The Future Fund’s asset allocation changes are worth watching as they reveal the investment decisions of a well-resourced team in a large sovereign wealth fund. It's a unique snapshot, as most professional managers do not break up their diversified asset allocations in such detail.

Even better, the Future Fund has a long-term capital preservation emphasis which mirrors the desires of many retirees and SMSF trustees who rightly plan for their money to last for decades, not years.

We explored how retail investors could go some way to replicating the Future Fund’s investments in this article.

It's also a pointer to where industry funds may head as the CEO of the Future Fund, David Neal, this week announced he is moving to the industry fund-owned, IFM Investors. Neal joined the Future Fund in 2007 and was promoted from Chief Investment Officer to CEO in 2014. His decision after 12 years signals ambitious plans by IFM to grow its business.

How has the asset allocation changed?

As the table shows, the Future Fund made important changes to its risk and market exposure during calendar 2019.

The most notable was the move into public global equities, with an increased allocation from 23.6% to 29.2%, a material 5.6%. Australian equities was also up 1%, while every other asset class was down. David Neal said the switch from private to public markets gave greater flexibility and allowed the Fund to "adjust the portfolio quickly to respond to emerging opportunities and risks."

Future Fund asset allocations (% of total portfolio)

|

Asset class

|

31 December 2018

|

31 December 2019

|

% Change

|

|

Australian equities

|

5.8

|

6.8

|

+1.0%

|

|

Developed markets global equities

|

16.3

|

19.0

|

+2.7%

|

|

Emerging markets global equities

|

7.3

|

10.2

|

+2.9%

|

|

Private equity

|

15.8

|

14.9

|

-0.9%

|

|

Property

|

7.2

|

6.3

|

-0.9%

|

|

Infrastructure & timberland

|

8.5

|

7.0

|

-1.5%

|

|

Debt securities

|

10.1

|

8.6

|

-1.5%

|

|

Alternatives

|

14.6

|

13.4

|

-1.2%

|

|

Cash

|

14.5

|

13.7

|

-0.8%

|

|

TOTAL

|

100%

|

100%

|

|

The Future Fund has always held a relatively high proportion of non-traditional assets, often in private markets, which makes a material contribution to its claims of lower volatility, as discussed later. Few other institutions, SMSFs or private portfolios match their private equity and alternatives allocations, although down over the year from 30.4% to 28.3%.

The strong rally in bond, interest rate and credit markets may also have driven the lower allocations to cash, debt, infrastructure and property, although there are still gains to be made in the ‘bond proxies’ with interest rates so low. High cash allocations match the SMSF experience.

The Future Fund is a believer in paying up for active management, with around 120 fund managers represented in its portfolio. The Fund looks for managers who can produce uncorrelated returns less influenced by economic and macro factors than traditional equity managers. Hedge funds, private equity and infrastructure managers often charge the highest fees. David Neal said:

“We are also focused on identifying and taking advantage of our managers’ skill so that we can add additional return or reduce risk. This includes our focus on strategies that have low correlation with risk assets.”

Focus on risk as well as return

The media coverage of the latest results focussed on the strong returns generated. Most investors would sign up immediately for 9.9% per annum over a decade and 14.3% last year from a diversified portfolio. The Future Fund's result was at the top end of the best super fund performance, and well ahead of its target of CPI plus 4% to 5%.

