In Australia and globally, the popularity of Exchange Traded Funds (ETFs) stems from several factors including low cost, accessibility and the vast array of options across asset classes.

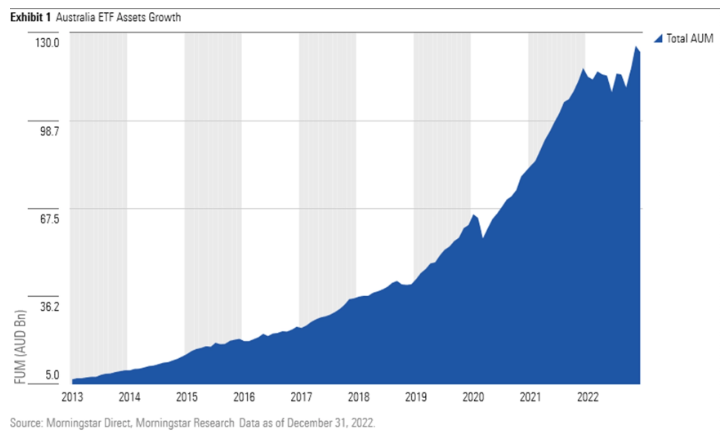

Despite this high profile, ETFs are not the largest managed product in Australia. That honour goes to platform-related products, such as master trusts and wraps (which mainly hold managed funds), which are vastly bigger. The market size of these products at $920 billion is much larger than that of ETFs at $130 billion and Listed Investment Companies (LICs) at $48 billion.

There’s no doubt that ETFs are growing rapidly though and taking market share. Over the past decade, the ETF market in Australia has grown about 26x.

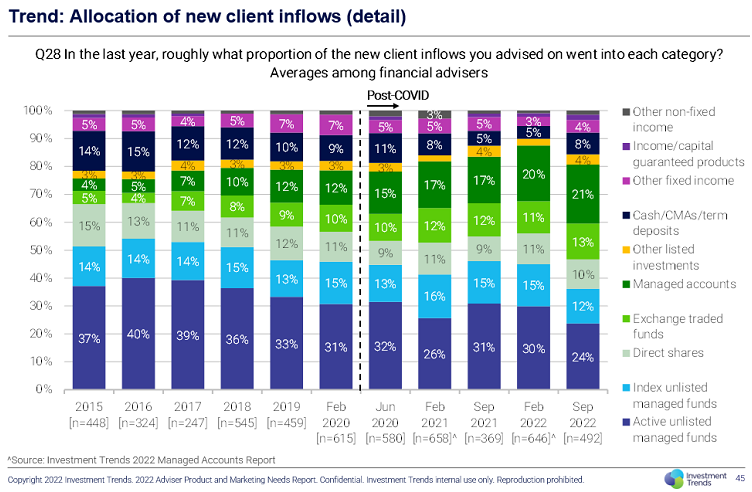

Investment Trends regularly surveys financial advisers on their client flows, and the chart below shows ETFs and managed accounts are the categories that are gaining share.

The growth of ETFs has attracted intense competition. In February 2023, Blackrock announced it would cut the fees on two of its ASX-listed ETFs, including its popular iShares Core S&P/ASX 200 ETF. The move takes its annual fee from 0.09% pa to 0.05% pa. A day later, Betashares slashed the management fee on its Australia 200 ETF from 0.07% pa to 0.04% pa.

New global ETF industry findings

PwC has released a new survey of 70 ETF executives from across the globe detailing key trends in the industry. The report has four findings:

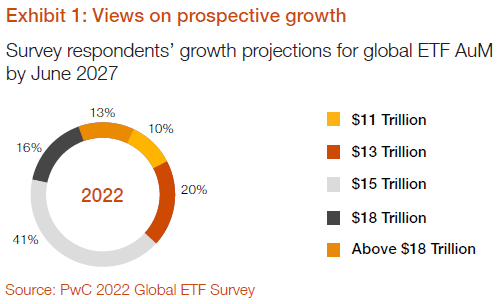

1. The global ETF market size is expected to increase by 63% to US$15 trillion in 2027.

Thanks to a large market correction, the asset management sector experienced significant fund withdrawals in 2022, with US$1.4 trillion of net outflows from mutual funds globally.

ETFs bucked the trend with net inflows of US$779 billion, the second highest net inflow on record. As at end-2022, global ETF assets under management (AuM) stood at US$9.2 trillion.

This strong performance is attracting both new fund launches and the conversion of mutual funds and separately managed accounts into ETFs. Many of the new entrants are large asset management groups that had previously shied away from the ETF market.

The big question is: can the extraordinary growth in ETFs continue?

Unsurprisingly, ETF executives are upbeat. Seven in 10 respondents expect global ETF AuM will increase to at least US$15 trillion by June 2027. That would require a compound annual growth rate (CAGR) of 11.8% compared with the 13.7% CAGR achieved over the past five years.

Almost 30% of executives are even more bullish on industry prospects, forecasting the global ETF market could reach US$18 trillion by 2027.

