There are many ways to measure exposure and risk. No single metric is perfect which is why professional risk managers use multiple measures of risk.

Many parts of the financial services industry classify portfolios based on a measure known as growth/defensive exposure. Growth/defensive has its fair share of flaws but it appears entrenched as an industry measure. However, there currently exists a one-off opportunity to improve the metric and make it standardised. All members of the investment community are encouraged to participate in the consultation currently open.

How do we use growth/defensive?

Growth/defensive exposure is used in many different ways, including:

- Research houses create super fund peer groups for performance comparisons, such as grouping together all funds classed as 60% growth/40% defensive.

- APRA’s Heatmap methodology assesses super funds by risk and return.

- Financial planners define growth/defensive categories to map clients to portfolios based on their risk tolerance.

For all its use in industry, growth/defensive remains undefined. As a result, there is a large degree of subjectivity, whether by industry when they self-assess or by groups such as APRA which has developed its own simple approaches, thereby introducing hard-coded subjectivity. These variations reduce confidence in any analysis produced using growth/defensive.

Industry attempts to standardise

Presently there is an industry-led project to create a standardised approach for assessing growth/defensive exposure to be used by all industry participants including regulators.

A working group (detailed here) was formed by volunteers from research houses and super funds. Following more than a year’s work, a proposed solution has been released for consultation.

Already there has been a high level of participation in the consultation process. Industry participants are encouraged to contribute and feedback will inform a better solution.

Consider the following puzzles:

- If we followed traditional thinking that defensive assets are cash and bonds and growth assets are generally equities which participate in economic performance, where does that leave alternative investment products which can exhibit sizable risk, which could be independent of equities?

- If we took a risk-based approach then should there be different scores among the universe of cash and fixed interest products, as they exhibit varying degrees of risk?

Pragmatism was the key to coming up with a solution. The working group stopped trying to come up with a definition (we accepted it as a hybrid measure of exposure and risk) and focused on the following:

- A quality measure that broadly reflects the risk/exposure consistently across different multi-asset portfolios

- A measure that doesn’t distort the portfolio decision-making process (compared to a decision made in a traditional risk/return framework)

- Manageable degree of operational impact.

We often found that these desires pulled against each other. Achieving a balance was the challenge.

