Gemma Dale is Director of SMSF and Investor Behaviour at nabtrade, NAB’s online investing platform.

GH: In this extraordinary year, what have your clients been doing, especially in the hectic days of March and April, and what's happened since?

GD: Yes, it’s been a fascinating year. Volumes started low in January and February as the market was quiet. The cash accounts of our clients were at record highs so it wasn't as if people didn't have the money to invest. They were waiting to put money to work but didn’t see much to interest them.

GH: Then the reality of COVID hit and everything changed.

GD: Yes, but what was most exciting was that the common view that retail investors panic when markets fall and go to cash at the worst possible time, then miss the first 20% of the upside when the markets bottom out, that wasn’t correct. This idea that retail investors are not good at managing their own money because they have too much emotion in investing doesn’t play out with our clients. And this is not just during COVID, but over the last four or five years of market pullbacks. Although other falls were not as severe, they start buying on falls. The one that springs to mind was when Domino's was hammered in the press in 2018 and 2019 and fell below $40, and it’s now nearly $90.

GH: And this is genuine ‘retail’, not institutional money?

GD: Yes, nabtrade clients, we don’t serve institutions. Obviously, a stock like Domino’s was one they wanted to buy. They jump into stocks considered either core of their portfolios like banks or opportunistically exciting.

GH: So what happened in March and April?

GD: Two major things. One, clients started buying like mad. Our buy/sell ratio is usually around 50/50, or slightly more buys than sells because people are building portfolios, although there are pension funds expected to run down their portfolios over time. But we saw the buyers swing up to 70 to 80% of trading activity. So the proportion of both value and number of trades that were sells dropped heavily and people were not selling at the worst time. They were buying and since it was a super-sharp correction, they moved really quickly.

And then the second thing was a huge number of new entrants to market. We saw a five-fold increase in new applications in March and a three-fold increase in April over our average numbers. And then that continued right through, in fact, our biggest trading day was in June.

GH: Was it much busier for all of February to June?

GD: March was the absolute peak of monthly trading value, April was also really strong, then there was some profit-taking in June. Some people had done unbelievably well and were taking some money off the table.

GH: And to finish the year-to-date, has it been more subdued since June?

GD: Much more like normal trading but here’s the third thing. Clients weren't just spending the cash on the sidelines from the cash product on our platform, where people keep cash ready to go. Huge amounts of cash came in from other sources and cash is still very high. We have investors not sure that markets will stay at this recovered level and if prices fall again, they have the money ready to go.

GH: That’s a strong counter argument to the prevailing view on the way retail reacts.

GD: It's such a good story. I've been saying for five years that retail investors are smarter than the market thinks they are. A lot of the behavioural research on this is historical, some of it goes back 20 years. Investing has changed. The first share I bought when I was 18, I had to find a broker in the Yellow Pages, and look for the share price in the newspaper. I had no idea what I was doing. It was difficult to find information so there was plenty of dumb money. Now, what you find on nabtrade and other platforms and media is real time data and education and quant research from Morningstar like a professional investor has. People are not in the dark and they can respond quickly.

GH: And all this activity includes SMSFs?

GD: Yes, and although SMSFs are only about 7% by number of our clients, they are about 35% by value. We do have a lot of younger investors coming through and there are now more females than in our older clients.

GH: And what have people been buying and selling in recent months?

