Through the volatility of recent weeks, the adverse impact on the market value of our portfolios has been minimised by a focus on high quality businesses, a margin of safety in the difference between price and valuation, and the ability to hold large amounts of cash when opportunities are unavailable. An extraordinary business must have bright prospects for sales and profits, a high rate of return on equity - driven by sustainable competitive advantages, solid cash flow, little or no debt - and be run by first-class managers who think like owners and treat their shareholders as such.

A good business to own is one that produces growing profits. That seems obvious. Indeed it’s what the vast majority of analysts and equity investors are looking for.

What is the ideal business to own?

Perhaps less obvious is that the best business also requires the least amount of capital invested in it to generate those profits. There is a yawning chasm in the worth of a business that grows and requires lots of additional capital, and the business that grows and doesn’t need any additional capital.

A perfect business might be one that requires no staff and thus has no labour costs; no machinery and so does not require any equipment to be maintained or replaced; and no inventory, so there’s no need for trucks, warehouses or stock management systems and no chance that you will be left holding products that are obsolete or out of fashion. When these things are required by a business, there is less cash to distribute to investors or less cash available to be invested elsewhere. First prize is a business that generates high returns with all of those profits available to be distributed or reinvested as the owner sees fit.

Importance of ‘return on equity’

Perhaps the single most important factor in the identification of a wonderful business is a number, a simple ratio, the return on equity. That is, the level of net income as a percentage of shareholders’ equity. The actress Mae West once said, “Too much of a good thing is wonderful”, and return on equity is like that. It is a measure of the earning power of a business and while accounting focuses on providing an estimate of the business’s performance and position, the economics reveals the true picture.

The wealthiest man alive today, Warren Buffett, is an enormous fan of return on equity as demonstrated by the statements: “Except for special cases (for example, companies with unusual debt-equity ratios or those with important assets carried at unrealistic balance sheet values), we believe [a more appropriate measure] of managerial economic performance to be return on equity capital.” And: “The best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.”

The return on equity ratio tells us many things. First, it is a measure of the quality of a company’s business. Many people wrongly believe that strong growth in profits over the years is an indication of a superior business. It isn’t. Companies like ABC Learning displayed strong growth in earnings yet still collapsed. ABC Learning had low and falling returns on equity. Economic returns, as measured by return on equity, are a better indication of business quality than earnings growth. Return on equity helps tell us which companies display ‘good’ growth. It sorts the wheat from the chaff. A company with strong earnings growth prospects and high rates of return on equity is the sort of business in which you should buy shares.

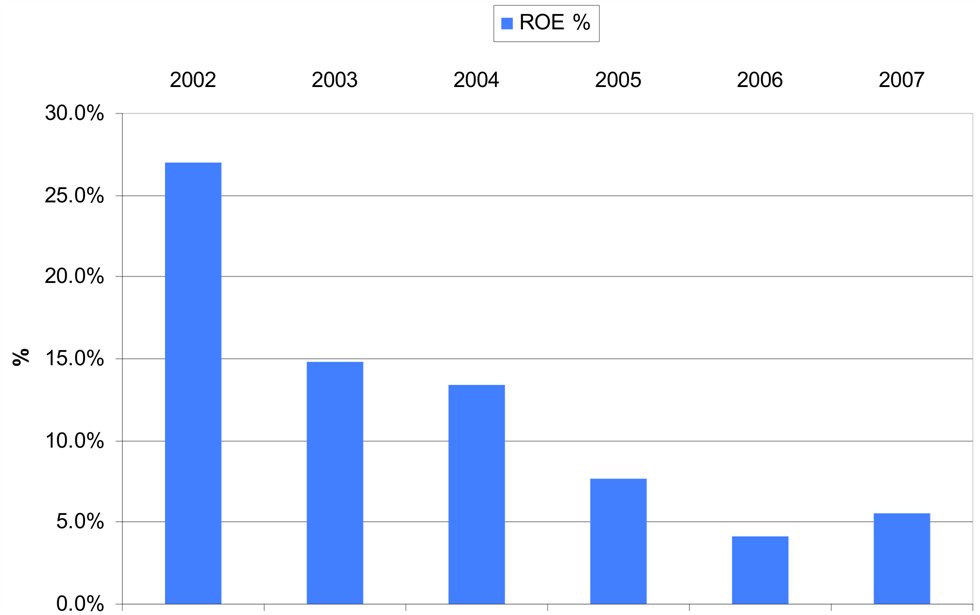

Using ABC Learning as an example, the company’s reported profits revealed spectacular growth, and it was not unusual for sell-side analysts to slap ‘strong buy’ recommendations on the shares. But ABC Learning’s earnings were growing because more and more money was being tipped into the company by shareholders. You can get more earnings each year if you tip money into a regular bank account. There is nothing special about that. Because the company was asking shareholders for money to help it ‘grow’, the profits coming out of the business, when compared to the money going into it, showed the returns from the business were declining, as Chart 1 displays.

Chart 1. ABC Learning’s Declining Returns on Equity

By 2006, the returns on the nearly $2 billion that shareholders had stumped up were about 5%. This was even less than the returns available from a bank term deposit at the time, which harbours a lot less risk than a listed business.

Would you put $2 billion of your money into a business if I told you that the best you could expect was 5%? Of course you wouldn’t. And if you aren’t prepared to own the whole business, you shouldn’t be prepared to own even a few shares. The stock market can sometimes be a slow learner, and while share prices tend to follow returns on equity rather than the earnings, it can take a long time. So in 2006 there was plenty of warning.

Second, high rates of return on equity can also suggest sound management, although a great managerial record is often the result of the boat the managers get into – the existing quality of the business. Indeed, high returns on equity are more likely to be the result of a great business than great management. Some excellent businesses may have a combination of both - a wonderful vessel and a great skipper.

Third, high returns on equity may be an indication that the business is operating as a monopoly or in an industry with high barriers to entry. Something unique that prevents others from competing directly or successfully with the business is known as a sustainable competitive advantage.

Fourth, the return on equity can also tell us whether the company should reinvest its profits or pay the earnings out as a dividend. Because this decision is made by management and the company’s board of directors, return on equity can help show us which teams understand how to allocate capital properly, and therefore those that treat their shareholders like owners.

Fifth, return on equity can tell us something about whether the auditors and the board of directors are realistic when it comes to what they think their assets are worth. If the return on equity is consistently very low, it may suggest that the assets on the balance sheet are being valued artificially high. Investors lose millions when companies announce write-downs, and write-downs usually follow a period of low returns on equity - for example, after the company paid too much for an acquisition and the promised ‘synergies’ failed to materialise. If a company makes a big acquisition and projected returns on equity are low, it’s usually wise to sell your shares.

Finally, return on equity is an essential ingredient in establishing the true worth of a company and its shares. Ultimately, investing is about buying something for less than it is worth. Do this consistently, over a long period of time, and you will beat the market and the majority of other investors. And at the heart of working out what a company is truly worth is the return on equity ratio.

Return on equity can tell us much, and it is a very powerful ratio essential for success in the stock market.

Roger Montgomery is the Founder and Chief Investment Officer at The Montgomery Fund, and author of the bestseller ‘Value.able’. This article is for general educational purposes and does not consider the specific needs of any investor.