The pathways to wealth are many and varied. For one person it may come from manufacturing, for another it may be entrepreneurial flair, while for another it may come from working the land.

A common misconception is that people that have achieved significant wealth are automatically good at managing it and understanding the investment opportunities available to both protect and grow that wealth. The reality is while someone may be very clever in their area of expertise, most of us cannot be experts across multiple disciplines.

Investing has become more difficult

Since the GFC of 2008-09, there has been a series of events that have made investing more problematic, including:

- The descent into an extended low interest rate environment, making some of the more common investment products like savings accounts and term deposits less attractive.

- Less stable global environment, driven by a retreat from globalisation and the rise of nationalist interests and leading to real and threatened trade wars.

- Increased digital disruption creating both rapid transformation and disruption in many industries, making equity investments more difficult to formulate.

- ‘Black swan’ events like COVID-19 have made forward forecasting particularly difficult, even impacting resilient markets like property.

- Lack of knowledge of investment alternatives outside of the big three – cash, shares and property.

The last point showed up clearly in research undertaken this year by Citi, with over half of wealthier investors citing lack of knowledge as the greatest impediment to examining other investment opportunities.

How do Australia's HNW investors feel about investing?

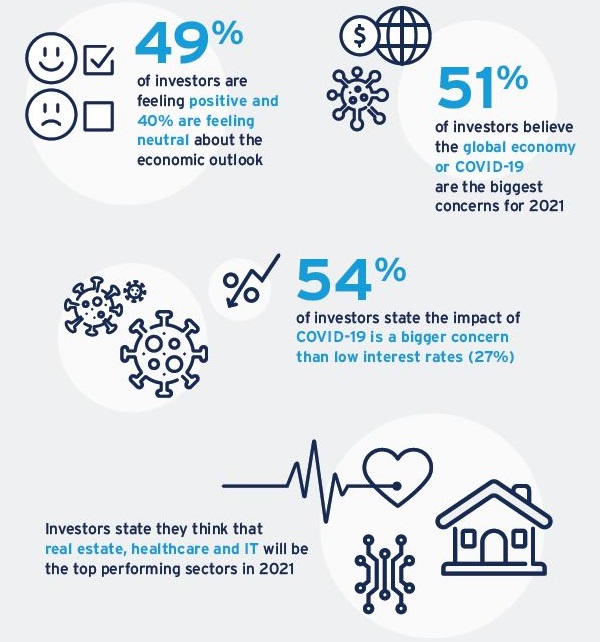

Outlook gives investors optimism

However, investors are also eager to take advantage of what they perceive as improving economic conditions. The research showed wealthier investors are 2.5 times more optimistic about the outlook this year compared to lockdown riddled 2020.

How do Australia's HNW investors feel about today's economic outlook?

COVID-19 remains the main concern to the outlook, followed by trade wars. Low interest rates are a major concern for less than one-third of surveyed investors.

That is likely because many wealthier investors are also approaching or in retirement and are more concerned with preserving wealth than high growth strategies. For that reason, they can build portfolios that carry less risk but still provide an acceptable return.

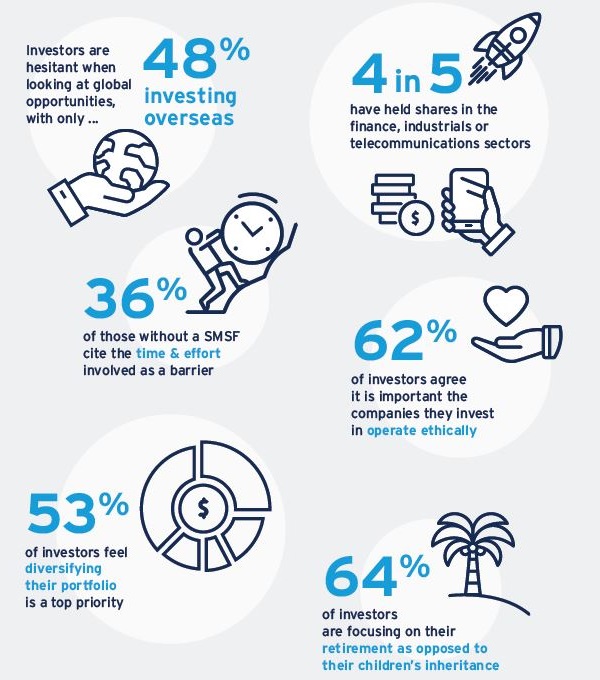

Diversification remains an elusive goal

The research shows wealthier investors are still struggling to embrace portfolio diversity, with 54% only holding domestic shares in their portfolio. It’s likely increased education on the benefits of diversity both by asset class and geography would see this concentration reduced. Citi’s clients tend to favour greater exploration of investment opportunities available, with 57% taking some form of international investment by the end of the first quarter of 2021.

Where do Australia's HNW investors choose to invest?

Investment areas of interest

Two areas that wealthier investors are showing particular interest in is healthcare and property.

Australian healthcare stocks, which include some leading global companies, have underperformed the ASX200, by 30% over the past 12 months. It is not a phenomenon restricted to Australia. In the United States the price of healthcare stocks, based on forward earnings estimates, trade at a 30% discount to the S&P500 index.

This is an real opportunity to gain an exposure to one of the few sectors remaining that we do not consider expensive following 15 months of stocks rising since markets started pricing in a COVID-19 recovery.

In property, we expect buying strength to remain robust for the remainder of the year with price growth exceeding 10% for the year. However, we view increasing issues with affordability to temper growth next year, with growth contained below 4%.

Despite outbreaks of the pandemic continuing to impact many parts of the world we are solidly in a global recovery phase. It aligns us with investors optimism going forward, but we remain cautious that volatility has been a consistent driver of markets over the past decade and will likely remain a significant element in portfolio construction for the foreseeable future.

Gofran Chowdhury is Head of Investment Specialists at Citi Australia, a sponsor of Firstlinks. Information contained in this article is general in nature and does not take into account your personal situation.

For other articles by Citi, see here.