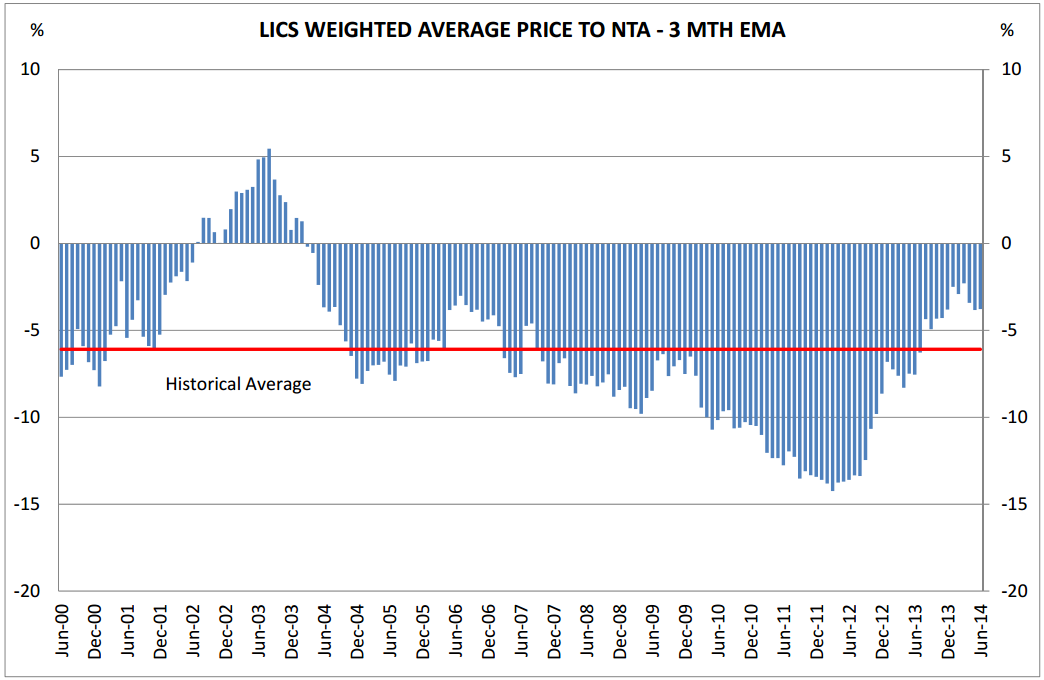

With a surge of Listed Investment Companies (LICs) coming to market recently in Australia, there are now over 60 LICs listed on the ASX with a combined market capitalisation of more $25 billion – up 15.1% over the last 12 months and a remarkable 52.1% over the last 24 months. A key feature of this investment vehicle is that, unlike unlisted managed funds, it can trade at a premium or a discount to its underlying asset value. Over the last ten years, Australian LICs have traded at an average discount to net tangible assets (NTA) of 6%. Today the median discount is 4%, with some LICs trading at significant premiums to NTA including Djerriwarrh Investments Limited (ASX:DJW) and WAM Active Limited (ASX:WAA) with share price premiums of 24.0% and 34.0% respectively (as at 10 October 2014).

Increasing profile of LICs

This trend of reducing price discounts has been driven by a number of factors including the increased popularity of LICs following the introduction last year of the FOFA (Future of Financial Advice) reforms banning upfront and trailing commissions payable by other managed funds to investment advisers and financial planners. This development helped raise the profile of LICs and their benefits. In addition, while valuations of LICs traditionally focused on their discount/premium to NTA, in their ‘hunt for yield’ investors are now more focused on fully franked dividends, an important feature of LICs.

In this article, I look at the factors that may cause an individual LIC to trade at a premium or a discount to its NTA.

Source: Patersons ‘Listed Investment Companies’ Quantitative Research report – 27 June 2014

Trading at a discount to NTA

There are a number of reasons why a LIC may trade at a discount to its NTA including:

- Poor investment portfolio performance, or for newer LICs, having no established past performance.

- Lack of fully franked dividends, a poor track record of paying them, or a perceived inability by the market to pay fully franked dividends in the future.

- Ineffective marketing and communications resulting in the failure of the LIC to raise its profile amongst prospective investors or build an understanding relationship with existing shareholders.

The consequences for a LIC and its shareholders when it consistently trades at a discount to its NTA are generally negative.

Shareholders are likely to become disgruntled, particularly if they bought their shares when the LIC was trading at or around its NTA. Consider a shareholder who bought when the underlying assets were worth $1.00 per share which later trade at 80c each. Trading at a discount means a LIC’s ability to raise capital is constrained and its growth is stunted. The LIC may then be forced into a share buyback or to undertake other capital management initiatives. Attempts to grow by raising capital at a discount are often highly dilutive to existing shareholders, further exacerbating or causing shareholder frustration. As a publicly listed company, disgruntled shareholders have the ability to call for the company to be wound-up, as with India Equities Fund Ltd (ASX: INE) and Van Eyk Three Pillars (ASX: VTP) in recent years.

Over time, if shares consistently trade at a discount, it can attract agitators or activists to the share register who may take a short term approach to their investment. For example, during the GFC, investors Weiss and Carousel Capital took positions in discounted LICs and then cashed-out as soon as they were trading closer to their NTA.

However, this does provide upside for prospective investors who want the opportunity to gain exposure to the LIC’s underlying securities for less than their value. Also, investors can exploit occasions where a LIC’s shares trade at a discount to its NTA, creating the potential for some gain.

Trading at a premium to NTA

In our view, there are some common factors that contribute to a LIC trading at a premium to its underlying asset value including:

- Experienced management – in recent years, newer LICs have traded at discounts (or more significant discounts) than their older counterparts, such as AFIC (ASX: AFI), founded in 1927, and Argo Investments (ASX: ARG), founded in 1946, suggesting investors value companies with long term experience trading through various market cycles.

- Solid investment portfolio performance – a track record of consistently good performance of the LIC’s investment portfolio in absolute or relative terms to a benchmark.

- Stream of dividends – the LIC’s track record of paying a regular stream of fully franked dividends over time.

- Effective marketing and communications initiatives that raise the profile and improve the reputation of the LIC and its manager. For example, investor presentations, regular market updates and media appearances.

For a LIC trading at a premium to its NTA, its ability to raise capital in order to grow the company is enhanced. Over the last year, we have seen numerous LICs raise capital through placements (in addition to Share Purchase Plans and Dividend Reinvestment Plans) such as Cadence Capital (ASX: CDM) and WAM Capital Limited (ASX: WAM). Last calendar year, almost $1 billion was raised by LICs (including Initial Public Offerings) – a record for the sector.

Existing shareholders generally welcome an increase in the value of the shares relative to the LIC’s assets as it increases the value of their investment. For example, a shareholder may have bought their shares when the LIC’s underlying assets were worth $1.00 per share and they later trade at $1.20 per share. In the shorter term, this may translate into larger than usual gains, however, this is often short-lived with history showing that LICs normally return to trade at or around their NTA. The downside is for prospective investors who must pay in excess of the value of a LIC’s NTA.

In general, the premium to NTA trend has contributed to attracting considerable capital to the LIC sector over the past year with more LICs listing in the last 12 months than over the previous decade.

Chris Stott is Chief Investment Officer at Wilson Asset Management. His views are general in nature and readers should seek their own professional advice before making any financial decisions. Wilson Asset Management is a major manager of LICs.