with Laurens Swinkels and Pim van Vliet

After three decades of muted price increases, inflation has once again become a major talking point for investors. A confluence of factors such as the reopening of economies following protracted Covid-related lockdowns, supply chain bottlenecks, sharply rising commodity prices (particularly gas and oil) and Russia’s invasion of Ukraine have driven global inflation well beyond comfortable levels.

Given the environment, it is worth looking into how risk premiums typically behave across different inflation regimes, such as periods of deflation or high inflation. In our study1, we examined the performance of asset classes and factors using a deep sample stretching back to 1875, thereby accounting for various and numerous inflation regimes.

Behavior of asset classes in different inflation buckets

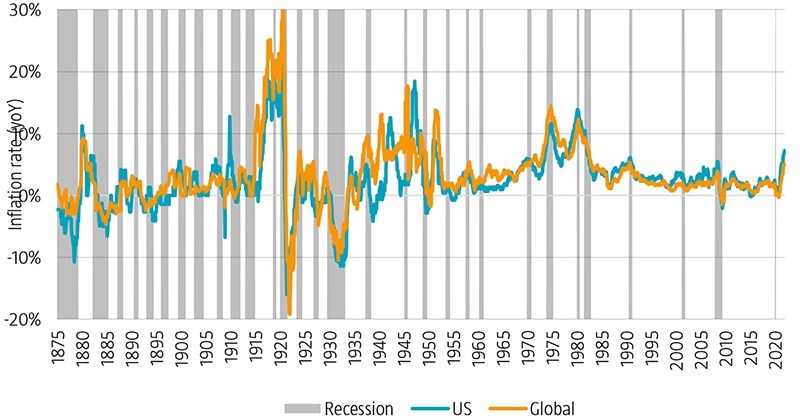

We observed that inflation varied over time and was punctuated by periods of deflation, moderate inflation and high inflation. Moreover, there were a few periods during which high inflation coincided with a recession, i.e. stagflation. Figure 1 depicts the inflation cycle over our 146-year sample period, with the grey bars indicating recessions.

Figure 1 | Inflation cycles over 146-year period, January 1875 to December 2021

Source: The chart shows the inflation cycles from January 1875 to December 2021. For inflation we used year-on-year CPI data for France, Germany, Japan, UK and US from Datastream and MacroHistory.

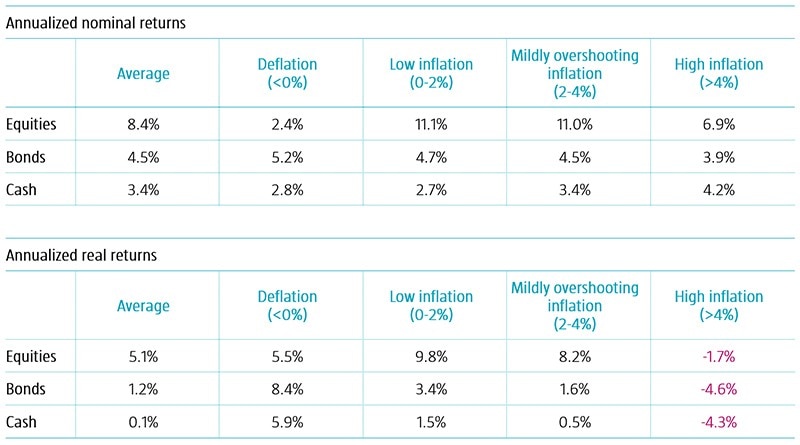

To assess the impact of inflation on asset and factor returns, we chose to distinguish four broad types of inflation regimes: deflation (<0%), low inflation (0-2%), mildly overshooting inflation (2-4%) and high inflation (>4%). Table 1 summarizes the average annual returns for traditional asset classes across the different inflation buckets over our sample period.

Table 1 | Asset class returns across different inflation buckets, January 1875 to December 2021

Source: The table shows the asset class returns across various inflation buckets from January 1875 to December 2021. For equities, we used return data from the MSCI World Index and before then global value-weighted equity market returns, see Baltussen, Swinkels and Van Vliet (2022). For bonds, we used return data from the Bloomberg Global Treasury Index and before then GDP-weighted bond returns across French, German, Japanese, UK and US bond markets, see Baltussen, Swinkels and Van Vliet (2022). For cash, we used return data based on short-dated US Treasuries from the Kenneth French library and before then data from Jeremy Siegel. For inflation we used year-on-year CPI data for France, Germany, Japan, UK and US from Datastream and MacroHistory. All returns are quoted in USD.

During deflationary periods, equities delivered nominal returns well below their average over the sample period, but above-average real returns due to the negative inflation. The outcome was similar for cash, with above-average real returns. Bonds benefited over this period, generating above-average nominal and real returns, with the latter being particularly strong.

