If you are concerned about your returns, you should brace for an end of the residential construction boom. You should also be very cautious about the excessive prices of high-yielding stocks (those paying dividends that are unlikely to grow), and you should be most enthusiastic about high-quality mid cap and small cap stocks that have been punished recently with share price declines of up to 50%.

Let’s start with property

Courtesy of UBS and the RLB Crane Index, we recently learned that the residential crane count in Australia skyrocketed by 313% between September 2013 and September 2016. There were more residential construction cranes along the east coast of Australia than across New York, Boston, Chicago, San Francisco, Los Angeles, Toronto and Calgary combined.

Property doyens are selling. Harry Triguboff tried to sell Meriton and the ‘For Sale’ shingle has been placed on the century-long held Soul Pattinson building in Sydney’s Pitt Street Mall by one of Australia’s most successful and respected investors and patriarch of listed investment firm Washington H Soul Pattinson (ASX:SOL) Rob Millner. John Symond has listed his waterfront mansion on Sydney Harbour and John Gandel realised a large profit exiting Charter Hall in a $500 million sale.

There has been stunning growth in the number of practising real estate agents. Australia’s population is growing at 1.6% per annum, so the number of real estate agents required to service the population does not need to grow at a rate in excess of this. Yet in 2016, Victoria, NSW and Queensland have experienced growth in the numbers of real estate agents of 8.7%, according to the NSW Office of Fair Trading, Consumer Affairs Victoria, and Queensland Office of Fair Trading.

And notice the preponderance of property developers making the rich lists and in particular the mushrooming number of property developers under 40 who were still at school during the last recession.

According to a UBS survey, more than a quarter of 1,228 Australian home buyers who had taken out a mortgage over the past two years admitted they misrepresented some information on their loan application. Bank shares anyone?

A relationship between residential dwelling commencements and full time employment, produced by our friend and equity researcher Douglas Orr, reveals peaks in commencements have foreshadowed large drops in full time employment in Q3-1999, Q1-1995, Q2-2000, and Q2-2008. There are signs this decline is happening now.

Acutely expensive real estate

Australian residential real estate, despite being on the cusp of oversupply, is some of the most expensive in the world on a house price-to-income ratio basis.

Record prices and oversupply cannot co-exist for very long. At the same time that house prices are rising stratospherically, debt is being accumulated at an alarming rate. Of course mortgage debt to income and mortgage debt to GDP ratios are at records.

There is always, without exception, one common precedent to the vast number of crises the world has experienced — excessive debt accumulation. Quite simply, Australians have taken on more debt, typically to chase more expensive houses, and have less money to pay for it.

John Kenneth Galbraith in The Great Crash defined a bubble thus;

“… at some point in a boom all aspects of property ownership become irrelevant except the prospect for an early rise in price. Income from the property, or enjoyment of its use, or even its long-run worth is now academic … What is important is that tomorrow or next week, market values will rise, as they did yesterday or last week, and a profit can be realised …”

Australia’s east coast capitals are facing a tidal wave of apartment supply and developers will not be able to sell all their inventory at current prices. Indeed, they are already offering carrots to lure potential buyers. These carrots, such as millions of frequent flyer points, holidays to Asia or 10-year rental guarantees, are forms of discounts designed to preserve the ticket price. As supply increases, however, the discounting will become more aggressive simply because the developers owe their lenders money and need to pay back the loans, many of which have also capitalised interest (something to think about when owning bank shares too).

Investors who borrowed to buy an investment apartment are at particular risk. Take a look at Brisbane where in the first nine months of 2016 just 5200 apartments were completed in the inner 5 kilometre ring from the CBD. Investors who purchased outside that inner ring, five to 15 kilometres from the CBD, have seen aggregate vacancy rates climb from 2.3% to 4.7%. And that number can only keep rising when another 13,000 apartments are due to be completed over the next 18 months. A unit without a tenant has a yield of 0%, and where a mortgage is attached, it could put its owner under financial stress.

