Tim Hodgson has probably spent as much time as anyone in the last decade thinking and writing about investing and funds management, and his conclusions are far from flattering. With Roger Urwin, Tim set up the Thinking Ahead Group at Towers Watson in 2002, and this recently morphed into the Thinking Ahead Institute, a not-for-profit ideas forum with external sponsors that has already attracted 20 major institutions managing US$5.6 trillion in assets.

A couple of months ago, I was at the Research Affiliates conference with Tim in Los Angeles where some of the best minds in the industry, including Nobel Laureates, spent two days discussing how little we knew about markets. How do we value stocks? What value do asset consultants add? Why bother with the fees for active management? Tim presented at the Conference and shared these concerns.

I sat down for a chat with him in Sydney last week. He has not worked as a consultant at Towers Watson for many years, and he brings his ideas to his colleagues and their clients by writing research papers and making presentations.

I asked him what happens when one of his opinions, such as the merits of ‘smart beta’ rather than active management, is not in the best interests of a Towers Watson client. “If you do the right thing, it will have relevance,” he replied.

Alpha is a negative sum game

He argues an articulation of beliefs by a client or investor is the first step in the investment process. For example, it is a truism that ‘alpha is a negative sum game’. That is, the sum of all investment decisions is the market, and after fees, the active performance (the alpha) must be negative. But there are many managers both above and below the market benchmark. One belief might be that it is possible to identify the better managers, while another belief might be that outperformance cannot be done consistently over time.

Hodgson falls in the camp that identifying the best managers is very difficult, and we probably spend far too much time searching for outperformance. It’s no use recognising Warren Buffett’s skill now, you need to identify the Warren Buffett of the next 20 years. He advocates moving away from the majority allocation to active managers to perhaps 70% in various types of passive management. The market still needs active managers for efficient price discovery, but it does not need to pay the fees for so many active relative value managers.

Passive does not necessarily mean the usual cap-weighted index investing. Hodgson was an early supporter of what is now known as ‘smart beta’ but which he called ‘beta prime’ in research papers going back a decade. He supports the view that cap weighting leads to larger allocations to the most expensive stocks, and an index which weights by factors other than price can remove this drag. How have his colleagues taken this view? “It’s my job to initiate ideas. It can sometimes take a long time for them to be appreciated.” Such a move across the industry would remove over $100 billion of management fees from the estimated $350 billion paid globally at the moment, not something which many in the industry would enjoy. It will only happen through bottom-up change from asset owners, who control the mandates they offer.

Risk as permanent impairment of goals

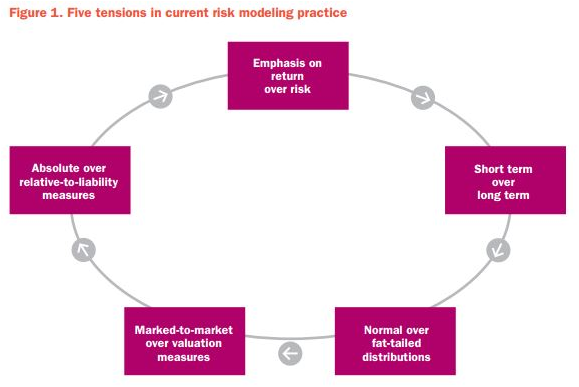

Hodgson defines risk as “a permanent impairment of mission goals or expectations”. He believes risk models struggle in the five ways described in Figure 1. Risk management needs to find a way to overcome these tensions as investors go on a ‘journey plan’ through their lifetime. Funds should be more concerned about impacts that impair long term plans than short term Value at Risk measures or tracking errors.

He supports dynamic or tactical asset allocation, using valuation techniques that measure when markets are expensive or cheap. When I suggested it seems inconsistent to say you cannot pick good active managers but you can pick when markets are cheap, he quoted from F. Scott Fitzgerald in 1936:

“The test of a first rate intelligence is the ability to hold two opposed ideas in the mind at the same time, and still retain the ability to function.”

He drew out the comparison to active versus passive investing in a fascinating way. “‘Is there aggregate added value from market timing’ is a similar question to ‘Is there aggregate added value from active investing’. Probably no to both, but we are dealing with highly complex, adaptive systems, and the answers are not simple. Which is why we always start with our beliefs.”

In other words, investing is not like practicing medicine, where an experienced surgeon can become an expert over time because the human body does not change and he knows what to expect when he goes into it. Markets change depending on the actions of others in a highly adaptive way.

We have morphed from a profession to an industry

The Thinking Ahead Group has long championed the need to focus on the ultimate beneficiary, and Hodgson riles against the self-interest of many finance executives. His colleague, Roger Unwin, has seen investment management morph from a profession to an industry. There used to be more focus on stewardship and long term perspectives.

One of his hopes for the new Institute is that by changing behaviour at the top of the investment pyramid among major asset owners, it will improve retail products and client interactions. He likes the analogy of a Formula 1 car and the research impact on the family sedan. “By having better working partnerships, we hope the investing equivalents of antilock brakes and airbags trickle down from the Institute to the end investor.”

(To read some of Tim’s most recent work on the attitudes of investment managers, see the related Cuffelinks article, “Our industry has a problem”).