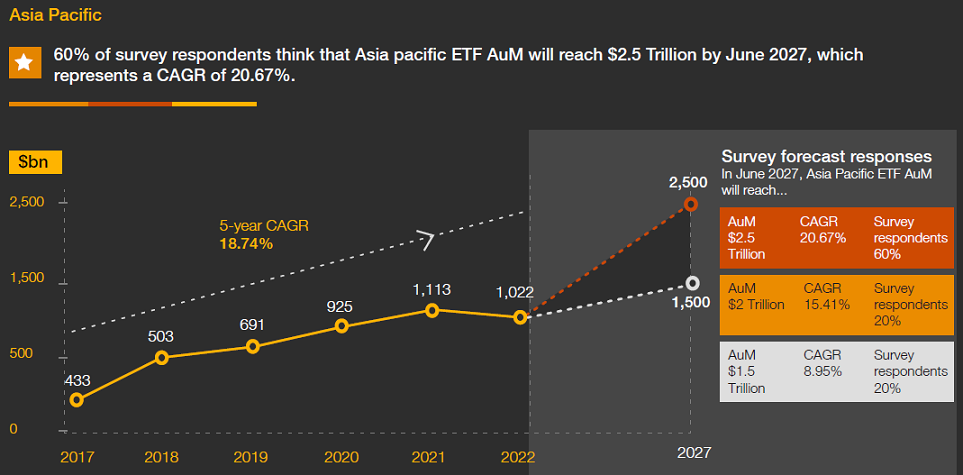

The executives are most positive on the Asia Pacific region, where most expect growth to rise by more than 20% annually.

Are these forecasts realistic? They might be as ETFs are only 11% of equity assets in the US and just 2% in Asia. The percentage share of fixed income assets is even smaller, at under 3% in all regions. Plenty of room for growth.

2. Product innovation is key

Traditional passive equity (about 75% of global ETF AuM) and fixed income (around 20% of AuM) remain the key segments of the global ETF market.

Fixed income saw significant inflows in 2022 as yields moved higher, attracting renewed interest from both retail and institutional investors. In terms of inflows, fixed income’s share was 32% last year versus 23% the year before. Six in 10 survey respondents think fixed income will continue to take market share.

Yet the survey also suggests that executives are wary that an over-reliance on traditional plain-vanilla type products could put them at risk of disruption by competitors with greater scale, brand awareness, and technology. Therefore, they’re looking to spend more money on internal processes, systems, and people to build more complex and specialised types of ETFs.

3. New areas of growth

The managers see three areas to drive considerable growth:

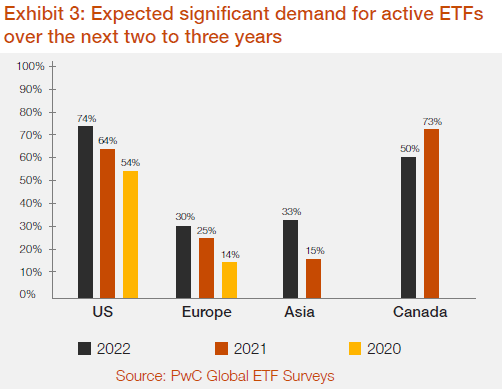

- Active ETFs. Net inflows into active ETFs were US$102 billion in 2022 and the industry executives believe there’s more to come. The bullish sentiment is especially apparent in the US, where active ETFs are already well established, at around 5% of overall ETF AuM.

- European optimism. ESG ETFs make up more than 21% of ETF AuM in Europe, and survey respondents expect that level to rise. The expectation of new products launches in ESG isn’t shared as much in other regions such as the US and Asia.

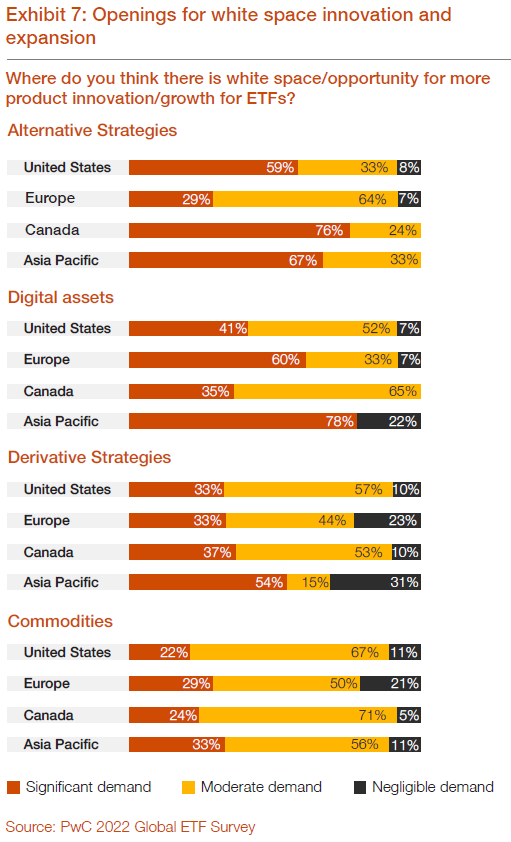

- Alternative strategies and cryptocurrency. The survey respondents cite both alternative strategies and crypto/digital asset ETFs as the nascent markets to watch. With cryptocurrency, the positive view is much more apparent in Asia and Europe, where 78% and 60% of respondents respectively anticipate significant demand ahead. US managers are less upbeat. For alternative strategies, executives in Asia and Canada are the most bullish, while those in Europe are much less so.

4. New routes to market including white labels

The managers surveyed see the development of effective distribution channels as the number one driver for future success. Priorities include expanding online distribution to target fast growing but still under-represented markets in Africa, Latin America and the Middle East.

The survey also notes that barriers to entering the ETF market are lowering. For instance, growing access to white label platforms is allowing small and specialised managers to launch ETFs without the need to set up new bespoke infrastructure.

James Gruber is an Assistant Editor for Firstlinks and Morningstar.com.au. This article is general information.