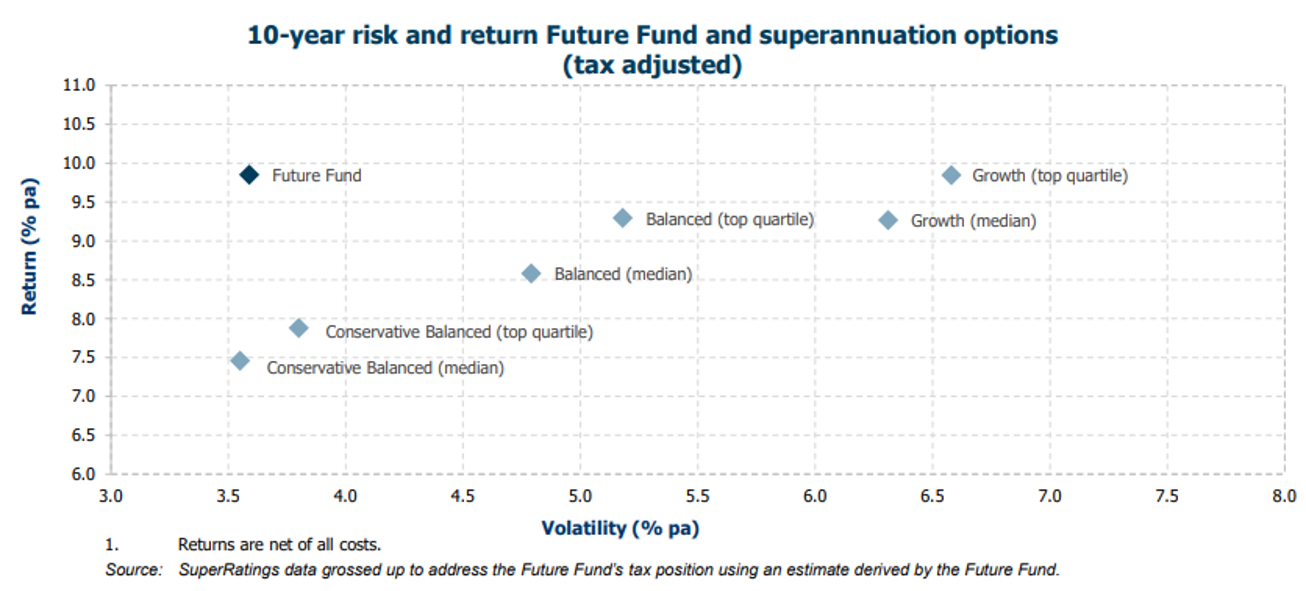

However, what should matter most are risk-adjusted returns, and the Future Fund also does well on this score. Everybody should prefer returns of 10% per annum with 4% volatility rather than 8% volatility. Or put another way, returns of 10% might be better than 12% if the latter comes with a lot of extra risk.

The aim of investing should be maximising returns (that is, as far up the y-axis as possible) while minimising risk (that is, as far to the left of the x-axis as possible) in the chart below. The Future Fund’s numbers in the top left are impressive. A stated volatility of half that of the top quartile growth fund with similar returns would help more people sleep at night, especially those who worry about loss of their capital to live off.

What is this thing called volatility?

While volatility and risk mean different things to different people, the most common measurement of risk is the standard deviation or variance of results around a mean. This is the measurement in the x-axis above.

However, for investors who can ride out short-term volatility, a permanent loss which is more worrying, as many prominent investors have argued:

- Howard Marks: “The risk that matters most is the risk of permanent loss”.

- Warren Buffett: “We will attempt to bring the risk of permanent capital loss (not short-term quotational loss) to an absolute minimum by obtaining a wide margin or safety in each commitment and a diversity of commitments.”

- John Maynard Keynes: An intrinsic loss of capital was “in an altogether different category from fluctuating securities, since there is no particular reason to expect a subsequent recovery.”

Keynes, Marks and Buffett are correct if an investor can look beyond short-term losses. The reality is that people living on their savings are devastated by falls of 20% to 50% and often sell before there is a recovery. For most investors, volatility matters and they cannot be as dispassionate about their losses as these luminaries espouse.

A National Seniors Survey in March 2019 found that 73% of retired investors keep some or all of their savings out of the sharemarket because they cannot tolerate losses. For them, volatility certainly matters.

Professional fund managers are judged quarter-by-quarter, and a year or two of poor performance can jeopordise their business. Try telling them that risk is only a ‘permanent loss of capital’.

The ASX offers a ‘market sentiment indicator’, A-VIX, which is a real-time volatility index, to provide “insights into investor sentiment and expected levels of market volatility.” A relatively high level of the A-VIX implies the market expects large changes in the S&P/ASX200 index.

The chart below shows the A-VIX for the last five years, with enough spikes to unsettle investors although the market has risen strongly overall in this period.

For example, the market falls at the end of 2018 were accompanied by a spike in volatility, with more-settled periods for most of 2018 and then most of 2019 after February. While there was no permanent loss of capital, December 2018 spooked many investors.

Source: VIX index chart from Market Index, 4 February 2020.

The Future Fund's way to manage risk

Many non-professional investors manage their risk by making large allocations to cash and term deposits. This strategy may have been acceptable in the past, but it guarantees a lack of income and erosion in real capital when rates do not even match inflation.

The Future Fund points to other ways to manage risk while generating returns, including:

- Diversifying among many types of assets

- Finding managers who produce uncorrelated returns

- Investing in lower-volatility funds

- Buying infrastructure with inflation-protected assets

- Moving down the risk spectrum in debt securities.

The intent is to hold a resilient portfolio that falls much less than the market in tough times.

A qualification on volatility

It should be acknowledged, however, that private assets are not necessarily less price volatile than public assets simply because their value is not measured regularly. They are often the same assets (a listed versus unlisted airport does not change the nature of the asset or its long-term value).

The Future Fund's portfolio has a low measured volatility because it holds cash, property, private equity, alternatives, infrastructure, timberland and even debt securities which are revalued less frequently than the constant trading of listed equities.

Notwithstanding this qualification, there are useful lessons in defensive portfolio construction for all investors.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor.