Dudley requested: "Please publish a simple article to explain company tax, dividend imputation, franking credits and double taxation. It would help eliminate some of the woeful nonsense written on the topic. My guess is that less than 1% of the public can describe the taxation of dividends, yet it is simple and most people have some level of understanding of imputation through the PAYG system. Let's make the debate more grounded in fact."

Cuffelinks has published several explanations on franking, such as by Geoff Walker, Warren Bird and Jon Kalkman.

Here's the short version: to avoid taxing company profits twice, tax must be paid at either the company or individual level, but not both. If it were paid only at a company level, high income people would benefit from the 30% tax rate. So our system taxes company profits at the individual's level. Any tax already paid by the company is refunded.

Shareholders pay tax on franked dividends at their personal marginal tax rates and receive a credit for the tax on profits paid by the company. For example:

1. A company makes a profit of $100 and pays company tax of $30 at the 30% rate.

2. The franking credit account of the company increases by $30.

3. The company fully distributes the profit after tax by declaring franked dividends to shareholders of $70.

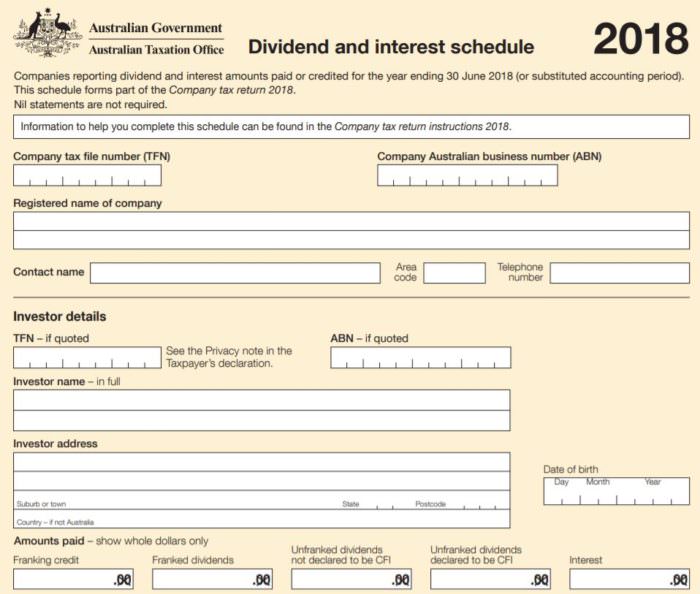

4. The company informs the Australian Taxation Office (ATO) how much dividend was paid to each shareholder and the proportional amount of franking credits for each shareholder. The ATO return looks like this, from Dividend and interest schedule 2018:

5. ATO imputes (or 'allocates' or 'assigns' or 'credits') the franking credit to each shareholder, and reduces the company's franking account by the same amount.

6. When shareholders complete their tax returns, they add the $70 of dividend to the $30 of franking to declare the $100 of taxable income, in this form here. The $100 of company profit is therefore subject to tax.

7. Shareholders pay tax on the $100 at their marginal tax rate and claim the $30 that was already paid by the company as a tax credit.

8. If the shareholder's marginal tax rate is 45%, the tax is $45 but $30 is a tax credit and the shareholder pays the extra $15 to the ATO.

9. If the shareholder's marginal tax rate is 0% (for example, someone with income below the tax-free threshold of $18,200 or an SMSF in pension mode), the tax is $0 and the $30 is refunded to the shareholder (in the current system).

10. Under the Labor proposal, the franking credit can be used to pay tax on other income but there will be no refund for investors who cannot use the full $30 credit (with some exceptions).

The denial of refunds of franking credits results in a minimum tax rate the same as the company rate for the shareholders earning only fully franked company dividend income. Those shareholders would not be able to access the tax rate previously offered by the 0% and 19% tax bands.

Here ends the simple bit.

Why is there such an argument going on?

The treatment of three different people earning $17,500

Warren Bird provided this example of unwelcome consequences:

- Person A does some part-time work that earns $17,500 a year, just under the income tax threshold. They don’t pay tax.

- Person B is semi-retired, but runs a small sole trader business that brings in a net of $17,500 a year. They also don’t pay tax.

