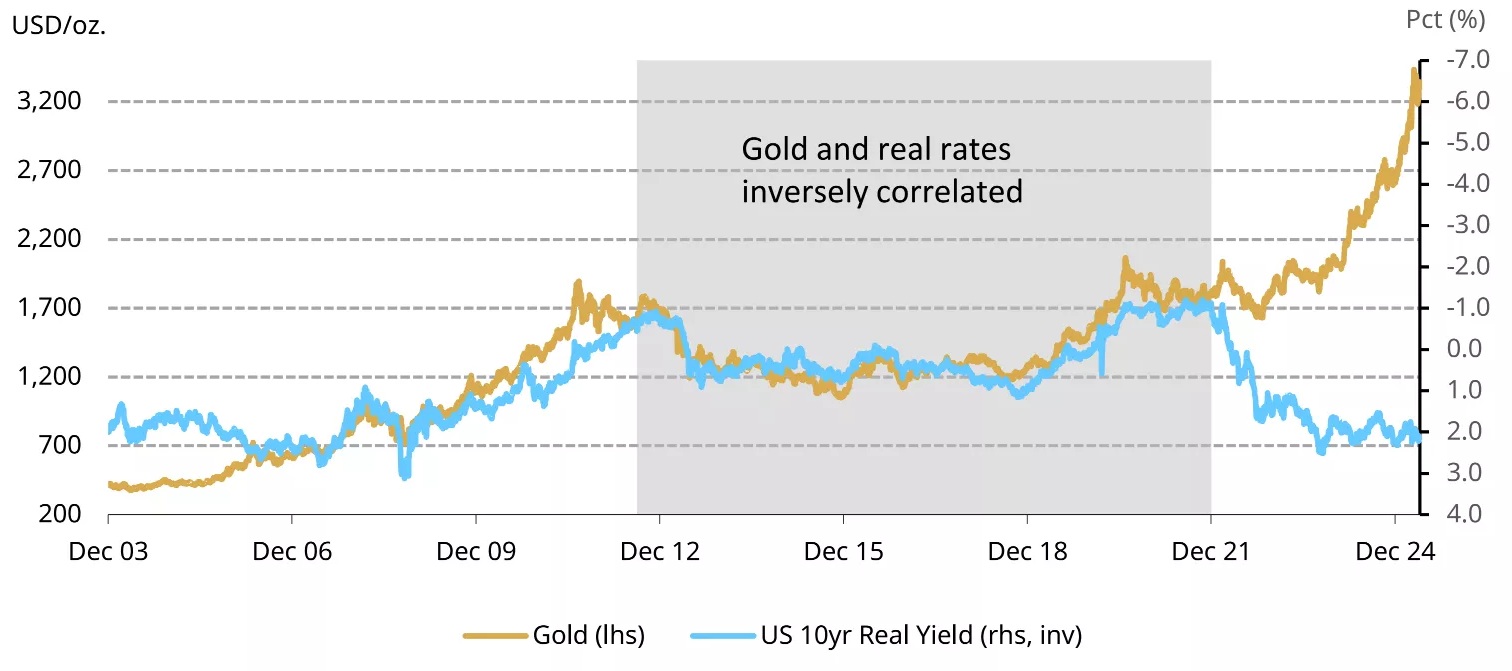

For about a decade, real interest rates were a prominent factor driving the gold price (Chart 1), i.e. gold was inversely correlated with real rates, with gold becoming less attractive as real interest rates rose. Since 2022, however, this inverse correlation has again been counterbalanced by other factors. As real rates rose – currently sitting above 2% – gold prices also generally rose, supported this time by investors seeking to mitigate a variety of risks and by central bank buying.

Chart 1: Higher opportunity costs counterbalanced by other factors

US 10yr Real Yield and Gold (USD/oz)*

*Data from 31 December 2003 to 30 May 2025. Source: Bloomberg, World Gold Council.