In high inflation intervals, all the asset classes experienced positive returns, but equities and bonds lagged their averages. But more importantly, all asset classes delivered negative real returns as they failed to offset the heightened inflationary pressures.

The low inflation and mildly overshooting inflation scenarios reflect a ‘goldilocks’ environment, which is typically good for risk assets and was prevalent for more than half of the sample period. In line with expectations, equities displayed their strongest performance in these periods, attaining robust nominal and real returns. Meanwhile, bonds fared reasonably well, delivering nominal returns in line with their average and solid real returns. By contrast, nominal cash returns were below average, but positive in real terms.

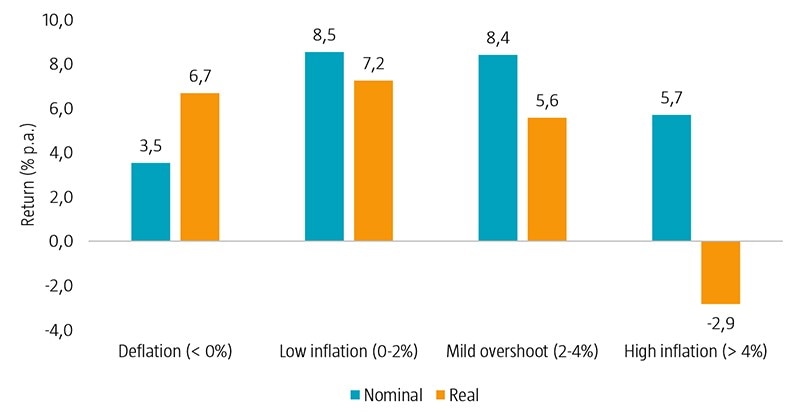

Multi-asset impact and the typical 60/40 portfolio

We then assessed the impact of these different inflation regimes on a generic multi-asset portfolio that consists of 60% equities and 40% bonds. As depicted in Figure 2, we observed that the low inflation and mildly overshooting inflation buckets (‘goldilocks’ environment) were the sweet spot for multi-asset investors both in terms of nominal and real returns.

Figure 2 | Nominal and real returns of generic multi-asset portfolio across different inflation buckets, January 1875 to December 2021

Source: The chart shows the nominal and real returns of a multi-asset portfolio across various inflation buckets from January 1875 to December 2021. For equities, we used return data from the MSCI World Index and before then global value-weighted equity market returns, see Baltussen, Swinkels and Van Vliet (2022). For bonds, we used return data from the Bloomberg Global Treasury Index and before then GDP-weighted bond returns across French, German, Japanese, UK and US bond markets, see Baltussen, Swinkels and Van Vliet (2022). The generic multi-asset portfolio consists of 60% equities and 40% bonds, rebalanced monthly. For inflation we used year-on-year CPI data for France, Germany, Japan, UK and US from Datastream and MacroHistory. All returns are quoted in USD.

In deflationary times, nominal returns from multi-asset portfolios were subdued, but materially better in real terms. By contrast, nominal multi-asset returns were solid in periods of high inflation, but these were eroded by heightened price pressures leading to negative real returns.