- Person C is retired and owns shares in a company that earns $17,500 of profit on C’s shares. Being a company with other shareholders, it pays 30% company tax and most of the rest is distributed to shareholders as dividends. Person C receives a dividend of $12,250 (that is, 70% of $17,500). They have effectively paid $5,250 in tax on their income because of the veil that the company structure has created.

Under the current imputation system, Person C receives a franking credit for that amount and a payment of $5,250 comes from the ATO. This recognises the fact that the full $17,500 earned by the company should belong to Person C, just the same as Person B’s business income or Person A’s part-time salary.

It’s similar to someone getting a tax refund at the end of the year because their PAYG taxes didn’t take legitimate deductions into account. They overpaid tax and so are allowed to get it back. It is their money.

Why we tax companies based on their shareholders’ marginal tax rates

Steve Martin had a senior technical career in financial services, is a CTA Chartered Tax Adviser (retired) and a FIPA Fellow of the Institute of Public Accountants (retired). He provided this summary.

At its heart, our company tax system operates on the proposition that company profits are taxed at the shareholder level. To understand why we do this, you need to understand the history of company tax and the options for alternatives.

In fairness, you want to create a system that taxes company profits once, but you have some options. You can tax at the company level (say 30% on all company profits); or, you can do as is done with partnerships and trusts, and use the company as a conduit and tax the profits solely in the hands of the shareholder. When taxing the hands of the shareholder, there is a risk to revenue collection, so there is a strong case to withhold tax at the company level to make sure that the company profits (i.e. dividends) are ultimately disclosed at the shareholder level.

Voila! the Australian system.

If the Australian tax system did not have the withholding tax at the company level but just taxed shareholders, would self funded retirees have been any better or worse off since 2000? Neither, they would have received untaxed company profits – i.e. a $100 dividend instead of a $70 dividend with a further tax refund of $30 at tax time.

Why not just tax companies?

Because there would be a significant shortfall in revenue. While all of the attention has been on those shareholders who have a tax rate of under 30%, far more of our company profits are taxed in the hands of shareholders who are on a higher tax bracket. Also, the tax burden on lower income earners is unjust and this plays into the present controversy.

In 1979 the Fraser Government commissioned an independent review into the Financial System. The Campbell Review considered the then double taxation of company profits: firstly in the hands of the company and secondly in the hands of the shareholder. The committee set a critical benchmark when it said at paragraph 13.8:

“the taxation system should meet the tests of neutrality, equity and simplicity.”

The Campbell Review set out in beautiful simplicity the company tax system we have now enjoyed for some 30 years.

In dealing with the system of imputation, it described the tax paid at the company level as a “withholding tax” (at 14.39) and it contemplated as part of a full imputation system that there would be a refund of excess credits to lower income earners (at 14.40).

The Report highlighted that company tax profits ought to be taxed once, effectively by reference to the marginal tax rates of the shareholder. It looked through the corporate veil and asked the central question at Para 14:

“the relevant question is how the individual shareholders overall tax burden compares with the tax he would have paid had the equivalent income been received through non-corporate channels and the whole amount being taxed at personal rates.”

It described as inequitable when the ‘effective combined company and personal income tax rate’ is higher ‘than the marginal personal income tax rate’.

Labor proposal puts that inequity back into the system

In setting out the blueprint for the present imputation system, it recognised that such a radical new approach could adversely affect government revenue and so, as a first step, it recommended that refunds could be held back as an ‘interim’ measure.

The Hawke-Keating Government in 1987 gave effect to the 'interim’ recommendation of the Campbell Review. What Keating did was not, as represented by Shorten and Bowen, the original Keating model; it was the interim recommendation of the Campbell Review.

The interim arrangements ended following the Ralph Review in 1999. The legislation giving effect to refunds of excess franking credits was introduced under the Howard Government. Our present system was designed by an independent body and was implemented with bipartisan support.

The proposed change is unfair to low to middle income earners and compromises the company tax system that has held us in good stead for nearly 30 years. The proposal fails the essential integrity tests of equity and neutrality, and this failure is made worse by the exemptions given to unions and other not-for-profits and pensioners.

Should a potential Treasurer of our country understand this? Yes. So, why would a potential Labor government create a policy that hurts lower income earners?

Graham Hand is Managing Editor of Cuffelinks.