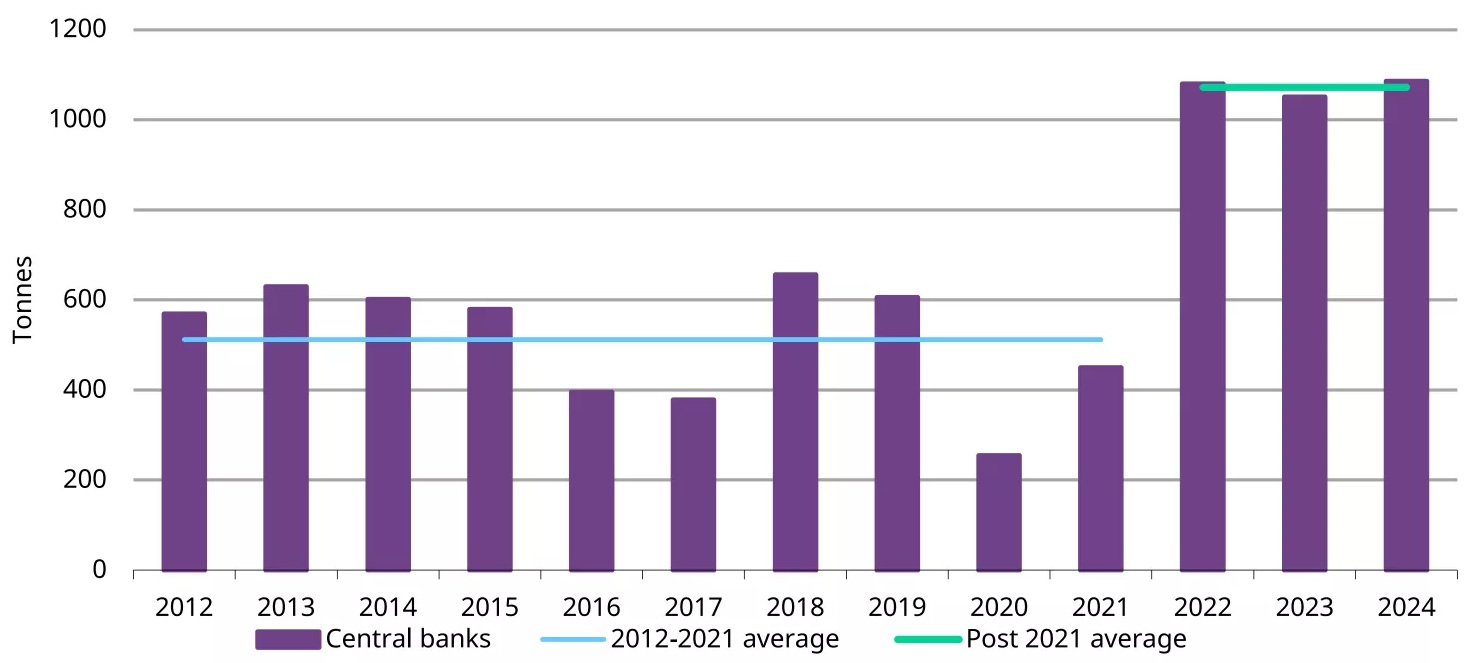

Indeed, the central bank buying we have witnessed since 2022 and the acceleration of those purchases has been a big factor in gold’s strength (Chart 2). The reasons for this increased appetite from emerging market central banks for greater gold reserves are multiple, e.g. diversification, geopolitical risks, and gold’s performance in periods of crisis.

Chart 2: Central banks coming into the market in unprecedented levels

Annual central bank net purchases, tonnes*

*Data from 2012 to 2024. Source: Metals Focus, World Gold Council.