Some shares don’t look great either

With record levels of mortgage and credit card debt in Australia, we expect there will be some financial stress ahead. We think investors should be cautious on companies like the banks, Telstra, the supermarkets, BHP and RIO. Either they are being disrupted, have challenges to their growth, are cyclical or have increased their payout ratios to such an extent that they are thwarting their own ability to grow future income and dividends.

In a low interest rate environment, purchasing power from fixed income streams are eroded. If bond rates rise, as they have begun to, the outcome for any bond-like security paying a fixed income will be even worse.

What other investments look better?

Over the past year or two, a lack of growth in the banks (credit growth is expected to slow given maturing residential development as well as record mortgage and credit card debt) and resource companies meant large institutional fund managers fuelled a boom in the prices of smaller high-quality growth companies, as they migrated down the market capitalisation spectrum, looking to boost returns. High quality, mid and small capitalised company shares, those with bright prospects and economics, benefitted.

More recently, the perceived prospects of the banks and resource companies have improved and those same institutions, finding themselves underweight, were forced to sell down their holdings in smaller, high-quality growth companies to fund their purchases of the banks, BHP, RIO et al.

As those large institutional funds unwound their positions, we have witnessed corrections, if not crashes, in the share prices of smaller high-quality, high-growth companies. ISentia has declined more than 30% as has APN Outdoor and Vita Group. Healthscope has fallen 32% from a high of $3.14 to a low of $2.15, while REA Group and Carsales are down 27 and 28% respectively from their highs.

Our inability to identify good value earlier in the year resulted in The Montgomery [Private] Fund building cash to more than 30% of the fund’s value. This allows it to take advantage of lower prices, and in some cases, the first opportunity to acquire value in a long time.

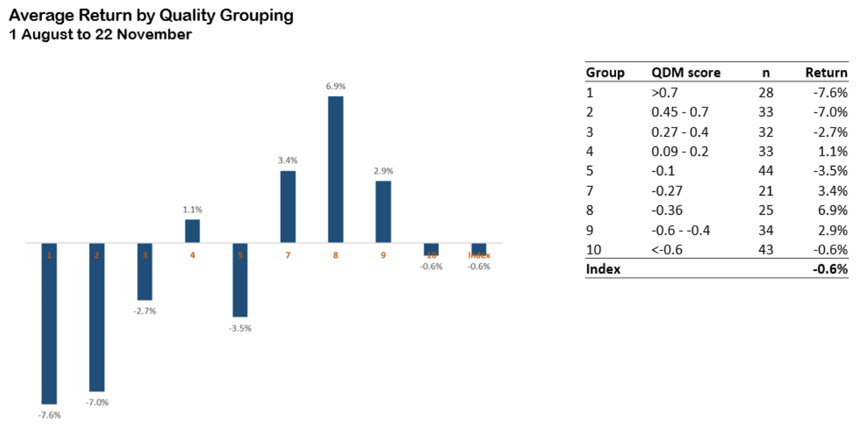

Surprisingly, some companies that score highest on our quality matrix have been the worst performers. Conversely, some of the lowest quality companies – those with no track record of adding shareholder value – have been the best share price performers. This cannot last and the eventual reversal of these trends will deliver more reassuring results.

We maintain a database covering the entire ASX300, scoring every business in terms of its pricing power, barriers to entry, industry structure, switching costs, and a myriad of other factors. Our objective is to rank businesses by the sustainability of their propensity to create shareholder value by investing incremental capital at rates of return above the cost of capital.

This is a long-term dynamic. Value creation only reveals itself over a number of years and as the business reports growing shareholder equity while sustaining a high return on that growing equity. Over shorter periods, the share prices for good businesses can decline and the prices for inferior businesses can surge, and we believe we are currently witnessing just such a period.

As shown below, the businesses with our highest quality scores (at the left of the chart) delivered the worst returns between 1 August and 22 November, 2016. Meanwhile, the strongest returns have been towards the lower end of the quality scale.

Just as record apartment prices cannot coexist for long with record supply, high quality and strong earnings growth cannot coexist with poor share price performance for long.

Roger Montgomery is the Founder and Chief Investment Officer at The Montgomery Fund, and author of the bestseller ‘Value.able’. This article is general information and does not consider the circumstances of any individual.