Standard & Poor's undertakes a semi-annual review of the performance of actively-managed funds compared with S&P indexes, and the June 2014 ‘SPIVA Australia Scorecard’ was recently released. The Scorecard measures both equal weighted (where every active fund is given the same weighting) and asset weighted (where a fund’s weight depends on its assets) returns from actively-managed funds.

It’s important to know some limitations of the SPIVA Scorecard. Actively-managed fund returns are measured after expenses, whereas index returns have not had investment fees deducted, which exaggerates the returns achievable from following a hypothetical index. Also, some indexes used in the scorecard, such as bond indexes, may not be easily replicable. The Scorecard only utilises five highly aggregated fund categories that can be lined up with available comparator benchmark indexes.

Overall, active funds struggle to beat index

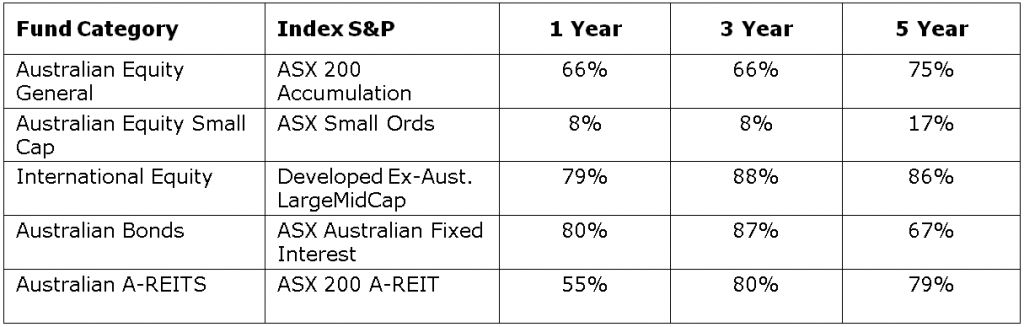

The Scorecard finds that the majority of actively-managed funds failed to beat their comparable benchmark indices over a one, three or five year period. In Australian equities, the mainstay of most Australian portfolios, the underperformance of actively-managed funds against the comparator index was reasonably consistent across one, three and five year periods at 66%, 66% and 75% respectively.

The only exceptions in performance versus index are actively-managed small cap funds, the clear majority of which beat their comparable indexes across all time periods.

Summary Table: Percentage of actively-managed funds outperformed by their comparable index

Index versus fund performance and survivorship

Taking a look at the percentage returns across the five asset categories:

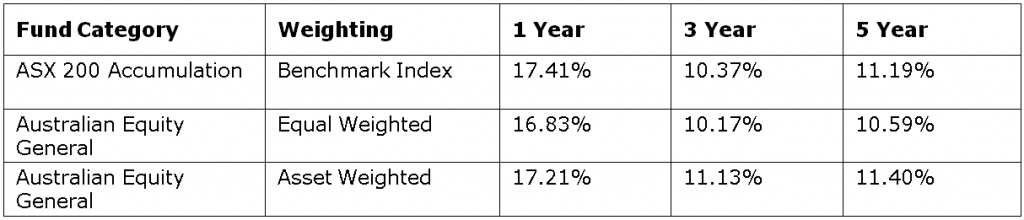

a) Australian Equity General Funds

Contrary to popular belief, the findings suggest large funds in Australian equities have better returns than smaller ones, because the asset weighted returns were higher than the equivalent equal weighted returns across one, three and five years by 0.38%, 0.96% and 0.81% respectively.

81% of managed funds in this group survived the five year period.

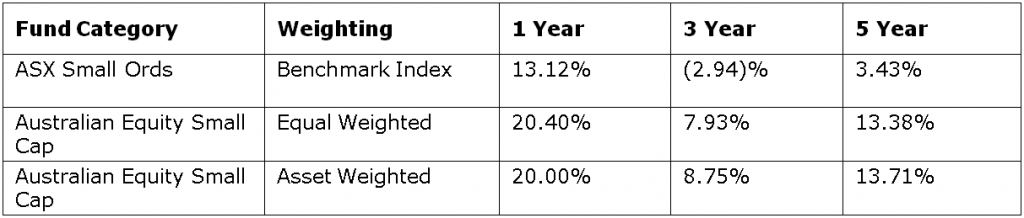

b) Australian Equity Small-Cap Funds

Only 8% of small cap funds failed to beat their comparator indexes across a one or three year period, and 17% across a five year period. Over all periods the investment returns from actively managed small cap funds held a massive lead over the comparator index.