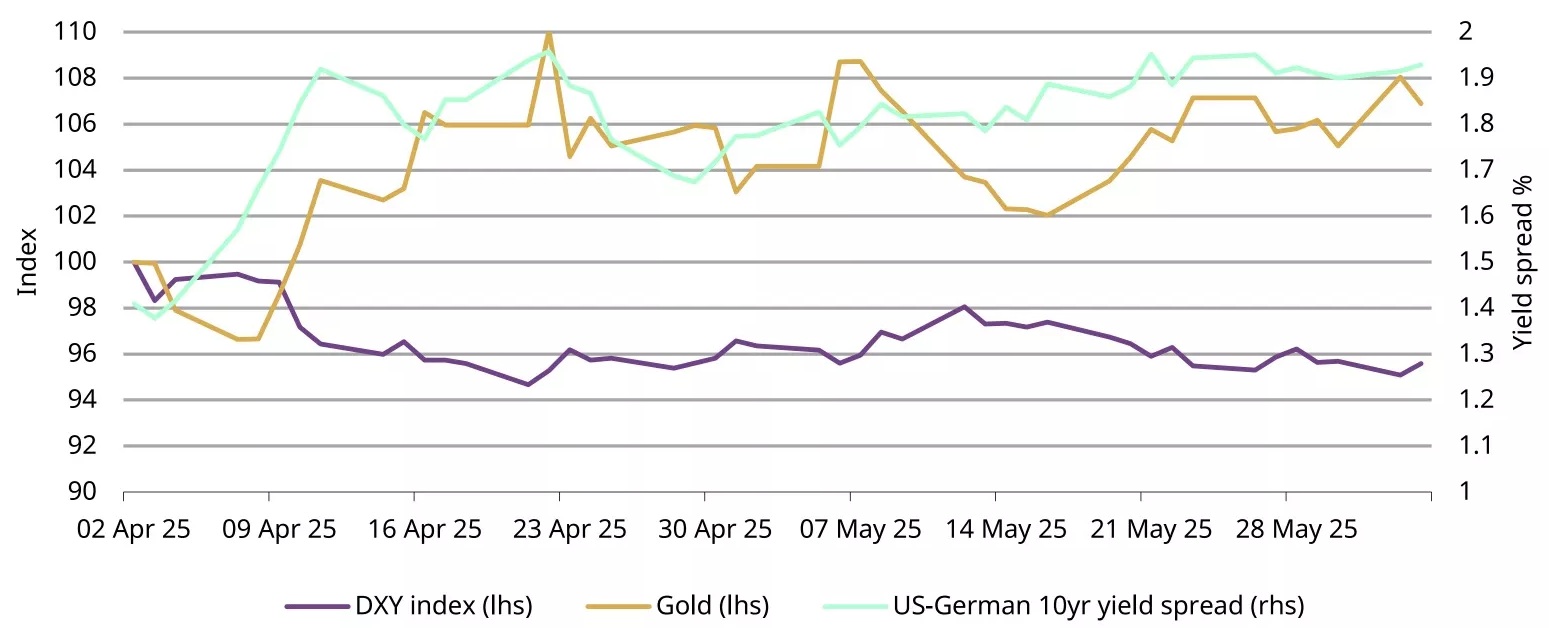

More recently, consumer confidence and business investment intentions have been affected by economic and trade policy uncertainty. This has triggered a reallocation of global capital out of the US, with global investors seeking out alternative safe-haven assets to US Treasuries. The consequences have been a weaker dollar, rising gold prices, and US bond yields widening versus other high-grade sovereigns, e.g. Germany (Chart 3).

Chart 3: ‘Liberation day’!

Gold, DXY and US-German 10yr yield spread

*Data from 2 April 2025 to 3 June 2025. Source: Bloomberg, World Gold Council.