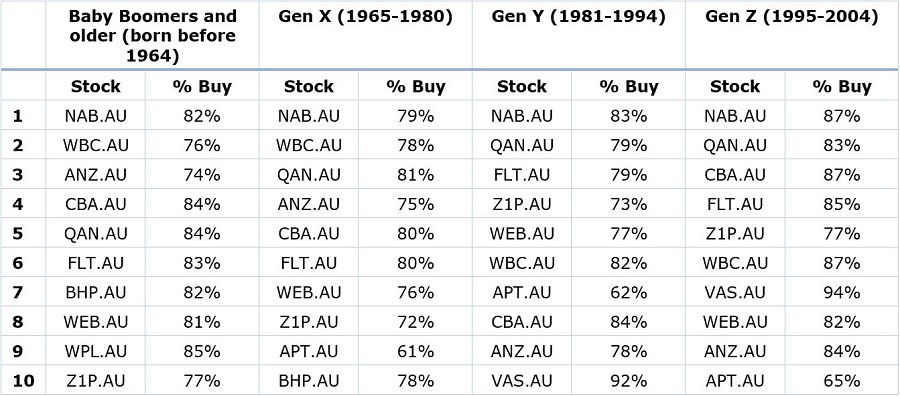

GD: Let’s insert a table of the Top 10 by demographics.

(Note that a person must be over 18 to open an account so in theory, 2002 is the latest year in which an investor can be born. It is not known how often parents use a child's account).

It’s fascinating that the generations are almost identical, except very young people invest in twice as many ETFs as all other people, at about 12% of trades. And see Flight Centre, Qantas and Webjet. They were popular during the crisis because investors felt they would get rescued and they were great buying opportunities. And Zip and Afterpay of course.

GH: So the educational work on ETFs is reaching younger people?

GD: Young people understand diversification and they see ETFs as an easy solution. They have a strong tendency to buy and hold. This hypothesis that they're just day trading and they're just buying up tech, we just don't see it. Maybe we would not be the broker of choice for a young trader who wants super cheap execution, below the cost of providing the service, where there is a link to chats and rewards and CFDs.

GH: The overall data shows much stronger interest in global ETFs, but are you seeing much in direct equities, into global shares such as Apple, Microsoft and Amazon?

GD: Number one is Tesla in global stocks, but it never cracks the top 10 of total stocks.

GH: nabtrade’s site carries a lot of content and educational material. What do people like to read about?

GD: Stocks that are widely held with a high-conviction view on them, either positive or negative. Stories on Telstra, the banks and CSL. Afterpay and Zip. Podcasts have become popular, but a wide variety of media works, including video. People like to consume in different ways.

GH: And the podcast that you host, Your Wealth, how has that been going?

GD: We’ve had some wonderful guests and the audience has increased tenfold in 12 months, depending on the guest and the topic. We’ve found people are happy to consume lengthy content so long as they can listen to it and do something else as well.

GH: So you’re not seeing much of the ‘Robinhood’ effect here, where young people are punting the market instead of playing e-sports or because they are bored in lockdowns?

GD: We've had many conversations with the regulator about this. It's not an amusing side story for us as we watch it really closely, make sure that this is not the kind of behavior we're seeing. Neither nabtrade nor ASIC wants to see young people blowing up their money, particularly when you link it to the ability to withdraw superannuation. That would be an absolute heartbreak.

Although we may not be the broker of choice for this day trading anyway, the most telling statistic I can give you is that if anything, new investors are more conservative than existing clients. An older person with $200,000 in shares might put $5,000 into something speculative, but our young clients will not speculate with all their savings.

Anyone who wants to trade options must take an assessment and sign an agreement, but there’s little of it with us. It's confined to experienced and wealthier investors for downside protection or income rather than by new investors. At certain times, the 'bear' ETFs have also been popular. And on shares generally, people need to have the cash in their account in order to trade. We’re a ‘cash up front’ business.

GH: Last question. Many of your clients who have done really well in recent months and maybe now feel like they know how the stock market works. Are you worried about them?

GD: Perhaps it was a once-in-a-lifetime buying opportunity where it fell so quickly and then recovered, unlike in the GFC which took 12 years to grind back and picking the right stocks was difficult. So if this was a first experience, some people may think it’s normal. My biggest fear is a slow grind of losing money say if we don't get a vaccine for some time. How will people cope with losing money day after day as a new experience? That will be a bigger test than what happened in March when we had an obvious catalyst.

Gemma Dale is Director of SMSF and Investor Behaviour at nabtrade, a sponsor of Firstlinks. Gemma is host of the Your Wealth podcast. Any advice contained in this information does not take account of your objectives, financial situation or needs.

For more articles and papers from nabtrade, please click here.