Most wars and military crises in the past several decades were accompanied by rising share markets, or at worst, had little impact on equity markets at the time. The main reason is that wars generally create sudden increases in demand and spending that flow through to company profits. Besides the humanitarian horrors, the economic downside is that wars are almost always inflationary due to the same sudden increases in demand and prices.

The focus in this article is the short-term impact of crises on share markets, because the sudden escalation of conflict is what captures headlines and triggers investor panic. Here we look at 30 selected military and geopolitical crises since 1939. They include events in the lead up to World War 2 (WW2), then during WW2, and the major conflicts since then, as shown below:

There were hundreds of other incidents and wars during the past century, including dozens of post-WW2 wars for colonial independence across the world, but we have selected the main events affecting the major powers, and affecting Australia (as a UK/US ally).

Quick recovery in Australian and US markets

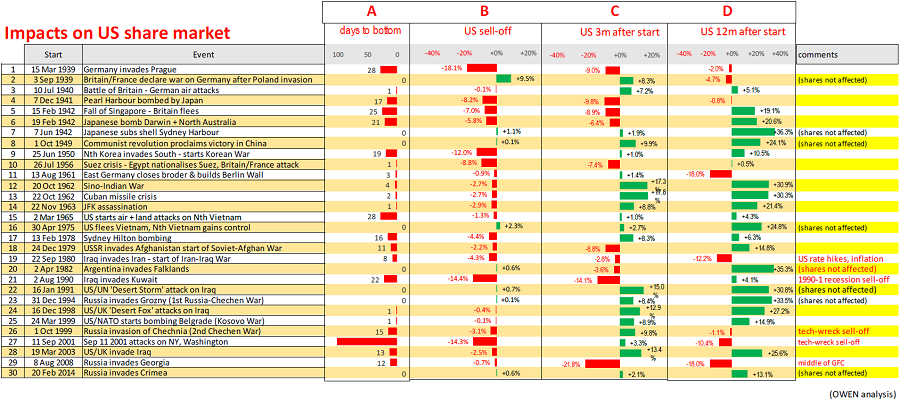

The tables below summarise the short-term impacts of these events on the US share market (first table) and on the Australian share market (second table). In each table, the four bar charts show:

A) the number of days to the bottom of the share market sell off (if any)

B) the extent of the share market sell off (if any)

C) the share index three months after the start (from the pre-crisis level, not from the bottom) and

D) 12 months after the start.

While share markets reacted negatively in the immediate outbreak in 22 out of the 30 crises (column B), in almost all of these, the sell-offs lasted just a few days (column A). In most cases share markets were back above pre crisis levels within three months (C), and nearly all were ahead after 12 months (D).

In those few instances where share markets were not ahead 12 months later, these were due to other factors at work, like the GFC, the ‘tech wreck’, or economic recessions unrelated to the wars.

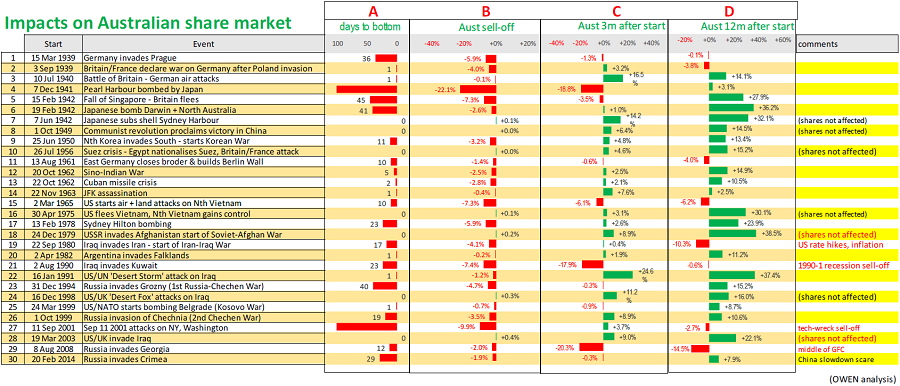

The next table below shows the impacts of the same crises on the Australian share market. Three of the events selected here occurred on Australian soil:

1. the Japanese bombing of Darwin and northern Australia started on 13 February 1942 (6)

2. Japanese subs shelling ships in Sydney Harbour on 7 June 1942 (7)

3. the bombing of the Sydney Hilton on 13 February 1978 (17).