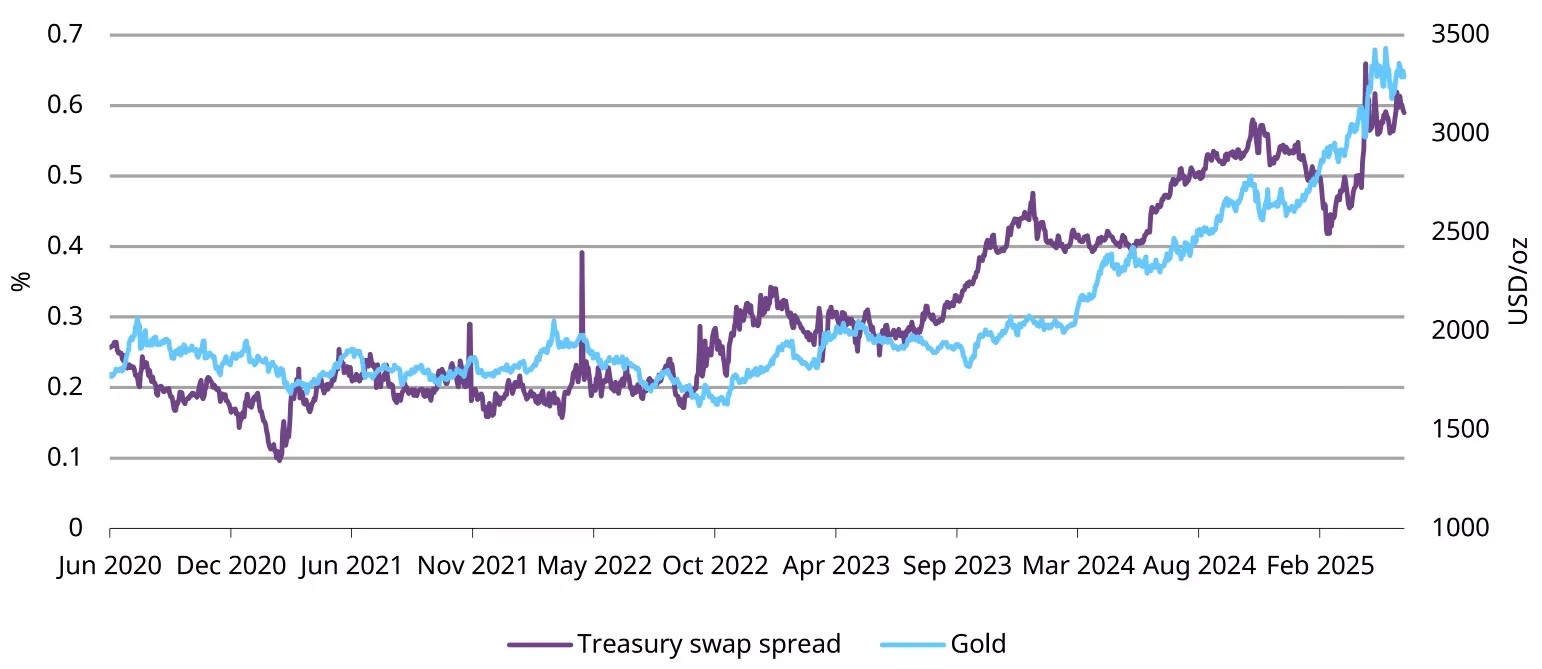

More broadly, we believe fiscal concerns have been one of the factors supporting the gold market (Chart 4). For example, the difference between the yield on a US government bond and the fixed rate of an interest rate swap has been pushed up – a potential sign of fiscal concerns. In other words, we are witnessing investors' inability or unwillingness to absorb debt issuance or sales by other bond holders at prevailing prices, in turn exerting upward pressure on bond yields, pushing the US Treasury swap spread higher.

Chart 4: Gold rising alongside US fiscal concerns

US 10yr Treasury swap spread and gold (USD/oz)*

*Data from 30 June 2020 to 30 May 2025. Source: Bloomberg, World Gold Council.

Our simplified analysis points out that the differential between US Treasuries and swap rates, which we believe is at least partly linked to US fiscal concerns, is statistically significant in explaining movements in the gold price (Table 1). In practical terms, when fiscal concerns increase – reflecting worries over US government debt sustainability or deficits – investors may seek the relative safety of gold, driving its price higher.1

Table 1: As US fiscal stress has increased, investors have sought out gold

Regression of gold returns on fiscal stress, DXY index and 10yr real yields*

* Data from 15 June 2022 to 15 June 2025. Regression analysis using log daily gold price returns as dependent variable. Independent variables are: fiscal stress (US 10yr Treasury swap spread), DXY index and US 10yr real yields. Source: Bloomberg, World Gold Council.