83% of funds in this group survive the five year period, the highest of all the groups used in the Scorecard.

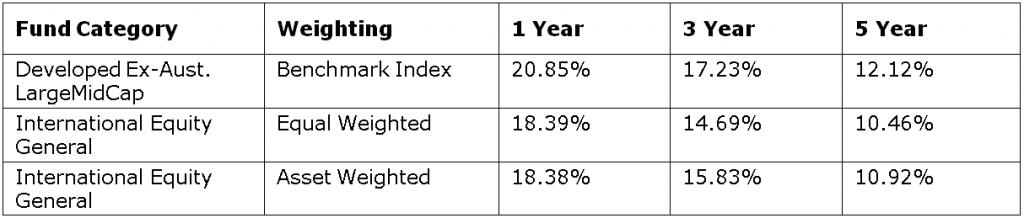

c) International Equity General Funds

Only 78% of funds in this group survived more than five years, the lowest survivorship recorded of the groups used in the scorecard. The first Summary Table above showed the percentage of actively-managed international equity funds failing to beat the index was the highest of any asset class across one, three and five years at 79%, 88% and 86%. When 8 or 9 out of every 10 managed funds fails to beat their index, it suggests the markets are so well researched that it’s tough to gain an edge after fees.

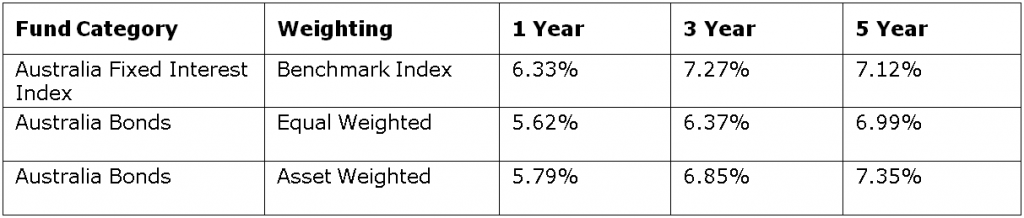

d) Australian Bond Funds

Bond indexes are also not truly replicable which limits the useability of the data. Over a five year period the performance return difference of around 0.2% between a bond fund and a hypothetical bond index is extremely small, considering fees have not been deducted from the hypothetical bond index. Managed bond funds had a survivorship rate of 82% for a five year period. The Summary Table above showed the percentage of managed bond funds failing to beat their index respectively across one, three and five years was 80%, 87% and 67%.

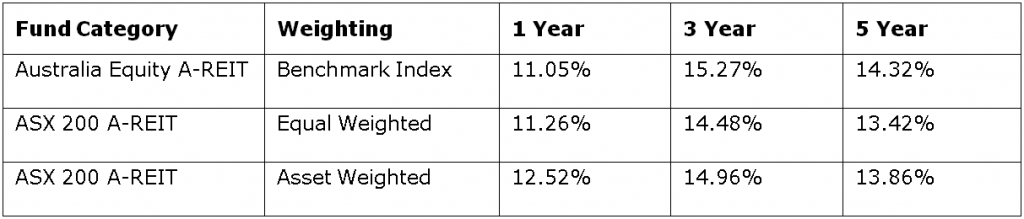

e) Australian Equity A-REIT Funds

The A-REIT index recorded the strongest investment return over a five year period of all the asset classes at 14.32%. Asset weighted returns were above equal weighted returns suggesting that larger A-REITS perform better than smaller ones. Over a five year period 79% of A-REIT funds survived, which is lower than the survivorship rates of either domestic equity or bond funds. The Summary Table showed the percentage of actively managed A-REIT funds that failed to beat their comparator index across one, three and five year periods was 55%, 80% and 79%.

Tough finding good active managers

The SPIVA numbers once again demonstrate how difficult it is to identify active managers who justify their fees, other than in the small cap space. While no doubt there are talented asset managers who do outperform their index, by far the majority do not. The challenge for the investor who wants alpha above the market beta is to find a way to identify the minority of managers who add value over time. Many can do it for a short period, but investing is a long term activity.

Les Goldmann has over 20 years’ experience as a Chartered Accountant, and his roles have included freelance journalism, shareholder advocacy for the Australian Shareholders Association and senior roles in the commercial and non-profit sectors.