Examples of growth/defensive asset scores

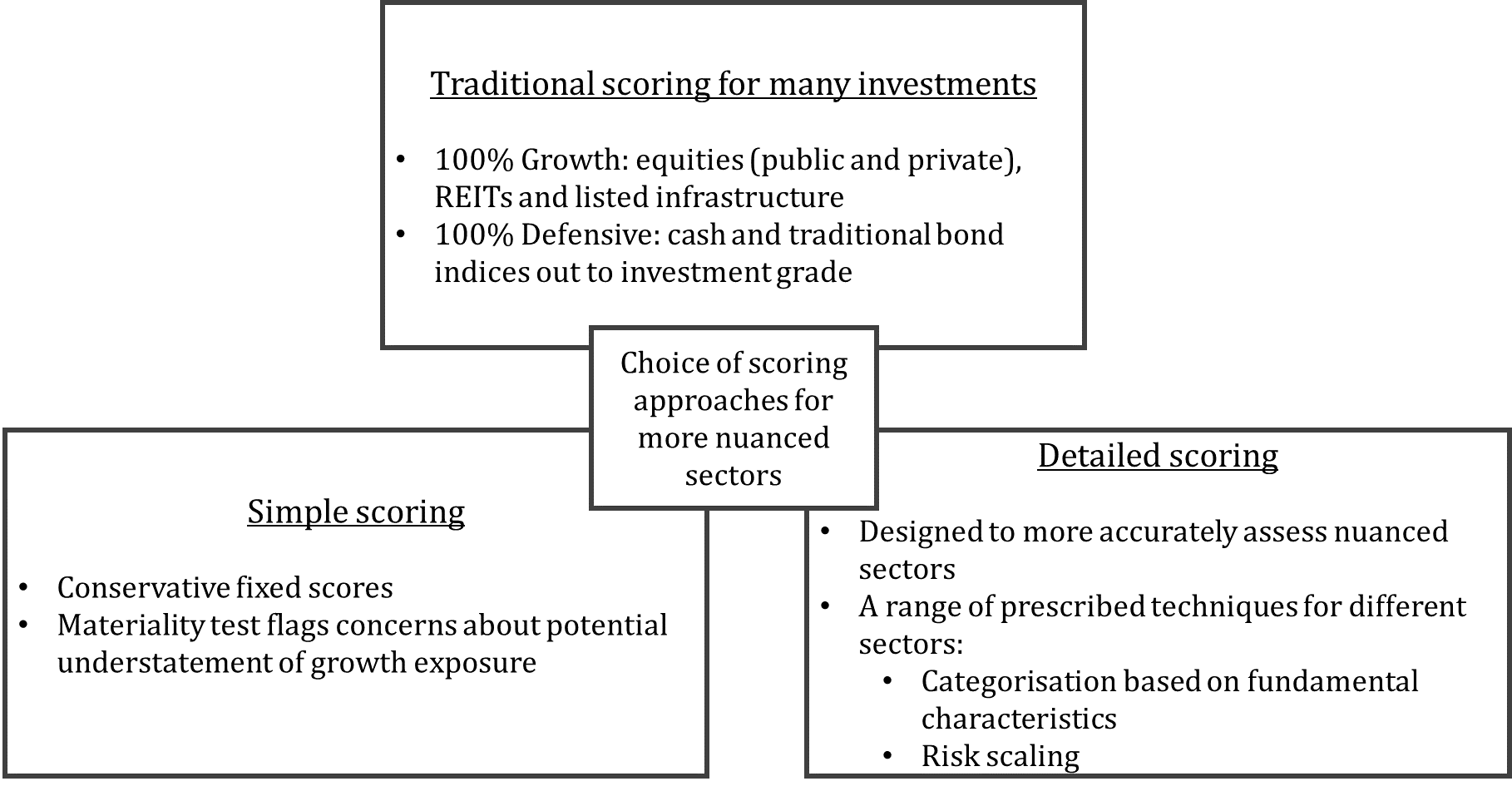

The proposed solution is outlined in the diagram below.

A couple of case studies help to illustrate the detailed scoring process:

Property and infrastructure. Fundamental criteria such as leverage levels and asset purpose (lower-risk income or higher-risk development) channel assets into two categories: Tier 1 risk (scored 60% growth/40% defensive) and Tier 2 risk (100% growth).

Hedge funds. The level of risk taken or targeted by the hedge fund is scaled to determine a growth/defensive score. Consider the simplified case of two hedge funds who target 6% and 12% volatility. Under our risk scaling approach, we scale the product volatility by 12% to determine that the two hedge funds would score 50% growth/50% defensive and 100% growth respectively.

Full details of the proposal are here.

It may be a healthy exercise for SMSFs to estimate their own growth/defensive score. The process we have detailed provides a healthy reminder that not all unlisted property has the same characteristics, that there is a huge dispersion among alternative investment products and that higher yielding credit can carry significant risk.

The working group was unable to incorporate portfolio diversification benefits into the solution. A variety of investments with different risk drivers should result in lower portfolio risk compared to the weighted sum of those individual risk exposures. But how do you standardise this calculation when there are so many investments?

Not being able to incorporate diversification benefits should be viewed as a limitation of growth/defensive as a risk measure. It serves as a reminder to those groups that use growth/defensive, including APRA, that the definition should be complemented by other approaches to measuring exposure and risk when undertaking analysis.

Feedback welcome

The aim is for a single industry solution and a standardised approach. At present the industry is under the microscope as never before. All feedback will be shared with the working group. The consultation paper is found here and the consultation closes on Monday 28 September.

Hopefully this will provide clear headspace for industry to move beyond growth/defensive and start using a variety of measurements to assess risk and performance. Thank you to the working group for all their contributions.

David Bell is Executive Director of The Conexus Institute, a not-for-profit research institution focused on improving retirement outcomes for Australians.