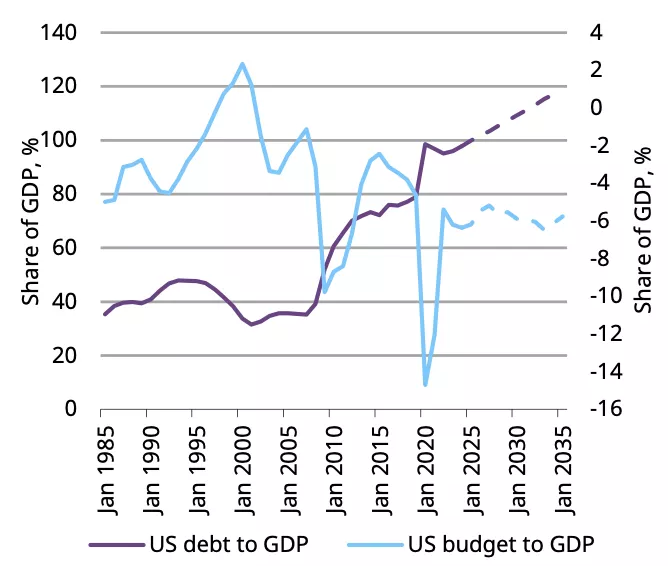

The US’s precarious fiscal position

The gold market is likely to continue to be supported by US fiscal issues as the bond market will remain sensitive to US debt sustainability considerations. Indeed, the last two decades of relaxed fiscal policies (Charts 5 & 6) and shifts in the demand structure have now put the US in a precarious position.

Chart 5: Fiscal loosening started in 2001

US debt to GDP, US budget to GDP, and respective forecasts from the CBO*

*Data from 1985 to 2024, projections thereafter. Source: Congressional Budget Office, Bloomberg, World Gold Council.

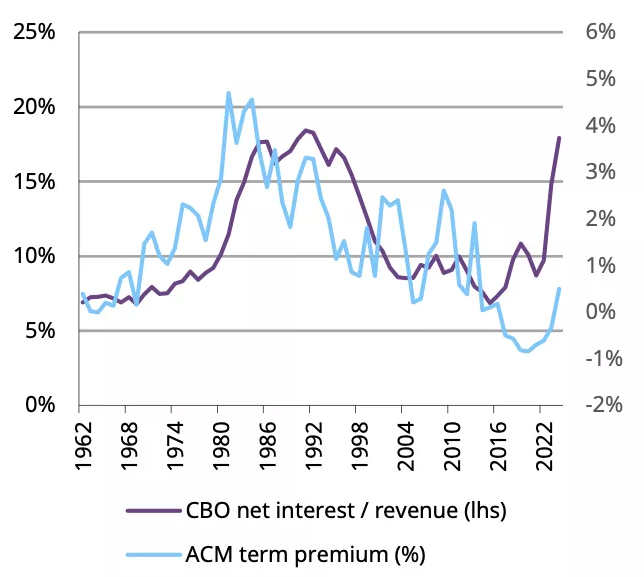

Chart 6: Is the only way up?

US govt interest payments vs. 10yr term premia*

*Data from 1962 to 2024. Source: Congressional Budget Office, Bloomberg, World Gold Council.