The first two of these brought WW2 to Australian soil, and the third (Sydney Hilton bombing) is included here because (a) it was the first fatal terrorist attack in Australia and (b) the hotel was hosting the Commonwealth Heads of Government meeting at the time, which included a number of possible international targets.

The impacts of these events on the Australian share market were almost exactly the same as on the US market. Most of the events triggered immediate panic sell-offs for a few days, but recovered over the ensuing months. While past events provide no guarantee of the future, this is a good reminder that military invasions and geopolitical crises (even very major ones) usually cause short, temporary sell-offs that recover quickly.

Russia’s aims

Putin appears to have four main motivations for expansion:

(a) rebuilding a buffer zone against US/NATO, which it lost when the USSR fell apart at the start of the 1990s

(b) restoring dignity to re-capture and re-live Russia’s past glory days as a major power after the humiliation of the collapse of the Soviet empire

(c) re-uniting ethnic Russians in the former (but now independent) buffer states

(d) building pipelines through compliant client states into Europe, making Europe dependent on Russian oil and gas and therefore less likely to oppose Russia’s expansion.

There is more to Ukraine and Kyiv than meets the eye. For hundreds of years, Ukraine was the centre of ‘Russia’ and Kyiv was the seat of ‘Russian’ power. The idea of Ukraine and Kyiv as a critical part of ‘Russia’ runs deep, although that does not justify military invasion.

There have been a succession of Russian interventions to achieve these joint aims since the collapse of the Soviet empire, with some by political means and others by military force. These have been included in our list of 30 conflicts analysed above. The first military win was in Chechnya after losing the First Russian-Chechen War (conflict #24 in the above tables) but finally winning the Second Russian-Chechen War (#26) which ended with Russia gaining control and starting to build oil and gas pipelines through to Europe.

Then in the Russia-Georgia War (#29), Russia invaded and took back two more parts of its old Soviet empire, South Ossetia and Abkhazia. In Ukraine, Putin had backed and installed the Russia-friendly Viktor Yanukovych as President, but he was ousted by a popular uprising and revolution in early 2014, and Putin responded immediately by invading and occupying Crimea from Ukraine (#30).

In each case, the US and NATO did not step in with military action although they did impose some sanctions. Russia has been able to build extensive pipelines into Europe via its controlled or friendly buffer states, and Europe has become reliant on Russia for 30-40% of its oil and gas supply, and 30% of Russia’s pipelines to Europe run through Ukraine.

Despite Putin’s threat of putting Russia’s nuclear arsenal on alert, our base case is not for a nuclear or all-out war in Europe yet (or perhaps ever), but for further gradual, opportunistic expansion by Putin to achieve his aims, emboldened by the US and NATO’s reluctance to act militarily, and by Putin’s support from Xi’s China.

Likely outcomes

One possible outcome would be for a long drawn-out guerrilla-style war like Russia fought in Afghanistan during the 1980s (#18 in our tables). In that war, the US and NATO did not take direct action but backed the insurgents for nine years before Russia finally retreated. That type of long drawn-out war would not be good for Putin. If the sanctions incurred serious long term damage to Russian incomes, Putin risks an internal military coup or popular uprising. This is a possible but less likely outcome.

A more likely outcome would be a peace treaty in which Russia takes Donbas (which Russia has partially occupied since 2014), and retains Crimea, in return for withdrawing from the rest of Ukraine and having sanctions lifted. Americans are war-weary after the retreat from Afghanistan in August 2021 and Putin knows it. Putin and Xi Jinping probably have a deal to support each other over their plans for Ukraine and Taiwan but Xi knows that China is not yet ready for a war against the US, although it is catching up rapidly.

Whatever the outcome of this latest invasion, the military build-ups (including in the US, China, Japan, Korea, Taiwan and even Australia) and hostilities are lifting commodities demand and prices, which in turn benefits Australia’s commodities exports, but it also adds further to inflationary pressures globally.

Ashley Owen is Chief Investment Officer at advisory firm Stanford Brown and The Lunar Group. He is also a Director of Third Link Investment Managers, a fund that supports Australian charities. This article is for general information purposes only and does not consider the circumstances of any individual.