and papers from GSFM and partners, click here.