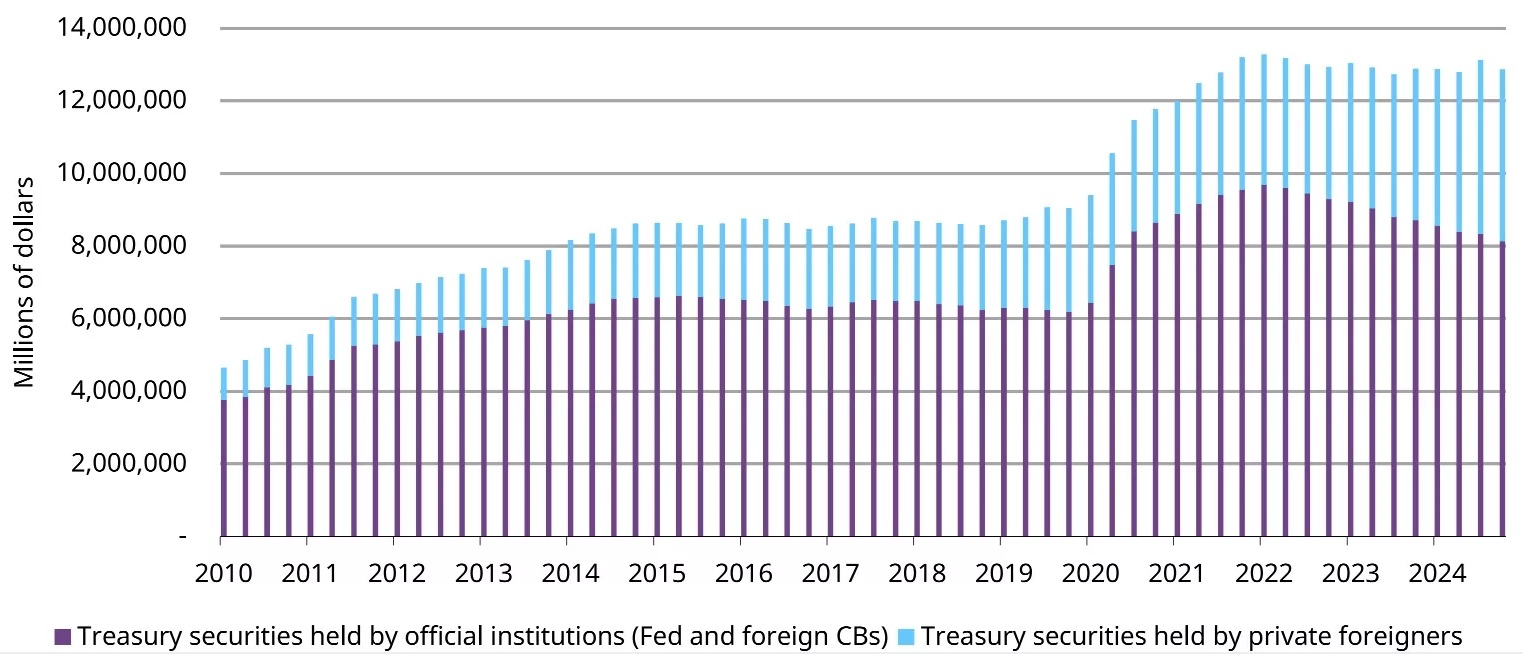

Demand for Treasuries from the Fed and foreign official institutions, which are least return sensitive, is falling (Chart 7). By contrast, foreign private investors are now the largest non-official holders of Treasuries. These investors are likely to be the most price-sensitive category of investors as they are likely to have global mandates and therefore compare Treasuries with government bonds in multiple jurisdictions.

Chart 7: Treasury demand is becoming more price sensitive

Treasury securities held by official institutions and private foreigners*

*Data from 01 January 2010 to 31 December 2024. Source: Board of Governors of the Federal Reserve System, World Gold Council.

Full-blown fiscal crisis unlikely and unnecessary for gold support

All of this does not mean a full-blown crisis is imminent. Such a crisis would require a short-term trigger – such as a debt-ceiling miscalculation resulting in a technical default – that exacerbates the existing long-term destabilising trends.

