Few stages in life are as complex and emotionally taxing as when the need for aged care arises. And while many people plan for retirement, often counting down the months and years, few plan for aged care.

One reason for the lack of planning is that most people are reluctant to move to a ‘nursing home’ (now called 'residential aged care facilities'). So possibly the most important thing to realise is that ‘aged care’ doesn’t equal ‘nursing home’.

Last year, more than 1.3 million people received aged care and more than 1 million received their aged care at home, a trend that will continue as the silent generation folk leave aged care and the baby boomers enter.

The challenges in providing or receiving quality advice start with the complexity. Moving beyond the bounds of residential aged care, there is a plethora of accommodation options available to senior Australians including apartments, granny flats, retirement villages and land lease communities, each with their own legal and financial implications.

Where would you like to live?

Before the need for care arises, many people are adamant about staying in the family home. But there can be downsides such as increasing maintenance or growing isolation if they are no longer driving or if there is a loss of a spouse.

And then there are the practical care elements. Many homes are not built for providing care, and while some modifications can be simple and inexpensive, others are expensive or simply impossible.

In some families and cultures, the responsibility of caring for ageing family members falls to the broader family and intergenerational living can benefit the whole family. However, these arrangements may establish what Centrelink calls a 'granny flat right'. Granny flat arrangements can have enormous implications, both emotionally and financially, as the older person has no legal ownership in the property.

Critical to these arrangements is an agreement that clearly outlines the rights and responsibilities of each party. It should contemplate likely changes such as:

- the children are divorced

- the children become ill or pass away

- the need for appropriate insurances

- any amortisation or residual value of the amount paid

- the circumstances under which the agreement ends.

The whole family should seek advice to ensure that they understand the impact on pension entitlement and other government benefits, the stamp duty and tax implications, estate planning considerations and the future cost of aged care should home care or residential aged care be required.

Choices away from the family home

Retirement villages and land lease communities are becoming a favoured choice for many retirees. There is often a strong social network, many newer villages are built with the intention of catering to care needs (either now or in the future) and from a lifestyle point of view, people can strike a balance between doing what they are able to do (or want to do) for themselves with the ability to access support and care.

The buying power of these communities when it comes to care delivery is often second only to an aged care facility. Carers are able to move from one home to another in a matter of metres.

For others, the decision will be to move into residential aged care. A crucial consideration in the choice of living arrangements is the ability to access care and at what point a person may need to move on. Is care required now and what can be reasonably anticipated in the future? Will they move to somewhere that can support them as they age, or would they rather kick up their heels for as long as possible then move to a care environment when its needed?

While some retirement communities are designed to enable people to ‘age in place’, others are what we call ‘carefree’. In these communities, it is common for the contract to state that if the person requires ongoing care, they must leave the community.

Crunching the numbers

When crunching the numbers without the right tools, financial advisers and their clients may discover the financial implications associated with the different accommodation choices and care options are complex and fraught with danger.

Not only does the adviser and client need to know the cost of these care options today but also the expected future costs and how decisions made today could impact the future.

Here are two situations:

1. A person entering a granny flat arrangement needs to consider the impact on their current situation, such as pension, rent assistance, amount of money paid for the arrangement and if the reasonable test is applied. In addition, will the arrangement include a provision for any residual value, what are the ongoing costs of care and how or when does the arrangement cease?

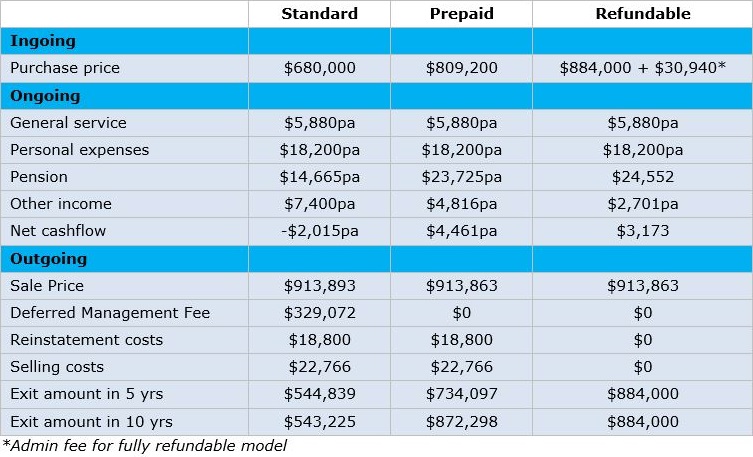

2. In retirement village decisions, it is not uncommon to see a range of alternative payment options. These include the standard Deferred Management Fee (DMF) model, prepaid management fees and even fully refundable options. They often have different shares of capital gain or loss, reinstatement costs, marketing and selling fees and buyback timeframes, and all these choices should be considered and modelled by a financial planner.

Let’s look at a specific example.

Betty is keen to right-size. She will be selling her home inner-city Melbourne home for $900,000 (net); she currently has $150,000 in investments and $20,000 of personal assets. Betty is receiving the full age pension and is looking to move into a retirement village nearby.

She has been offered a range of retirement payment options for apartment she is considering in the village. Outlined in the table below:

The financial implications for Betty are significant with her pension entitlement varying by almost $10,000 p.a., her exit entitlement varying by almost $340,000 after 10 years and a variation in the cash flow of more than $5,000 p.a. depending on which option she chooses.

An alternative to a retirement village is a Land Lease Community, sometimes referred to as a lifestyle community or over-55 village. This arrangement involves the client buying the home and leasing the land it sits on. A decision to move into a Land lease Community may have both a positive and negative financial impact.

Residential aged care may not be the first choice of accommodation. However, there may be limited accommodation options available when it comes to safety and wellbeing.

Often a response to a crisis

For many people, residential aged care is usually not thought about or planned for until a ‘crisis’ unfolds. This can make the decision rushed, emotionally difficult and very expensive. Understanding the options available before entering care can provide more choice and save thousands of dollars. The value of advice should not be underestimated.

Advisers narrowly defining aged care advice as helping people moving into residential aged care potentially leads to poor advice. Quality aged care advice must be based on the individual’s needs and objectives. It should cover granny flats, home care (not just Home Care Packages), retirement villages, Land Lease Communities as well as residential aged care and it’s about having the education, tools and resources needed to deliver that advice.

Jemma Briscoe is Head of Research and Technical Advice at Aged Care Gurus. This material is general information only and does not take into account your objectives, financial situation or needs.