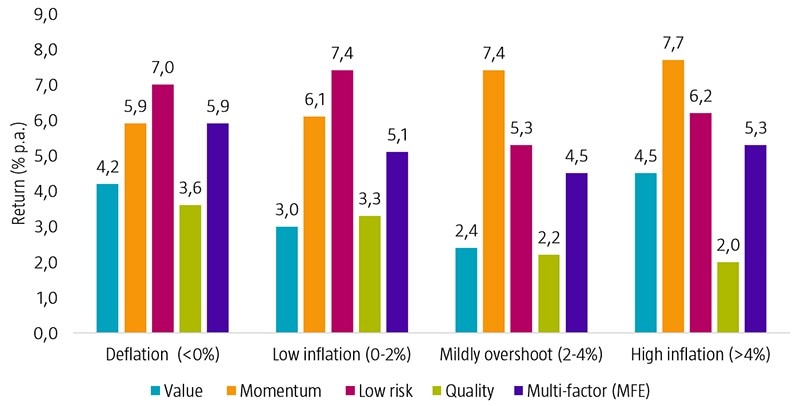

Impact on factor premiums across various inflation regimes

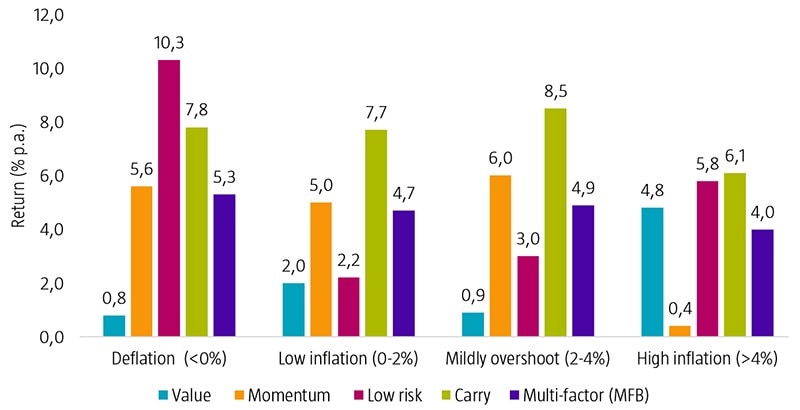

We carried out the same exercise for factor premiums across both equities and government bonds. This is illustrated in Figures 3 and 4, where the factor returns are the differences in performance between a long portfolio with the highest factor exposures and a short portfolio with the lowest factor exposures. Interestingly, we saw that the performance of factors seemingly does not depend much on the level of inflation, in contrast to the asset class returns.

Indeed, Figure 3 shows that the multi-factor equity portfolio produced fairly stable performance across all four regimes. At the individual factor level, the variation in returns across inflation buckets was somewhat higher, but never strayed too far away from long-term averages.

Figure 3 | Equity factor premiums across different inflation buckets, January 1875 to December 2021

Source: The table shows equity factor returns across various inflation buckets from January 1875 to December 2021. For the equity factors, we used data from the Kenneth French library and Baltussen, Van Vliet and Van Vliet (2022) 2 and methodology from the latter. The equity factor returns are based on the return spreads between the top and bottom factor quintile portfolios using US stocks. For inflation we used year-on-year CPI data for France, Germany, Japan, UK and US from Datastream and MacroHistory. All returns are quoted in USD.

The picture for bond factors was similar as they delivered positive returns in all four regimes as depicted in Figure 4, while the multi-factor bond portfolio performed consistently well in all inflation buckets. At the individual factor level, the variation in returns across the different inflation scenarios was higher, leading to a well-diversified multi-factor bond portfolio.

Figure 4 | Bond factor premiums across different inflation buckets, January 1875 to December 2021

Source: The table shows bond factor returns across various inflation buckets from January 1875 to December 2021. For the bond factors, we used data from Baltussen, Martens and Penninga (2022) 3 and methodology from the latter. The bond factor returns are based on the return spreads between the top and bottom factor quintile portfolios. For inflation we used year-on-year CPI data for France, Germany, Japan, UK and US from Datastream and MacroHistory. All returns are quoted in USD.

Asset classes struggle during stagflation but factors provide some reprieve

We acknowledge that not all inflation regimes are alike. Periods of high inflation that coincide with recession particularly stand out. We therefore scrutinized the impact of stagflation on asset class and factor premiums. We found that the nominal (-7.1%) and real (-16.6%) returns for equities were especially weak in these episodes. This suggests that the asset class is a poor hedge during these occasions.

The outcome was somewhat better for bonds as falling interest rates typically present tailwinds for the asset class. During these stagflationary intervals, bonds delivered a nominal return of 5.1%, but a real return of -4.4% due to the high levels of inflation. Overall, a generic multi-asset portfolio tended to struggle in this scenario as it produced nominal and real returns of -2.2% and -11.7%, respectively.

The picture was different when we looked at factor premiums. The multi-factor equity and multi-factor bond portfolios charted in positive territory with gains of 5.4% and 4.7%, respectively. Moreover, all equity and bond factor premiums performed well during stagflation, with the exception of the bond momentum factor which endured losses during these episodes. In other words, equity and bond factors also performed consistently in periods of stagflation, thereby providing some reprieve from poor asset class returns during these periods.

Conclusion

Our findings reveal that asset class premiums vary substantially across inflation regimes. Deflation and moderate inflation scenarios generally result in positive nominal and real equity and bond returns, while real returns suffer in times of high inflation, especially during periods of stagflation.

Meanwhile, equity and bond factor premiums are generally consistent across all inflation regimes, with marginal variations in returns across inflation regimes. Although this may sound unexciting, it does imply that factor investors should, on average, be less affected by inflation. As a result, we conclude that factors can help alleviate the pain during high inflation periods, albeit they are not a perfect hedge against inflation.

Read full research paper

1 Baltussen, G., Swinkels, L., and Van Vliet, P., June 2022, “Investing in deflation, inflation, and stagflation regimes”, SSRN working paper.

2 Baltussen, G., Van Vliet, B., and Van Vliet, P., March 2022, “The cross-section of stock returns before 1926 (and beyond)”, SSRN working paper.,

3 Baltussen, G., Martens, M., and Penninga, O., January 2022, “Factor investing in sovereign bond markets: deep sample evidence”, Journal of Portfolio Management.

Guido Baltussen is Head of Factor Investing, Laurens Swinkels is a Researcher, and Pim van Vliet is Head of Conservative Equities and Head of Quantitative Equities at Robeco Quantitative Investments.