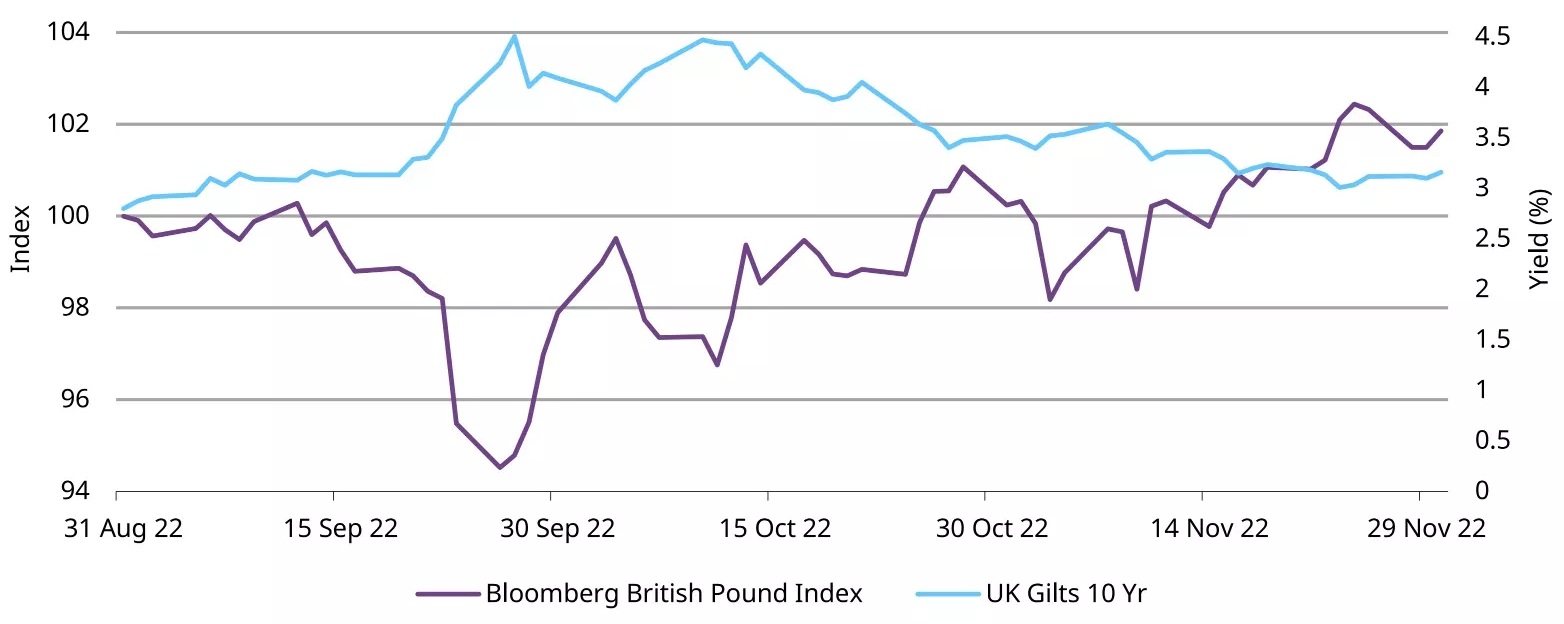

Rather, the more likely outcome is a series of rolling mini-crises as political objectives and bond market expectations collide. In fact, when it comes to fiscal sustainability, perceptions matter as much as policy. If leaders give the impression that their commitment to long-term fiscal discipline is weakening – or that they are determined to force through policies that will weaken the fiscal position – then the reaction in bond markets is usually quick and severe.

This, however, is generally short-lived as the government backs down in the face of market pressure. Central banks can also step in to prevent yields rising too quickly – and they will always do so if those moves in yields threaten financial stability, as we witnessed in the UK 2022 mini-crisis (Chart 8). As fiscal concerns come to the fore, gold – an alternative safe-haven asset – should remain supported.

Chart 8: UK 2022 mini-crisis

Bloomberg British Pound index and 10yr UK Gilt yield*

*Data from 31 August 2022 to 30 November 2022. Source: Bloomberg, World Gold Council.

Conclusion

The interest rate environment and geopolitical tensions undoubtedly play a significant role in driving the gold price but they are not the sole factors. Recently, we believe that fiscal concerns have also had a say. And while there is a strong belief that the US Treasury market will never lose its safe-haven status, a major crisis, while unlikely, is not impossible. However, the more likely outcome is a series of rolling mini-crises as highly indebted sovereigns like the US are confronted with market-imposed limits on fiscal largesse. This uncertainty and resulting market volatility are likely to give additional support to the gold market.

Footnote

1A more detailed analysis would be needed to better assess the accuracy of the US Treasury swap spread as a direct proxy for fiscal issues, as well as its direct impact on the gold market. For example, we would need to test how this factor fits into our more comprehensive Gold Return Attribution Model – whether directly or indirectly – and if its effect persists once we have controlled for other factors.

Jeremy De Pessemier is an Asset Allocation Strategist at World Gold Council, a sponsor of Firstlinks. This article is for general informational and educational purposes only and does not amount to direct or indirect investment advice or assistance. You should consult with your professional advisers regarding any such product or service, take into account your individual financial needs and circumstances and carefully consider the risks associated with any investment decision.

For more articles and papers from World Gold Council, please click here.